Key Points:

- Berkshire Hathaway holds significant cash reserves (over $347 billion) capable of acquiring a substantial portion of Bitcoin’s circulating supply.

- Greg Abel’s stance on Bitcoin remains uncertain, with no clear indication of deviating from Warren Buffett’s traditionally cautious approach.

- Berkshire already has indirect exposure to the crypto market through investments in companies like Nu Holdings and Jefferies Financial Group.

With Warren Buffett stepping down as CEO of Berkshire Hathaway by the end of 2025, the question arises: Could Berkshire, under Greg Abel’s leadership, potentially invest in Bitcoin? This article explores Berkshire’s financial capabilities, its current investment strategies, and the factors influencing a potential shift towards cryptocurrency.

Berkshire’s Financial Capacity to Acquire Bitcoin

Berkshire Hathaway boasts a considerable cash reserve, reaching $347 billion in Q4 2024. This substantial amount represents approximately 32% of its $1.1 trillion market capitalization. At a Bitcoin price of around $95,000 (May 2025 estimate), Berkshire could theoretically acquire over 3.52 million BTC. This represents approximately 17.88% of Bitcoin’s circulating supply.

Even if Berkshire only allocated its US Treasury holdings, estimated at $295.98 billion, it could still purchase around 3.12 million BTC, or about 15.85% of the circulating supply. Such an acquisition would establish Berkshire as a major player in the cryptocurrency market.

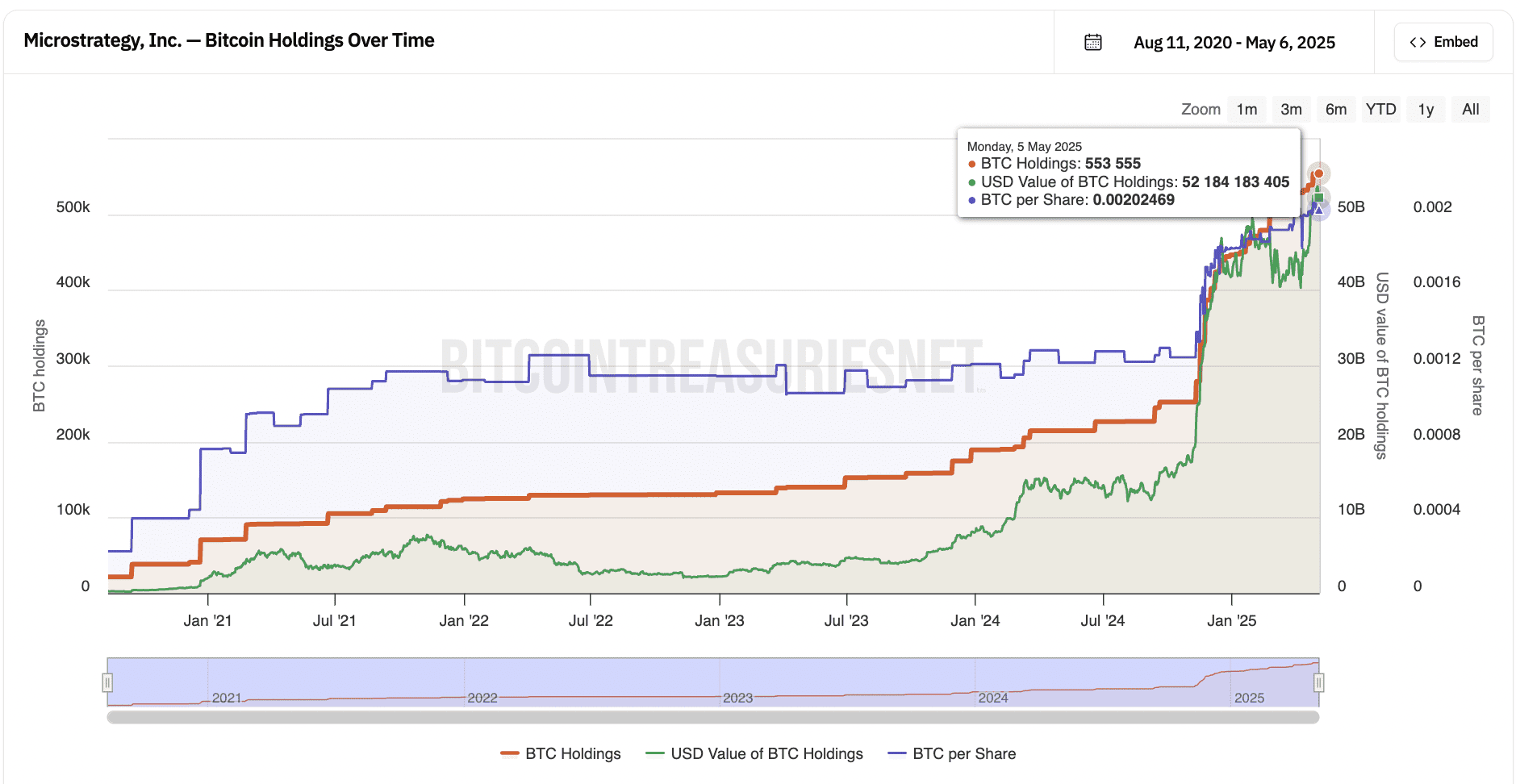

Comparing to Current Corporate Bitcoin Holders

Currently, Strategy Inc. (formerly MicroStrategy) holds the largest corporate Bitcoin stash, with approximately 553,555 BTC, valued at roughly $52.2 billion (as of May 6, 2025). Berkshire could match this holdings with only about one-sixth of its cash reserves.

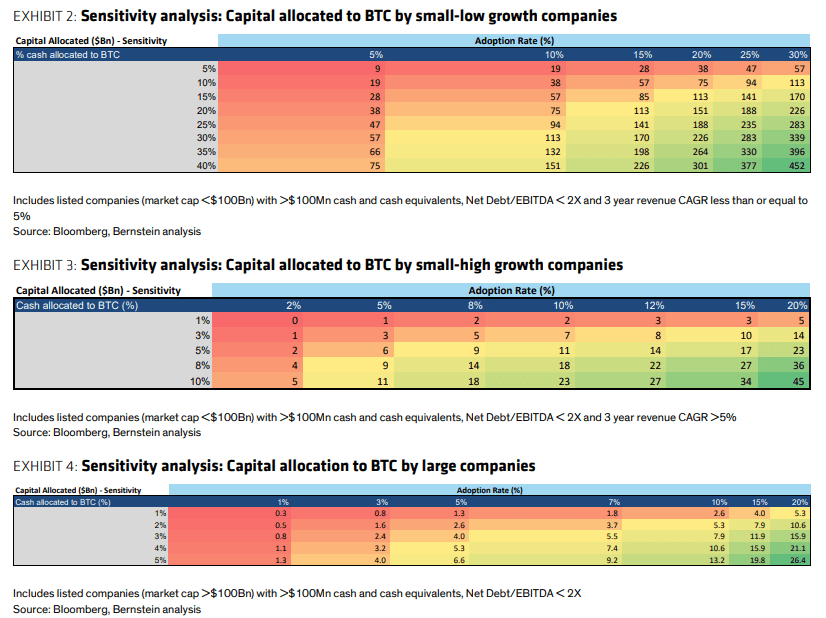

Projected Corporate Bitcoin Adoption

Analysts at Bernstein forecast substantial growth in corporate treasury-driven Bitcoin inflows, estimating roughly $330 billion by 2029. A significant portion of this, approximately $205 billion, is expected to come from listed companies between 2025 and 2029. These analysts suggest that smaller companies may emulate Strategy Inc.’s Bitcoin strategy to enhance their value when other growth avenues are limited.

Bernstein’s optimistic outlook also anticipates that Strategy will continue to increase its Bitcoin holdings, estimating an additional $124 billion in purchases backed by increased capital raising plans.

Greg Abel’s Potential Influence on Berkshire’s Bitcoin Stance

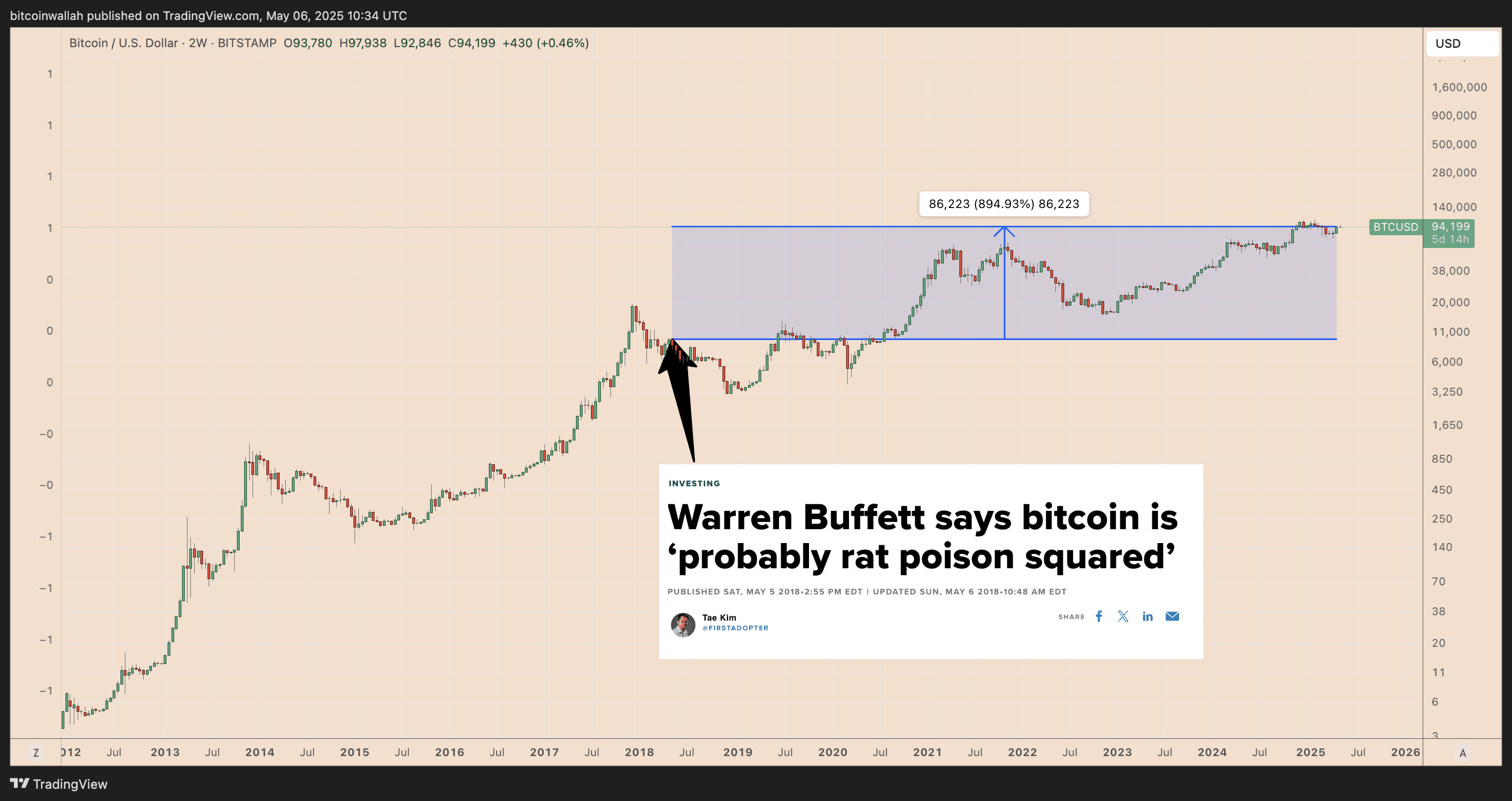

The crucial question remains: Will Greg Abel, as the incoming CEO, influence Berkshire’s investment strategy regarding Bitcoin? Currently, Abel has not explicitly signaled a departure from Buffett’s value-investing philosophy. Buffett has historically favored assets generating tangible cash flows over speculative assets like Bitcoin, famously dismissing it as “rat poison squared.”

However, despite Buffett’s skepticism, Bitcoin’s price has surged significantly since his initial criticism. Moreover, Berkshire already maintains indirect exposure to the crypto space through investments in crypto-friendly companies such as Nu Holdings and Jefferies Financial Group (which has exposure to BlackRock’s IBIT ETF).

Lessons from Berkshire’s Approach to Gold

Berkshire’s previous investment in Barrick Gold (a gold mining company) provides an interesting precedent. Despite Buffett’s long-standing criticism of gold’s lack of productivity, Berkshire briefly invested in Barrick Gold in 2020, only to later sell its position. This suggests that Berkshire is willing to consider assets outside its traditional comfort zone under certain circumstances.

While a direct investment in Bitcoin may not be immediate under Abel’s leadership, Berkshire’s cautious and indirect approach to the cryptocurrency market could potentially expand as the market matures. Whether this leads to full adoption or remains a cautious exploration remains to be seen. The company’s actions will likely be data-driven, and based on rigorous risk-assessment.

Disclaimer: This article does not constitute investment advice. Investing in cryptocurrency involves risk, and readers should conduct thorough research before making any investment decisions.