Animoca Brands, a Hong Kong-based game software company and venture capital firm specializing in blockchain games and NFTs, is actively exploring a listing on the New York Stock Exchange (NYSE). This potential move is largely influenced by the perceived crypto-friendly stance of the current US administration under President Donald Trump.

Yat Siu, Animoca’s executive chairman, indicated in an interview with the Financial Times that an official announcement regarding the listing could be imminent. The company is currently assessing different shareholding structures to optimize its entry into the US market.

The decision to list in the US is driven by a combination of factors, including a perceived shift in regulatory attitudes towards digital assets and the strategic importance of accessing the world’s largest capital market. The timing of the listing is deemed critical, independent of prevailing market conditions, to capitalize on the current environment.

Animoca Brands was previously delisted from the Australian Securities Exchange (ASX) in 2020 due to governance concerns and questions surrounding certain cryptocurrencies. Since then, the company has significantly expanded its investment portfolio, acquiring stakes in prominent crypto companies like OpenSea, Kraken, and Consensys.

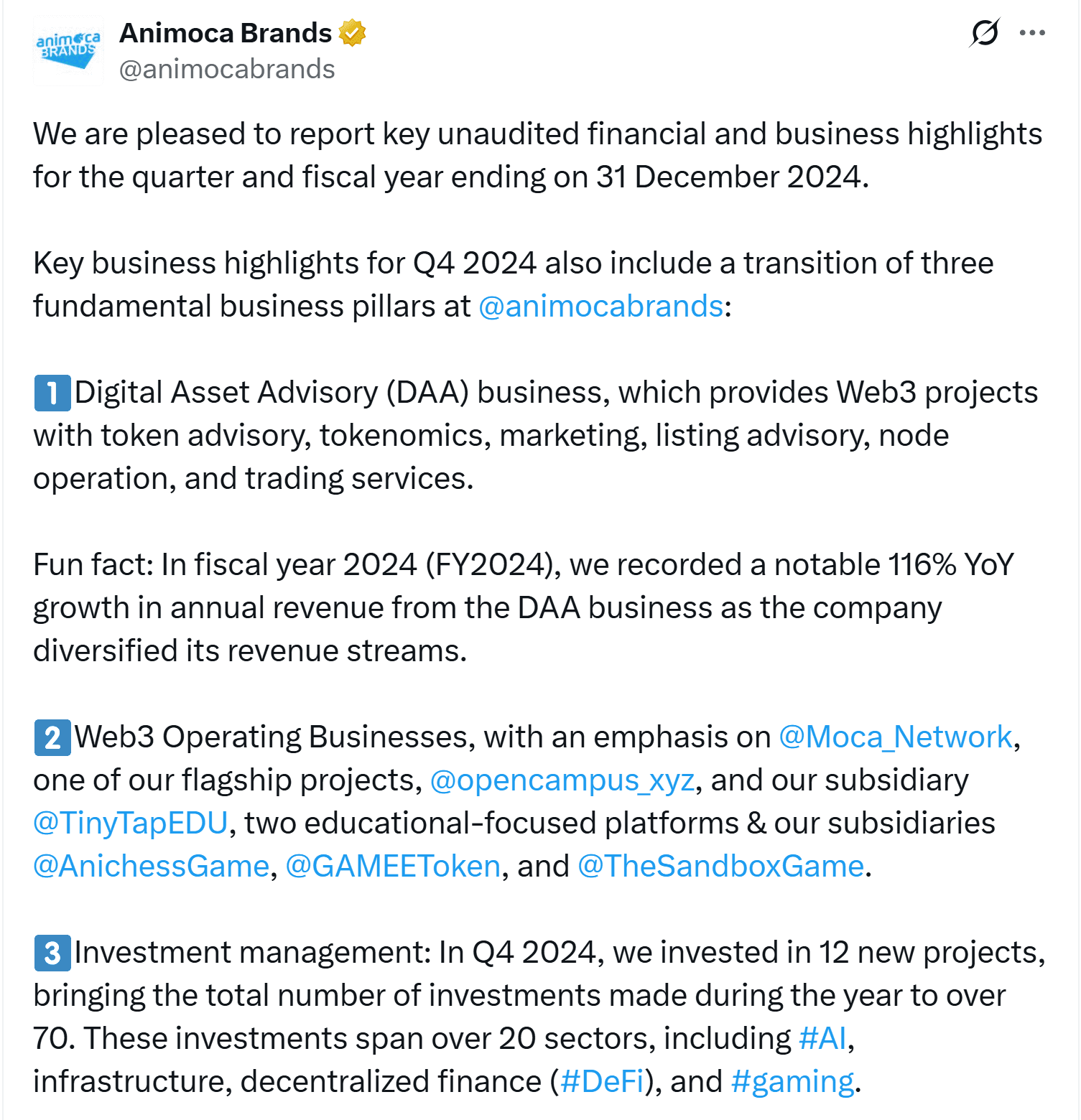

The company’s financial performance has also seen substantial growth. Animoca Brands reported unaudited earnings of $97 million on revenues of $314 million for the year ending December 2024, marking a significant increase compared to the previous year.

According to Yat Siu, Animoca holds a substantial position as a leading non-financial crypto firm globally, possessing $300 million in cash and stablecoins, in addition to over $538 million in digital assets.

Siu also suggested that other companies within Animoca’s investment portfolio, including US-based Kraken, might also consider pursuing US listings in the near future, potentially in 2025 or 2026.

US Crypto Landscape: A Shift in Sentiment?

The regulatory climate for crypto companies in the US experienced a period of increased scrutiny under the previous administration. Federal agencies initiated numerous lawsuits and enforcement actions against digital asset firms, which, according to Siu, stifled innovation and discouraged international companies from entering the US market.

However, the return of Donald Trump has brought about a perceived shift. With pledges to support the crypto sector and potentially roll back some enforcement measures, the environment is viewed as more conducive to growth and investment. Siu characterized this as a crucial moment to capitalize on the opportunities presented by the current administration’s approach.

Since Trump’s election, there have been indications of a change in regulatory posture. The US Securities and Exchange Commission (SEC) has reportedly dropped or paused over a dozen enforcement cases targeting crypto companies. Furthermore, the Department of Justice (DOJ) recently announced the dissolution of its dedicated cryptocurrency enforcement unit, signaling a potentially less aggressive approach to the sector.

Other Crypto Firms Eyeing US Expansion

Animoca’s potential move is not an isolated case. Several other crypto firms are also re-evaluating their presence and strategies in the US market.

For example, OKX, a cryptocurrency exchange, has announced plans to establish a US headquarters in San Jose, California, shortly after reaching a $504 million settlement with US authorities. This indicates a willingness to engage with US regulators and establish a formal presence in the country.

Nexo, a crypto lending platform that exited the US market in 2022 citing a lack of regulatory clarity, has also revealed its intention to re-enter the US market, further illustrating the shifting sentiment towards the US regulatory landscape.

Key Takeaways

- Animoca Brands is considering a New York Stock Exchange listing.

- This decision is largely influenced by Trump’s perceived crypto-friendly stance.

- The company sees this as a strategic opportunity to access the US market.

- Other crypto firms like OKX and Nexo are also expanding or re-entering the US market.