GDC to Invest $300M in Bitcoin and TRUMP Memecoin: A Deep Dive

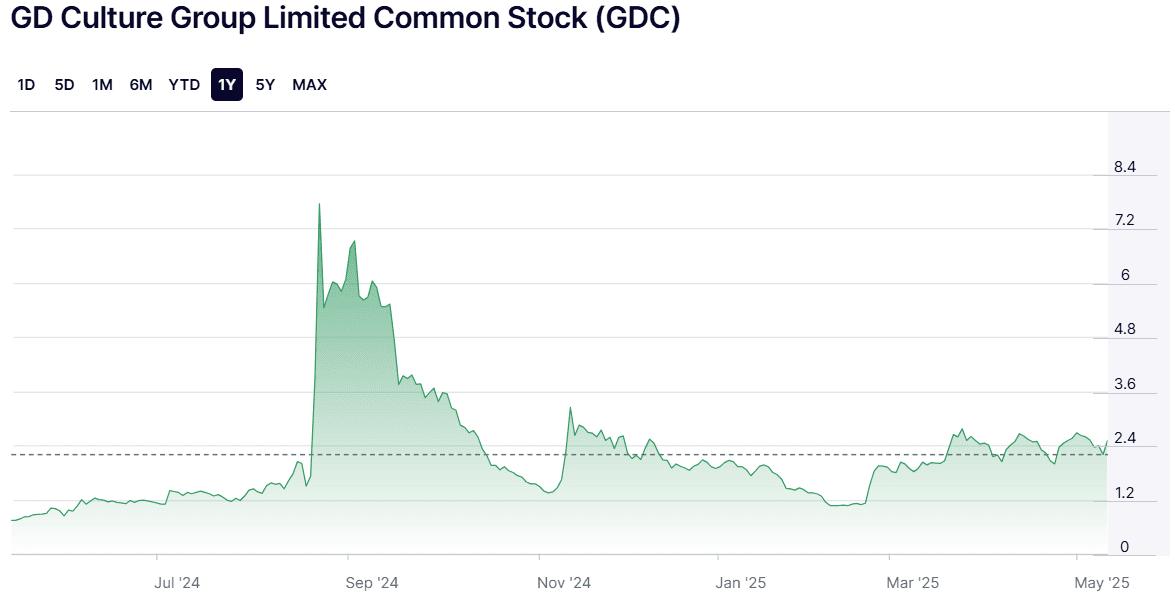

GD Culture Group (GDC), a Nasdaq-listed company specializing in livestreaming, e-commerce, and AI-driven digital human technology, is making headlines with its bold move into the cryptocurrency space. The company plans to raise up to $300 million to establish a cryptocurrency treasury reserve, signaling a significant shift in its investment strategy.

In a May 12 announcement, GDC and its subsidiary, AI Catalysis, revealed a common stock purchase agreement with a British Virgin Islands-based entity. This agreement allows GDC to sell up to $300 million of its common stock, with the proceeds earmarked for funding its crypto treasury.

The crypto treasury will primarily focus on acquiring Bitcoin (BTC) and the Official Trump (TRUMP) token. This dual-asset approach demonstrates GDC’s intention to balance the established stability of Bitcoin with the speculative potential of memecoins.

“Under this initiative, and subject to certain limitations, GDC intends to allocate a significant portion of the proceeds from any share sales under the facility to the acquisition, long-term holding, and integration of crypto assets into its core treasury operations,” GDC stated in its announcement.

GDC views this strategy as a commitment to the growing “decentralization transformation” reshaping various industries.

Founded in 2016, GDC is a micro-cap company with a market capitalization of approximately $34 million, according to Nasdaq data.

Strategic Rationale Behind the Crypto Investment

GDC’s chairman and CEO, Xiaojian Wang, emphasized the strategic alignment of this initiative with the company’s core strengths in digital technologies. He believes it positions GDC to capitalize on the burgeoning blockchain-powered industrial revolution.

“GDC’s adoption of crypto assets as treasury reserve holdings is a deliberate strategy that reflects both current industry trends and our unique strengths in digital technologies and the livestreaming e-commerce ecosystem,” Wang explained.

Nasdaq Compliance and Financial Considerations

It’s worth noting that the stock offering announcement followed a noncompliance warning from Nasdaq regarding GDC’s stockholders’ equity. The company reported stockholders’ equity of $2,643, falling short of the minimum requirement of $2.5 million. GDC has been given a timeframe to present a plan to regain compliance with Nasdaq’s listing requirements.

This investment makes GDC part of a rising amount of public companies allocating part of their balance sheets to crypto assets

TRUMP Token Dinner and Controversy

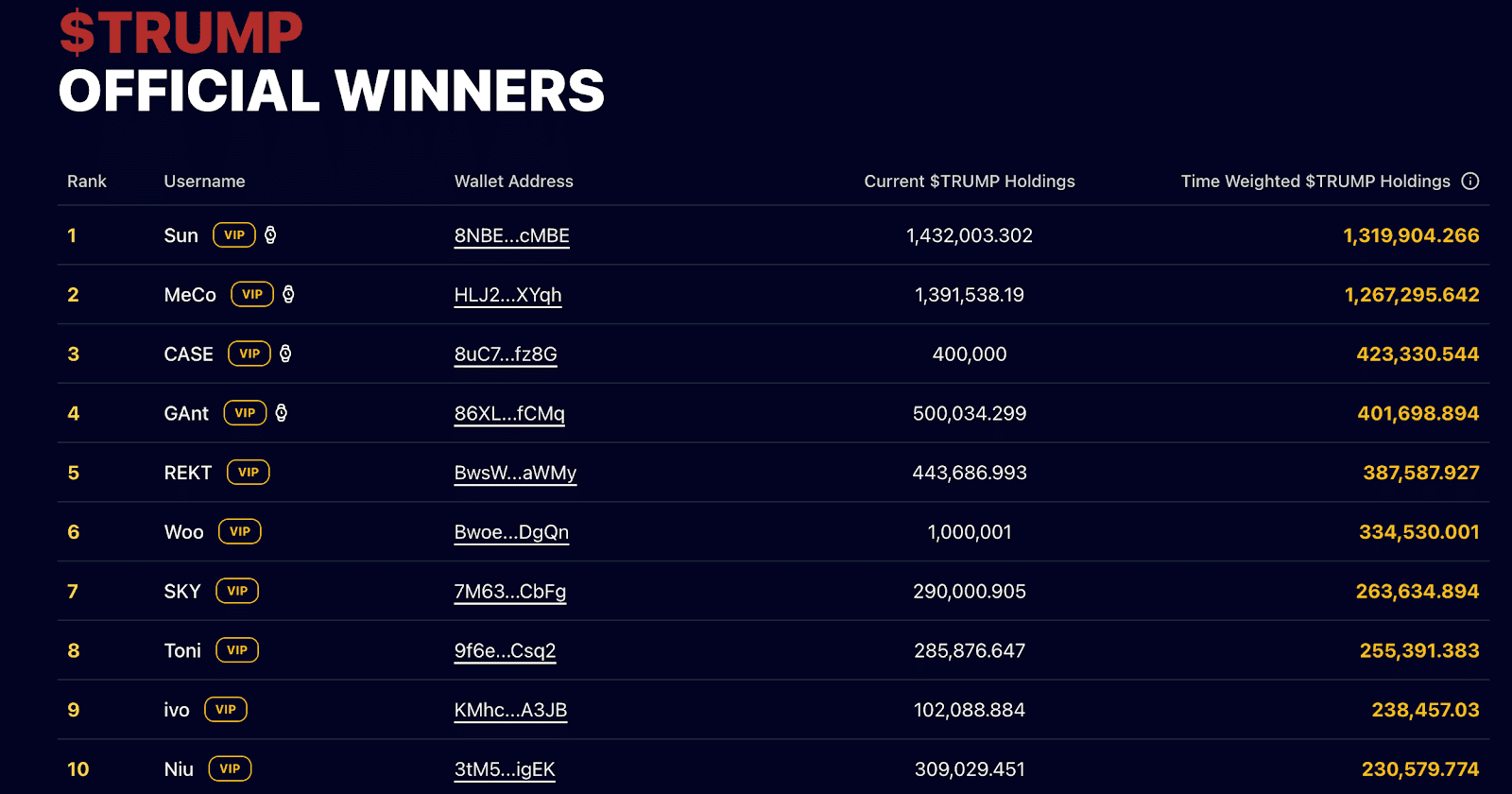

GDC’s announcement coincides with a controversial event related to the TRUMP memecoin. The top 25 TRUMP token holders are scheduled to attend a private dinner at the White House on May 22, sparking both excitement and criticism.

The TRUMP memecoin project has since announced that it has halted additional purchases for the dinner and that attendees are undergoing background checks.

As of May 12, the top 220 wallets held over 13.7 million TRUMP tokens, valued at approximately $174 million.

The White House dinner has attracted criticism from US lawmakers, including Republican Senator Cynthia Lummis, who expressed concern over the perception of exclusive access being granted to those willing to invest in the memecoin.

Crypto regulation experts also suggest that the Trump family’s involvement in crypto ventures could trigger greater scrutiny from the US Securities and Exchange Commission (SEC), as politically affiliated memecoins pose new regulatory challenges.

Implications and Future Outlook

GDC’s decision to invest in Bitcoin and TRUMP memecoin raises several questions. What are the potential benefits and risks of this strategy? How will the company manage the volatility associated with these assets? And what impact will this move have on GDC’s overall financial performance?

The company’s success will depend on its ability to navigate the complexities of the cryptocurrency market, effectively manage risk, and adapt to evolving regulatory landscape. GDC’s move is a compelling case study in the evolving relationship between traditional finance and the digital asset space.

Ultimately, GDC’s bold move into crypto represents a significant shift in its business strategy. Whether it pays off remains to be seen, but it certainly positions the company at the forefront of a rapidly evolving digital landscape.