Key Takeaways:

- Bitcoin’s price experienced a sell-off following positive developments in the US-China trade negotiations.

- Macroeconomic shifts favoring stocks over gold contributed to the decrease in Bitcoin’s momentum.

- Institutional investment in Bitcoin ETFs suggests underlying demand remains strong, mitigating potential further price drops.

Bitcoin (BTC) faced a price correction after initially reaching a peak of $105,720 on May 12. This decline occurred despite a temporary truce in the US-China trade conflict, leaving many investors questioning the asset’s reaction to seemingly favorable news.

The agreement involved reduced import tariffs and ongoing discussions about currency manipulation, steel price dumping, and semiconductor export restrictions. However, the positive sentiment surrounding the trade deal seemed to negatively impact Bitcoin’s price.

Why Did Bitcoin’s Price Decline?

Several factors contributed to Bitcoin’s price correction:

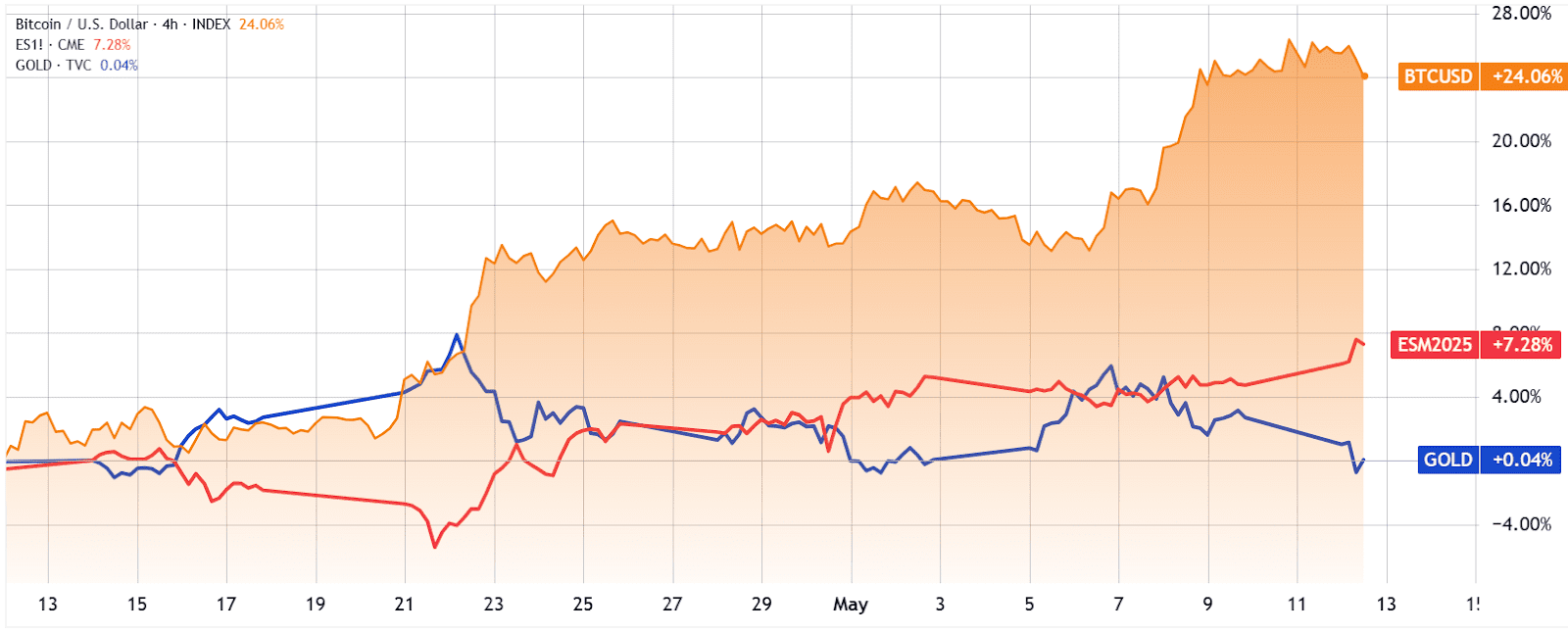

- Profit-Taking After Recent Gains: Bitcoin had experienced substantial gains (24%) in the preceding 30 days, leading to profit-taking by investors.

- Correlation with Stock Market: The strong correlation (83%) between Bitcoin and the stock market meant that positive news for stocks often led to investors shifting capital.

- Macroeconomic Conditions Favoring Stocks: The US-China trade deal directly benefited the stock market by potentially improving revenues and profit margins for companies. This reduced demand for safe-haven assets like Bitcoin and gold.

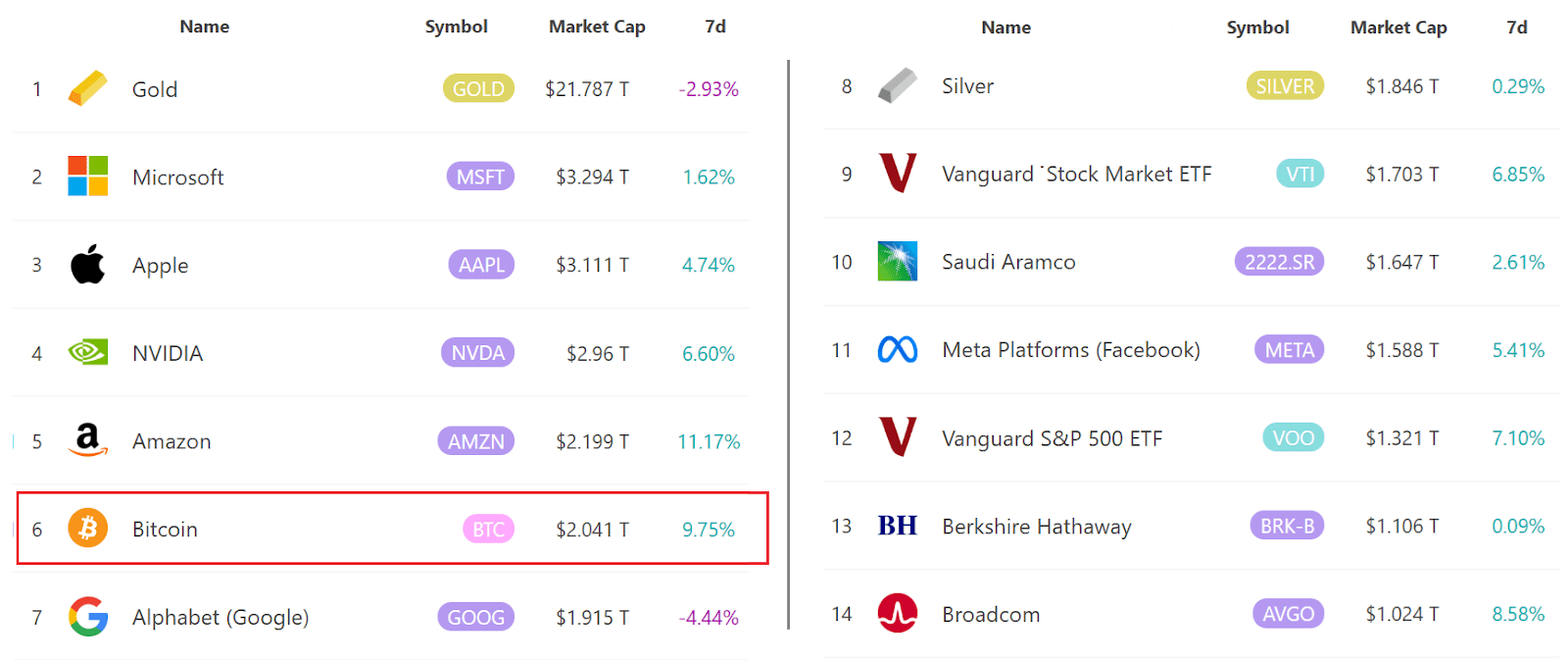

Bitcoin’s Market Position

Bitcoin has surpassed the market capitalization of both silver and Google, solidifying its position as the world’s sixth-largest tradable asset. This demonstrates the growing acceptance and value attributed to the digital currency.

Concerns Surrounding Large Bitcoin Holdings

The significant Bitcoin holdings of companies like Strategy and BlackRock (totaling 1.19 million BTC) have raised concerns among some investors. There are worries that these large positions might be influencing the price and creating a potential risk if these companies were to sell a portion of their holdings.

Critics have voiced concerns regarding the sustainability of such large-scale investments, particularly if the average purchase price continues to rise. However, companies like Strategy have demonstrated the capacity to increase their capital and debt limits, indicating a strong commitment to their Bitcoin investments.

Broader Macroeconomic Trends

The weakness in Bitcoin’s price near $105,000 can also be attributed to broader macroeconomic conditions. The easing of trade tensions benefited the stock market, while the demand for scarce assets like Bitcoin diminished.

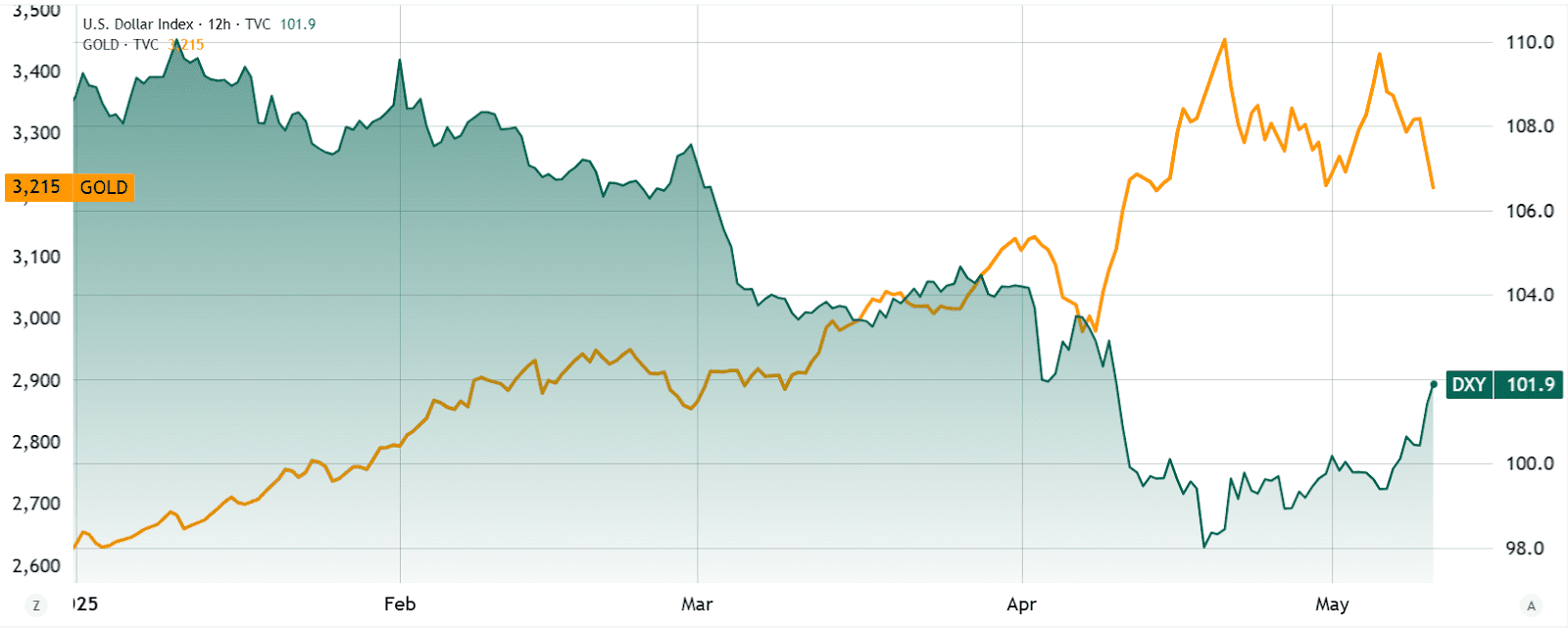

Gold, another safe-haven asset, also experienced a decline as investors shifted their focus toward riskier assets. The US Dollar Index (DXY) rose, indicating investor confidence in the US economy despite some negative economic data.

The Role of Bitcoin ETFs

Despite the price correction, the steady inflows into US spot Bitcoin ETFs—amounting to $2 billion between May 1 and May 9—indicate strong institutional demand for Bitcoin. This sustained demand suggests that any significant price drop below $100,000 is unlikely.

The continued investment in Bitcoin ETFs signifies institutional adoption and long-term confidence in the asset’s potential, rather than short-term retail-driven speculation.

Conclusion

The recent Bitcoin price correction following the US-China trade deal can be attributed to a combination of factors, including profit-taking, correlation with the stock market, and macroeconomic conditions favoring stocks. While concerns exist regarding large Bitcoin holdings, the steady inflows into Bitcoin ETFs indicate strong institutional demand and a positive outlook for the long term.

Investors should closely monitor macroeconomic developments, institutional investment trends, and regulatory changes to make informed decisions regarding Bitcoin investments.