Key Takeaways:

- The Federal Reserve’s (Fed) monetary policy decisions, particularly regarding interest rates and liquidity, significantly impact Bitcoin (BTC) and the broader cryptocurrency market.

- A potential pause in interest rate hikes, coupled with liquidity injections by the US Treasury, could create a favorable environment for crypto assets as investors seek recession hedges.

- The declining US dollar and rising gold prices signal a shift towards scarce assets, further bolstering the case for Bitcoin as an alternative investment.

The US Federal Reserve Open Market Committee (FOMC) decision is a crucial event to watch. While current expectations lean towards maintaining existing interest rates, several factors suggest that Bitcoin and other cryptocurrencies could still experience gains. The primary catalyst for this potential rally is the possibility of the US Treasury injecting liquidity into the market to prevent a recession.

The Liquidity Injection Scenario:

An accommodative monetary policy, characterized by liquidity injections, aims to stimulate economic activity. However, the Fed also faces the challenge of a weakening US dollar. Some analysts argue that simply cutting interest rates may not be enough to spur growth, particularly if recession risks persist. This scenario creates a fertile ground for alternative assets like cryptocurrencies to thrive.

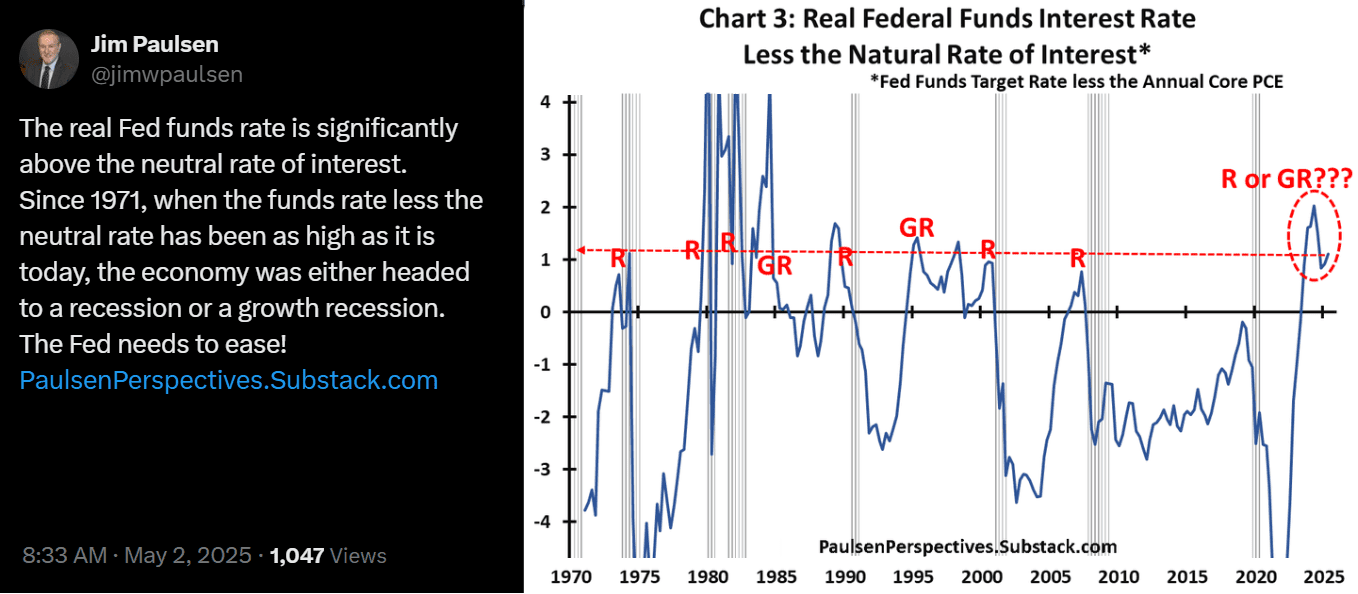

Economist Jim Paulsen points out a historical correlation between Fed funds rates exceeding a “neutral” level (adjusted for inflation) and subsequent economic slowdowns. This pattern suggests the Fed may be compelled to lower interest rates to avoid a recession. Moreover, the Fed and its chairman face political pressures regarding interest rate policies.

Reasons for Potential Fed Easing:

- Recession Concerns: As Jim Paulsen’s analysis highlights, historical patterns suggest the current Fed funds rate could lead to a recession or a period of weak growth.

- Weakening US Dollar: A strong dollar can negatively impact US exports and overall economic competitiveness. Easing monetary policy could help weaken the dollar, boosting exports.

Despite these arguments, some factors suggest the Fed may hesitate to ease monetary policy immediately:

- Inflation: US consumer inflation remains above the Fed’s 2% target.

- Low Unemployment: A low unemployment rate suggests a healthy labor market, reducing the urgency for monetary easing.

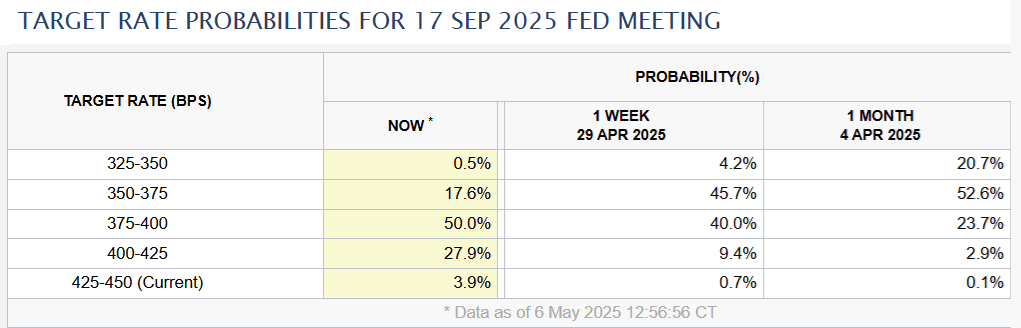

Market expectations, as indicated by Treasury yield futures, reveal a fluctuating confidence in the Fed’s willingness to ease monetary policy. Traders are becoming less certain that the Fed will cut rates, which could lead the Treasury to intervene with liquidity injections to support government spending.

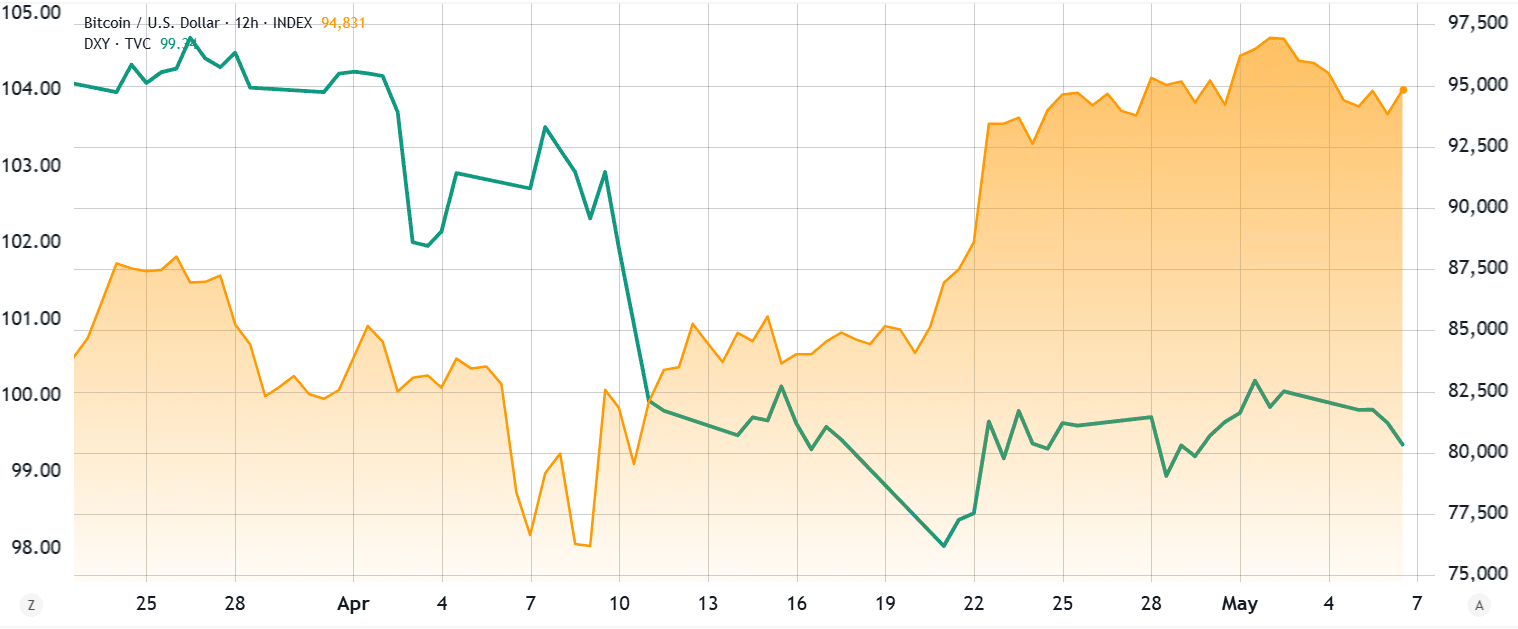

Regardless of the FOMC’s immediate decision, some analysts point to recent actions, such as the Fed’s Treasury bond purchase, as a sign of renewed intervention. Increased liquidity has historically been a positive catalyst for cryptocurrencies, especially when the US dollar underperforms other major currencies. Consequently, investors are looking for alternative hedges, such as Bitcoin, instead of holding cash.

The US Dollar Index (DXY) has experienced a decline, signaling investor concerns about the US economy. Simultaneously, gold prices have risen, indicating a move towards safe-haven assets. This environment favors scarce assets like Bitcoin, as confidence in the US Treasury’s ability to manage its debt weakens.

Even if multiple rate cuts become less probable, this scenario can still benefit cryptocurrencies. If the Fed is pressured to expand its balance sheet, it would likely cause inflation, devaluing fixed-income investments and supporting the case for cryptocurrencies as a hedge.

The Case for Bitcoin as a Hedge:

- Scarcity: Bitcoin’s limited supply of 21 million coins makes it a hedge against inflation, similar to gold.

- Decentralization: Bitcoin operates outside traditional financial systems, making it resistant to government control and censorship.

- Global Accessibility: Bitcoin can be accessed and used by anyone with an internet connection, regardless of their location or financial status.

In conclusion, Bitcoin’s potential rally is tied to a complex interplay of factors, including the Federal Reserve’s monetary policy decisions, potential liquidity injections, and the overall economic outlook. While the future remains uncertain, the conditions are in place for Bitcoin to act as a valuable hedge against economic instability.