Bitcoin (BTC) is currently experiencing a surge in profit-taking, raising questions about the sustainability of its recent bull run. Investors are cashing out at high price levels, leading to significant daily realized profits. This activity has triggered concerns that the market might be approaching a local top or a sharp correction.

Key Takeaways

- Massive Profit-Taking: Bitcoin investors are realizing approximately $1 billion in profits daily.

- Late-Stage Bull Market Sign? This level of profit-taking is historically associated with the late stages of a bull market, where investors become more inclined to secure gains.

- Potential for Correction: If profit-taking remains high, a local top or sharp price correction becomes increasingly likely.

- Investor Psychology Unchanged: Despite increased institutional participation via ETFs, underlying investor behavior regarding profit-taking hasn’t significantly altered.

Bitcoin Profit-Taking Reaches Multi-Month Highs

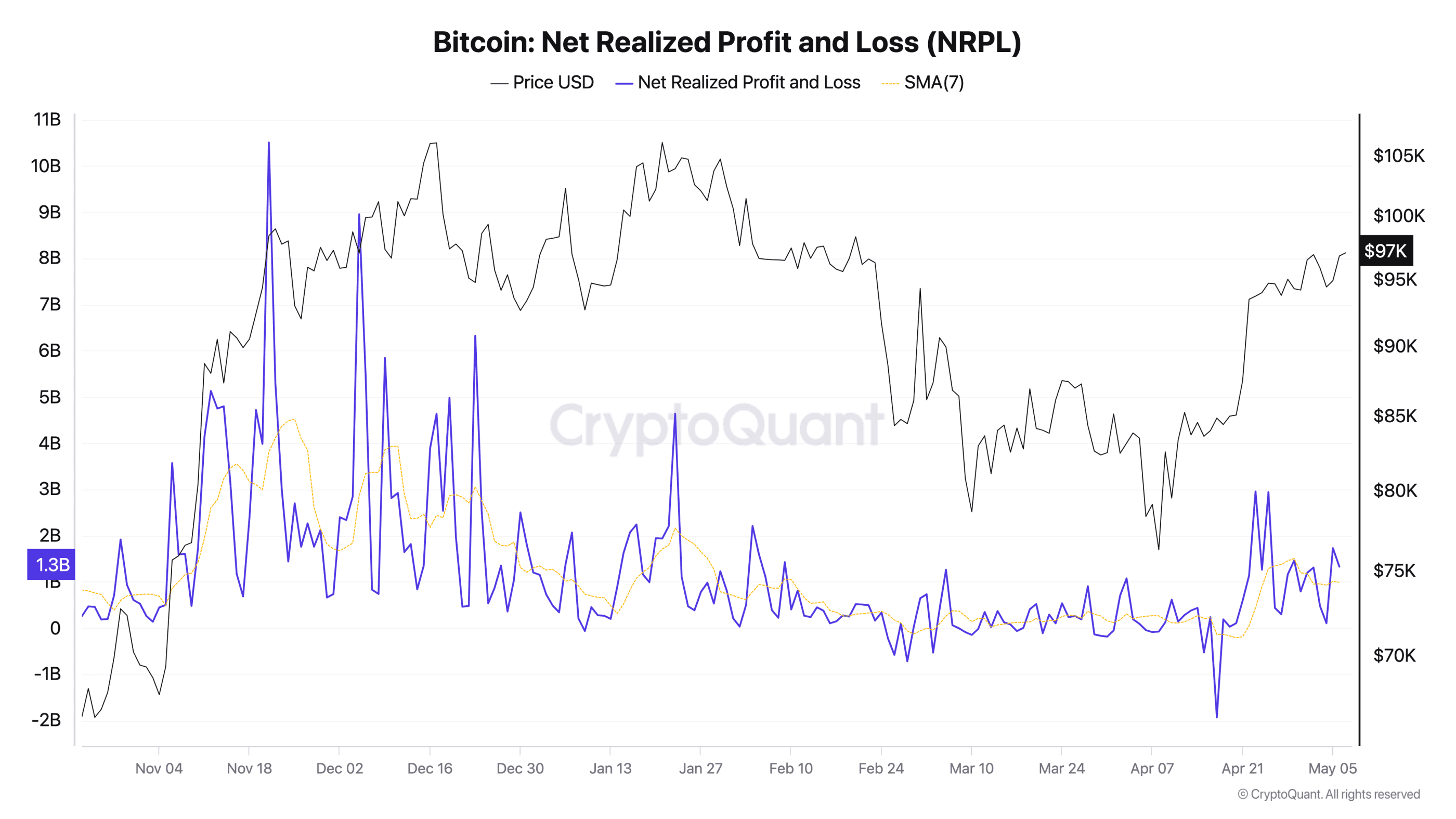

Data from CryptoQuant reveals that Bitcoin realized profits have spiked to levels not seen in months as BTC flirts around $98,000. This pattern mirrors the late stages of previous bull markets, specifically drawing comparisons to late 2024 when Bitcoin broke through previous all-time highs.

According to Kripto Mevsimi, a contributor to CryptoQuant, even after positive price movement, aggressive profit-taking persists. This behavior aligns with historical trends observed during late-stage bull markets where profit-taking dominates despite continued price increases.

The current 7-day moving average realized profit across all Bitcoin holders sits at approximately $1 billion per day. Historical analysis suggests that such phases often precede market corrections, particularly when profit-taking remains consistently high.

Institutional Investment vs. Investor Behavior

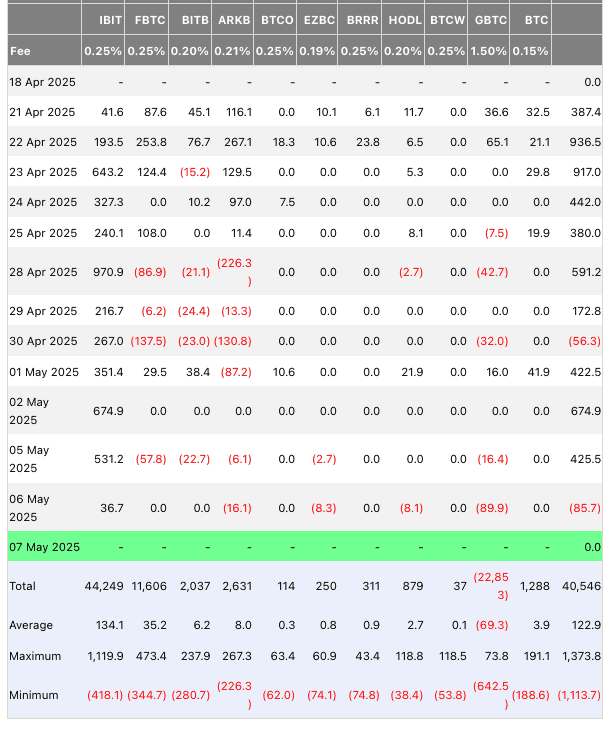

The introduction of US spot Bitcoin ETFs, particularly BlackRock’s iShares Bitcoin Trust (IBIT), was expected to fundamentally change the Bitcoin investment landscape. IBIT has experienced consistent daily inflows, indicating strong institutional interest.

However, Kripto Mevsimi argues that despite the structural changes brought about by ETFs, underlying investor psychology remains largely unchanged. Investors continue to react to price changes in a manner consistent with previous market cycles, prioritizing profit-taking when opportunities arise.

The Implications of Profit-Taking

High levels of profit-taking can exert downward pressure on Bitcoin’s price. As more investors sell their holdings to secure profits, the supply of Bitcoin available on the market increases, while demand may not keep pace. This imbalance can lead to a price correction.

Furthermore, aggressive profit-taking can create a self-fulfilling prophecy. As prices begin to decline, more investors may be incentivized to sell, further accelerating the downward trend. This is especially true if fear, uncertainty, and doubt (FUD) enter the market.

What’s Next for Bitcoin?

The current market conditions present a mixed outlook for Bitcoin. While strong institutional interest and potential for further price appreciation remain, the elevated levels of profit-taking warrant caution. Investors should carefully monitor market trends, news, and on-chain data to make informed decisions.

Ultimately, the future of Bitcoin’s price will depend on a complex interplay of factors, including investor sentiment, macroeconomic conditions, and regulatory developments.

Bitcoin’s Price History (to Provide Context)

To truly understand the current profit-taking behavior, it’s helpful to consider Bitcoin’s recent price history. After a significant downturn in 2022, Bitcoin began a strong recovery in early 2023, driven by factors like the anticipation of spot Bitcoin ETFs and renewed institutional interest. The approval of these ETFs in January 2024 further fueled the rally, pushing Bitcoin to new all-time highs. However, this rapid price appreciation also created opportunities for investors who had been holding Bitcoin for longer periods to realize substantial profits.

The following events have affected the price of bitcoin in the past few months:

- Bitcoin ETF Approvals: The approval of spot Bitcoin ETFs in the United States in January 2024 was a major catalyst for price appreciation.

- Inflation Data: Inflation reports and Federal Reserve meetings influence investor sentiment and risk appetite, impacting Bitcoin’s price.

- Geopolitical Events: Major world events can drive investors towards or away from Bitcoin as a safe haven asset.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.