Key Takeaways:

- Ethereum (ETH) experienced a significant 29% price rally between May 8 and May 9, potentially signaling the end of a 10-week bear market.

- Despite the rally, demand for spot ETH ETFs remains muted, indicating a lack of strong conviction among traders.

- Recent network upgrades have solidified Ethereum’s leadership in decentralization and security, reflected in its substantial Total Value Locked (TVL).

- Political factors, such as President Trump’s shifting stance on altcoins, could influence investor sentiment towards Ethereum.

Ethereum (ETH) has recently shown signs of life, posting an impressive 29% gain and potentially ending a prolonged bear market. This surge triggered the liquidation of over $400 million in short ETH futures positions, suggesting a surprise to many market participants. However, a deeper look reveals a more nuanced picture of investor sentiment and underlying fundamentals.

Market Sentiment and Derivatives:

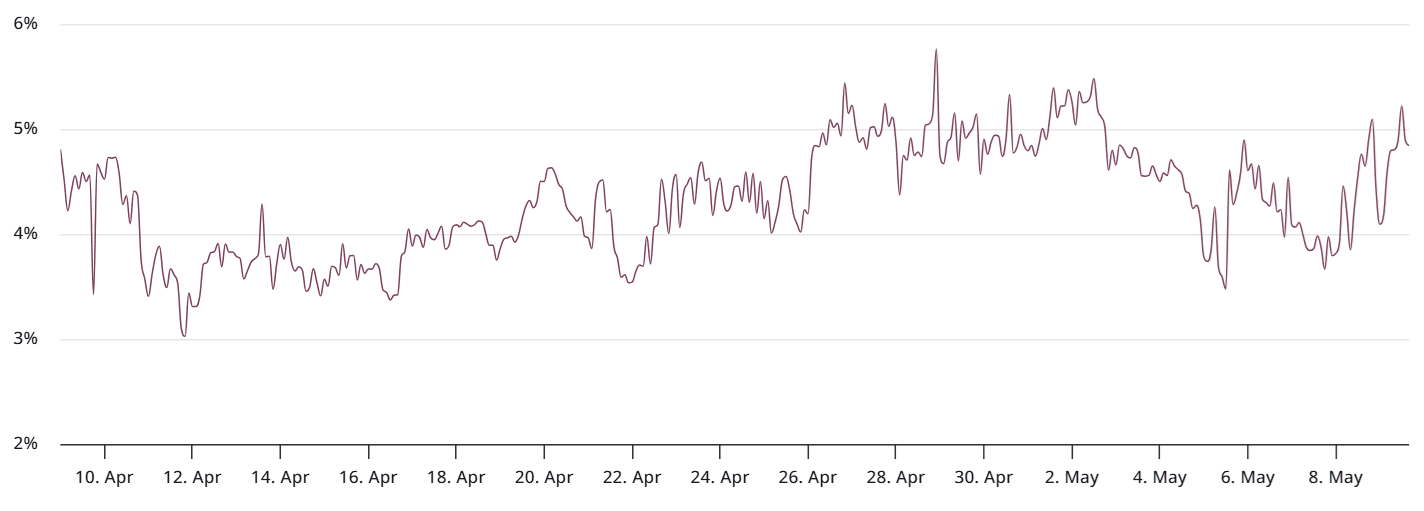

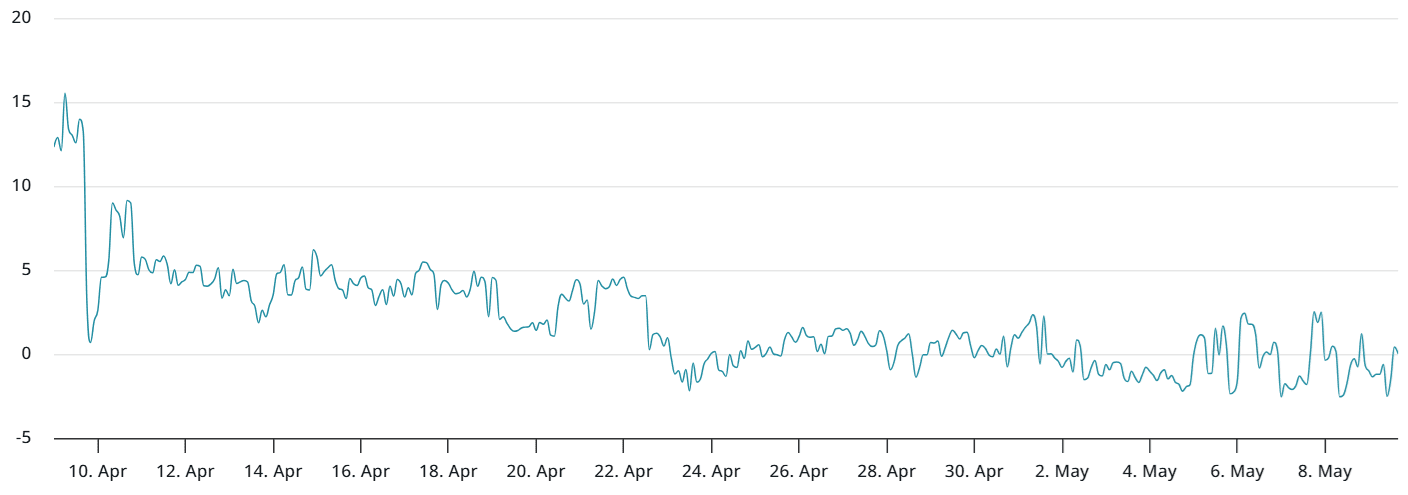

Despite the price increase, traders have largely maintained a neutral stance in ETH derivatives. The ETH futures premium remains below the 5% threshold typically associated with a bullish market, indicating limited demand for leveraged long positions. This cautious approach may stem from Ethereum’s underperformance compared to the broader altcoin market in 2025.

Some analysts view this lack of bullish conviction as an opportunity for further short covering, while others believe that Ethereum’s core fundamentals need to improve significantly to sustain a long-term rally.

Ethereum’s Strengths: Decentralization and TVL

Regardless of short-term price fluctuations, Ethereum continues to excel in decentralization and security. Recent network upgrades have enhanced layer-2 scalability, further solidifying its position as the leading platform. This strength is reflected in Ethereum’s substantial Total Value Locked (TVL) of $64 billion, significantly surpassing its competitors like Solana, BNB Chain, and Tron.

ETF Flows and Network Fees:

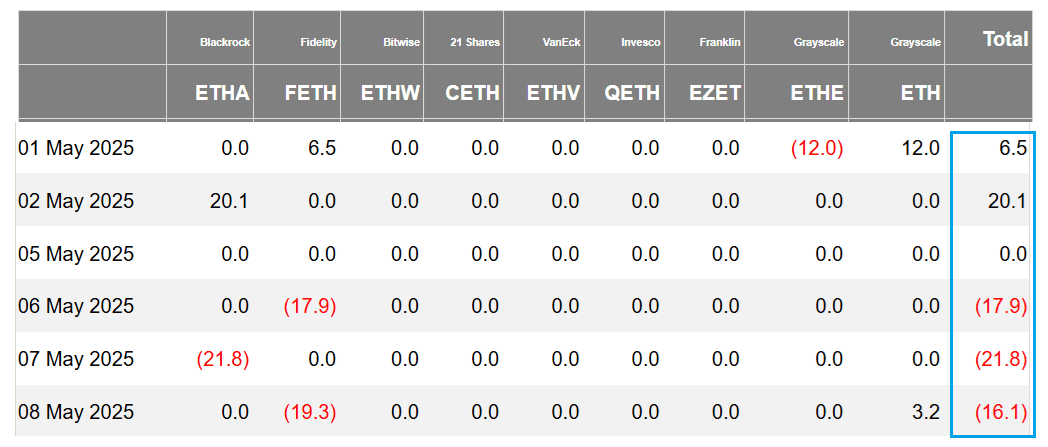

One potential warning sign is the limited demand for spot Ether exchange-traded funds (ETFs). Even after the recent price surge, US-listed Ether spot ETFs experienced net outflows, indicating a lack of strong institutional buying pressure. This muted enthusiasm may be related to the sharp decline in Ethereum network fees observed from January to April. Reduced network activity lowers overall demand for ETH and impacts net staking yields.

Options Market Sentiment:

Analysis of ETH options markets provides further insight into market sentiment. Currently, put (sell) options are trading at similar levels to call (buy) options, suggesting a neutral outlook. This contrasts with the potential bullish signal from the price rally and highlights the uncertainty surrounding Ethereum’s near-term trajectory.

The Trump Factor: Political Influence on Crypto

Recent reports indicate that former US President Donald Trump has shifted his stance on certain altcoins, potentially favoring Ethereum. This change in political sentiment could positively impact investor confidence and contribute to a renewed rally. His previous mentions of Solana, Cardano and XRP may have created an impression of preference, so him severing ties with people who proposed those altcoins could mean he is more open to Ethereum.

Ethereum Price Prediction and Potential Catalysts:

Despite the mixed signals from various indicators, a rally toward the $2,700 level remains plausible, particularly if investor sentiment improves due to positive news or developments. Potential catalysts for a further rally include:

- Increased demand for spot ETH ETFs.

- Significant improvements in Ethereum network activity and reduced transaction fees.

- Positive regulatory developments for Ethereum.

- Further endorsements or support from political figures.

Conclusion:

Ethereum’s recent price rally represents a potentially significant turning point after a prolonged bear market. However, sustained upward momentum depends on a confluence of factors, including increased investor confidence, improved network fundamentals, and favorable regulatory and political developments. Traders should carefully monitor these factors to assess the sustainability of the current rally and make informed investment decisions. Whether Ethereum can overcome the existing market apathy remains to be seen, but the potential for further upside remains.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are inherently risky, and investors should conduct thorough research before making any decisions.