XRP has experienced a notable price surge, gaining 25% since April 7th, accompanied by a 32% increase in its open interest. This has sparked debate among traders and analysts: Is XRP poised for further gains, or is this a temporary rally before a potential downturn?

Key Developments:

- Price Surge: XRP has rebounded strongly after hitting a year-to-date low, increasing by 25% in just two weeks.

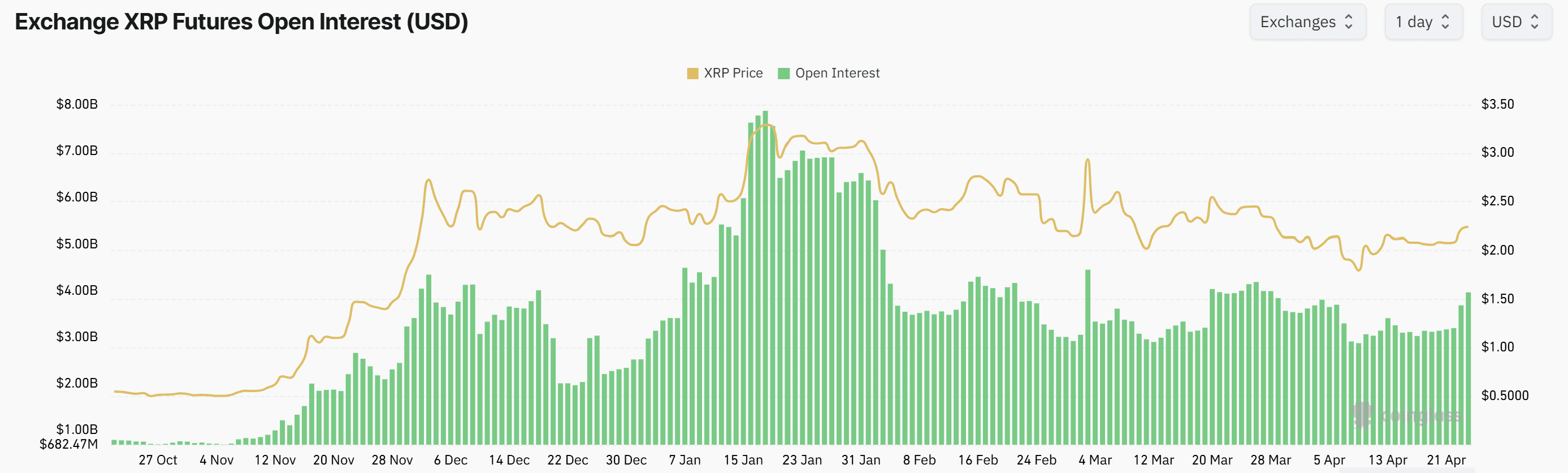

- Open Interest Increase: Open interest in XRP futures has risen dramatically, suggesting renewed interest from derivatives traders.

- Conflicting Signals: While spot market activity indicates bullish sentiment, futures market data presents a more neutral to bearish outlook.

- Analyst Predictions: Despite the mixed signals, some analysts maintain highly optimistic price targets for XRP.

Decoding the Data:

The surge in open interest alongside the price increase usually signals bullish sentiment, however, the aggregated premium on open interest is negative. This means the XRP futures market is bidding against an XRP price rise. Furthermore, the funding rate has remained near 0, implying a neutral stance between the bulls and bears.

Adding to the complexity, the aggregated spot tape cumulative volume delta has turned positive. This indicator measures the net difference between aggressive buy and sell trades. A positive value signals increasing buying pressure in the spot market, further blurring the picture.

In essence, XRP’s price movement seems to be caught between bullish spot market activity and cautionary signals from the futures market. This suggests a tug-of-war between buyers and sellers, making it difficult to predict the short-term trajectory of XRP.

Potential Price Targets and Analysis:

Despite the conflicting data, some analysts remain optimistic about XRP’s long-term potential. Sistine Research, a crypto investment community, has projected a long-term target between $33 and $50 for XRP, based on a higher time frame (HTF) symmetrical triangle pattern. This prediction draws parallels to XRP’s significant rally in 2017.

However, such a target would require a substantial increase in XRP’s market capitalization. Reaching $33 would translate to a market cap of approximately $2 trillion, exceeding Bitcoin’s current market cap. This raises questions about the feasibility of such a significant increase.

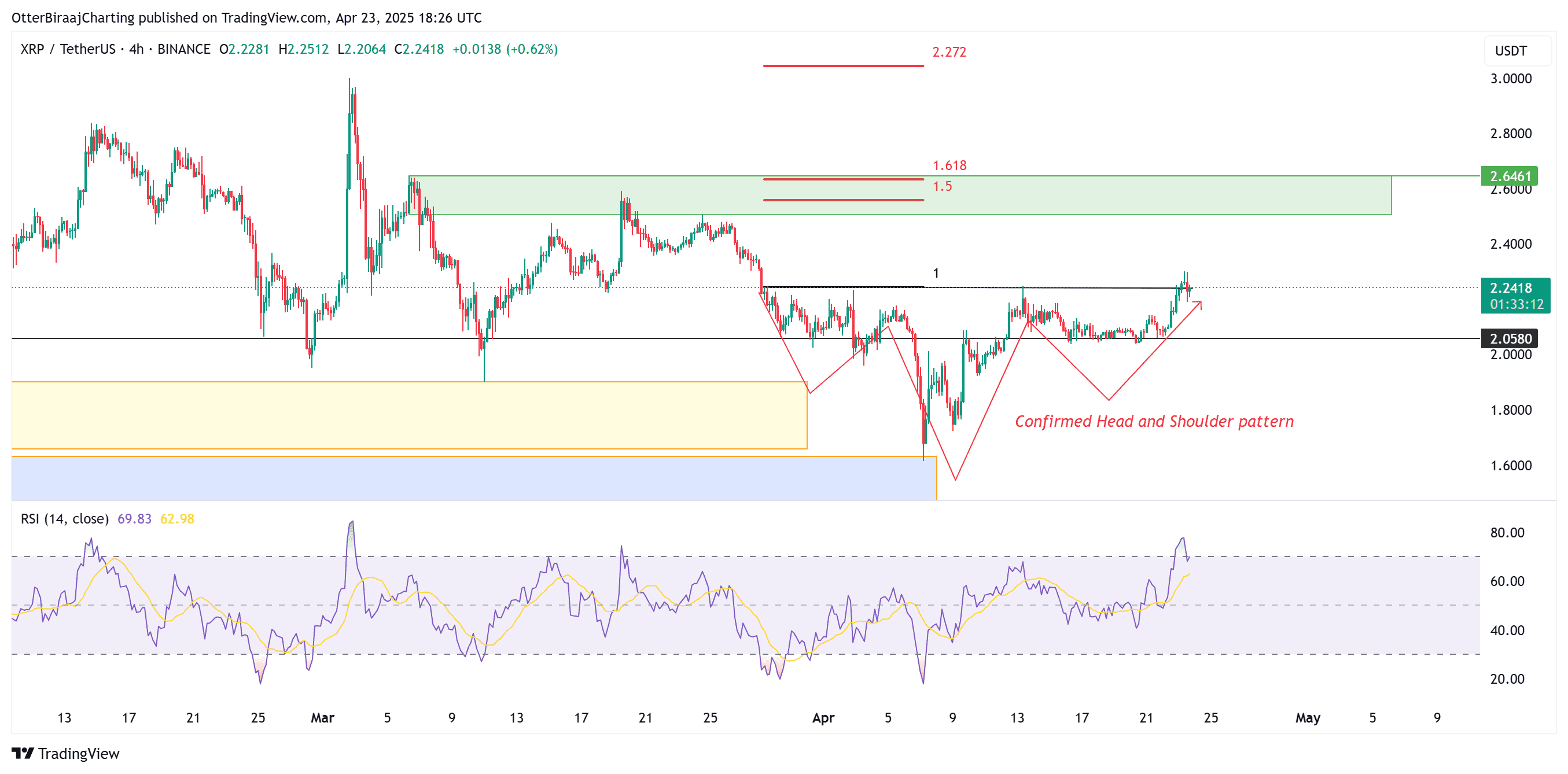

From a shorter-term perspective, XRP is showing an inverse head-and-shoulders pattern, hinting at a potential test of the resistance range between $2.50 and $2.67. This range aligns with Fibonacci extension levels, adding confluence to the potential resistance area.

The relative strength index (RSI) is nearing overbought territory, which could signal a potential pause in price movement at the current range. Traders should therefore exercise caution and monitor price action closely.

Analyzing Open Interest:

Open interest represents the total number of outstanding derivative contracts, such as options or futures, that have not been settled for an asset. A rising open interest suggests an influx of capital and greater participation, which can either support the current trend or precede a reversal.

In this case, the increase in open interest has coincided with the price increase, which some might consider a positive sign. However, given the negative aggregated premium on open interest, it’s crucial to consider that this surge could also be driven by traders anticipating and preparing for a potential price decline.

The Bottom Line:

While XRP has shown promising price action, it’s crucial to remain cautious and consider the conflicting signals emanating from the futures market. The tug-of-war between bullish spot market sentiment and bearish undertones in the futures market creates uncertainty. Monitoring key indicators, such as open interest, funding rates, and spot tape volume, will be essential to gauge the true direction of XRP’s price. Keep in mind, investing in cryptocurrencies involves risk, and it’s essential to conduct thorough research and consider your own risk tolerance before making any investment decisions.