Cryptocurrency Market Overview: May 12

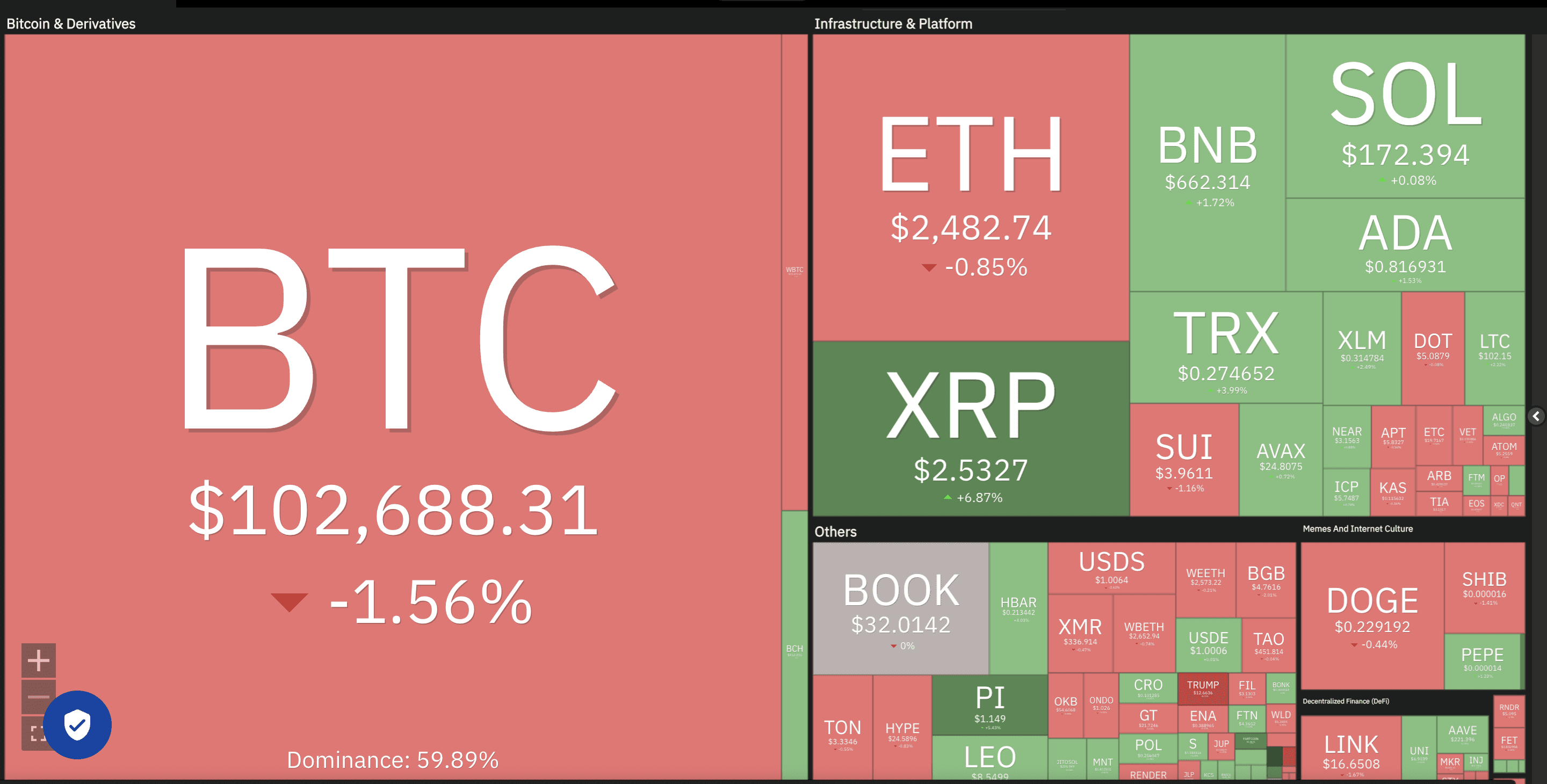

This analysis provides a snapshot of the cryptocurrency market as of May 12, examining the price movements and potential future trends of Bitcoin (BTC), Ethereum (ETH), XRP, Binance Coin (BNB), Solana (SOL), Dogecoin (DOGE), Cardano (ADA), and Sui (SUI). We also consider the influence of the S&P 500 (SPX) and the US Dollar Index (DXY) on the crypto market.

Key Takeaways:

- Bitcoin experienced profit-taking around $105,819, suggesting resistance at higher price levels.

- Certain altcoins continue to gain momentum, indicating growing investor interest beyond Bitcoin.

- The SPX and DXY are reacting to recent market developments, potentially influencing Bitcoin’s trajectory.

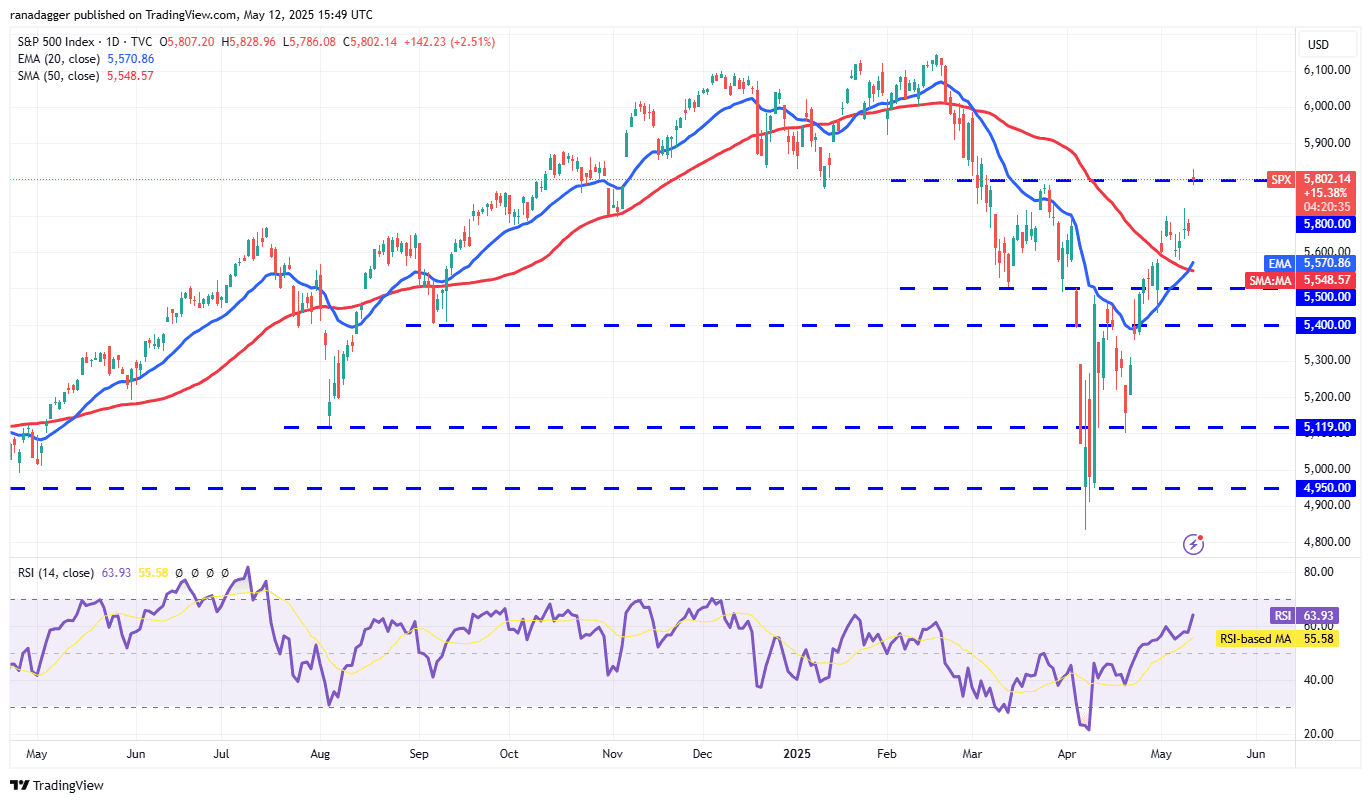

S&P 500 (SPX) Analysis

The S&P 500 Index saw a significant gap up on May 12, surpassing the $5,800 resistance level. Bears need to defend this level to prevent further gains, potentially driving the index down to $5,570 (20-day EMA) and possibly $5,400. A sustained close above $5,800 could lead to a rally towards $6,000 and a retest of the all-time high at $6,147.

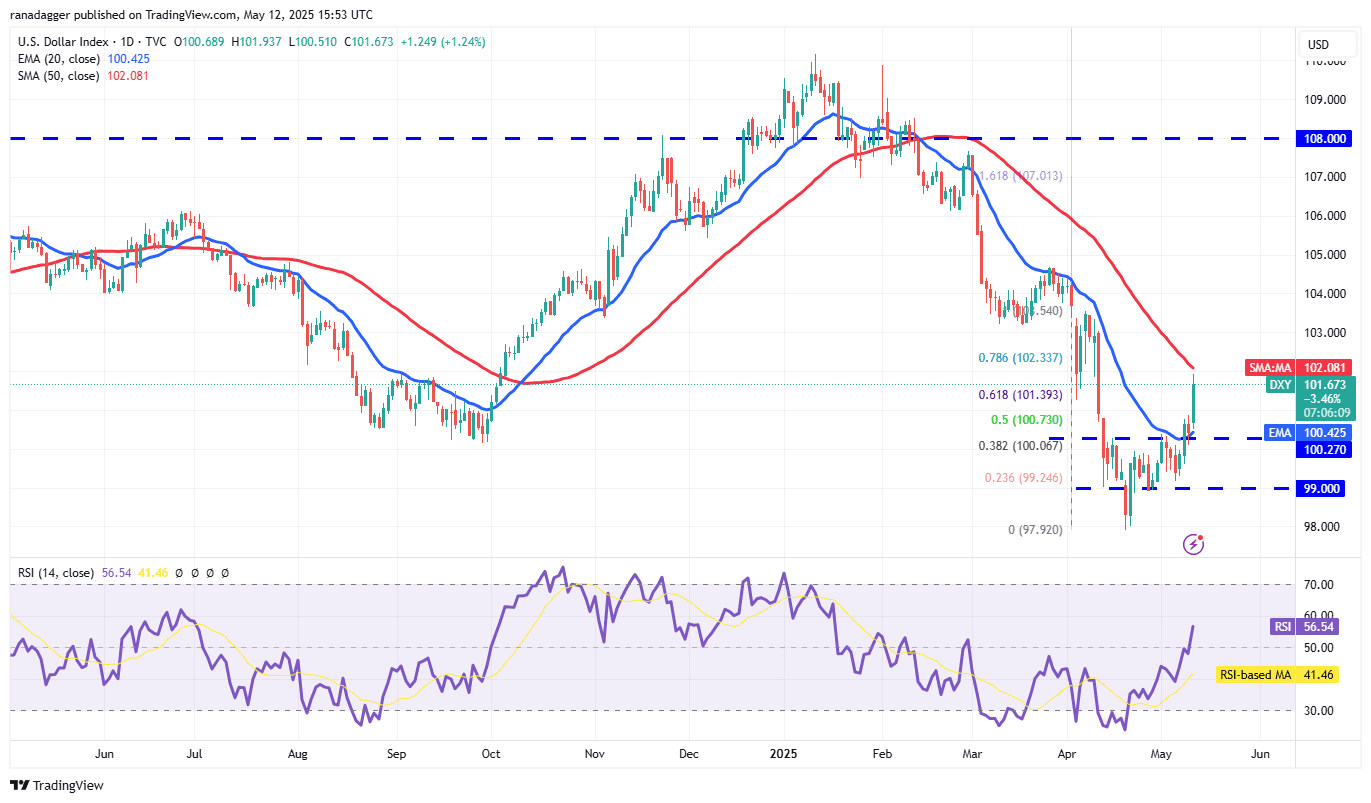

US Dollar Index (DXY) Analysis

The US Dollar Index has broken above the 20-day EMA (100.42), signaling a potential weakening of bearish control. Resistance is expected at the 50-day SMA (102.08). If the price retraces from the 50-day SMA but finds support at the 20-day EMA, a positive trend could emerge, potentially pushing the DXY toward 103.54 and 104.68.

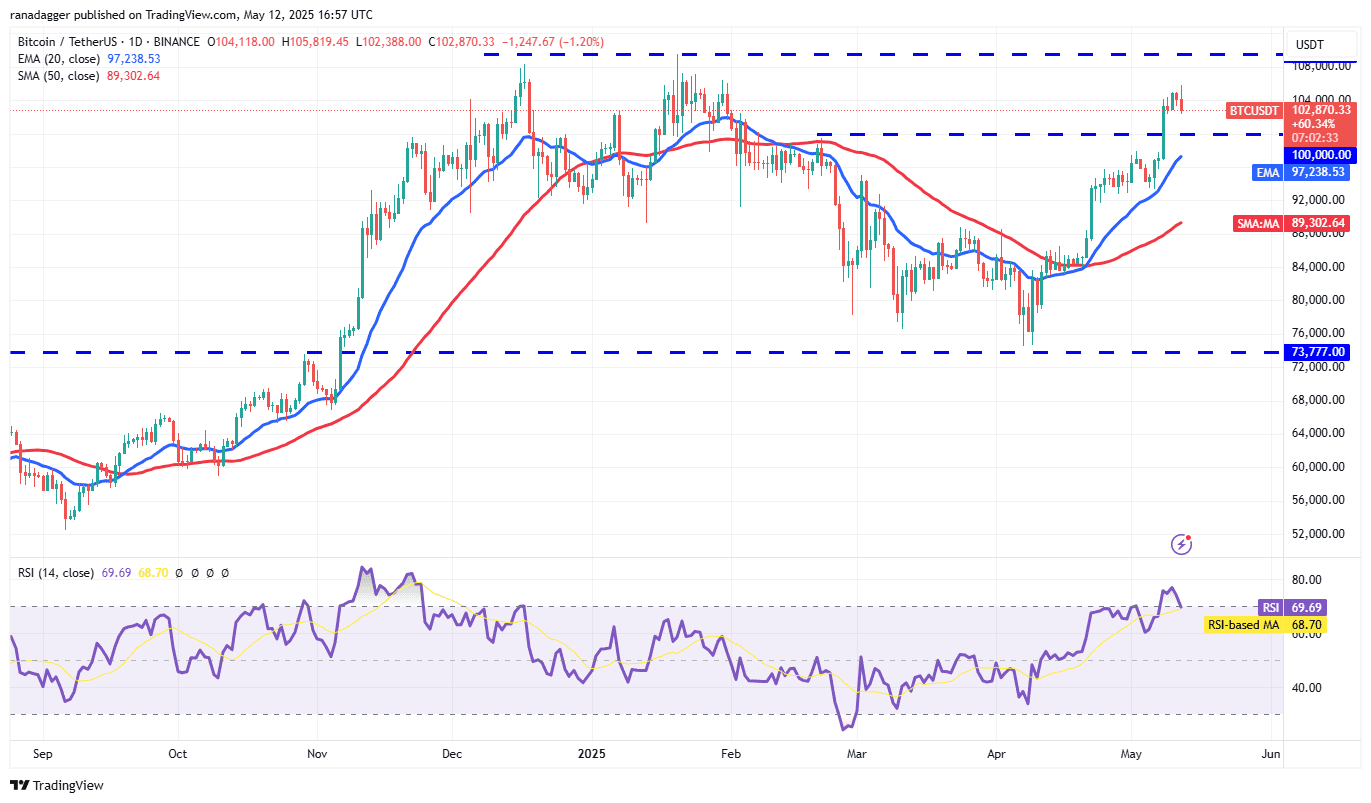

Bitcoin (BTC) Price Prediction

Bitcoin faced a rejection at $105,819, indicating bearish activity around the $107,000-$109,588 zone. Key support lies at $100,000, followed by the 20-day EMA ($97,238). A successful rebound from this support zone could propel BTC above $109,588, potentially reaching $130,000. Conversely, a break below the 20-day EMA could trigger a decline to $93,000 and then to the 50-day SMA ($89,302).

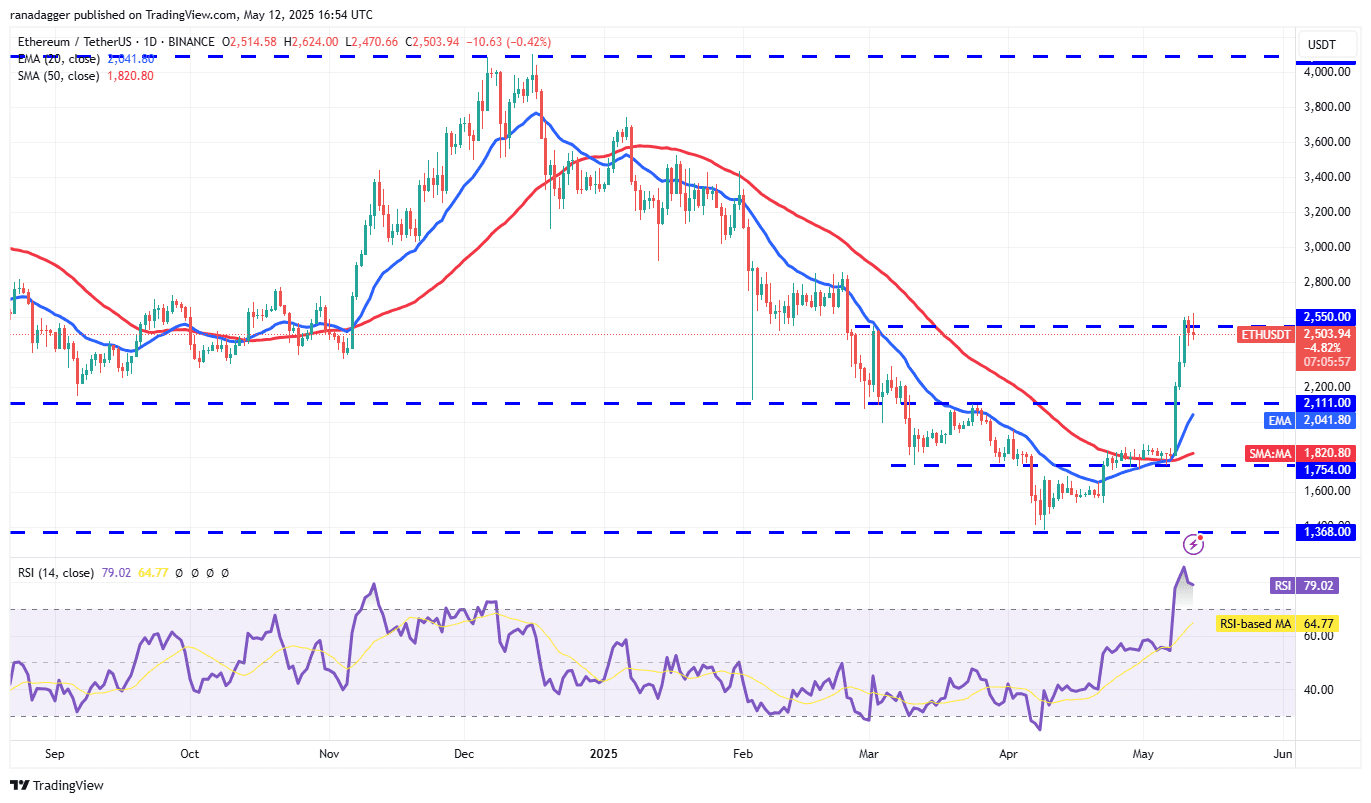

Ethereum (ETH) Price Prediction

Ethereum bulls are attempting to maintain the price above $2,550, but selling pressure persists. A fall below $2,435 could lead to a decline to $2,320. A rebound from $2,320 could initiate an upward movement, facing resistance at $2,850 and potentially reaching $3,000. Breaking below $2,320 could indicate profit-taking, potentially leading to a drop toward the $2,111 breakout level.

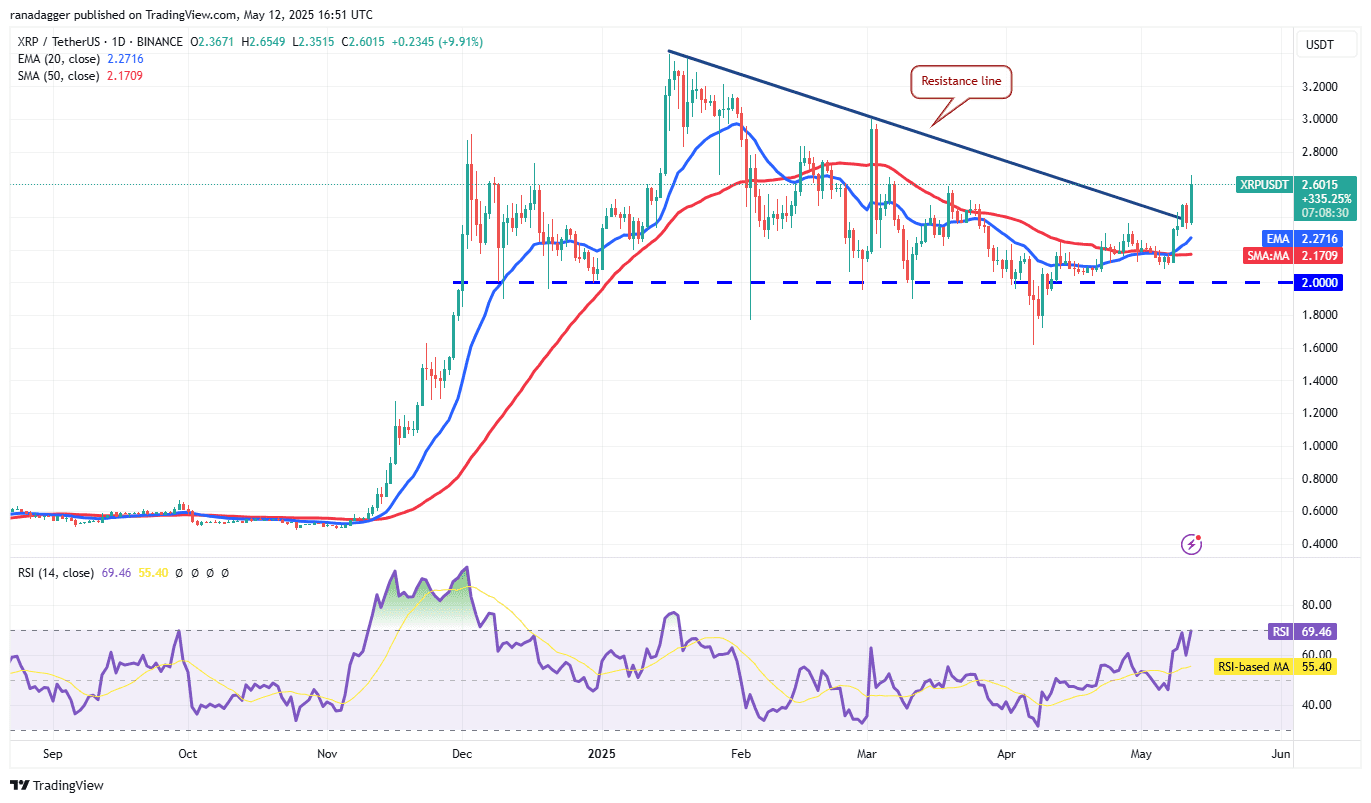

XRP Price Prediction

XRP broke above the resistance line on May 10 and successfully retested it on May 11. Bulls have strengthened their position above $2.50. Minor resistance exists at $2.65, and a break above this level could lead to a rally towards $3, potentially signaling a trend change. A sharp decline from $2.65, breaking below the 20-day EMA ($2.27), could indicate a range-bound formation between $2 and $2.65.

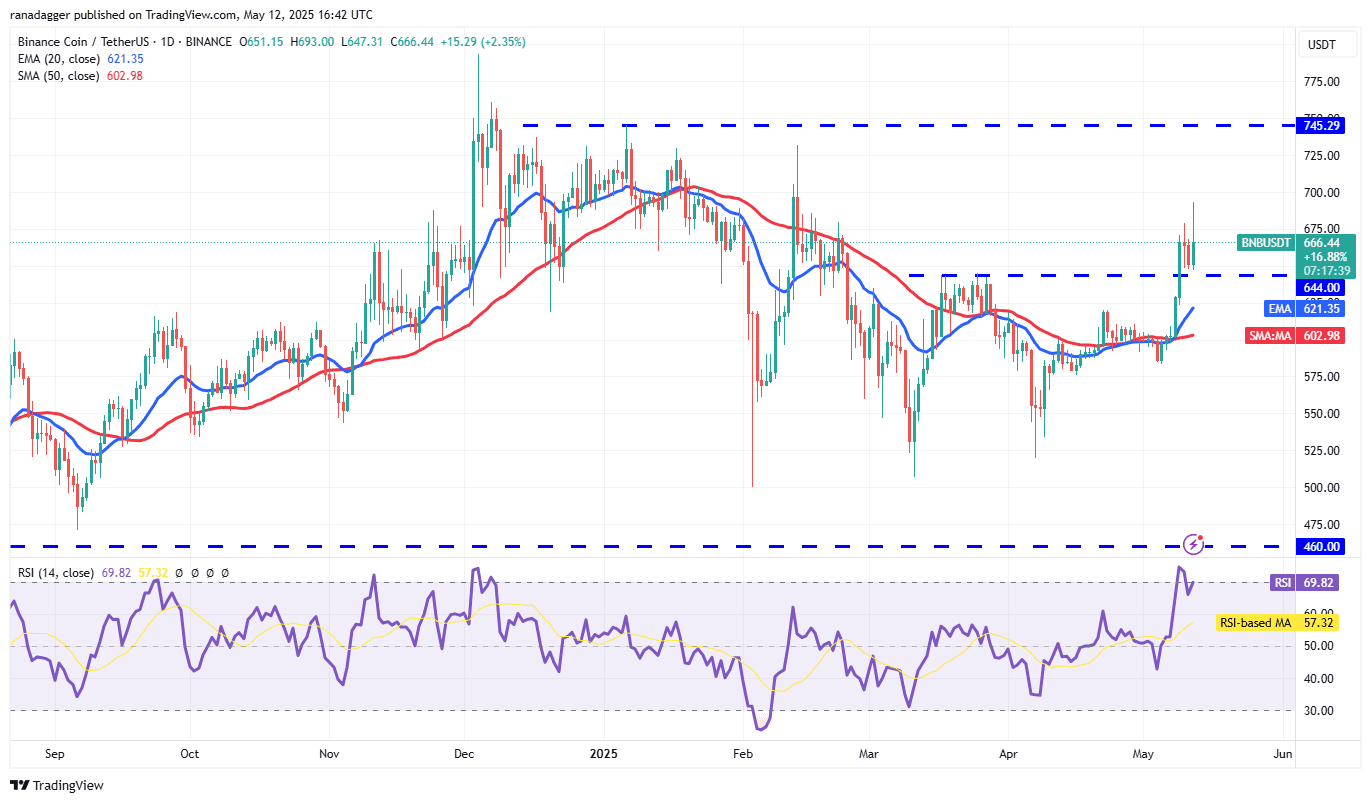

Binance Coin (BNB) Price Prediction

BNB retraced from $679 on May 10 but rebounded from the $644 breakout level on May 12. If the price remains above $644, bulls will likely attempt to push BNB towards $745. A break below $644 would weaken the bullish momentum, potentially leading to a fall to the 20-day EMA ($621). Buyers are expected to defend the 20-day EMA to prevent a shift in favor of the bears.

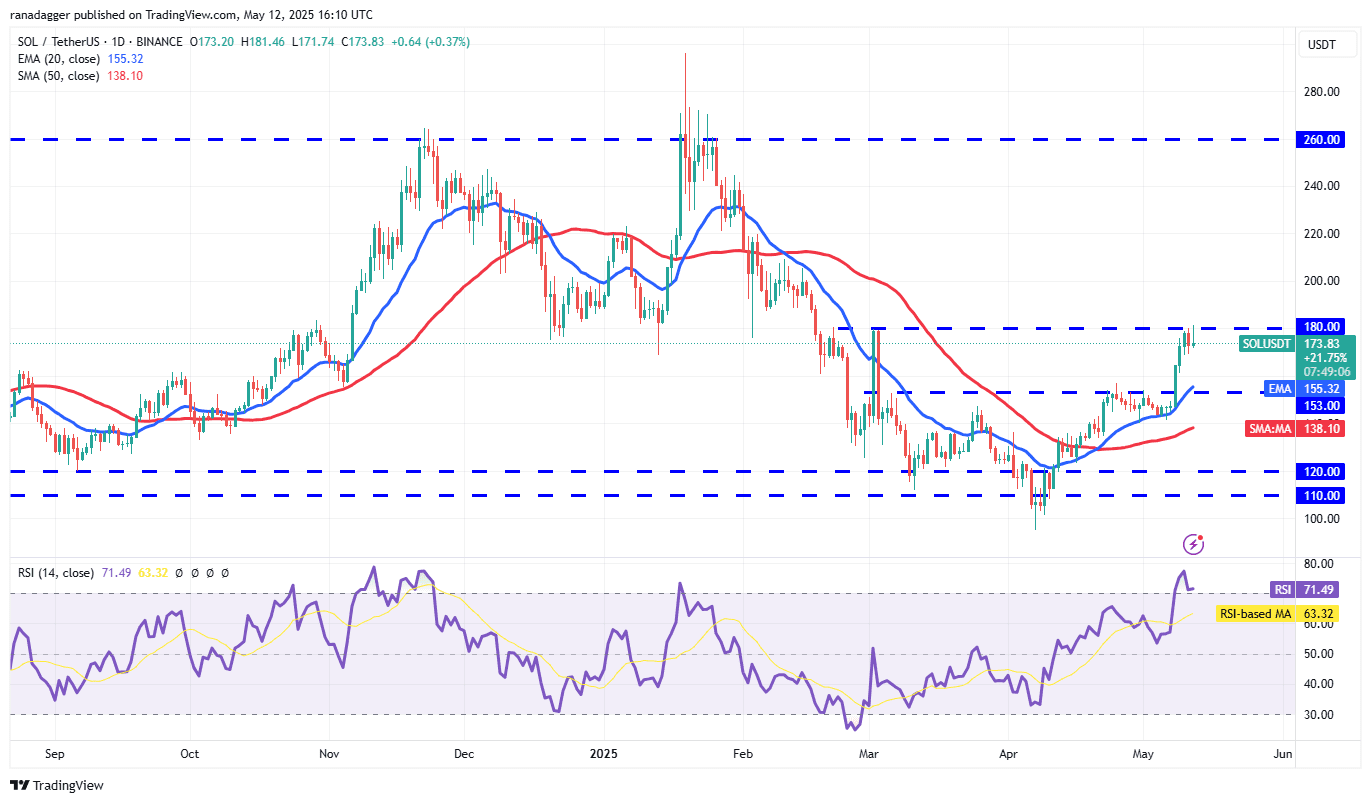

Solana (SOL) Price Prediction

Solana’s upward movement has paused near the $180 resistance level. If buyers push the price above $180, SOL could rally to $210. Immediate support lies at $168. A drop below $168 could lead to a descent to the 20-day EMA ($155). A solid rebound from the 20-day EMA would suggest continued bullish control, increasing the likelihood of a break above $180. Sellers will gain the upper hand with a break below $153.

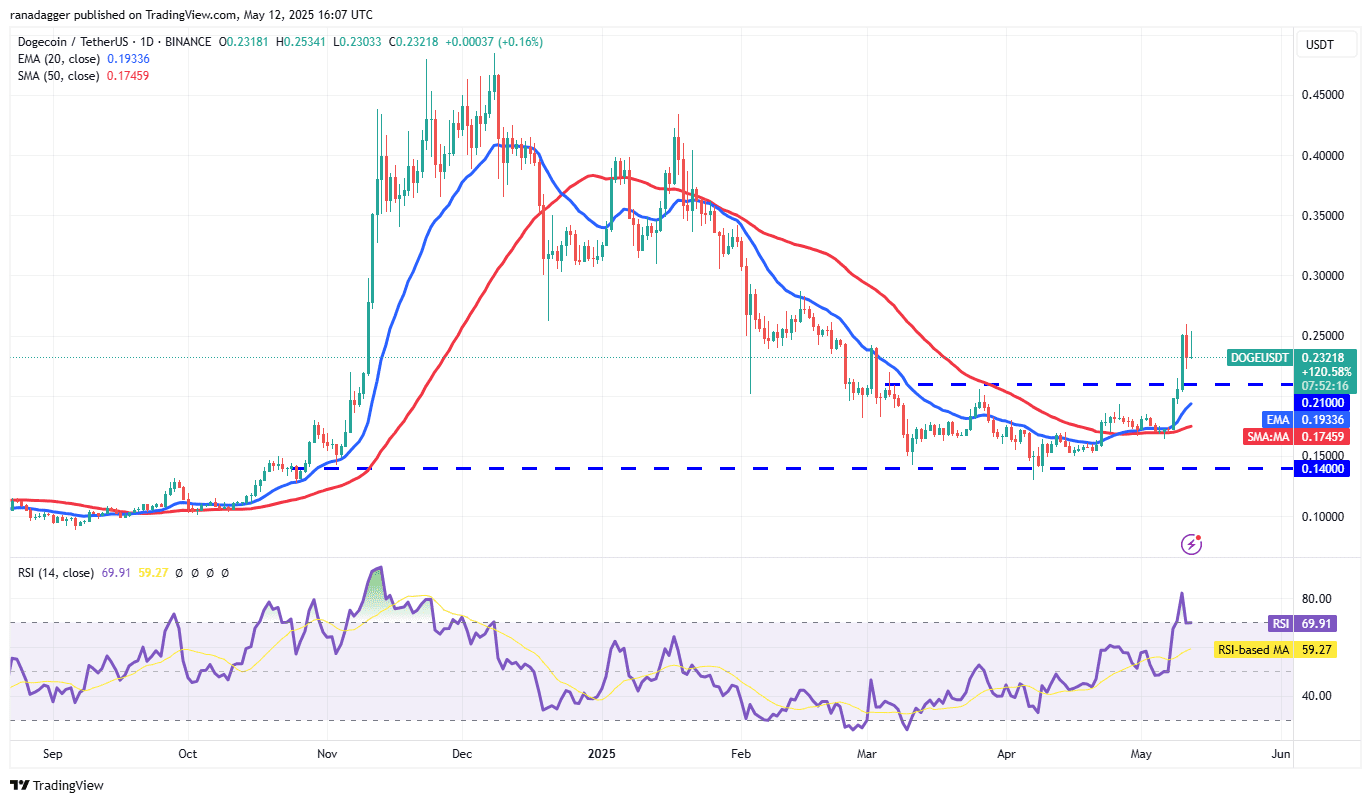

Dogecoin (DOGE) Price Prediction

Dogecoin retraced from $0.26 on May 11, indicating profit-taking. Bulls are expected to defend the $0.21 breakout level aggressively. A strong rebound from $0.21 would signal a successful flip of this level into support, potentially allowing DOGE to climb to $0.31. Conversely, a break below $0.21 could indicate increased bearish activity and a potential drop to the moving averages, suggesting a range-bound formation between $0.14 and $0.26.

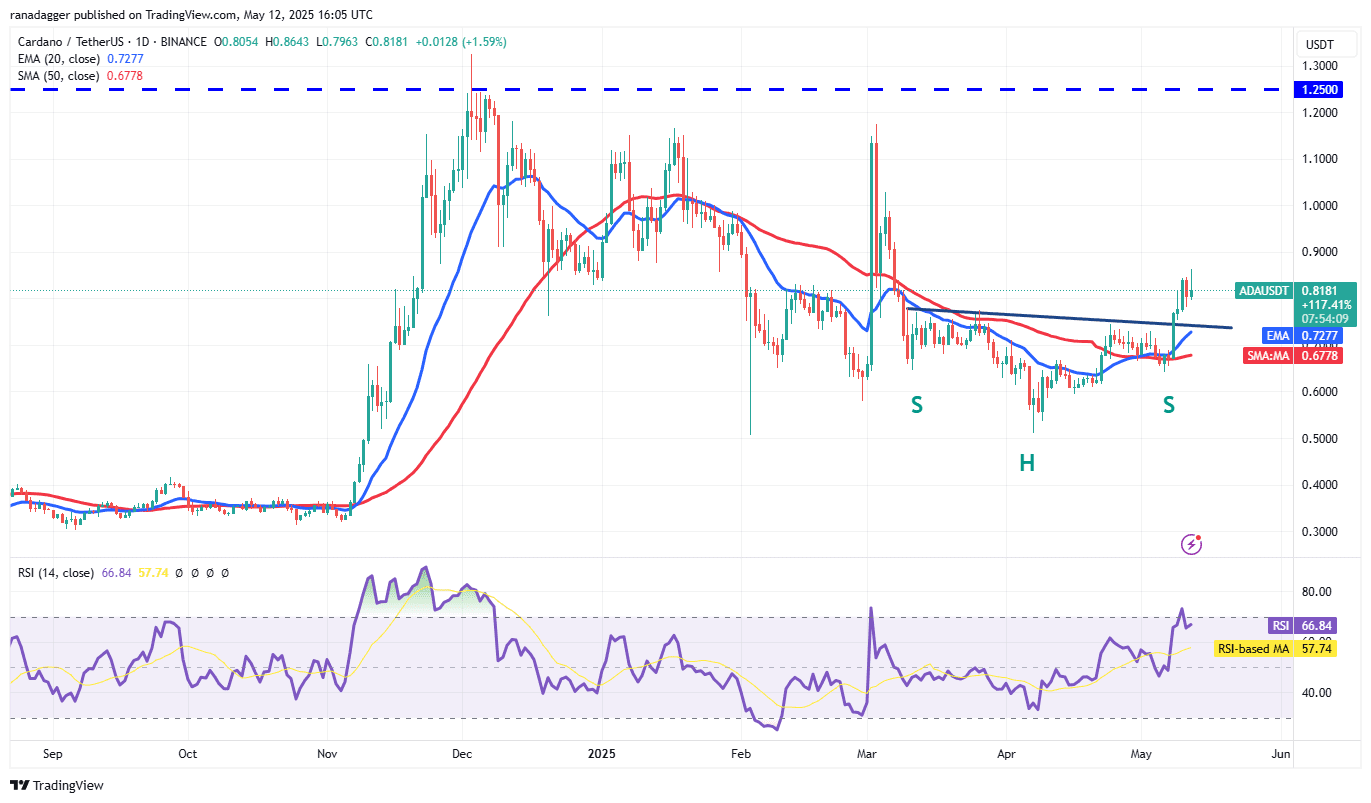

Cardano (ADA) Price Prediction

Cardano faces resistance near $0.86. The 20-day EMA ($0.72) is trending upward, and the RSI is approaching overbought levels, indicating a buyer advantage. If the price rebounds off the neckline, bulls will attempt to push ADA above $0.856, potentially reaching a target of $1.01. Sellers need to swiftly pull the price below the moving averages to prevent the upside. A successful move would lead to a descent towards the $0.58 support level.

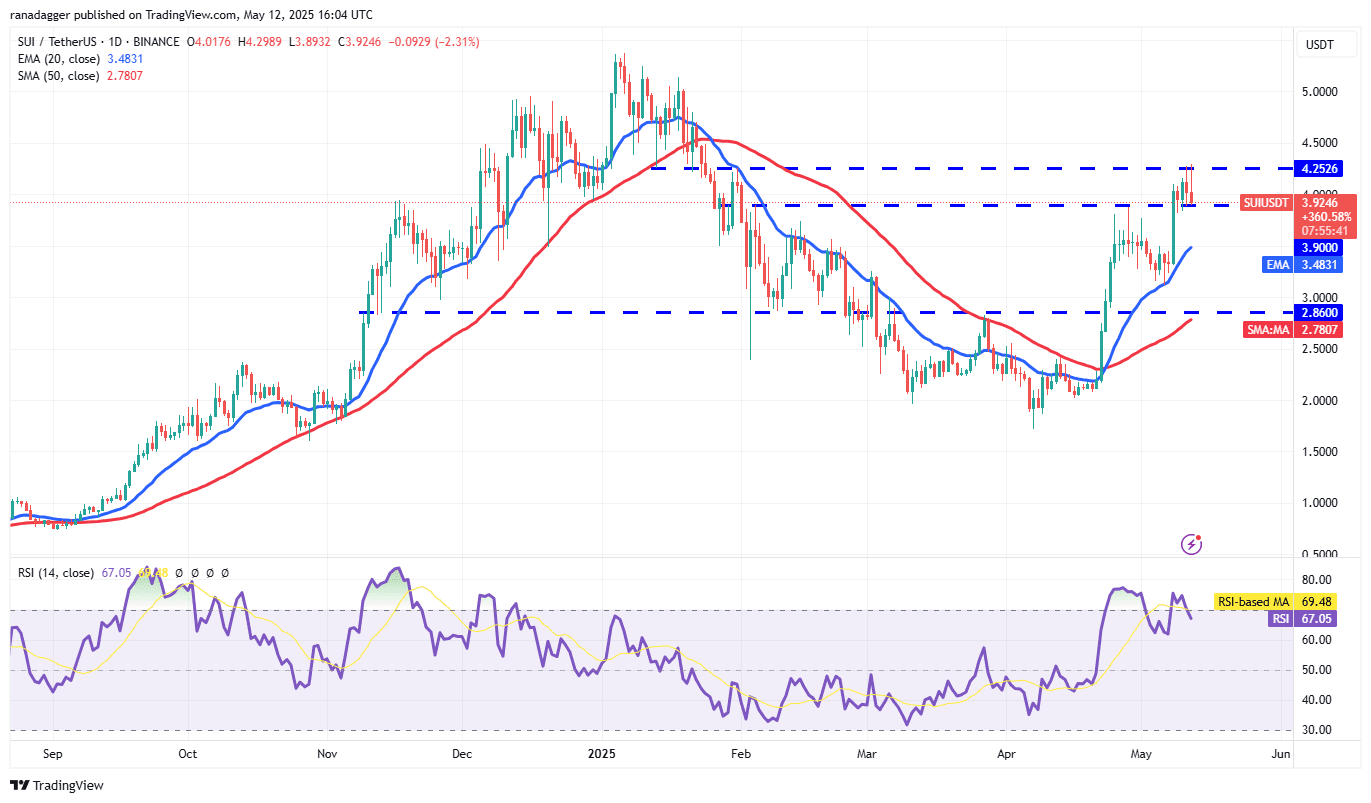

Sui (SUI) Price Prediction

Sui faces selling pressure at $4.25, but bulls have maintained the price above the $3.90 breakout level. Both moving averages are sloping upwards, and the RSI is near overbought territory. If buyers clear the $4.25 level, SUI could surge to $5. A break below $3.90 would signal weakness, potentially leading to a fall to the 20-day EMA ($3.48). A bounce off the 20-day EMA indicates that positive momentum remains intact, and bulls will likely try to clear the $4.25 resistance again.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency investments are highly speculative and carry significant risk. Always conduct thorough research before investing.