United States exchanges are significantly expanding their cryptocurrency derivatives offerings, driven by market turbulence stemming from trade uncertainties. This surge in demand for financial instruments allows traders to hedge against risk and profit from volatility.

Since late 2024, major exchanges including Coinbase, Robinhood, Kraken, and the Chicago Mercantile Exchange (CME) Group have been actively listing new crypto derivatives and exploring acquisitions to solidify their positions in this rapidly growing market.

In April, the introduction of new tariff plans triggered market volatility, further boosting crypto derivatives trading volumes. This activity underscores the increasing role of crypto derivatives in navigating macroeconomic risks.

David Siemer, CEO of Wave Digital Assets, notes that “Institutional and sophisticated retail traders are increasingly turning to crypto derivatives platforms to navigate macroeconomic risks and uncertainty brought on by escalated tariff policies and global trade tensions.”

Consequently, US exchanges are seeing record trading activity and are expanding their investment options, supported by the promise of regulatory clarity.

Key Drivers of Crypto Derivatives Growth

The growth of crypto derivatives can be attributed to several factors:

- Market Volatility: Trade uncertainties and economic events create volatility, which drives demand for hedging and speculative trading in crypto derivatives.

- Institutional Interest: Growing acceptance by institutional investors is increasing liquidity and legitimizing the crypto derivatives market.

- Regulatory Clarity: Progress in regulatory frameworks provides exchanges with the confidence to expand their offerings.

Trump’s Tariff Plans Spark Increased Trading

Crypto derivatives trading experienced significant growth following the election victory. The introduction of new tariff plans further accelerated this activity.

In December, Coinbase reported a massive year-over-year increase in trading activity on its derivatives exchange. Similarly, CME Group identified crypto derivatives as one of its fastest-growing product segments during its earnings call.

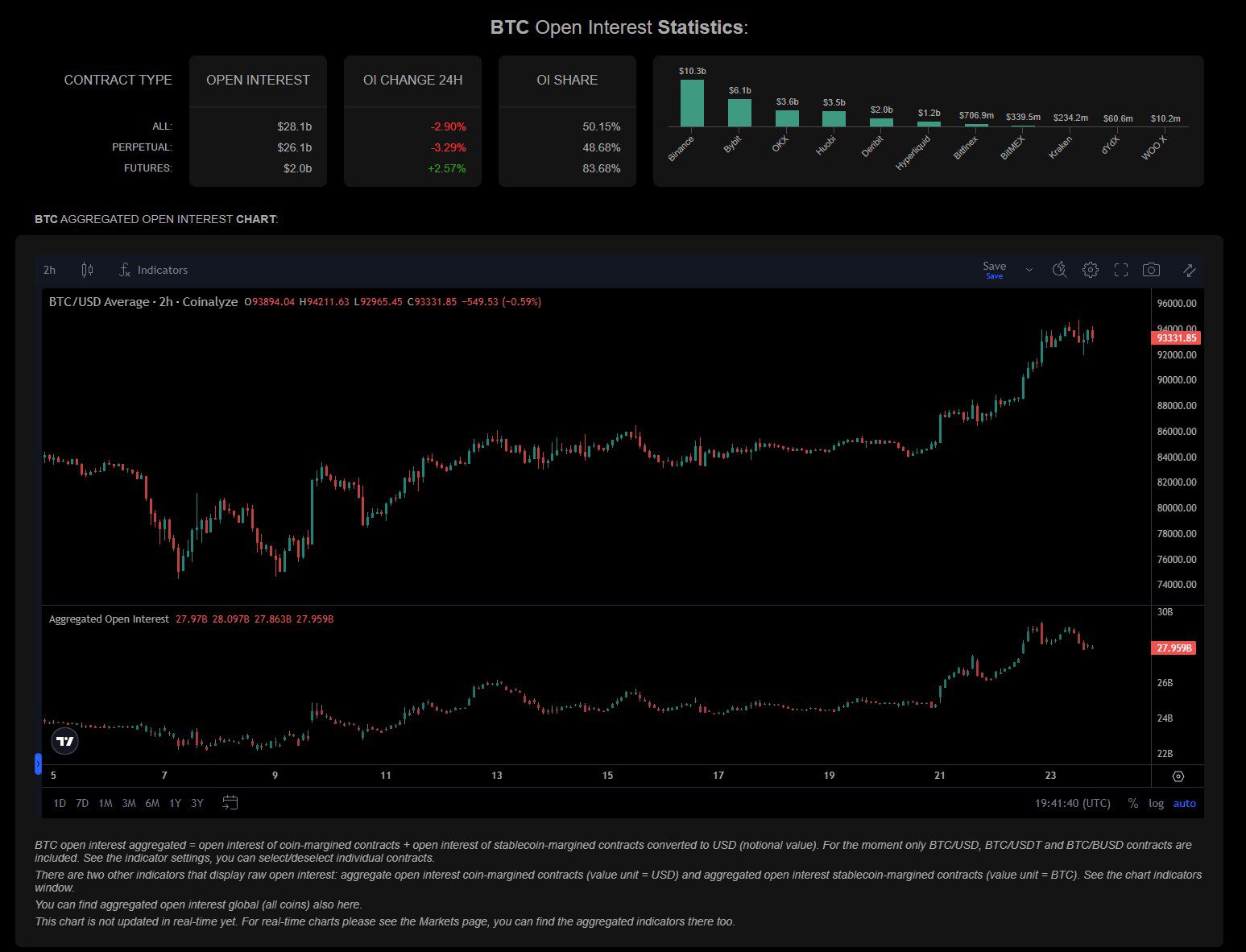

Data from Coinalyze shows a notable increase in net open interest in Bitcoin futures following the announcement of tariff plans. This signifies increased participation and capital inflow into the crypto derivatives market.

Futures contracts, which involve agreements to buy or sell assets at a future date, are instrumental in this market, offering opportunities for leveraged gains.

Intensified Competition Among Exchanges

The expanding trading volumes are creating fierce competition among exchanges, pushing them to innovate and expand their product lines.

Coinbase has launched multiple new crypto derivatives, including futures contracts for altcoins like Solana (SOL) and XRP. Robinhood has entered the market with Bitcoin futures, and CME Group has introduced Solana futures contracts.

The CME SOL futures recorded substantial trading volume on its first day, highlighting the increasing interest in altcoin derivatives.

Mergers and acquisitions are also playing a role, with Coinbase reportedly considering the acquisition of Deribit, and Kraken acquiring NinjaTrader, a futures exchange.

The Strategic Importance of Crypto Derivatives

Nic Roberts-Huntley, CEO of Blueprint Finance, emphasizes the crucial role of crypto derivatives exchanges in the current economic environment. “The recent wave of tariffs has transformed crypto derivatives exchanges into critical market infrastructure,” Roberts-Huntley states.

These platforms serve as both speculative venues and hedging mechanisms, allowing traders to manage risks associated with global trade dynamics. While traditional markets may struggle under tariff pressures, derivatives platforms can thrive by offering opportunities to profit from volatility.

Understanding Crypto Derivatives: A Deeper Dive

Crypto derivatives are financial contracts whose value is derived from an underlying cryptocurrency. These contracts allow traders to speculate on the future price movements of cryptocurrencies without actually owning the underlying asset.

Types of Crypto Derivatives

- Futures: Agreements to buy or sell a cryptocurrency at a predetermined price and date in the future.

- Options: Contracts that give the buyer the right, but not the obligation, to buy or sell a cryptocurrency at a specific price within a specific timeframe.

- Perpetual Swaps: Similar to futures contracts but without an expiration date, allowing traders to hold positions indefinitely.

Benefits of Trading Crypto Derivatives

- Leverage: Derivatives allow traders to control larger positions with a smaller amount of capital.

- Hedging: Derivatives can be used to protect against potential losses in the cryptocurrency market.

- Speculation: Traders can profit from both rising and falling cryptocurrency prices.

Risks of Trading Crypto Derivatives

- Volatility: The cryptocurrency market is highly volatile, which can lead to significant losses.

- Leverage: While leverage can magnify profits, it can also magnify losses.

- Complexity: Crypto derivatives can be complex instruments, requiring a thorough understanding of their mechanics.

In conclusion, the US crypto derivatives market is experiencing significant growth, driven by market volatility and increasing interest from both retail and institutional investors. As exchanges compete to expand their offerings, traders have more opportunities than ever to participate in this dynamic market.