1inch Upgrade: Faster, Cheaper Swaps – What It Means for DeFi Traders

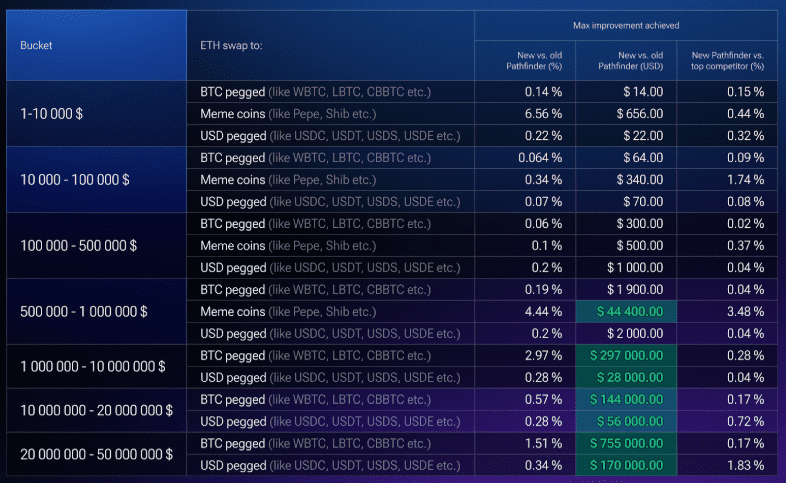

Decentralized exchange (DEX) aggregator 1inch has deployed an update for its price route discovery algorithm, claiming up to 6.5% better swap rates.

In a June 10 announcement, 1inch claims its “Pathfinder” upgrade results in better swap rates, while also making them faster and more seamless. The new algorithm consolidates specific swap steps and maximizes the use of concentrated liquidity, promising better gas efficiency.

A 1inch representative said the team hopes the gas efficiency improvements will decrease the barrier to entry for retail investors. “This can encourage more frequent usage and build trust in DeFi platforms, making DeFi more accessible,” they said.

On the user experience front, 1inch said the decentralized application (DApp) now also shows its users enhanced visualizations, providing insights into token and transaction execution. Sergej Kunz, co-founder of 1inch, claimed that the update “enables users and integrators to maximize the value of every trade” and cut gas costs.

Quick Summary of the News

- 1inch’s “Pathfinder” algorithm upgrade promises up to 6.5% better swap rates.

- The upgrade focuses on faster, more seamless swaps and improved gas efficiency.

- The DApp now features enhanced visualizations for token and transaction execution.

- 1inch aims to lower the barrier to entry for retail investors in DeFi.

- This follows 1inch’s recent expansion to Solana and plans for cross-chain swaps.

Why It Matters

This upgrade is significant for several reasons. Firstly, improved swap rates directly benefit traders by reducing slippage and maximizing returns. Secondly, lower gas fees are crucial for attracting and retaining users, especially smaller retail investors who are often priced out of DeFi due to high transaction costs. Finally, the enhanced user experience can improve DeFi adoption by making the platform more intuitive and transparent.

Market Impact

The DEX aggregator landscape is highly competitive, with platforms like Uniswap, SushiSwap, and Curve vying for market share. 1inch’s upgrade could give it a competitive edge by attracting users seeking the best possible rates and lowest fees. The potential impact can be visualized as follows:

| Feature | Impact |

|---|---|

| Improved Swap Rates (up to 6.5%) | Attracts arbitrage traders and users seeking optimal pricing. |

| Lower Gas Fees | Increases accessibility for smaller retail investors. |

| Enhanced Visualizations | Improves user experience and transparency. |

Expert Take or Personal Insight

The 1inch upgrade is a step in the right direction for DeFi. While a 6.5% improvement may seem incremental, these small advancements collectively make a significant difference in the long run. The focus on gas efficiency is particularly noteworthy, as it addresses one of the biggest pain points for DeFi users. I believe that 1inch’s strategy of gradual improvements and multi-chain expansion will position it well for continued growth in the evolving DeFi landscape.

Actionable Insight

Traders and investors should monitor 1inch’s performance metrics, such as trading volume and user growth, in the coming weeks to assess the real-world impact of the upgrade. It’s also worth comparing swap rates on 1inch with other DEX aggregators to see if the promised improvements translate into tangible benefits. Consider testing small swaps to gauge the gas fee reductions and improved user experience.

Conclusion

The 1inch upgrade demonstrates the ongoing innovation in the DeFi space. By focusing on efficiency, user experience, and multi-chain interoperability, 1inch is positioning itself as a key player in the future of decentralized trading. We can expect to see further developments in this area as DEX aggregators continue to compete for market share and strive to provide the best possible trading experience for users.