Bitcoin (BTC) enters a crucial week, with bulls hoping the retest of the $100,000 support level is complete amidst a heavy macro event schedule.

- BTC showed promise at the weekly close, fueling predictions of a return to all-time highs.

- Liquidity grabs remain a key factor and could intensify a correction if $100,000 fails to hold.

- CPI and PPI data releases are scheduled for this week, with the Fed’s next move in focus before the June FOMC meeting.

- Bitcoin short-term holders face resistance around $106,200, potentially capping short-term gains.

- The public spat between Donald Trump and Elon Musk might paradoxically benefit crypto holders.

Bitcoin Weekly Close Inspires Hope

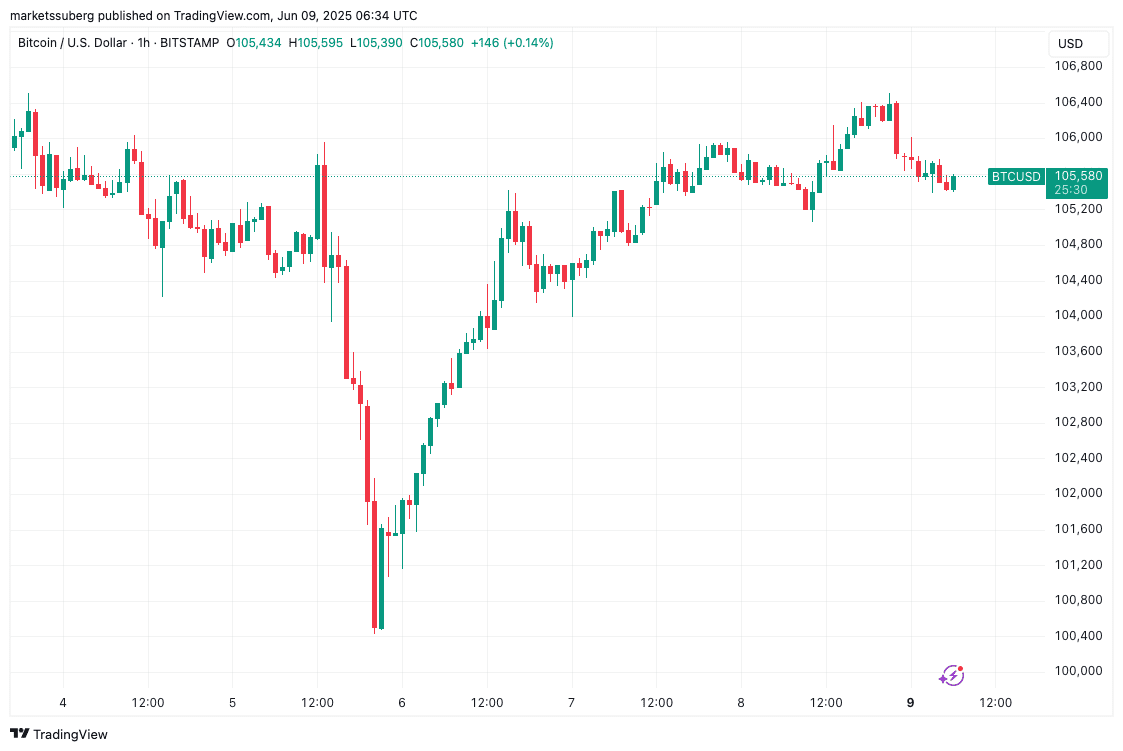

Bitcoin briefly surpassed $106,000 before encountering sellers near the June 8 weekly close.

Despite the week’s volatility, BTC/USD essentially returned to its weekly opening position, suggesting underlying stability.

This outcome is significant for market participants seeking confirmation of price strength after the $100,000 support retest.

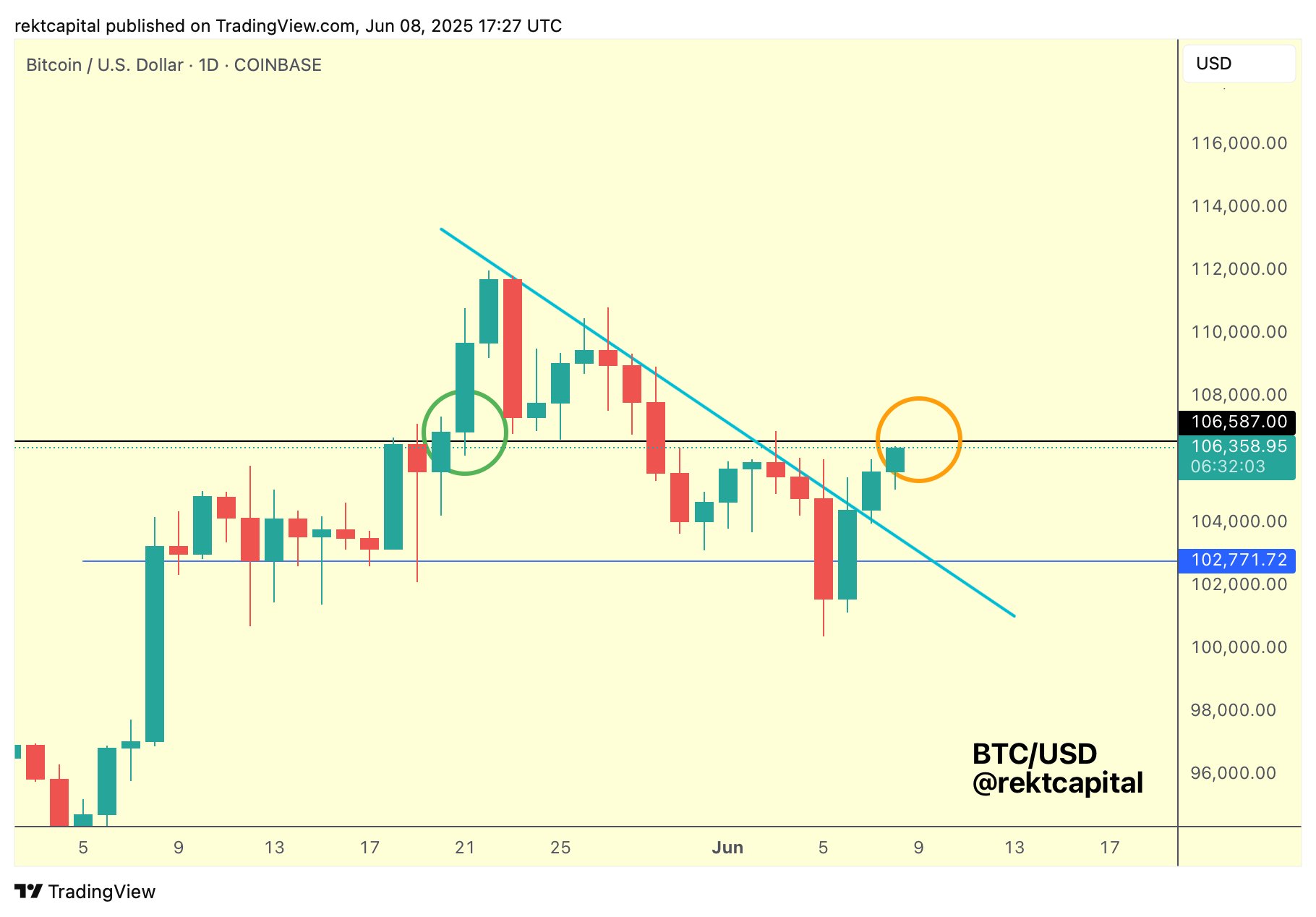

Analyst Rekt Capital views the situation as mixed. While $104,400 remained in play, marking the fourth consecutive higher weekly close for BTC/USD, a full-fledged bull market resurgence is still absent.

“Bitcoin has broken its two-week Downtrend (light blue). Now, Bitcoin is trying to challenge the $106600 resistance (black),” they noted, adding that a daily close above that resistance is needed to maintain a bullish outlook.

Others are already seeing encouraging signs of Bitcoin moving beyond the $100,000 level.

Trader Matthew Hyland pointed out that the price has now closed several daily candles above the 10-period simple moving average (SMA).

Long-term investors remain calm, anticipating an eventual bullish continuation.

Trader CryptoKing argues that Bitcoin is in a “Calm Before the Storm” phase, compressing below resistance at $107,800, indicative of a volatility squeeze. He anticipates a potential move towards $120,000 if resistance is broken.

All Eyes on BTC Liquidity

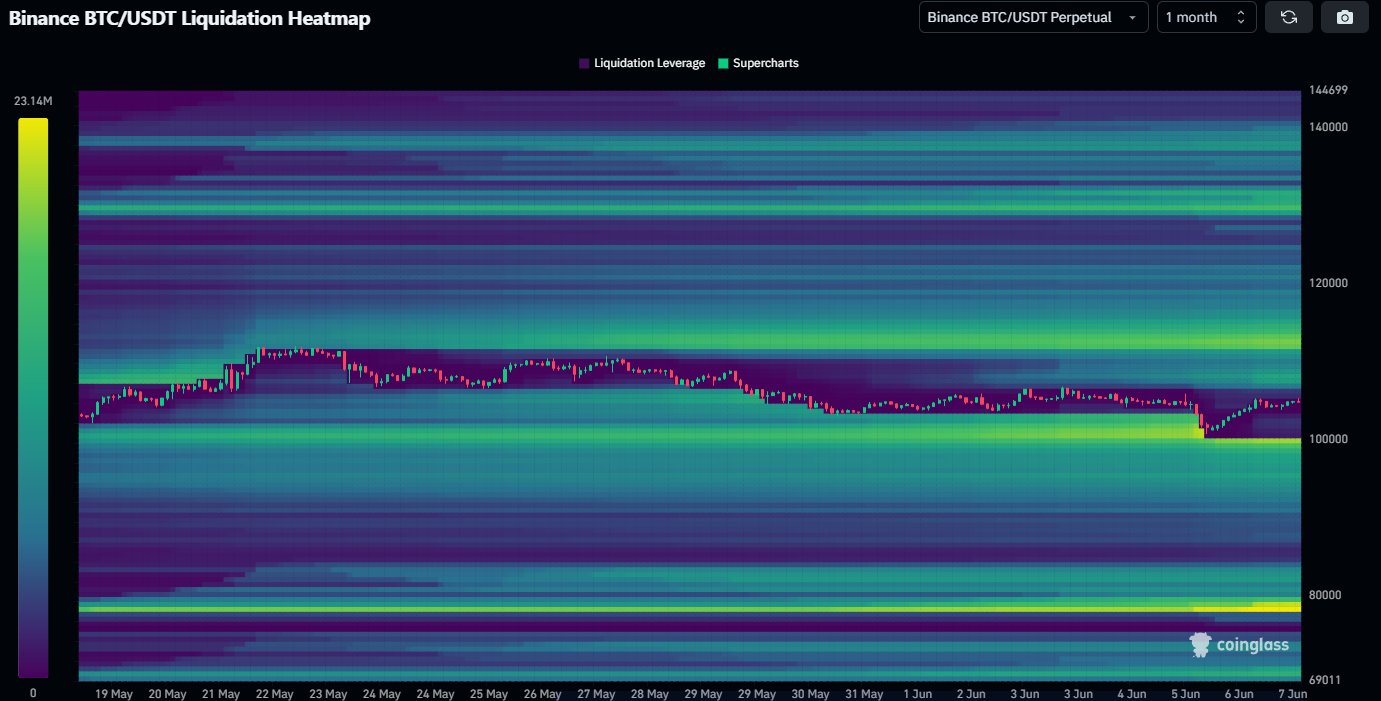

Exchange order book liquidity is playing a crucial role in recent Bitcoin price movements.

Throughout May and June, price action has been characterized by rapid upward and downward swings to “grab” areas of concentrated liquidity.

These liquidity patches are often speculative moves by large traders aiming to influence price direction.

Currently, the $100,000 level is being closely watched as a test of the market’s resilience against long liquidation risks.

Trader Daan Crypto Trades noted that liquidity clusters align with key levels, suggesting potential acceleration of the correction below $100,000 and Thursday’s low.

However, Daan Crypto Trades also emphasized the importance of upside liquidity, identifying Bitcoin’s all-time high at $112,000 as another significant area of interest.

Trader Cas Abbe pointed out that a 10% upward price move could trigger $15 billion in short liquidations.

CPI, PPI in Focus in Run-Up to FOMC

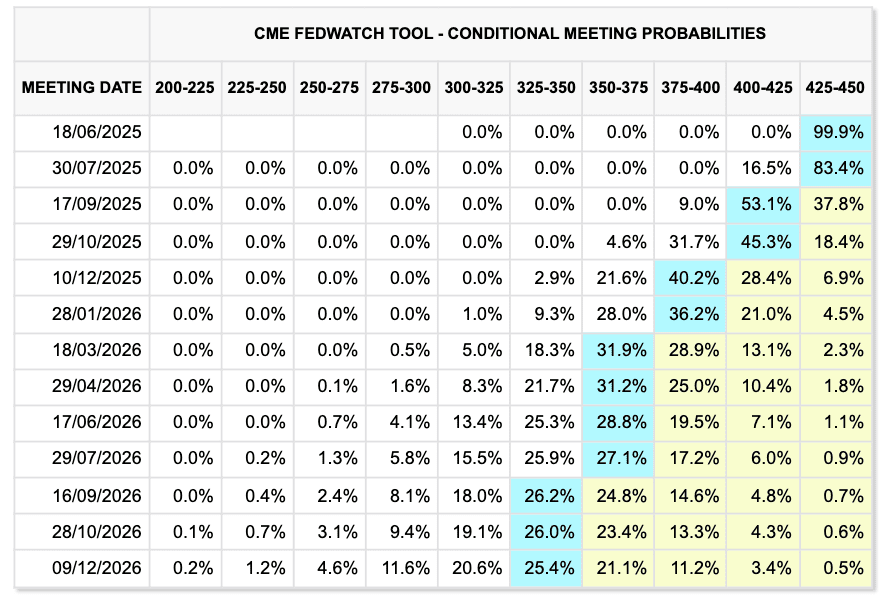

The week leading up to the Federal Reserve’s June meeting includes key inflation data releases.

The May Consumer Price Index (CPI) and Producer Price Index (PPI) are scheduled for release on June 11-12, with unemployment data accompanying the latter.

While inflation has slowed in 2025, focus remains on the Fed’s stance, as officials have resisted lowering interest rates, which would typically benefit crypto and other risk assets.

Officials, including Chair Jerome Powell, have faced criticism from US President Donald Trump for their hawkish approach.

Markets have largely priced out any rate cuts at the June or July FOMC meetings.

Expectations for a 0.25% rate decrease are only present for September, according to CME Group’s FedWatch Tool.

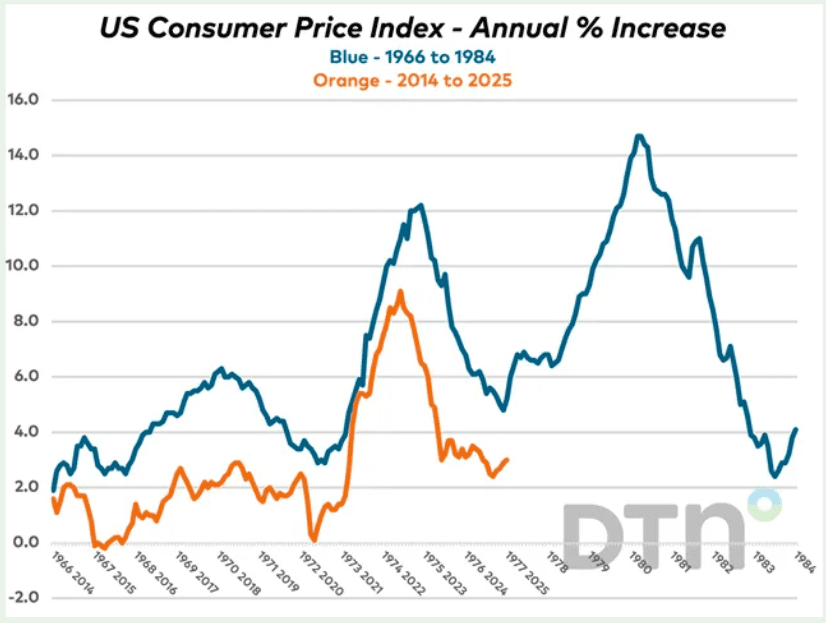

Trading firm Mosaic Asset, in their newsletter “The Market Mosaic,” cautioned that inflation could rebound in the latter half of 2025, reinforcing the Fed’s current position.

They noted that while recent CPI data showed the smallest gain since February 2021 and the Fed’s preferred PCE inflation measure is close to their target, historical trends suggest a potential end to the disinflationary period since mid-2022.

The firm compared the current inflation cycle to the 1970s, suggesting that a resurgence could stem from US trade tariffs impacting the economy.

Bitcoin Short-Term Holders Offer Resistance

The behavior of Bitcoin’s short-term investor base remains a potential catalyst for short-term price fluctuations.

At certain price levels, the profitability of short-term holders (STHs) may prompt them to sell or reduce their BTC holdings.

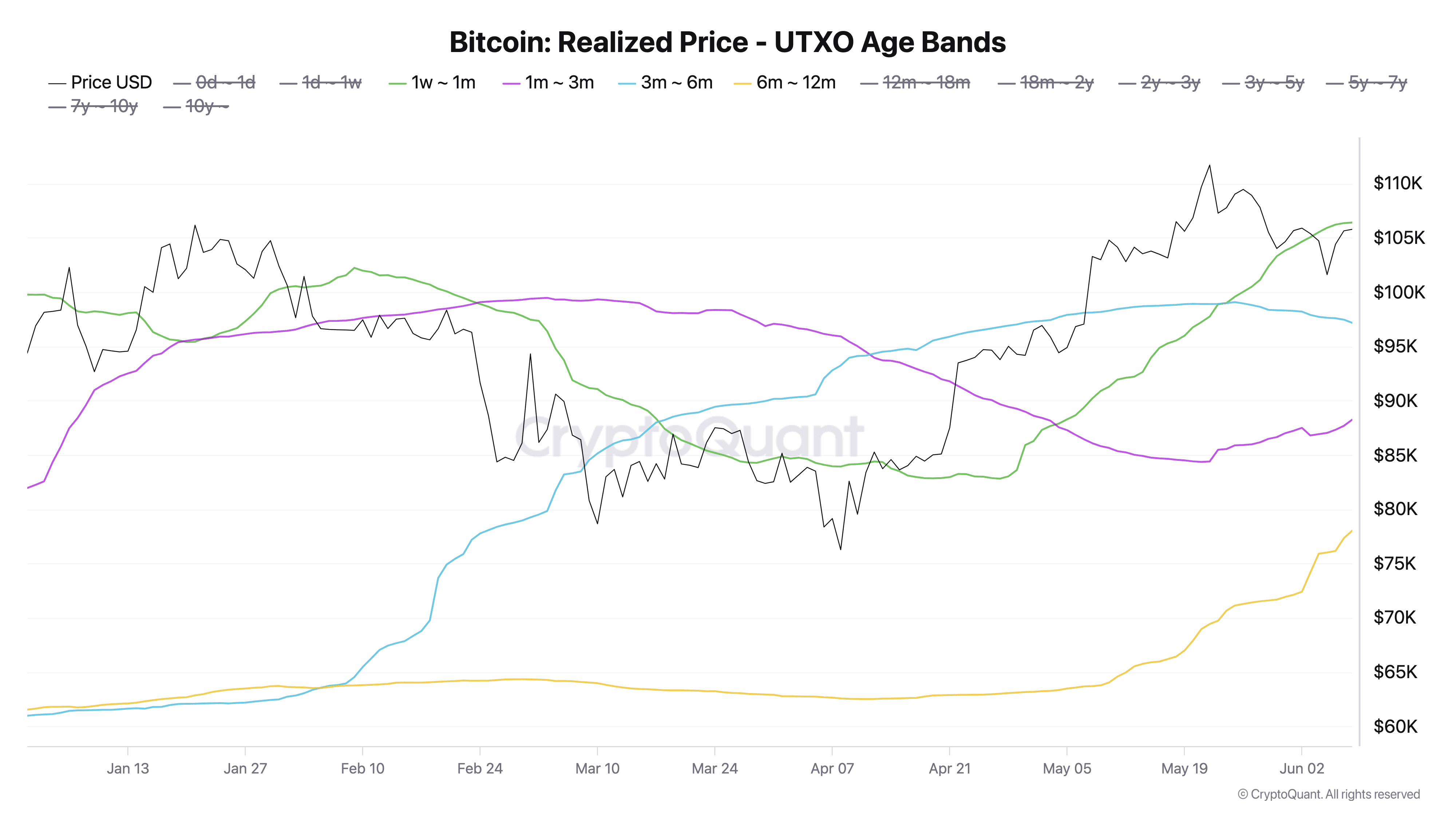

Onchain analytics platform CryptoQuant identified $106,200 as such a level, coinciding with Bitcoin’s recent local high into the weekly close.

According to CryptoQuant contributor Burak Kesmeci, short-term holders facing losses tend to panic. When the price returns to their break-even point, they may be inclined to sell, turning that zone into potential resistance.

CryptoQuant’s data indicates that $106,200 is particularly significant for investors who purchased Bitcoin between one and four weeks ago.

Conversely, buyers from three to six months ago have a cost basis around $97,500, making it crucial for the market to maintain that level as support.

Kesmeci notes that understanding the positions of short-term holders provides valuable insight into potential fear and opportunity levels.

“Sell the Rumor, Buy the News?”

Research firm Santiment suggests that the worst of the BTC price decline may be over.

They attribute this to the behavior of the crowd and the recent conflict between US President Donald Trump and Elon Musk.

Bitcoin’s price declined as Trump and Musk engaged in a public feud, potentially marking the end of their political alliance.

Santiment observed that the crypto community has responded with polarized reactions to the downfall of Trump and Musk’s relationship.

Some fear that the discord between these influential figures will negatively impact the crypto market in the long term.

However, Santiment proposes that this event may have already become a “sell the rumor, buy the news” scenario.

They argue that increased discussion rates surrounding major crypto personalities often precede market reversals.

Actionable Insight: Traders and investors should closely monitor the $100,000 level. A sustained break below this point could trigger further downside. Watch the upcoming CPI and PPI data releases and any statements from the Federal Reserve for clues about future monetary policy. Keep an eye on short-term holder behavior around the $106,200 resistance.

Conclusion: Bitcoin faces a week of challenges and potential opportunities. Navigating liquidity grabs, macro events, and short-term holder dynamics will be key to determining the next price direction. The $100,000 level represents a critical juncture. Will it hold, or will Bitcoin succumb to further correction? The coming days will tell.