21Shares, a prominent asset manager, has launched an Exchange Traded Product (ETP) in Europe, providing investors with a regulated and accessible way to invest in Cronos (CRO), the native token of the Crypto.com’s Cronos blockchain. This ETP is now listed on Euronext exchanges in Paris and Amsterdam, marking a significant step in expanding access to emerging Web3 infrastructure.

What is Cronos (CRO)?

Cronos is a layer-1 blockchain network developed by Crypto.com, a leading centralized cryptocurrency exchange. It’s designed to be compatible with both Ethereum and Cosmos ecosystems, enabling developers to build and deploy decentralized finance (DeFi) applications, NFT projects, and other Web3 innovations.

Key features of the Cronos network include:

- EVM Compatibility: Supports Ethereum Virtual Machine (EVM), allowing for easy migration of Ethereum-based dApps.

- Interoperability: Built on the Cosmos SDK, facilitating seamless communication and asset transfer between different blockchain networks.

- Scalability: Designed for high transaction throughput and low fees, making it suitable for a wide range of applications.

21Shares Cronos ETP: An Overview

The 21Shares Cronos ETP offers investors a straightforward way to gain exposure to CRO without the complexities of managing digital wallets or directly interacting with cryptocurrency exchanges. This ETP is accessible through traditional banks and brokers, making it easier for both retail and institutional investors to participate in the growth of the Cronos ecosystem.

Mandy Chiu, 21Shares’ head of financial products development, highlighted that the Cronos ETP provides regulated exposure to a blockchain ecosystem driving real-world adoption.

Cronos (CRO) Token: Key Metrics

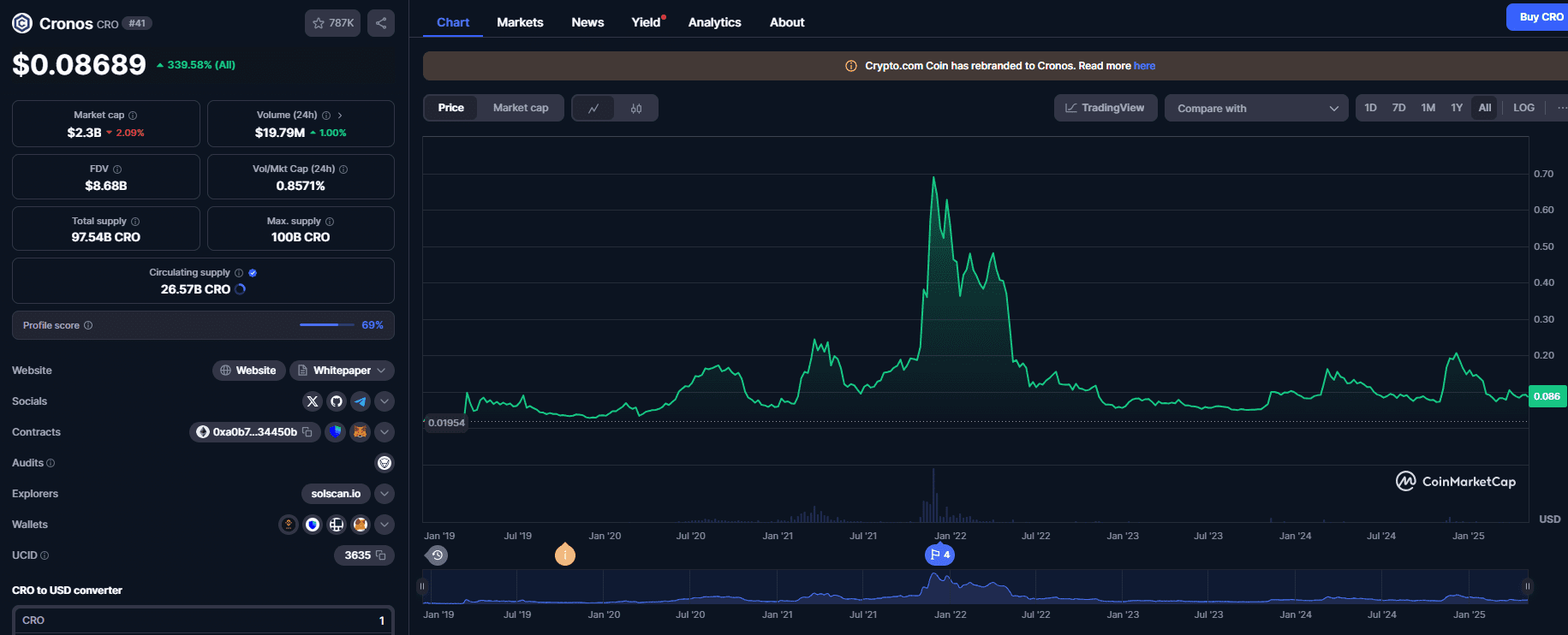

As of recent data:

- Market Capitalization: Approximately $2.3 billion

- Fully Diluted Value (FDV): Nearly $8.7 billion

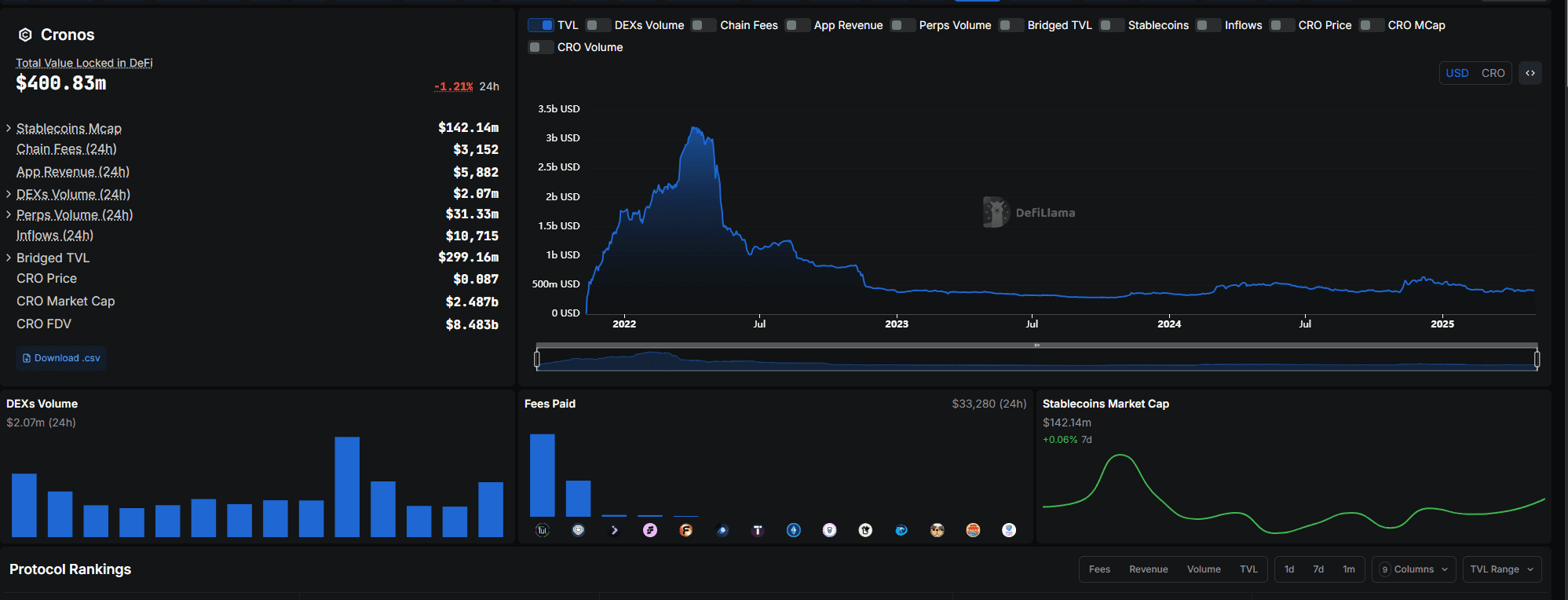

- Total Value Locked (TVL): Approximately $400 million

The Cronos DeFi ecosystem features various projects, including Crypto.com’s liquid Ether staking token, Crypto.com Staked ETH, which holds a significant portion of the network’s TVL.

The Rise of Altcoin ETFs and ETPs

The launch of the 21Shares Cronos ETP coincides with a growing trend of asset managers seeking to offer investment products tied to various altcoins. This trend is driven by increasing investor demand for diversified cryptocurrency exposure and the desire for regulated investment vehicles.

For example, VanEck recently filed for a BNB ETF in the US, which would be the first ETF holding BNB Chain’s native token. 21Shares has also proposed ETFs holding cryptocurrencies including Dogecoin (DOGE), Polkadot (DOT), and Solana (SOL).

Broader Market Context

The increasing interest in altcoin ETFs and ETPs reflects a maturing cryptocurrency market and a growing acceptance of digital assets among mainstream investors. The potential approval of these products by regulatory bodies like the US Securities and Exchange Commission (SEC) could further accelerate the adoption of cryptocurrencies and drive institutional investment.

Cronos Network: Expanding the Web3 Ecosystem

Cronos aims to facilitate the mass adoption of blockchain technology. By leveraging its interoperability features, Cronos is positioning itself as a crucial infrastructure layer for the decentralized web.

Furthermore, Cronos is actively working on partnerships and integrations to expand its ecosystem and attract developers. Recent initiatives are focused on boosting DeFi, NFT, and gaming applications.

Risks and Considerations

While the Cronos ETP offers a convenient way to invest in CRO, it’s important to be aware of the risks associated with cryptocurrency investments. The value of CRO can be highly volatile, and the regulatory landscape for cryptocurrencies is still evolving. Investors should conduct thorough research and consult with a financial advisor before investing in any cryptocurrency-related product.

In conclusion, the launch of the 21Shares Cronos ETP marks an important milestone for both Cronos and the broader cryptocurrency market. By providing a regulated and accessible investment vehicle, 21Shares is helping to bridge the gap between traditional finance and the rapidly evolving world of digital assets. As the demand for altcoin exposure continues to grow, expect to see more ETPs and ETFs focusing on specific blockchains and crypto projects in the future.