Bitcoin (BTC) experienced a surge on May 7th, fueled by geopolitical tensions and anticipation surrounding the Federal Reserve’s interest rate decision. This article delves into the factors driving Bitcoin’s price action, the significance of the Fed’s stance, and the changing expectations for future interest rate adjustments.

Key Takeaways:

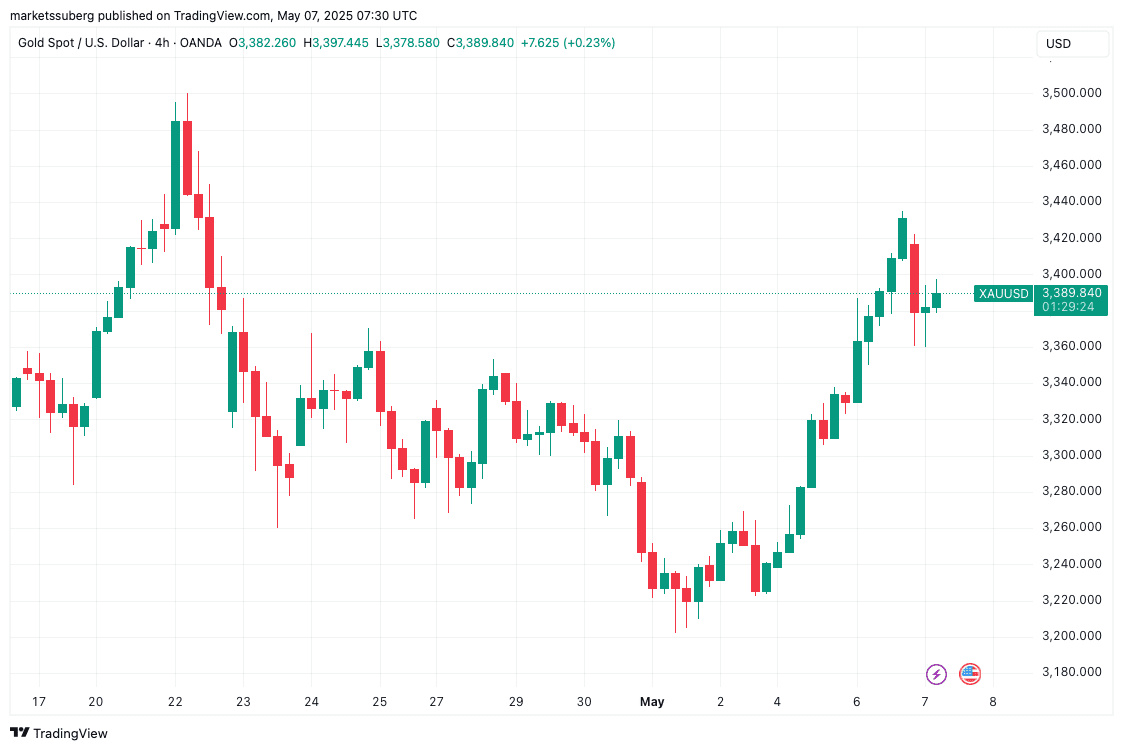

- Bitcoin and Gold Correlation: Both assets are reacting similarly to short-term macro volatility.

- Federal Reserve Watch: Market participants keenly anticipate insights from the Federal Reserve’s announcements.

- Diminished Rate Cut Optimism: Expectations for Federal Reserve rate cuts in 2025 have decreased leading up to the FOMC meeting.

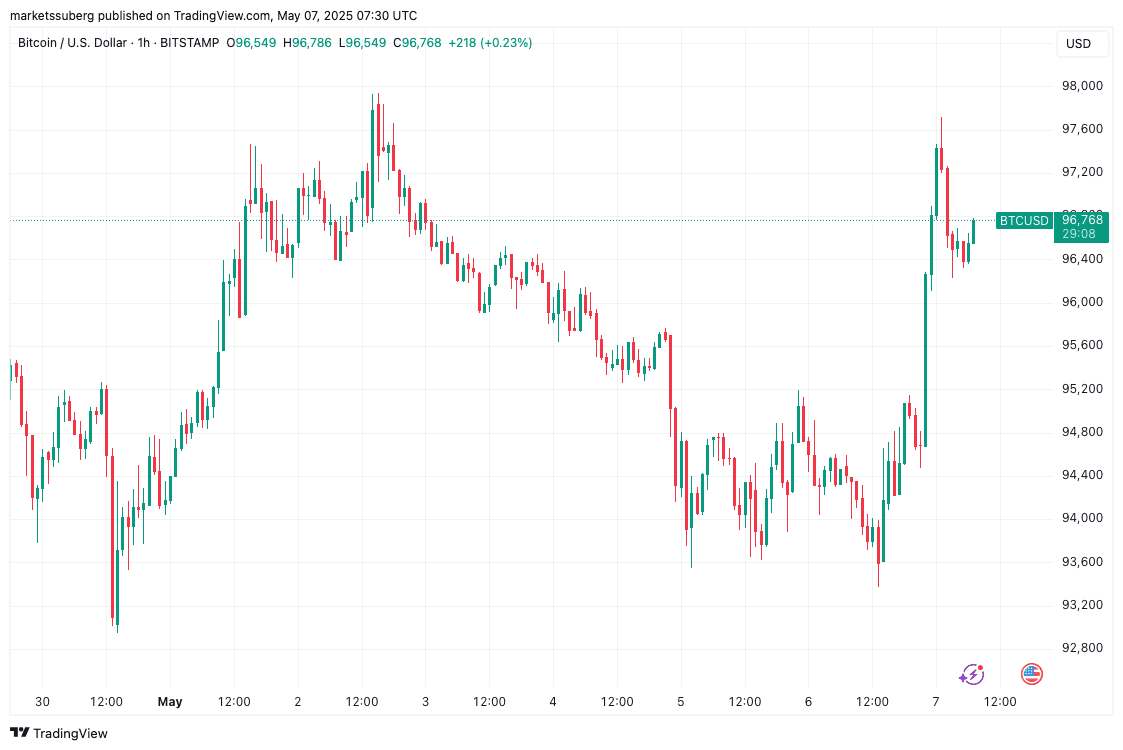

Following a dip below $94,000, Bitcoin rebounded, signaling a short-term trend reversal. The day prior, Wall Street trading laid the groundwork for this recovery, even as stock markets experienced declines. Bitcoin, alongside gold, achieved respective highs of $97,700 and $3,435 before entering a consolidation phase.

The Federal Reserve’s Role

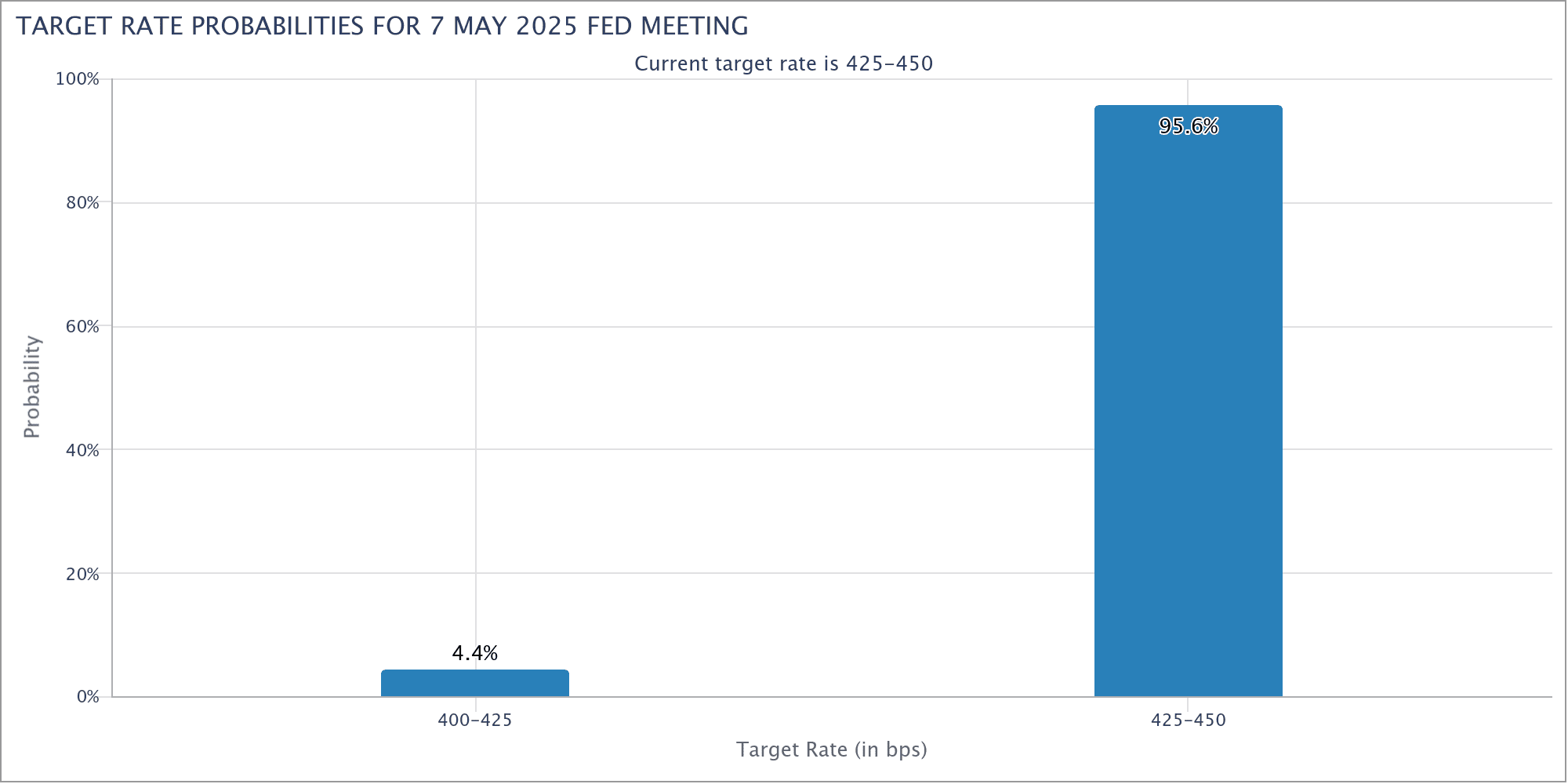

The market’s attention is heavily focused on the Federal Reserve’s actions. While a rate hold was widely anticipated, Fed Chair Jerome Powell’s communication is crucial. Traders are scrutinizing Powell’s statements for any shifts in tone regarding future monetary policy.

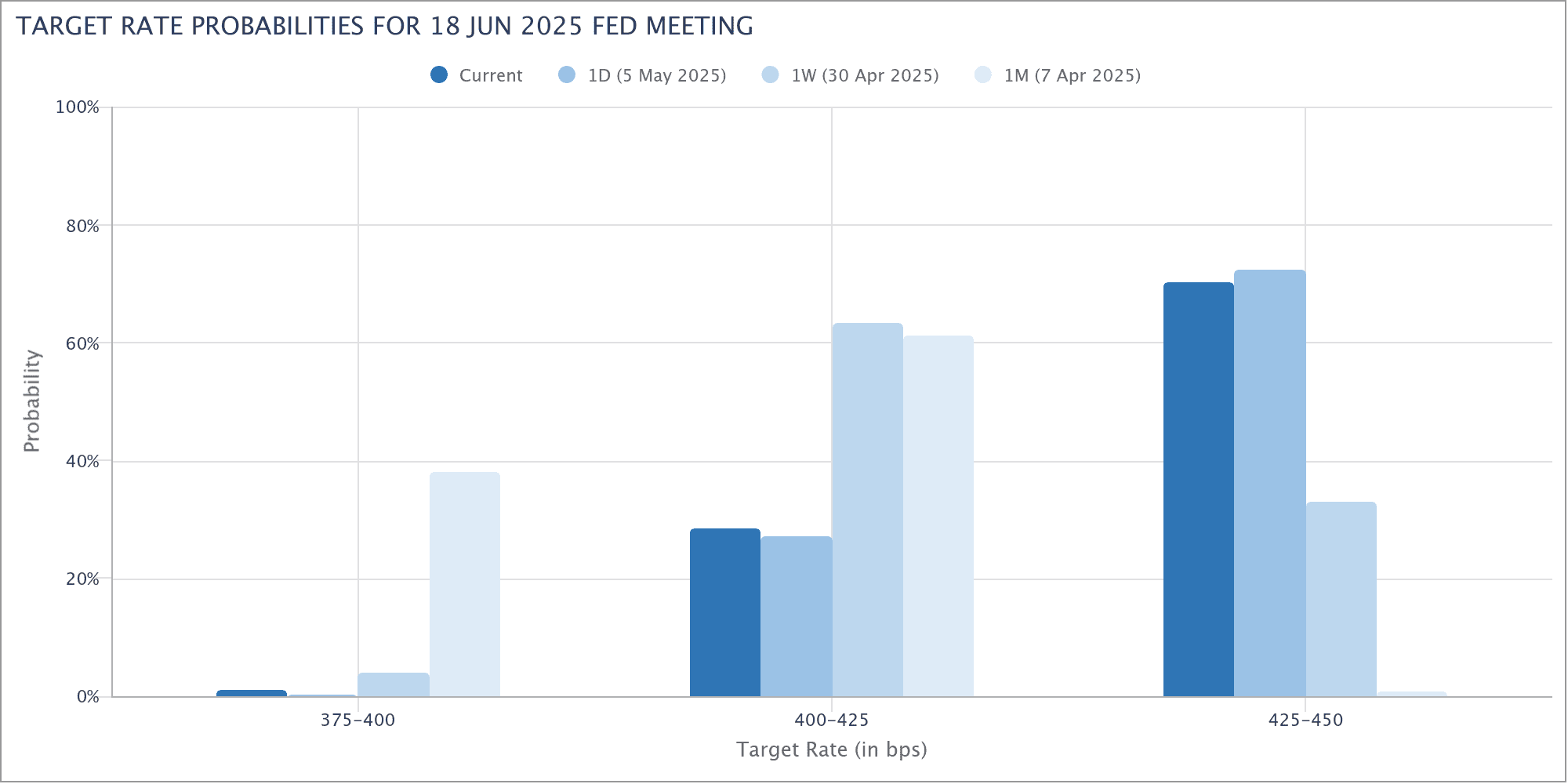

Daan Crypto Trades noted the importance of observing any dovish or hawkish signals from the Fed, highlighting recent mixed messaging. Data from CME Group’s FedWatch Tool further emphasizes the market’s focus on future rate adjustments.

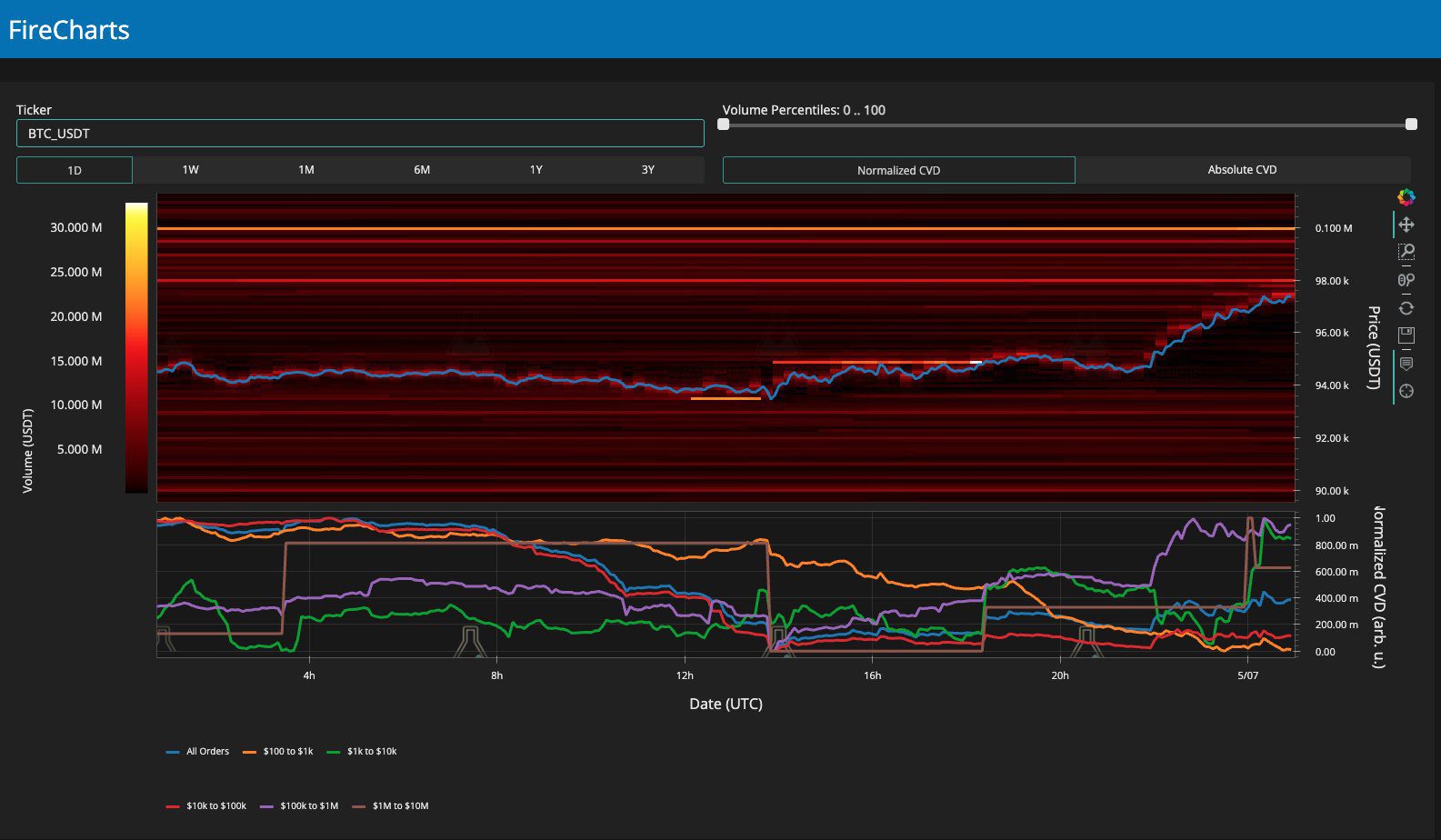

According to Keith Alan from Material Indicators, Bitcoin’s order book dynamics suggested a clearing of nearby liquidity before the Fed announcement. He cautioned about potential price fluctuations, indicating a possible retest of the yearly open level at $93,500.

Decreasing Rate Cut Expectations

CryptoQuant contributor Darkfost pointed out a decline in the probability of near-term rate cuts in 2025. Specifically, expectations for rate cuts at the June FOMC meeting have decreased substantially, signaling a more pessimistic outlook.

The reduced probability of rate cuts suggests that investors are anticipating a more hawkish stance from the Federal Reserve, potentially impacting risk assets like Bitcoin. The reaction of Bitcoin to these external factors showcases the crypto’s place in the wider global financial framework.

Bitcoin’s Resilience

Despite the shifting macroeconomic landscape, Bitcoin’s resilience remains noteworthy. The ability of Bitcoin to rally close to $98,000 shows how much potential it possesses. Some think that the Fed potentially changing direction, may send Bitcoin even higher.

The Global View

Bitcoin isn’t just affected by US events, for example news of India and Pakistan tensions along with the possibility of progress between the US and China also affect it.

Broader Market Context

To fully understand Bitcoin’s price movements, it’s essential to consider the broader market context. Factors like institutional investment, regulatory developments, and technological advancements all contribute to Bitcoin’s overall performance. Institutional adoption, particularly through Bitcoin ETFs, has provided significant inflows and increased market liquidity. The regulatory landscape, while still evolving, continues to shape investor sentiment and market structure. Technological innovations, such as the Lightning Network, aim to improve Bitcoin’s scalability and usability.

Future Outlook

Looking ahead, Bitcoin’s trajectory will likely be influenced by a combination of macroeconomic forces and internal developments. The Federal Reserve’s monetary policy decisions will continue to play a crucial role, as will regulatory changes and the pace of technological innovation. The increasing integration of Bitcoin into the global financial system suggests that its role as a store of value and an alternative asset will continue to evolve.

Disclaimer: This analysis is for informational purposes only and does not constitute investment advice. Trading and investing in cryptocurrencies involve significant risk, and individuals should conduct their own research before making any financial decisions.