Ethereum (ETH) is experiencing a significant price surge, marking its best weekly performance since May 2021. Several factors are contributing to this rally, suggesting potential for further growth. This article delves into the key drivers behind Ethereum’s upward momentum and provides insights into its future prospects.

Key Factors Driving the Ethereum Price Rally

- Pectra Upgrade: The recent Pectra upgrade introduces key improvements, such as higher staking limits and account abstraction (EIP-7702), enhancing Ethereum’s usability and flexibility.

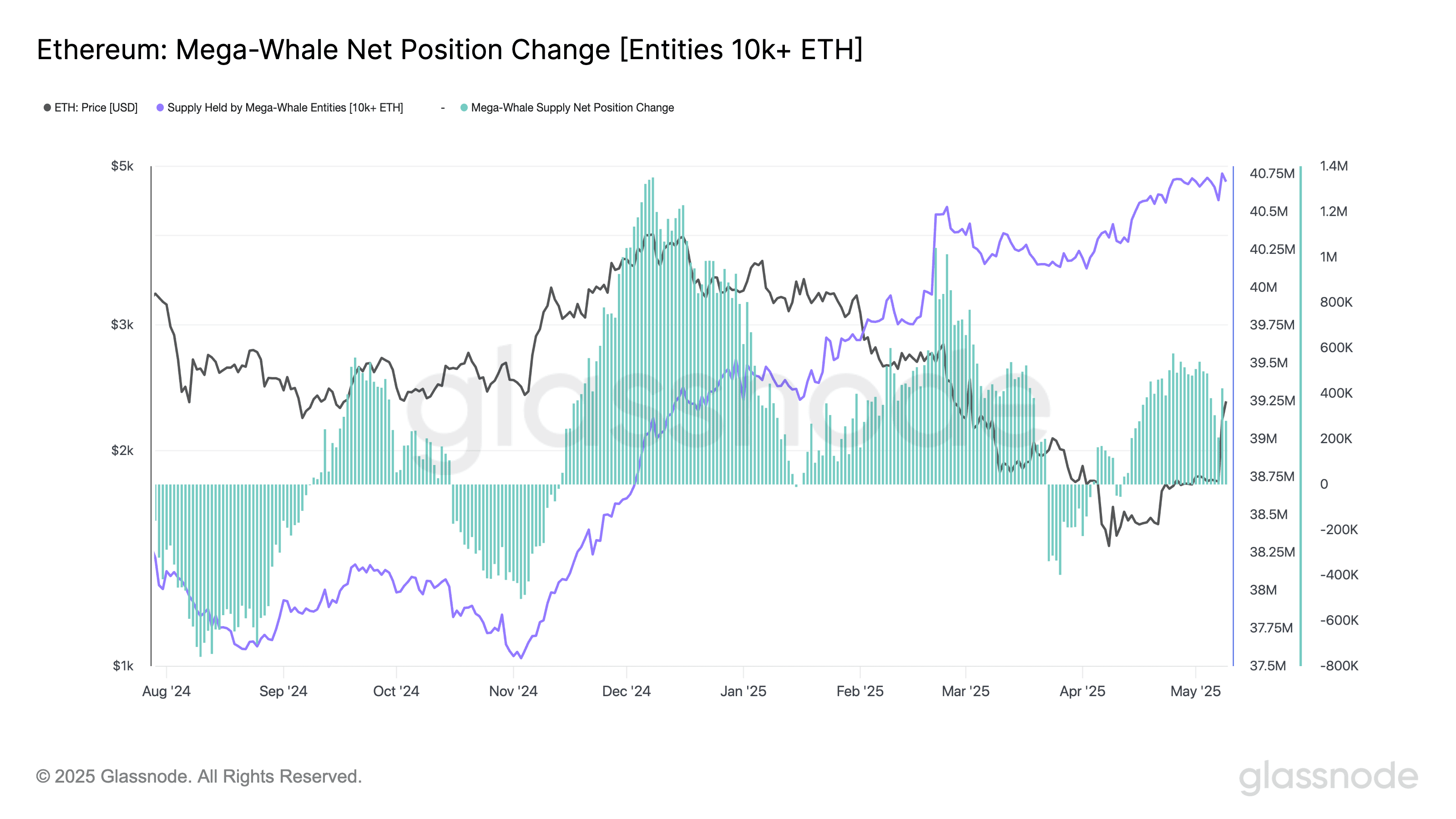

- Mega-Whale Accumulation: Large investors, known as “mega-whales” (wallets holding over 10,000 ETH), have been steadily increasing their ETH holdings since late April, signaling strong confidence in Ethereum’s future potential.

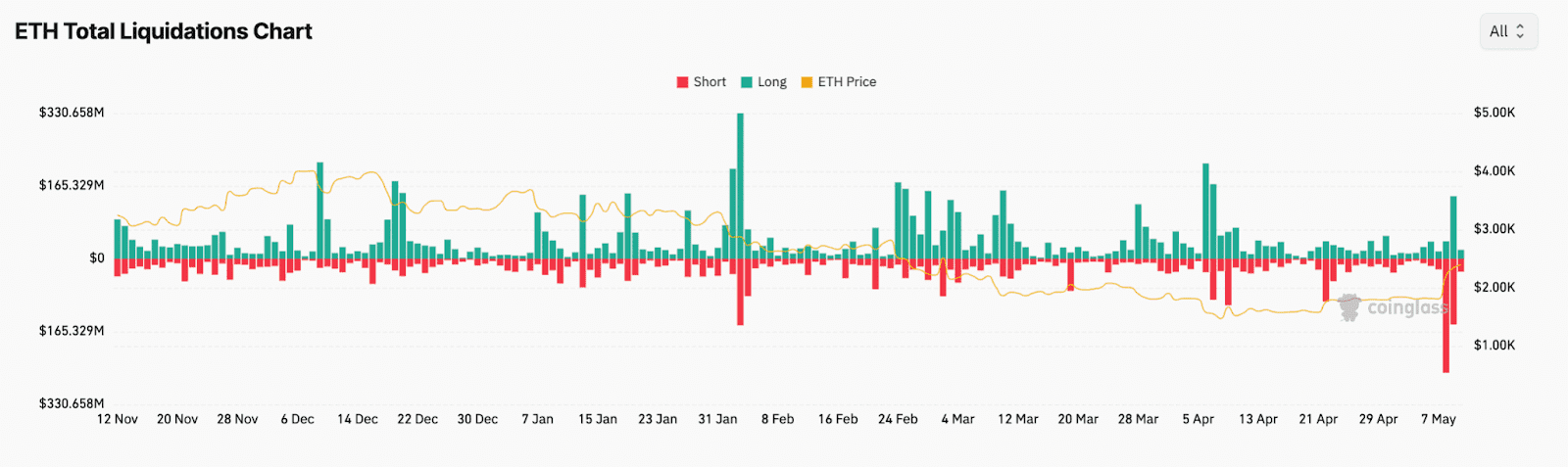

- Short Squeeze: A significant short squeeze in the Ethereum futures market has amplified the upward price movement. As prices rise, traders who bet against Ethereum are forced to close their positions, further driving up the price.

- Positive Market Sentiment: Developments like new trade agreements and trade talks between major economies have boosted the overall crypto market sentiment, benefiting Ethereum.

Diving Deeper into the Drivers

The Impact of the Pectra Upgrade

The Pectra upgrade is a pivotal moment for the Ethereum network. It isn’t just a simple patch; it’s a comprehensive overhaul designed to address key limitations and enhance the platform’s capabilities. One of the most notable improvements is the increase in staking limits. This allows more users to participate in securing the network and earning rewards, contributing to a more decentralized and robust ecosystem.

Account abstraction (EIP-7702) is another game-changer. It simplifies the user experience by allowing users to interact with the blockchain using more intuitive and user-friendly accounts. This lowers the barrier to entry for newcomers and makes Ethereum more accessible to a wider audience. Imagine interacting with a decentralized application without needing to manage complex private keys or seed phrases – that’s the promise of account abstraction.

Mega-Whale Accumulation: A Sign of Confidence?

The accumulation of ETH by mega-whales is often interpreted as a bullish signal. These large investors typically have significant resources and expertise, and their investment decisions can have a substantial impact on the market. When they start accumulating, it suggests they believe in the long-term potential of the asset. The recent increase in ETH holdings by mega-whales indicates a strong conviction in Ethereum’s future growth prospects.

This accumulation isn’t just about buying more ETH; it’s about holding it. Mega-whales tend to be long-term investors, meaning they’re less likely to sell their holdings during short-term price fluctuations. This reduces the selling pressure on the market and contributes to price stability.

The Ethereum Short Squeeze Explained

A short squeeze is a phenomenon that occurs when a heavily shorted asset experiences a sudden price increase. Short sellers, who bet against the asset’s price, are forced to buy back the asset to cover their losses. This buying pressure further drives up the price, creating a feedback loop that can lead to a significant price surge.

In the case of Ethereum, a substantial amount of short positions were open in the futures market. As the price of ETH started to rise, these short sellers were forced to liquidate their positions, contributing to the upward momentum. The higher the price climbs, the more short positions are squeezed, intensifying the rally.

Ethereum Outperforming Bitcoin

Interestingly, Ethereum has been outperforming Bitcoin (BTC) in terms of percentage gains. This suggests that investors are increasingly recognizing the potential of Ethereum’s ecosystem, including its decentralized applications (dApps), DeFi protocols, and NFT market.

The Ethereum ecosystem is constantly evolving, with new innovations and developments emerging regularly. This dynamism is attracting developers, entrepreneurs, and investors, fueling the growth of the network. Bitcoin, on the other hand, is primarily seen as a store of value, which limits its growth potential compared to Ethereum.

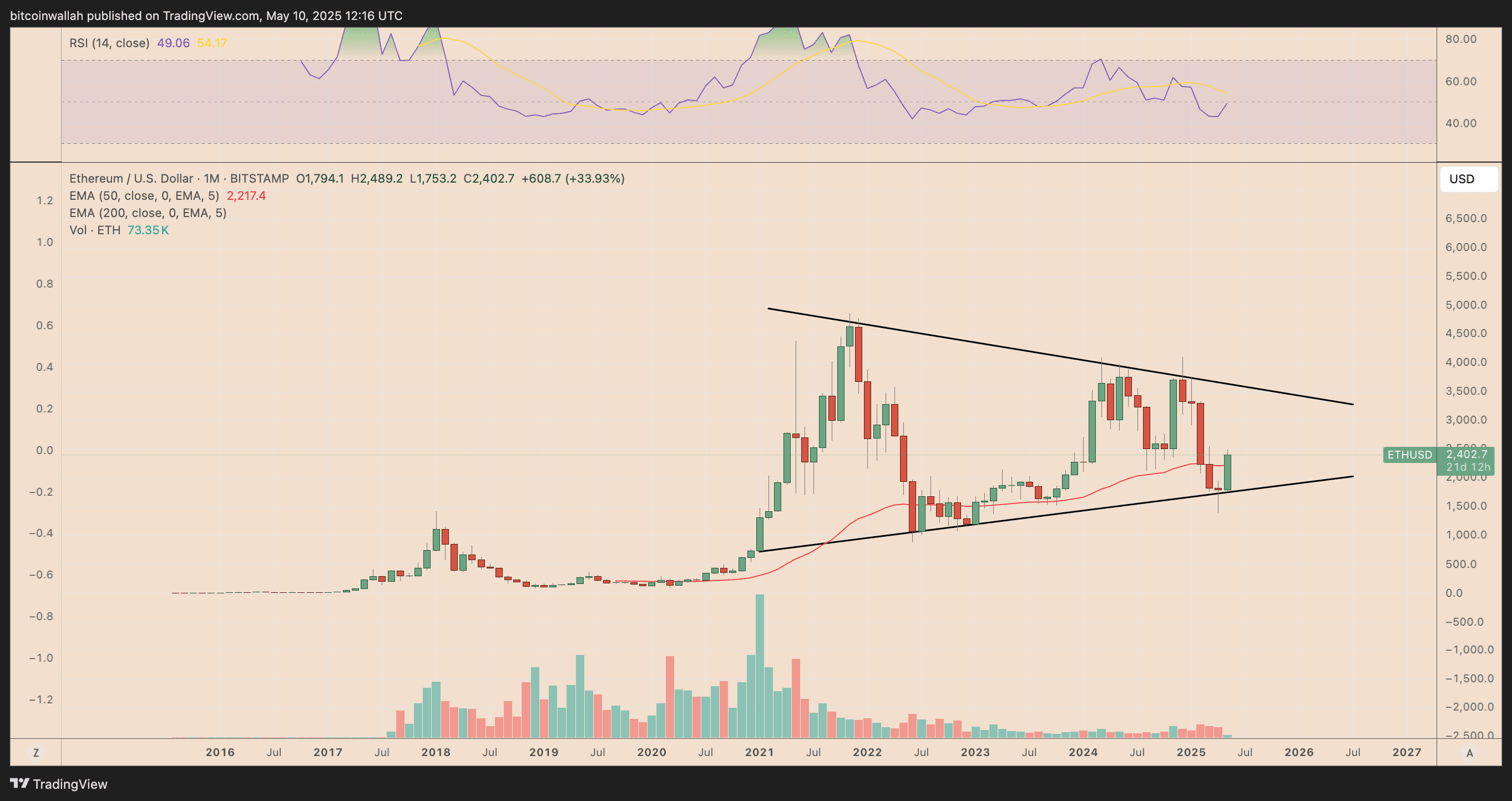

Technical Analysis: Potential for Further Gains

Technical analysis suggests that Ethereum’s price could continue to rise. Ethereum’s price is bouncing off a long-term ascending support line visible on the monthly chart, forming the lower boundary of a large symmetrical triangle pattern.

This bounce increases the likelihood of a move toward the triangle’s upper trendline near $3,400 in the coming months, up by around 40% from the current price levels. Historically, ETH has seen strong rallies each time it touches this support, reinforcing the bullish outlook.

Conclusion

Ethereum’s recent price surge is driven by a confluence of factors, including the Pectra upgrade, mega-whale accumulation, and a significant short squeeze. Positive market sentiment and strong technical indicators further support the potential for continued growth. While the cryptocurrency market is inherently volatile, the underlying fundamentals suggest that Ethereum is well-positioned for future success. Keep in mind that investing and trading involves risk, and individuals should conduct thorough research before making any decisions.