Australia’s top court has sided with fintech firm Block Earner, dismissing an appeal from the Australian Securities and Investments Commission (ASIC). The court determined that Block Earner’s crypto-lending product does not constitute a financial product, overturning a previous ruling that would have required the company to obtain a financial services license.

Key Takeaways:

- Favorable Ruling for Block Earner: The Federal Court of Australia ruled that Block Earner’s crypto-lending product does not meet the definition of a financial product or a managed investment scheme under the Corporations Act.

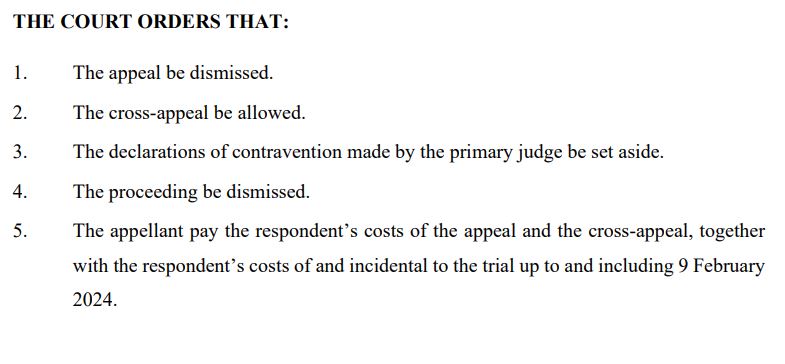

- ASIC to Pay Costs: The Australian Securities and Investment Commission (ASIC) has been ordered to cover Block Earner’s legal costs, including the costs associated with the appeal.

- Clarity for Crypto Lending: The decision provides some clarity regarding the regulatory treatment of crypto-lending products in Australia, suggesting that they should not automatically be classified as financial products.

- Earner Product Discontinued: Despite the legal victory, Block Earner will not be reviving its Earner product, focusing instead on other crypto-backed loan offerings.

Justices David O’Callaghan, Wendy Abraham, and Catherine Button delivered the judgment on April 22, stating that Block Earner’s yield product couldn’t be classified as an investment or financial product because users loaned crypto under fixed terms for interest payments and didn’t pool contributions to generate further benefits. The court emphasized that the terms and conditions of the product framed it as a loan, and users had no exposure to the firm’s business beyond the agreed-upon interest rate.

Background of the Case

ASIC initially launched legal proceedings against Block Earner in November 2022, arguing that the company needed an Australian Financial Services License to offer its crypto-linked fixed-yield earning products. In February 2024, an Australian court initially found that Block Earner would need a financial services license. However, a subsequent ruling in June 2024 released Block Earner from any financial penalties, citing that the company had acted honestly and sought legal advice before launching the products. This led to ASIC’s appeal, which has now been dismissed.

Industry Reaction

Block Earner’s chief commercial officer, James Coombes, stated that the court decision provides clarity, suggesting that crypto assets should be treated similarly to other asset classes under existing laws. He explained that their product was designed as a simple loan arrangement with a fixed return, without any shared upside from a pool of assets, and therefore didn’t constitute a Managed Investment Scheme.

Coombes expressed optimism that this case would serve as a foundation for other Australian businesses in the crypto space. ASIC has acknowledged the court’s decision and stated that it is currently reviewing its implications.

Impact on Crypto Regulation in Australia

This ruling could have significant implications for the regulation of crypto assets in Australia. By clarifying the distinction between crypto-lending products and financial products, the court has potentially set a precedent that could influence future regulatory decisions. It remains to be seen how ASIC will respond to this setback and whether it will lead to a more nuanced approach to regulating the crypto industry. The Australian Treasury has been actively working on a comprehensive crypto regulatory framework, aiming to balance innovation with consumer protection. This ruling adds another layer of complexity to the ongoing discussions.

What’s Next for Block Earner?

Despite the favorable outcome, Block Earner has confirmed that it will not be reviving its Earner product. The company plans to focus on other crypto-backed loan products, indicating a continued commitment to the crypto lending space. Regulation remains a key challenge, and Block Earner hopes for a collaborative process to foster positive change.

The dismissal of ASIC’s appeal represents a significant win for Block Earner and could potentially reshape the regulatory landscape for crypto-lending platforms in Australia. While the specific impact remains to be seen, the decision underscores the importance of clearly defining the nature of crypto products and services to ensure appropriate regulatory oversight.