Key Takeaways:

- Solana’s stablecoin supply reached a new all-time high of $13 billion in 2025, a 156% increase.

- Total Value Locked (TVL) on Solana surged by 25% to $7.65 billion, positioning it as a leading DeFi platform.

- SOL price forms a bullish flag pattern, suggesting a potential rally towards $220.

Solana (SOL) is showing promising signs of a potential price rally driven by increased stablecoin adoption, rising TVL, and a bullish chart pattern. This article explores these factors and their implications for SOL’s price.

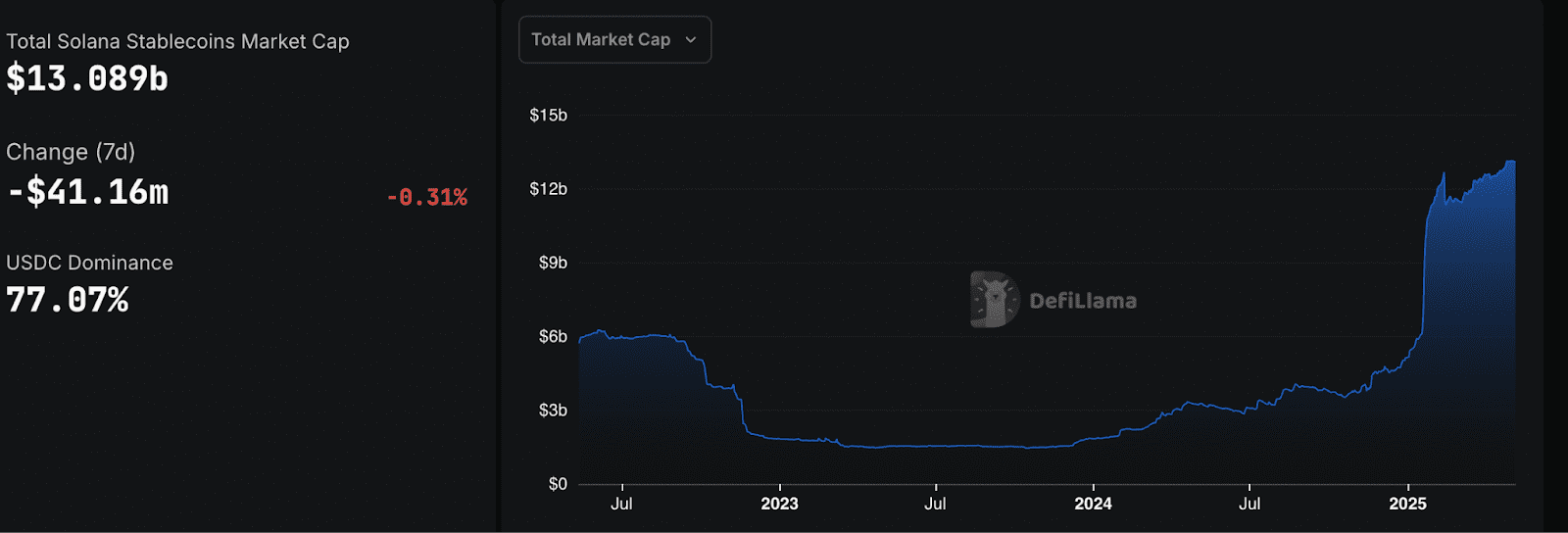

Solana’s Stablecoin Market Cap Soars

The Solana network has witnessed a significant surge in its stablecoin market cap, reaching over $13 billion. This 156% increase signals growing adoption and utility within the Solana ecosystem. Stablecoins like USDC play a crucial role in DeFi, providing liquidity and facilitating transactions. The dominance of USDC (77% market share) further emphasizes its importance to Solana users. The influx of stablecoins often precedes price appreciation as it provides readily available capital for investment. Historically, increased stablecoin inflows have correlated with SOL price rallies, suggesting a similar potential outcome.

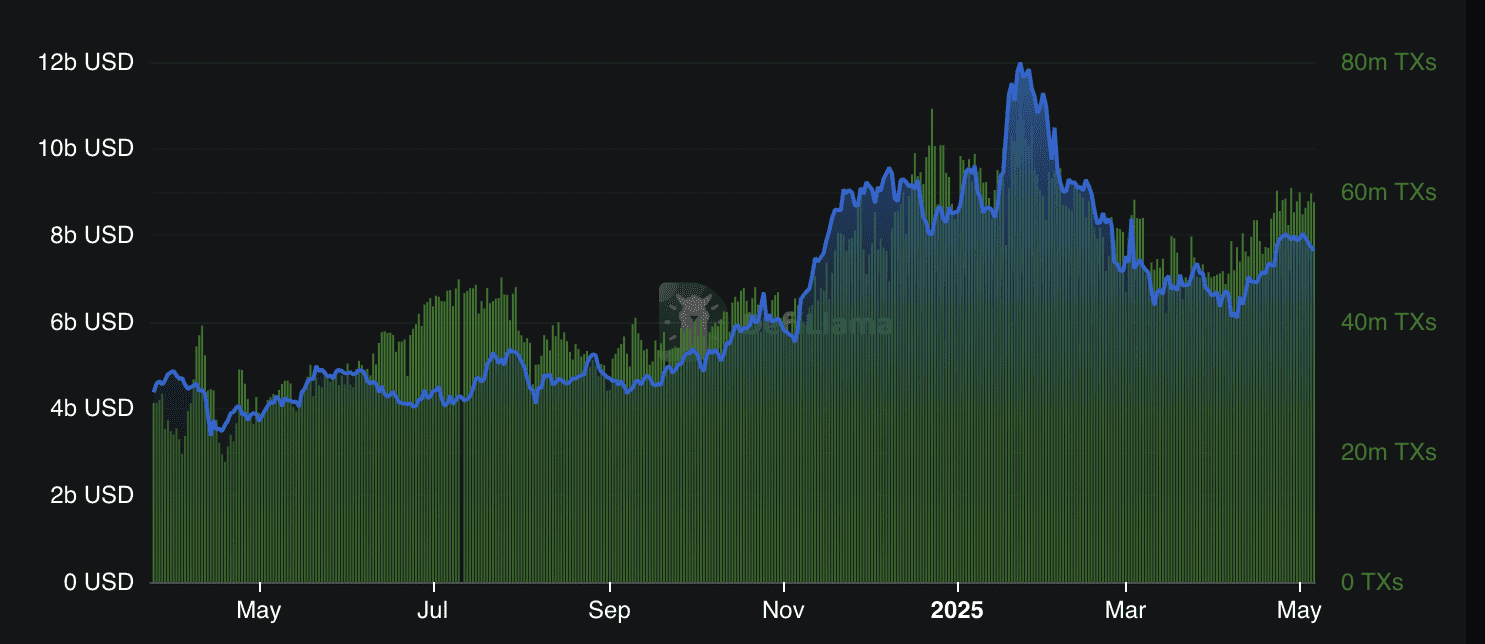

Solana’s TVL and Transaction Volume on the Rise

Solana continues to establish itself as a prominent blockchain for DeFi activities. Its Total Value Locked (TVL), a key metric for measuring the value of assets deposited in DeFi protocols, has increased by 25% in the past month, reaching $7.65 billion. This growth indicates increased user confidence and activity within the Solana ecosystem. The rise in TVL can be attributed to growing deposits in platforms like Sanctum, Jito and Kamino. Further bolstering its position is a 25% increase in daily transaction count reaching 57.77 million.

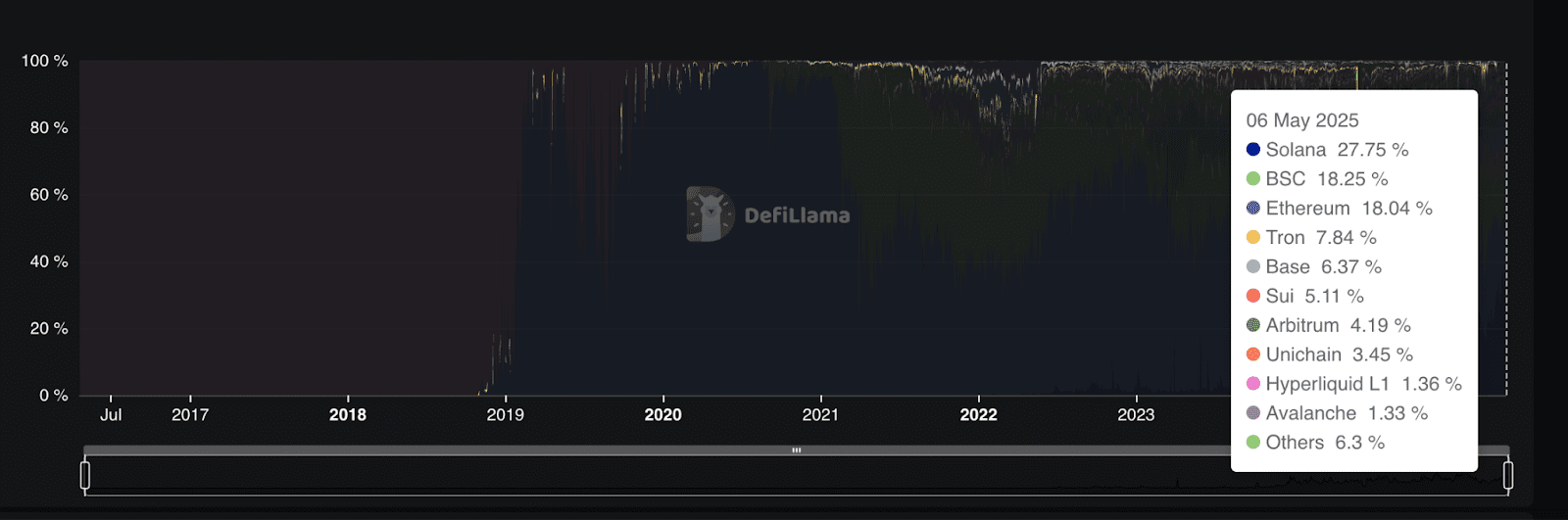

Solana is a leader in decentralized exchange (DEX) volume, surpassing Ethereum and BNB Chain. Its daily DEX volume stands at $2.61 billion, commanding a 27.7% market share. This dominance reflects Solana’s speed, scalability, and low transaction fees, making it an attractive platform for traders.

SOL Bull Flag Pattern Indicates Potential $220 Target

From a technical analysis perspective, SOL’s price chart has formed a bull flag pattern. A bull flag is a bullish continuation pattern that suggests the price will likely break upwards and continue its previous uptrend. This pattern forms after a sharp price increase (the “flagpole”) followed by a period of consolidation (the “flag”).

If the price breaks above the upper trendline of the flag, the target is typically the height of the flagpole added to the breakout point. In SOL’s case, this pattern projects a potential price target of $220, representing a 53% increase from current levels. However, analysts emphasize the importance of maintaining support levels between $120 and $130 to increase the likelihood of reaching the $178 target and beyond.

Factors Driving Solana’s Growth: Deeper Dive

Beyond the technical indicators, several fundamental factors contribute to Solana’s potential for growth:

- Scalability and Speed: Solana’s architecture allows for significantly faster transaction speeds and lower fees compared to Ethereum, making it attractive for high-frequency trading and DeFi applications.

- Growing Developer Ecosystem: Solana has attracted a vibrant community of developers building innovative DeFi protocols, NFTs, and other applications.

- Institutional Interest: Increased institutional interest in Solana is evident through investments and partnerships, further validating its potential.

- Low barrier to Entry: Solana offers low barrier to entry to new users.

Risks to Consider

While Solana exhibits strong potential, it’s important to acknowledge the inherent risks associated with cryptocurrency investments:

- Market Volatility: The cryptocurrency market is highly volatile, and SOL’s price can fluctuate significantly.

- Network Congestion: While Solana is known for its speed, network congestion can occasionally occur, leading to slower transaction times and higher fees.

- Competition: Solana faces competition from other layer-1 blockchains like Ethereum, Cardano, and Avalanche.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains uncertain, which could impact SOL’s price and adoption.

Conclusion

Solana’s rising stablecoin market cap, increasing TVL, and bull flag chart pattern present a compelling case for a potential price rally towards $220. However, investors should carefully consider the inherent risks associated with cryptocurrency investments and conduct thorough research before making any decisions. The combination of strong technical indicators and growing fundamental strength positions Solana as a noteworthy player in the evolving cryptocurrency landscape.