Key Takeaways:

- Solana’s price is showing bullish momentum, with a potential close above the 50-week EMA, a historical indicator of significant rallies.

- Liquidity bridged to Solana exceeds $165 million in the last 30 days, demonstrating increased network confidence.

- Solana leads in decentralized exchange (DEX) volumes, holding 28.99% of the market share among all chains.

Solana (SOL) has experienced an 18% price increase this week, indicating growing bullish sentiment. The cryptocurrency is approaching a critical juncture, potentially closing above the 50-week exponential moving average (EMA), a level historically associated with substantial rallies. This analysis explores the factors driving Solana’s potential for further gains, including technical indicators, liquidity inflows, and decentralized finance (DeFi) activity.

Technical Analysis: Bullish Indicators

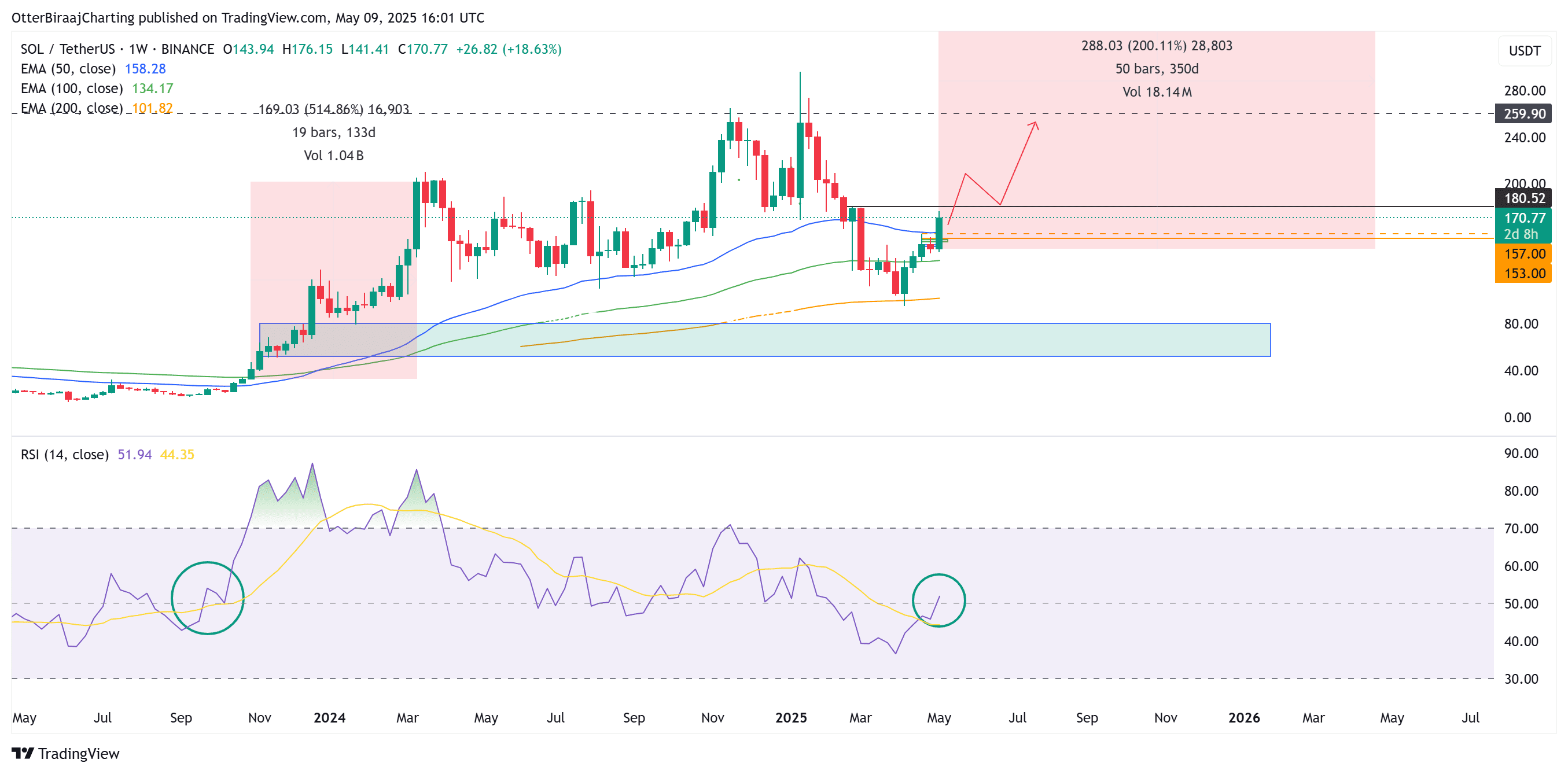

In March, SOL briefly dipped below the 50-week EMA, touching under $100 on April 7. However, Solana has since demonstrated a strong recovery, reclaiming key EMA levels (100W and 200W). The focus is now on the 50-week EMA (blue line), which, if breached, could signal a strong upward trend.

Historically, Solana has exhibited significant price movements following EMA breaches. In October 2023, SOL broke through the 50- and 100-week EMAs, consolidated above these levels, and then rallied by 515% by March 2024. The relative strength index (RSI) was below 50 during these periods, mirroring the current setup. If the 50-week moving average holds, price targets for SOL could range between $250 and $350 by September 2025.

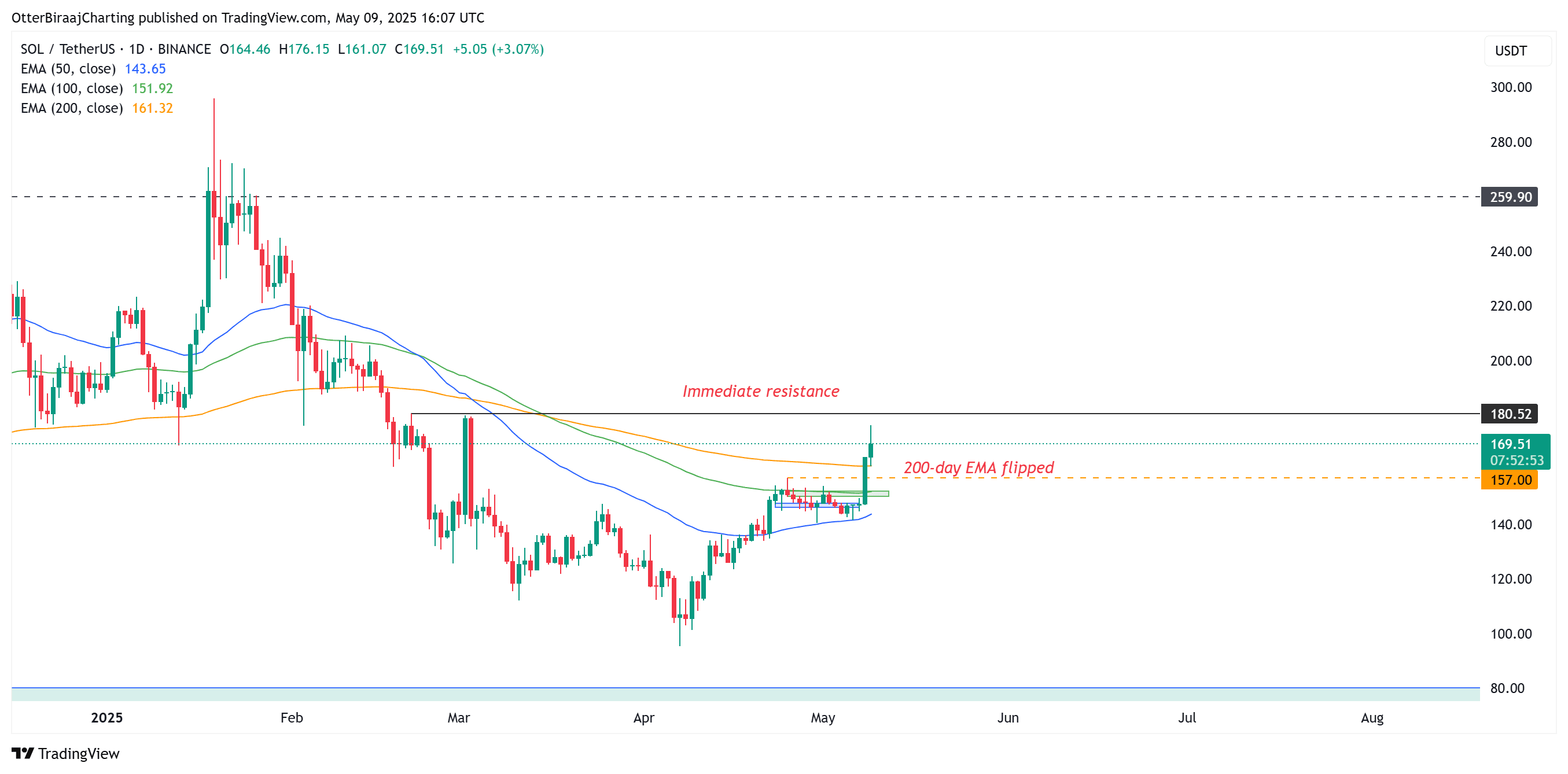

The daily chart further supports this bullish outlook. Solana has recently closed above the 200-day EMA, with immediate resistance at $180. Surpassing this level in the coming weeks and establishing it as a support level could potentially trigger a parabolic rally by Q3 2025. To achieve this, SOL needs to maintain its momentum and attract sustained buying pressure.

Liquidity Inflows: $165 Million Bridged to Solana

Over the past 30 days, over $165 million in liquidity has been bridged to Solana from other blockchains, reflecting growing confidence in the network. Ethereum led with $80.4 million in transfers, followed by Arbitrum with $44 million, according to Debridge data. Base, BNB Chain, and Sonic contributed $20 million, $8 million, and $6 million, respectively. These significant inflows indicate a strong belief in Solana’s potential and utility.

DeFi Dominance: Leading DEX Volumes

Data from DefiLlama indicates that Solana posted the highest decentralized exchange (DEX) volumes, totaling $3.32 billion, over the past 24 hours. The network currently holds 28.99% of the market share among other chains. This dominance highlights Solana’s scalability, efficiency, and user adoption within the DeFi ecosystem.

Solana’s high DEX volumes underscore its role as a leading platform for decentralized trading. Its ability to handle large transaction volumes efficiently contributes to its appeal among traders and investors.

Conclusion: Sustained Price Breakout Potential

Currently, substantial liquidity inflows and strong DEX volumes position Solana for a sustained price breakout. The combination of positive technical indicators and increasing network confidence suggests a favorable outlook for SOL. However, as with any investment, it’s important to conduct thorough research and consider the inherent risks involved in the cryptocurrency market. The possibility of regulatory changes or market corrections could impact Solana’s price trajectory.

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.