Bitcoin (BTC) has recently shown bullish signals, leading many to wonder if a $100,000 price target is within reach. This analysis delves into the factors supporting a potential rally, including short-term holder profitability, long-term accumulation, and resistance levels.

Key Factors Influencing Bitcoin’s Price

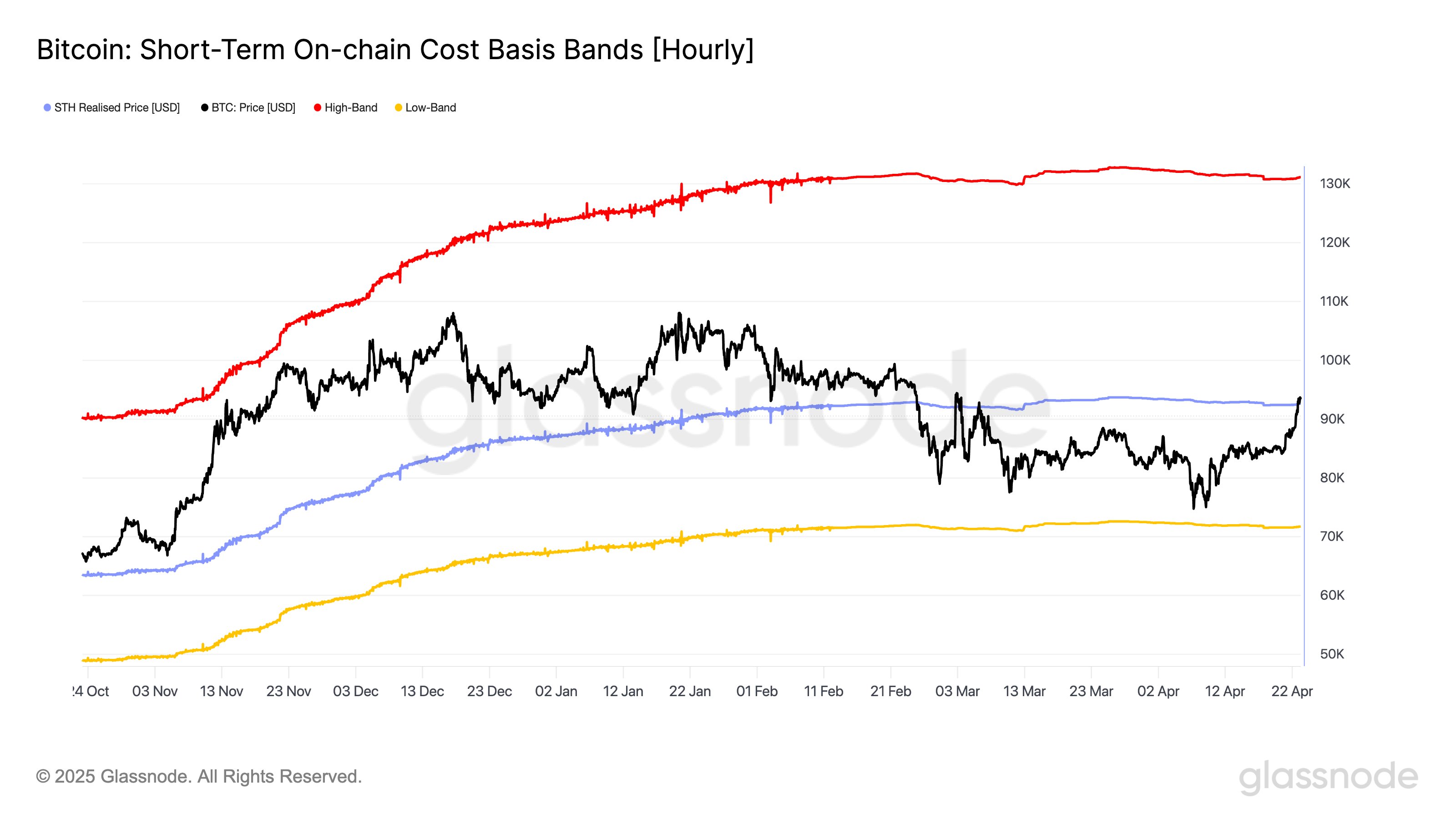

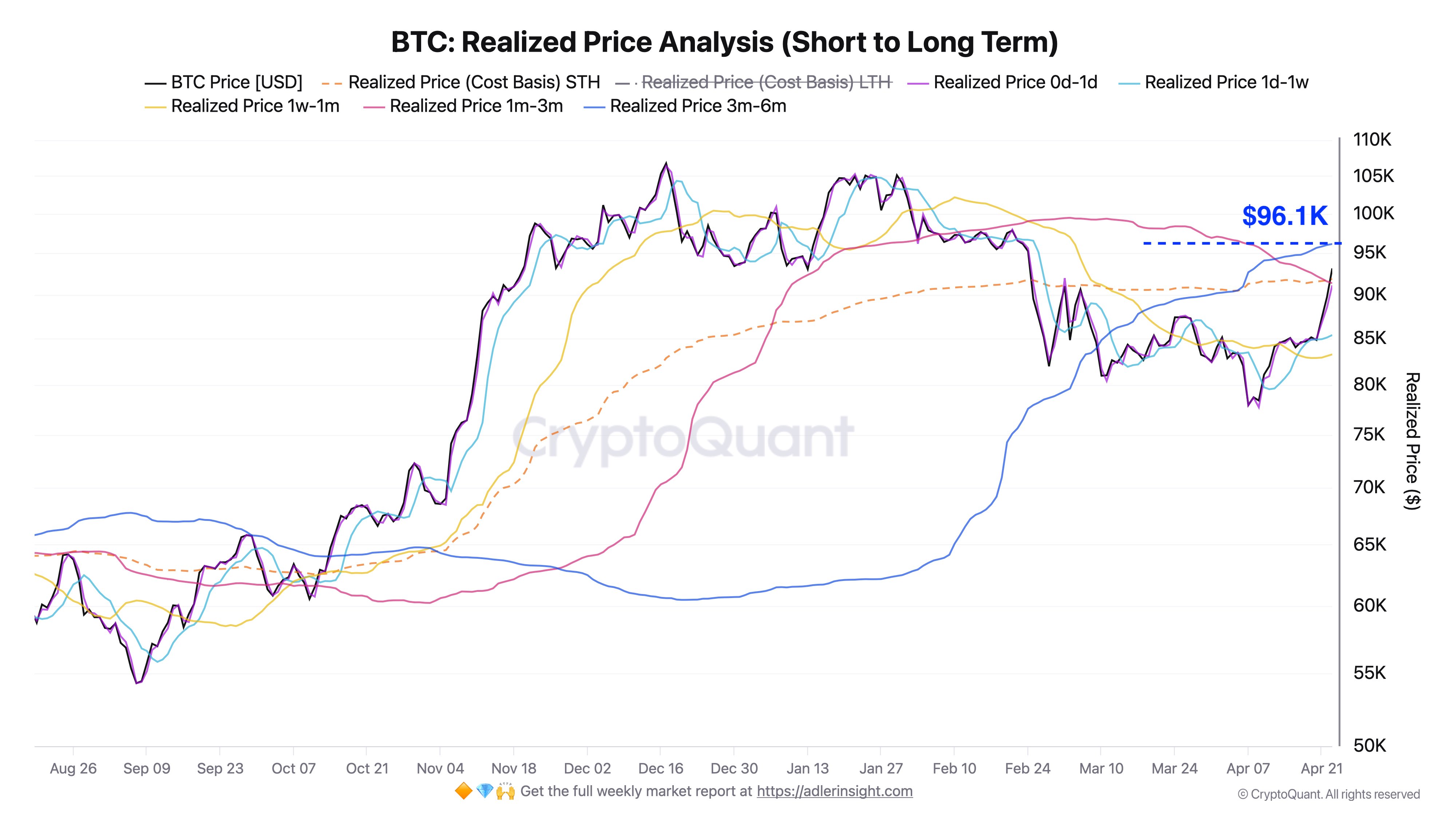

- Short-Term Holder (STH) Profitability: Bitcoin’s price has surpassed the short-term realized price, indicating that most STHs are now in profit. Historically, this has fueled upward momentum as STHs hold firm and attract new investors.

- Long-Term Holder (LTH) Accumulation: LTHs have increased their holdings by 363,000 BTC since February, demonstrating strong conviction in Bitcoin’s long-term potential.

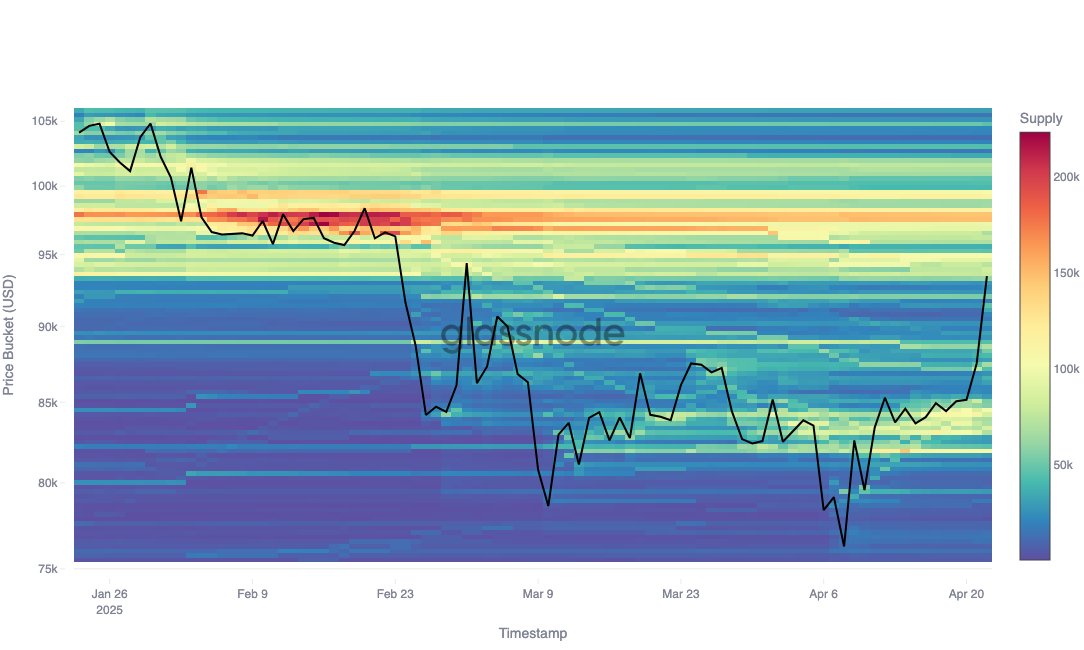

- New Capital Injections: Market activity in April suggests new buyers are entering the market at higher prices, injecting fresh capital and supporting the upward trend.

These factors collectively point to a positive outlook for Bitcoin. However, potential resistance levels could pose challenges.

Potential Resistance at $97,000

Analysis suggests a significant resistance level exists around $97,000, where approximately 392,000 BTC are held. Investors holding at this level may be inclined to sell at break-even, potentially creating sell pressure and stalling Bitcoin’s progress. Overcoming this resistance is crucial for a sustained rally.

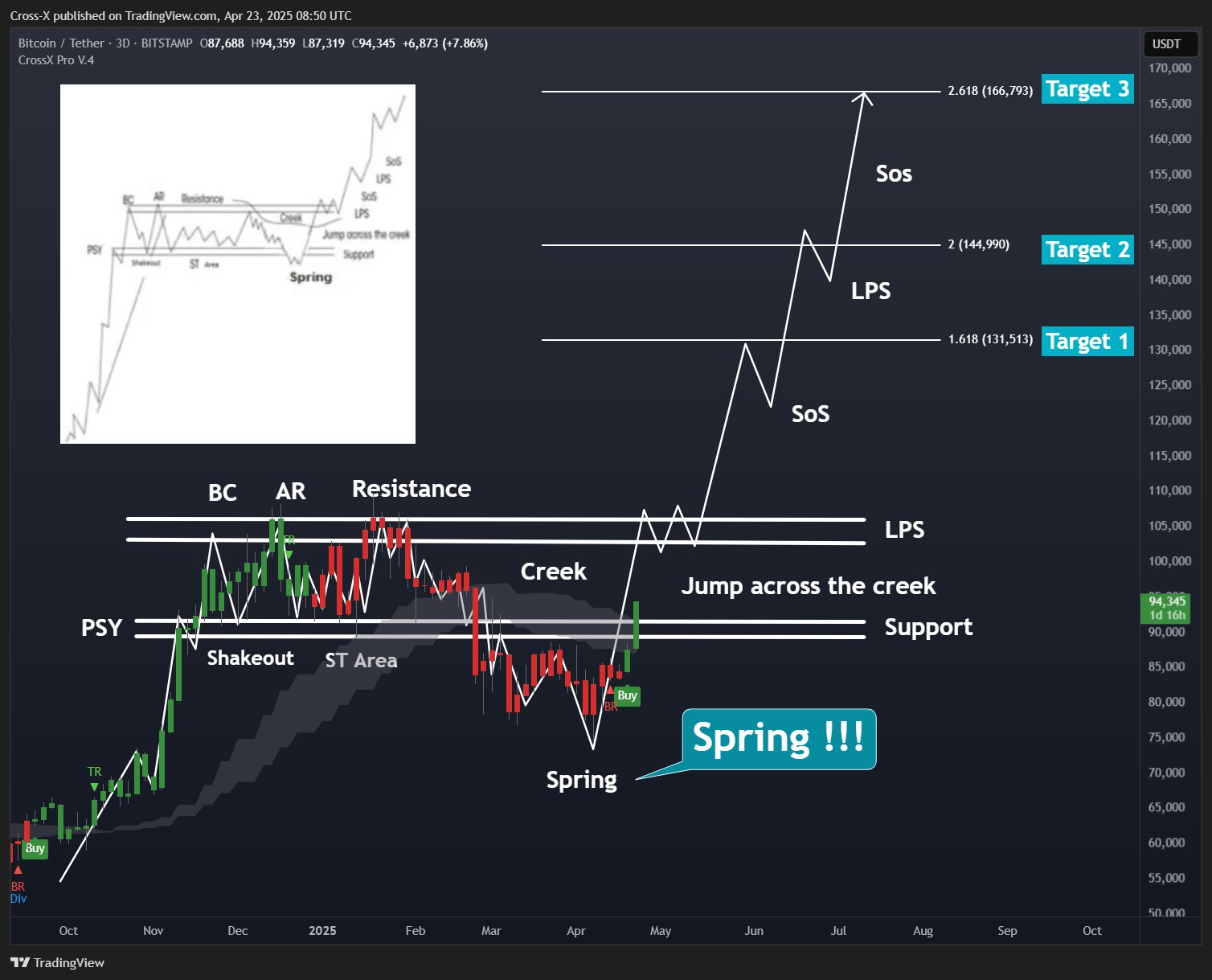

Wyckoff Pattern Suggests Further Upside

Despite the resistance, some analysts point to a Wyckoff reaccumulation pattern playing out, indicating potential accumulation by large players. This pattern suggests a continued upward trend with price targets of $131,500, $144,900, and $166,700.

The Wyckoff pattern suggests that large entities are accumulating BTC, indicating a strong belief in its future value. If this pattern holds, Bitcoin could experience a substantial price increase.

Bitcoin’s Halving Cycle: A Historical Perspective

It’s also important to consider Bitcoin’s halving cycle, which occurs roughly every four years. Historically, halvings have been followed by significant price increases due to reduced supply. The most recent halving occurred in April 2024, and its impact on Bitcoin’s price is still unfolding.

Key Considerations for a $100K Bitcoin Price

- Breaking Resistance: Overcoming the $97,000 resistance level is paramount for a sustained rally.

- Market Sentiment: Positive market sentiment and continued institutional adoption will be crucial drivers.

- Halving Impact: The long-term effects of the recent halving should continue to support price appreciation.

In conclusion, Bitcoin’s current market dynamics present a compelling case for a potential rally to $100,000. While resistance levels and market volatility remain factors to consider, the combination of short-term profitability, long-term accumulation, and the ongoing impact of the halving create a favorable environment for price appreciation.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in cryptocurrencies involves risk, and you should conduct your own research before making any investment decisions.