Ethereum (ETH) has recently experienced a significant surge, sparking renewed interest in its potential to reach $10,000. This analysis examines the factors driving this speculation, including historical price patterns, its performance relative to other cryptocurrencies like Solana (SOL) and XRP, and the potential for an upcoming altcoin season. This article provides an in-depth look at whether a $10,000 ETH price is a realistic possibility.

Key Factors Supporting a $10,000 Ethereum Price Target

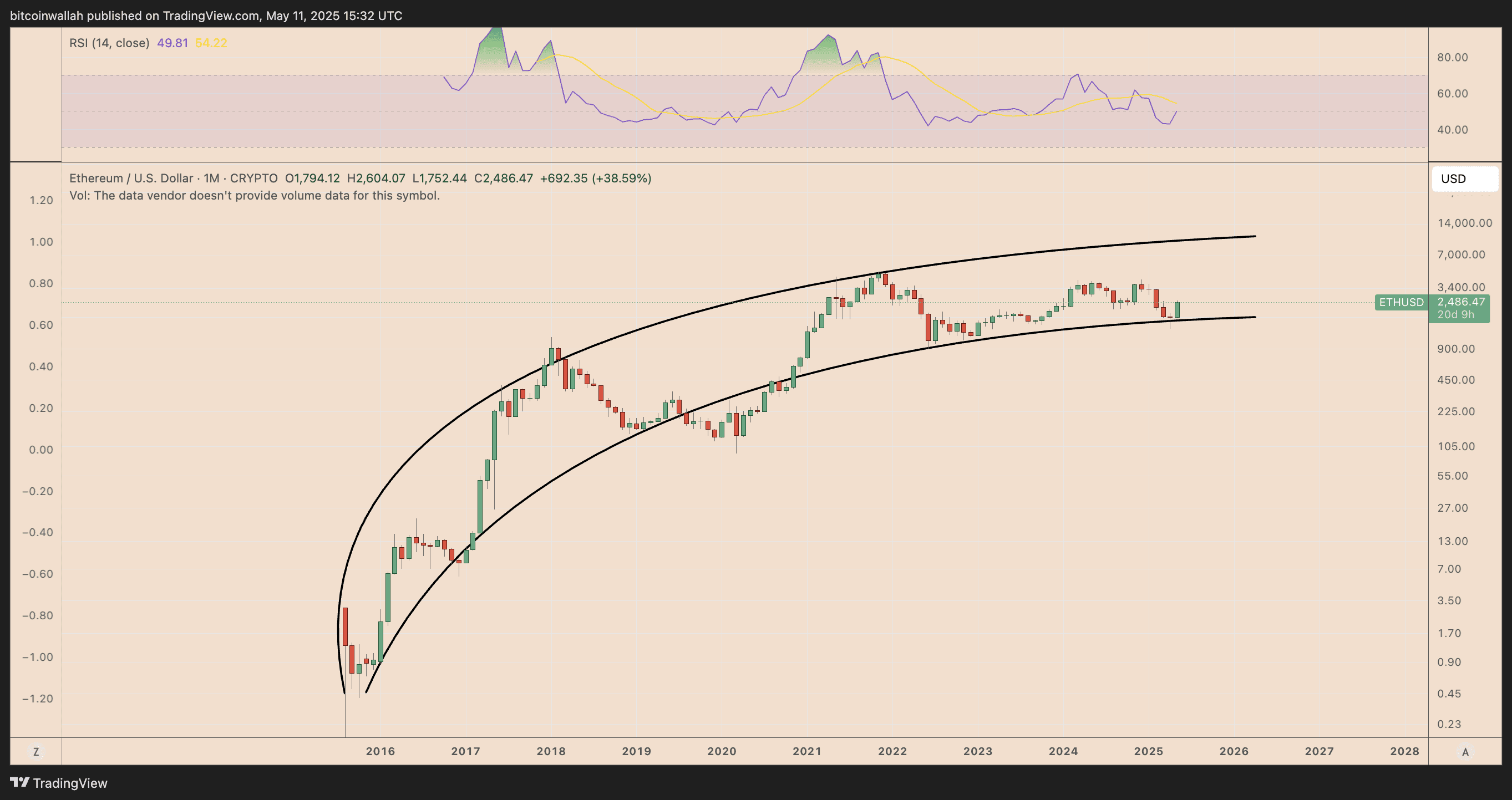

- Historical Price Patterns: Ethereum’s long-term price action has historically followed a parabolic curve, with rebounds from the lower boundary often preceding significant rallies.

- Altcoin Season Potential: Anticipation of an altcoin season, where altcoins outperform Bitcoin, could drive capital rotation towards Ethereum.

- Outperformance Against Rivals: Ethereum demonstrates potential to outperform top competitors like Solana and XRP, indicating a shift of capital towards ETH.

Ethereum’s Parabolic Trajectory and $10,000 Target

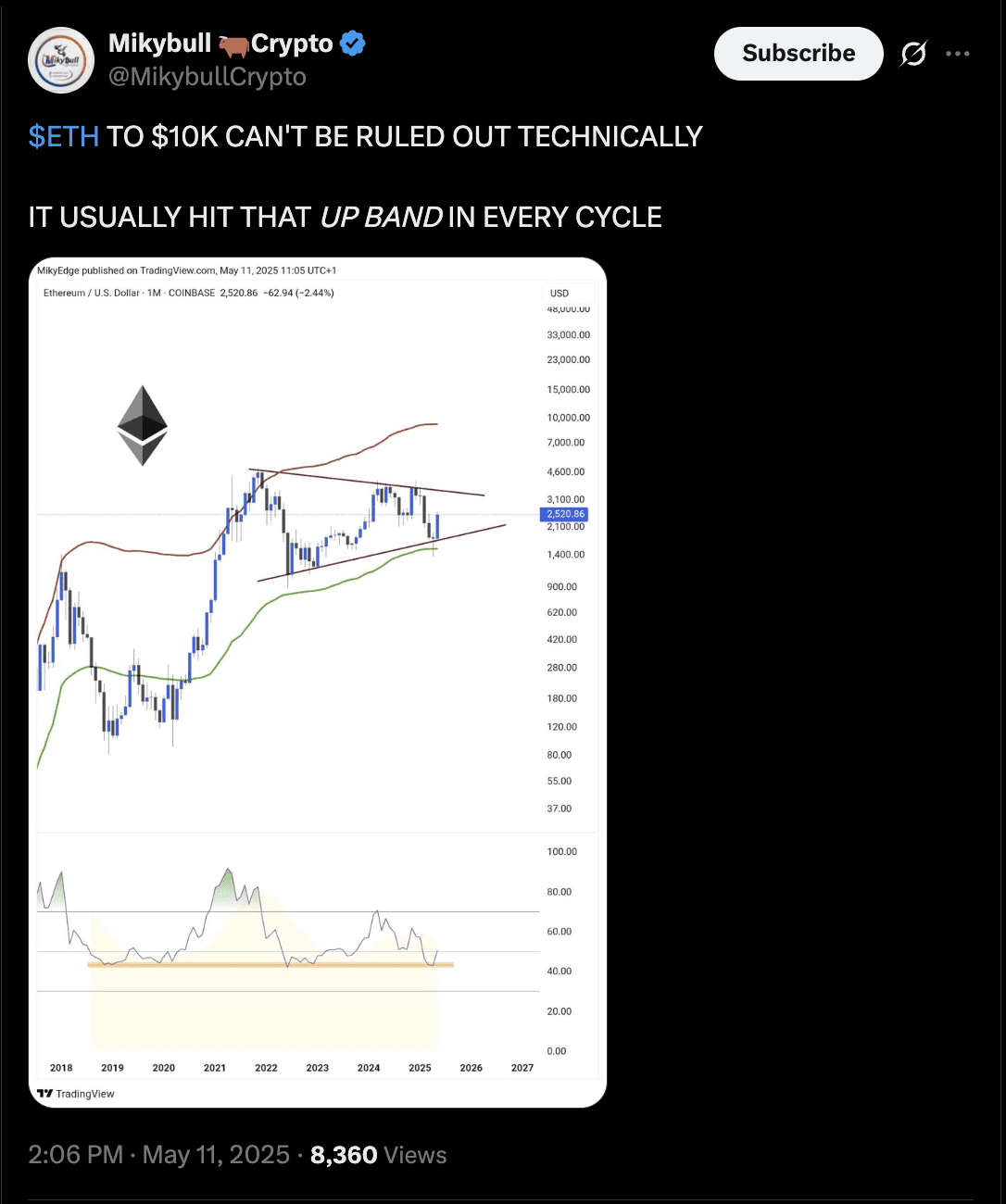

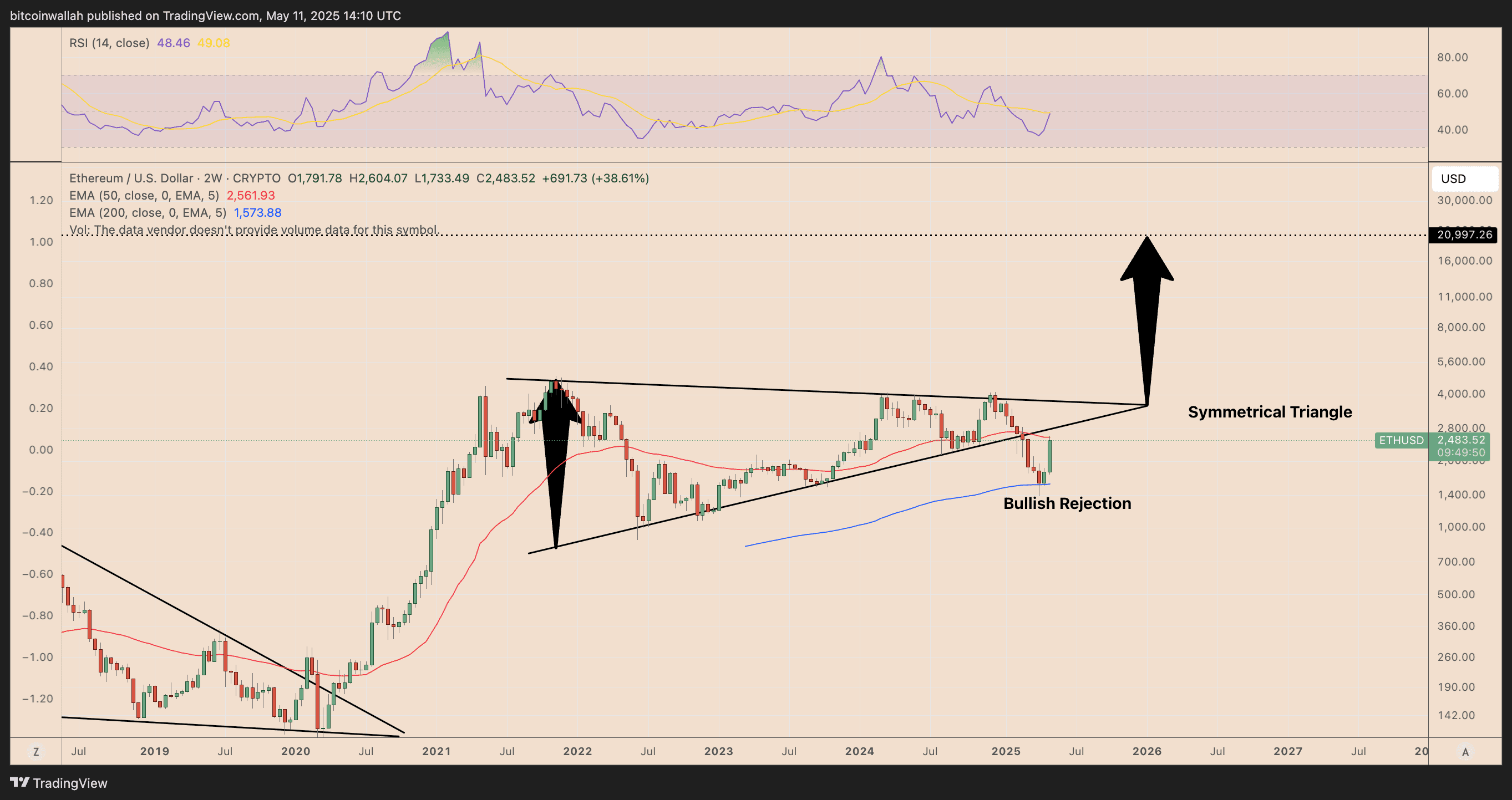

Since 2015, Ethereum’s price movements have largely adhered to a parabolic curve. A recent rebound from the curve’s lower boundary, near $2,100, which has historically acted as a trigger for major rallies, strengthens the case for a move toward the upper boundary. Currently, this upper boundary intersects near the $10,000 level.

Several analysts highlight similar setups on Ethereum’s monthly chart, suggesting that a rally to $10,000 is technically plausible. A recovery in the Relative Strength Index (RSI) from a multi-year support zone further reinforces this outlook.

Altcoin Season and Ethereum’s Potential to Outperform

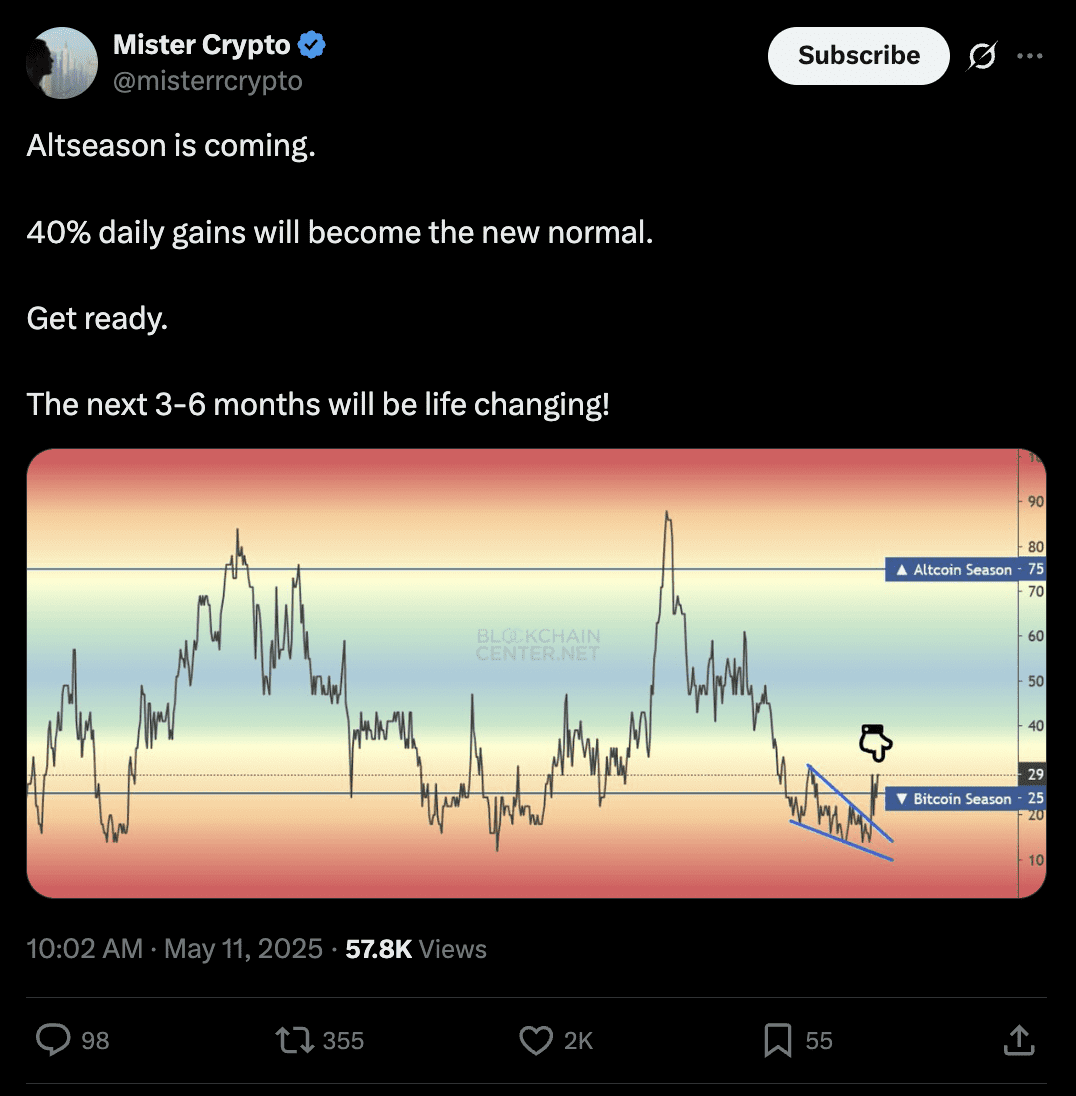

The anticipation of an altcoin season is fueling bullish sentiment for Ethereum. Historically, altcoin seasons have seen significant capital flow from Bitcoin to alternative cryptocurrencies, potentially benefiting ETH.

The Altcoin Season Index, while still indicating Bitcoin dominance, shows signs of a potential shift, suggesting that altcoins like Ethereum may soon start to outperform. Some analysts believe that altcoins like ETH may rally 40% in a single day amid capital rotation from Bitcoin.

Ethereum vs. Solana and XRP: A Comparative Analysis

Ethereum’s potential outperformance is further highlighted by its performance against key rivals like Solana (SOL) and XRP. Solana is currently forming a rising wedge pattern against Ethereum, indicating potential weakness. Similarly, Ethereum’s performance against XRP suggests a potential flow of capital towards ETH.

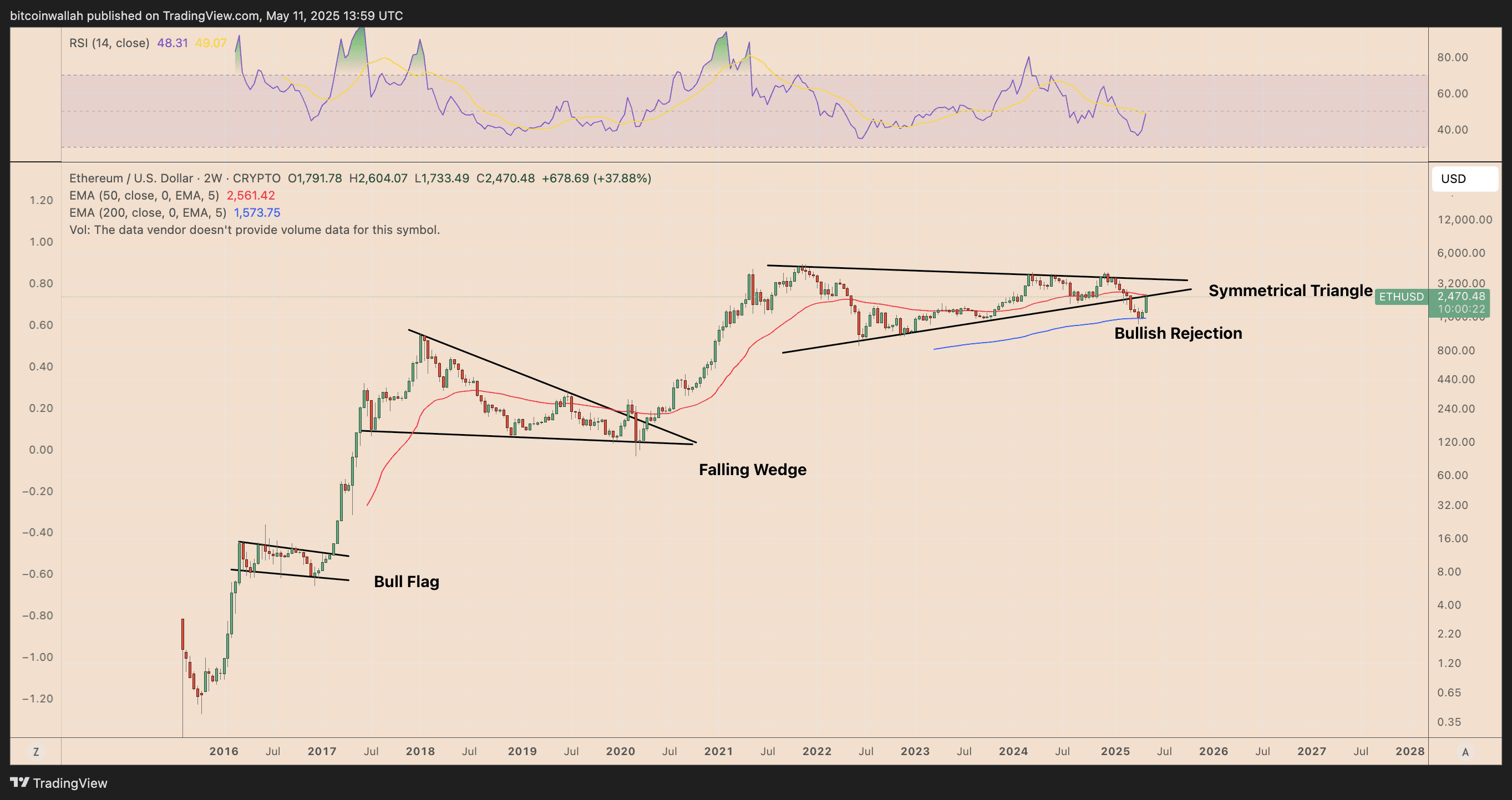

Symmetrical Triangle and Potential Breakout Scenarios

Currently, Ethereum is reclaiming the lower trendline of its multi-year symmetrical triangle after a brief breakdown. It is also bouncing off its 200-2W exponential moving average (EMA) support. This rebound confirms a bullish rejection and validates the ongoing consolidation structure.

This setup mirrors past macro consolidations observed in 2016 (bull flag) and 2018-2020 (falling wedge), both of which preceded major breakouts to new all-time highs. A breakout above the current triangle consolidation could follow a similar trajectory, potentially pushing ETH to the $10,000 mark or even higher, contingent on the nature of the breakout.

Alternative Scenarios: Factors That Could Hinder the $10,000 Target

- Bitcoin Dominance: A resurgence in Bitcoin’s dominance could hinder altcoin growth, including Ethereum.

- Market Correction: A broader market correction in the cryptocurrency space could negatively impact Ethereum’s price.

- Regulatory Uncertainty: Unfavorable regulatory developments could dampen investor sentiment and slow down Ethereum’s growth.

- Technological Hurdles: Unforeseen technological challenges or delays in Ethereum’s development could impact its price trajectory.

Conclusion: Is $10,000 Ethereum Realistic?

Based on historical price patterns, the potential for an altcoin season, and Ethereum’s relative strength against its rivals, a move towards $10,000 is a plausible scenario. However, potential factors such as Bitcoin’s dominance, market corrections, and regulatory uncertainty should be considered. While a $10,000 ETH price is not guaranteed, the technical and fundamental indicators suggest a bullish outlook for the cryptocurrency.

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.