Ripple’s Acquisition Strategy: Is It a SoftBank-Inspired Play for Crypto Dominance?

Ripple has been on an acquisition spree, aiming to control key transaction rails and route them through XRP and its stablecoin, Ripple USD (RLUSD). This strategy has drawn comparisons to SoftBank, the Japanese investment firm known for its aggressive investment approach.

The $1.25 billion acquisition of Hidden Road on April 8 allows Ripple to use RLUSD as collateral in the firm’s prime brokerage products. Hidden Road will also migrate its post-trade operations to the XRP Ledger, the blockchain underpinning XRP and several of Ripple’s institutional services.

Austin King, co-founder of Omni Network and former owner of Strata Labs (acquired by Ripple in 2019), describes Ripple’s approach as a “SoftBank-type” acquisition strategy. This involves aggressive investments, joint ventures, and acquisitions rather than in-house development, similar to SoftBank’s model.

The SoftBank Model: A Deep Dive

SoftBank rose to prominence through early investments in Yahoo and Alibaba. A $20 million bet on Alibaba exploded to $60 billion when Alibaba went public in 2014. SoftBank recycled these returns into fresh capital, exits, and a broad ecosystem, including ventures into US telecom (Sprint) and semiconductors (ARM).

King explains that SoftBank’s wide coverage allowed it to create synergies across its portfolio companies. Ripple is employing a similar strategy focused on financial services, using XRP instead of venture bets.

Ripple’s recent acquisitions reflect a strategy of buying infrastructure instead of building it from scratch, treating their portfolios as ecosystems. Key to this strategy is leveraging capital.

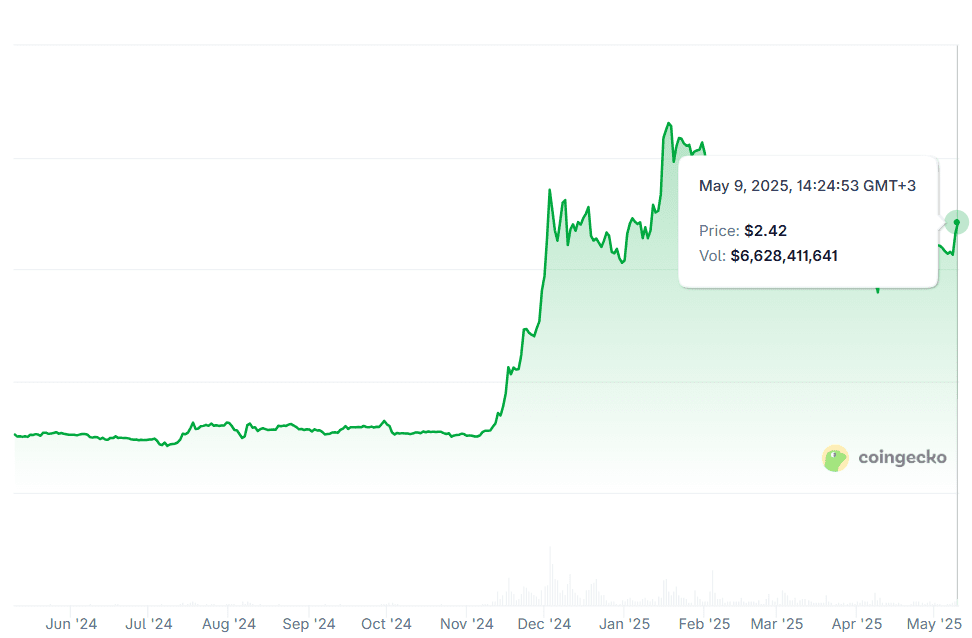

Ripple’s holdings as of March 31, included 4.56 billion XRP (around $11 billion) and another 37.13 billion XRP ($89.8 billion) in escrow, providing a significant war chest for acquisitions and strategic investments.

These acquisitions expand the reach of XRP and RLUSD in traditional finance, embedding them into custody, brokerage, and payment flows. King describes this as a token-fueled flywheel, where Ripple uses its assets to acquire infrastructure, driving usage back into those assets.

Sid Powell, co-founder and CEO of Maple, notes that Ripple can embed XRP as the native bridge asset between networks, custodians, and tokenized assets, while RLUSD can provide a regulated, USD-pegged unit of account.

Skepticism Surrounding the SoftBank Comparison

However, not everyone agrees with the SoftBank comparison. Powell argues that SoftBank operates as a conglomerate, taking broad investment positions across industries, while Ripple is taking a more focused, product-related approach with its acquisitions tied to payment missions and blockchain.

Casper Johansen, co-founder of Spartan Group, finds the comparison “a bit stretched,” emphasizing that SoftBank’s success came from acquiring and turning around operating businesses, joint ventures, and minority stakes.

Ripple Joins the Crypto M&A Arms Race

Rather than spanning diverse sectors like telecom and media, Ripple is assembling a financial infrastructure stack. Key acquisitions include custody firms Metaco (2023) and Standard Custody (2024). Hidden Road brings 300 institutional clients clearing $3 trillion annually.

Johansen notes that Metaco lays the foundation for storing assets, while Hidden Road allows Ripple to leverage its balance sheet to turbocharge Hidden Road’s business.

Factors Driving Ripple’s M&A Strategy

Several factors have contributed to Ripple’s acquisition strategy:

- Regulatory Clarity: Improving regulatory climate in the US, clearing the path for crypto firms to scale.

- Strategic Goals: Expanding the utility and adoption of XRP and RLUSD.

- Competitive Landscape: Crypto firms are increasingly turning to M&A to gain market share and expand their offerings.

Ripple’s Future Moves

Garlinghouse has indicated Ripple intends to continue exploring acquisitions.

King suggests Ripple might acquire a large-scale point-of-sale company to expand from backend financial services to direct consumer payments.

In April, Ripple reportedly made a $4 billion-$5 billion bid to acquire Circle, though it was rejected for being too low.

The Role of Stablecoins

Hadley Stern, chief commercial officer at Marinade, notes that the practical integration of XRP remains limited due to institutional hesitancy to use volatile crypto assets. RLUSD is more promising but faces competition from USDC and PayPal USD.

Key Takeaways

- Ripple’s acquisition strategy is focused on building a comprehensive financial infrastructure stack.

- The strategy draws parallels to SoftBank’s investment model, but with a focus on financial services and blockchain technology.

- XRP and RLUSD are central to Ripple’s vision of integrating crypto assets into traditional finance.

- Regulatory clarity and competitive pressures are driving Ripple’s M&A activity.