Bitcoin (BTC) is showing strong signals of a potential bull cycle resurgence, fueled by record-breaking network value and increasing investor confidence. The digital asset is eyeing a return to the $100,000 mark, buoyed by a series of positive on-chain metrics and market dynamics.

Key Indicators Pointing Towards a Bullish Trend

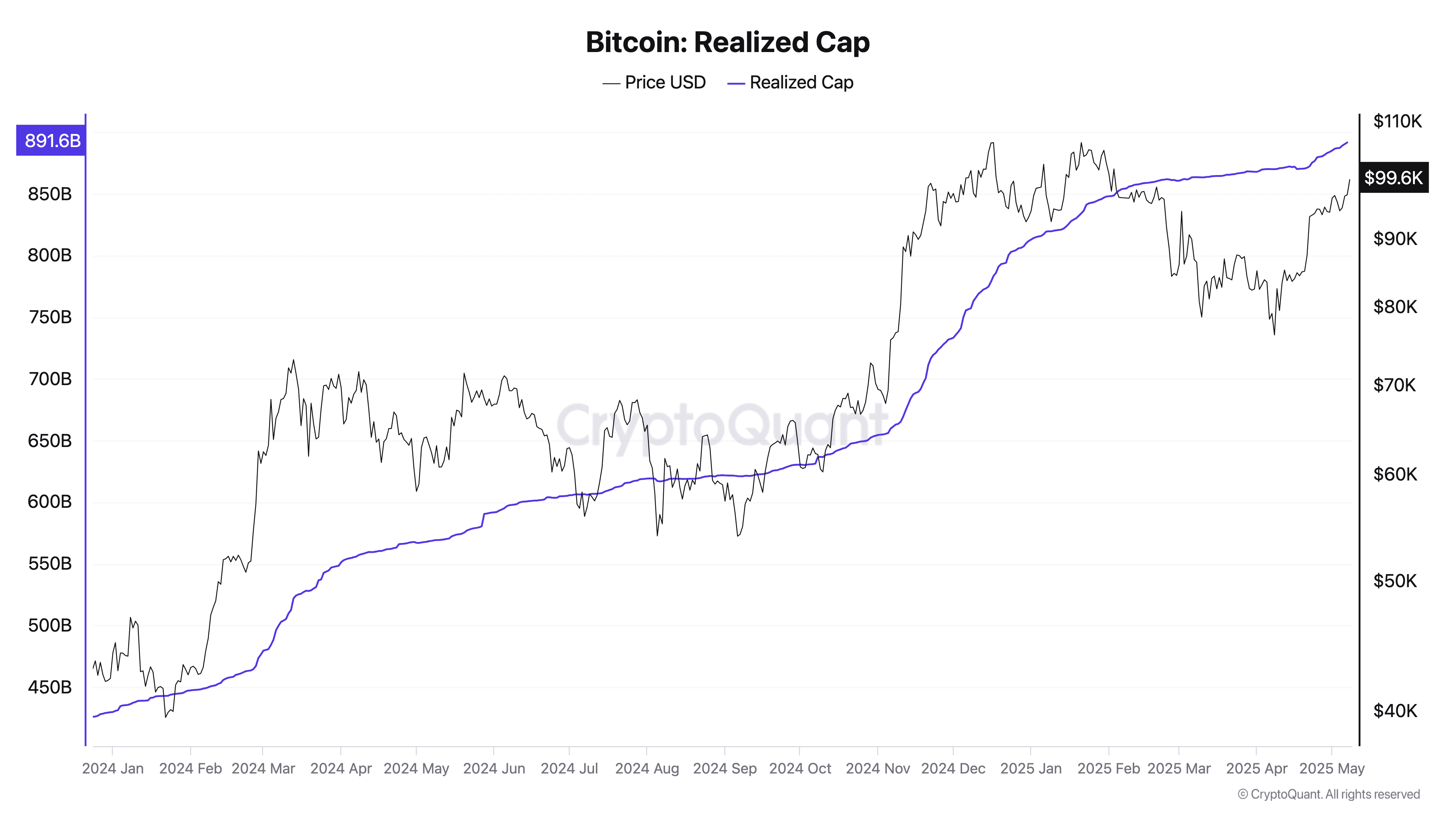

- Record Realized Cap: Bitcoin’s realized cap has reached new all-time highs, approaching $900 billion. This metric, which measures the value at which the extant supply last moved onchain, reflects the growing conviction among investors.

- Consistent Capital Inflows: Bitcoin has experienced sustained capital inflows, demonstrating renewed investor interest and demand.

- Balanced Buy and Sell-Side Conditions: Despite profit-taking activities, buy and sell-side conditions appear balanced, indicating a healthy market dynamic.

Bitcoin’s Realized Cap: A Sign of Growing Conviction

The realized cap, a metric that calculates Bitcoin’s market cap based on the price at which each BTC was last moved, has been steadily climbing. This suggests that investors are not only holding onto their Bitcoin but are also increasingly confident in its long-term value.

According to CryptoQuant, the realized cap uptrend reflects a long-term market shift across the Bitcoin investor spectrum. This surge indicates a growing conviction in Bitcoin’s potential as a financial asset.

Capital Influx and Demand-Side Strength

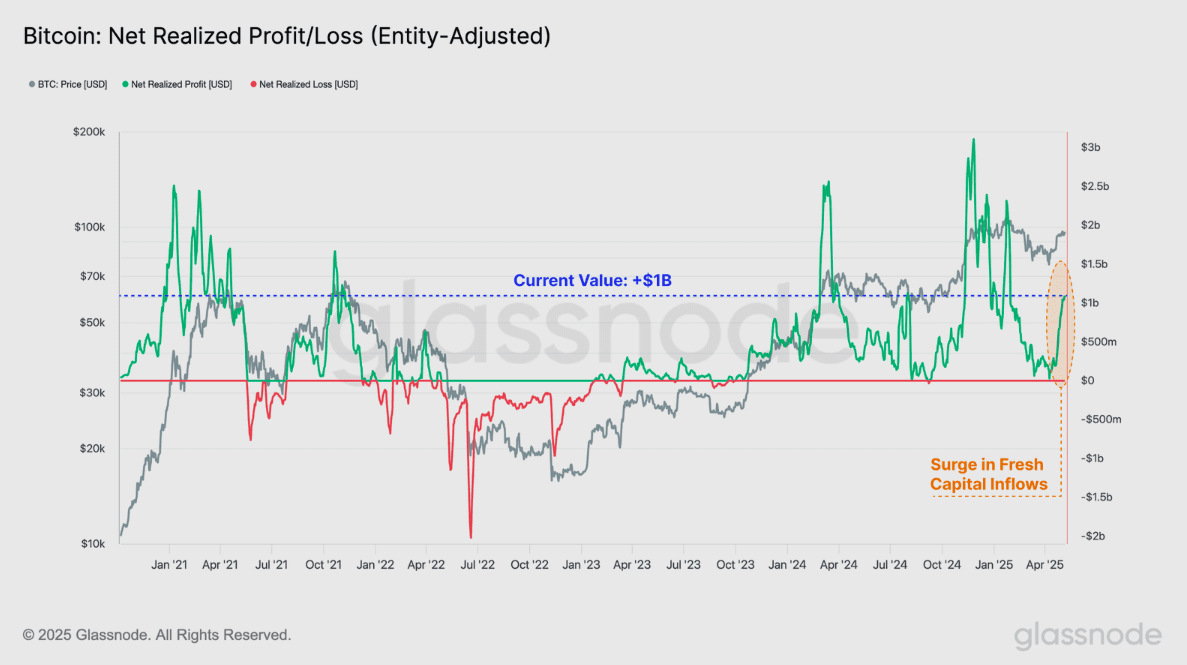

Since October 2023, the Bitcoin market has sustained a profit-driven regime, with capital inflows consistently exceeding outflows. This steady influx of fresh capital serves as an overall constructive signal, indicating a healthy demand for Bitcoin.

Glassnode noted that the recent rally has drawn in over $1 billion per day in net capital inflows, indicating a return of demand-side strength. This demand is absorbing the incoming supply, suggesting a balanced market dynamic.

Potential Roadblocks and Considerations

While the indicators are largely positive, it’s essential to acknowledge potential roadblocks. Profit-taking activities by both long-term holders (LTHs) and short-term holders (STHs) remain a factor to watch. However, the current market appears capable of absorbing this profit-taking without derailing the bullish trend.

Expert Perspectives

Analysts suggest that if the current trend of sustained accumulation from both LTHs and STHs continues, the market could be building a solid foundation for a potentially significant price breakout. This could potentially signal the early stages of a new bull cycle for Bitcoin.

Conclusion

Bitcoin’s current market dynamics, characterized by a record-high realized cap and consistent capital inflows, paint a promising picture for its future. While profit-taking activities and other market factors should be monitored, the overall trend suggests a potential return to six figures and the beginning of a new bull cycle.

It’s important to remember that the cryptocurrency market is inherently volatile, and past performance is not indicative of future results. Always conduct thorough research and consult with a financial advisor before making any investment decisions.