Key Takeaways:

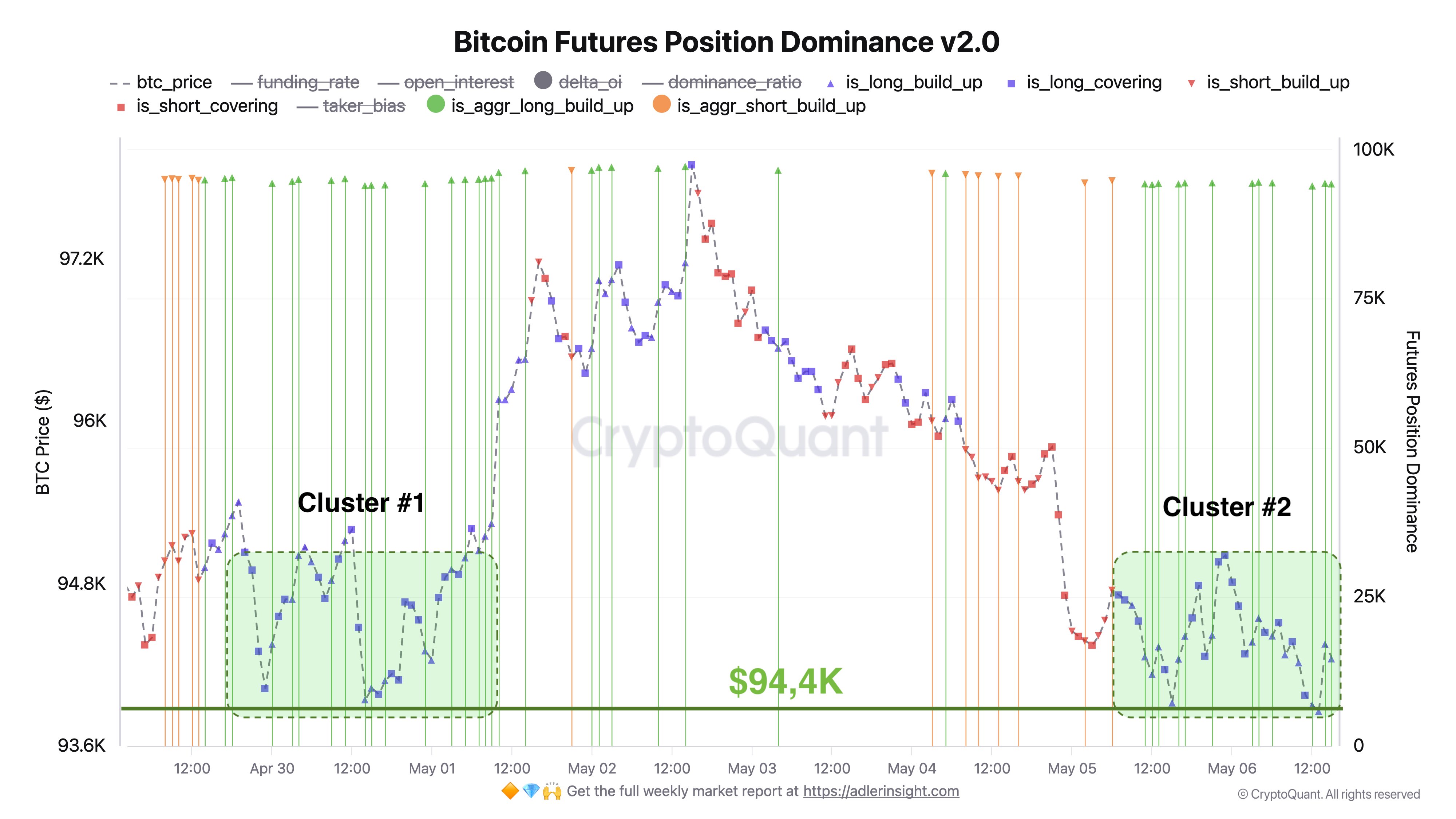

- Bitcoin bulls are opening margin long positions around $94,400, signaling strong buying interest.

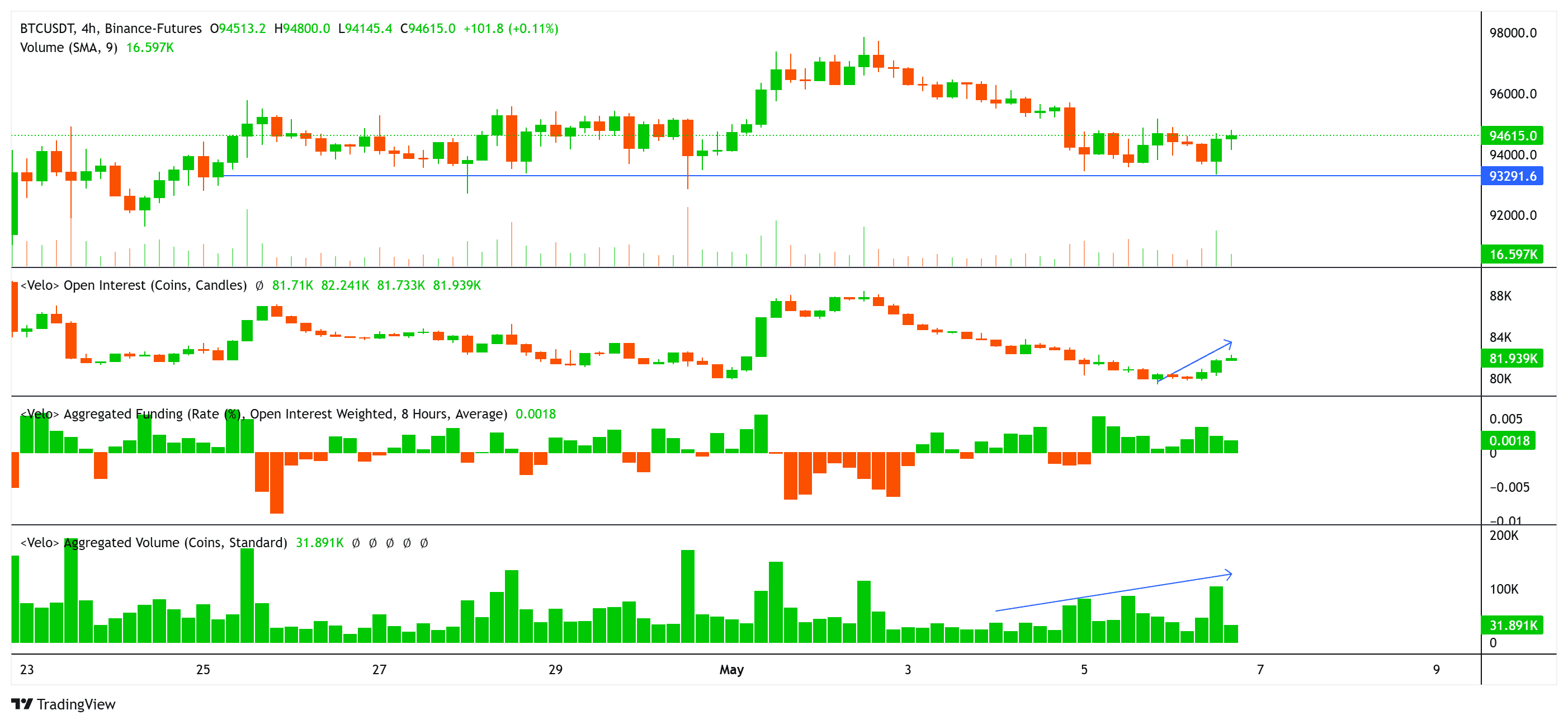

- A $189 million increase in Bitcoin futures open interest and a 15% increase in trading volume reflect sustained buying pressure.

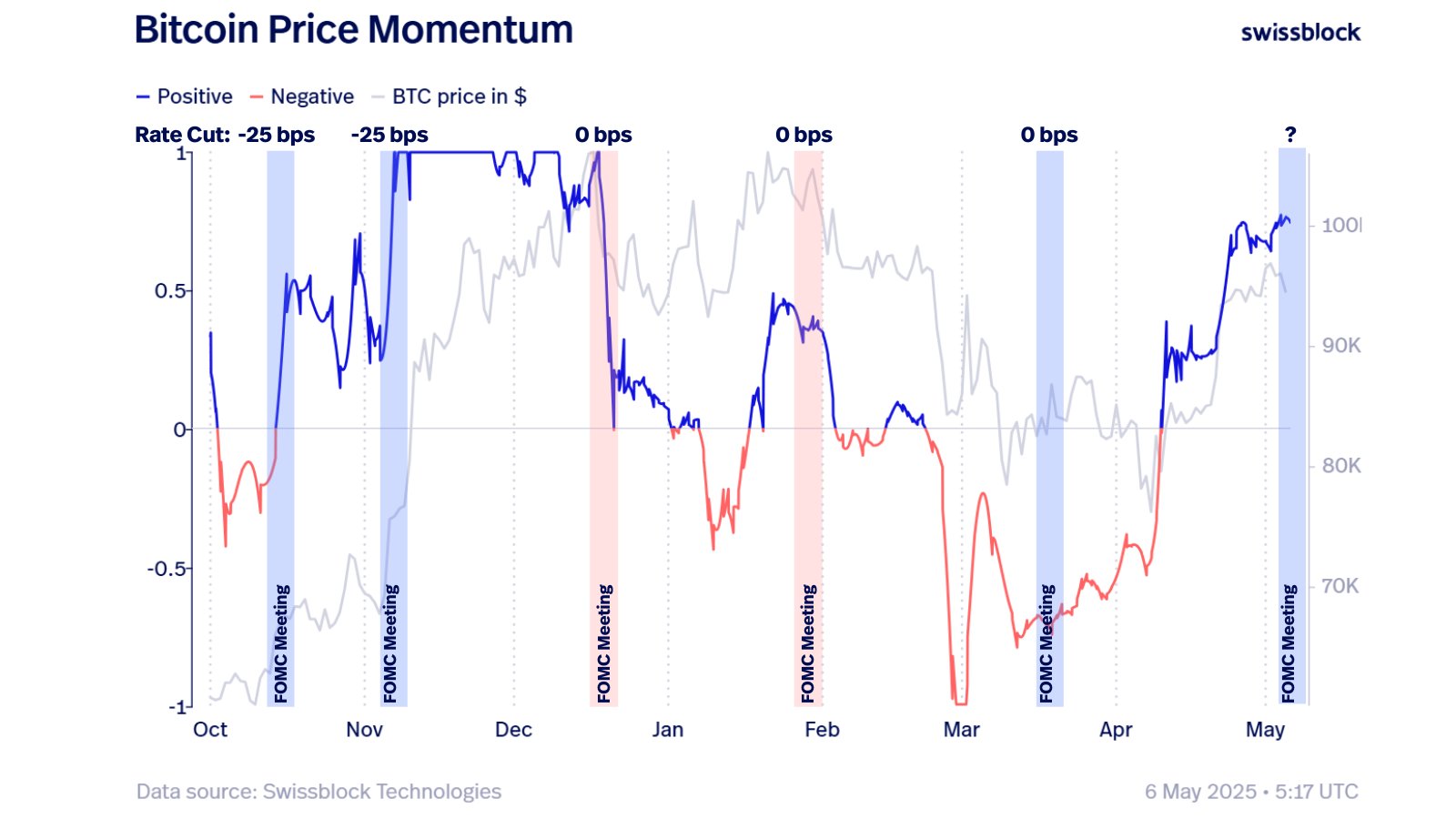

- Bitcoin’s momentum typically slows before FOMC meetings, followed by increased volatility.

- Analysts suggest a potential upward trend for Bitcoin if gold prices correct after the FOMC meeting.

Bitcoin (BTC) is exhibiting resilience around the $94,500 level as market participants brace for the Federal Open Market Committee (FOMC) meeting on May 7. Data reveals a surge in bullish long positions, reminiscent of a previous cluster that propelled BTC prices to $97,500 in late April.

Open Interest and Trading Volume: A Bullish Signal?

Bitcoin futures open interest (OI) has experienced a significant increase of 2,000 BTC (approximately $189 million), coupled with a 15% surge in aggregated trading volume. This simultaneous rise in OI and volume often indicates consistent buying pressure, suggesting strong conviction among investors despite recent price dips. The aggregated funding rate remains near neutral, showing a balanced sentiment between long and short positions.

Analyst Perspective: Potential for Continued Upward Movement

MN Capital founder Michaël van de Poppe has identified Bitcoin’s recent bounce as a potential precursor to further gains. He suggests that Bitcoin could continue its upward trajectory, contingent on gold prices correcting after the FOMC meeting. This correction in gold might signal the beginning of a new business cycle, further boosting Bitcoin’s prospects.

FOMC Impact: Historical Trends and Potential Volatility

Swissblock, an investment management firm, has highlighted a historical trend: Bitcoin’s momentum tends to slow down in the lead-up to FOMC interest rate decisions, followed by a spike in price volatility. An analysis of Bitcoin’s 25-day rate of change (ROC) reveals that the price typically climbs when the ROC trends upward. Conversely, corrections occur when the ROC tapers off. Recent data indicates an uptrend in the ROC, suggesting a potential price gain for Bitcoin. The FOMC meeting is seen as a crucial catalyst, with the rate decision and Federal Reserve Chair Jerome Powell’s commentary potentially triggering market volatility. Understanding the rate of change is key to understanding bitcoin trends. It can be useful to use technical analysis like MACD, RSI, and other indicators to see if bitcoin is overbought or oversold.

What is the FOMC?

The Federal Open Market Committee (FOMC) is the branch of the Federal Reserve System that determines the direction of monetary policy. The FOMC is composed of 12 members: the seven members of the Board of Governors; the president of the Federal Reserve Bank of New York; and the presidents of four other Reserve Banks, who serve on a rotating basis. It meets eight times a year to discuss the state of the economy and to set the federal funds rate, which is the target rate that commercial banks charge one another for the overnight lending of reserves. The FOMC also makes decisions about the Fed’s holdings of U.S. Treasury and agency securities.

Potential Scenarios Following the FOMC Meeting:

- Hawkish Tone: If Jerome Powell adopts a hawkish stance, signaling a commitment to fighting inflation through further interest rate hikes, this could negatively impact Bitcoin and other risk assets. Investors may reduce their exposure to speculative investments in favor of safer havens.

- Dovish Tone: Conversely, a dovish tone, suggesting a willingness to pause or even cut interest rates, could boost Bitcoin and other risk assets. Lower interest rates typically encourage investment in higher-yielding assets.

- Neutral Tone: A neutral stance, indicating a data-dependent approach to future rate decisions, may lead to short-term consolidation in the market. The impact on Bitcoin would likely depend on the subsequent economic data releases and their implications for future monetary policy.

Disclaimer: This analysis is for informational purposes only and should not be considered investment advice. Trading in Bitcoin and other cryptocurrencies involves significant risk. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.