Solana (SOL) has shown strong potential for a price rally, driven by increasing network activity and growth in its decentralized finance (DeFi) ecosystem. This article examines key on-chain metrics, recent developments, and market sentiment surrounding SOL to assess its potential for future gains.

Key Takeaways

- Solana’s Total Value Locked (TVL) surpasses the entire Ethereum layer-2 ecosystem.

- Solana’s 30-day fee revenue has significantly increased, indicating higher network usage and demand for SOL.

- Positive funding rates suggest healthy leverage demand from bulls, contributing to potential upward price momentum.

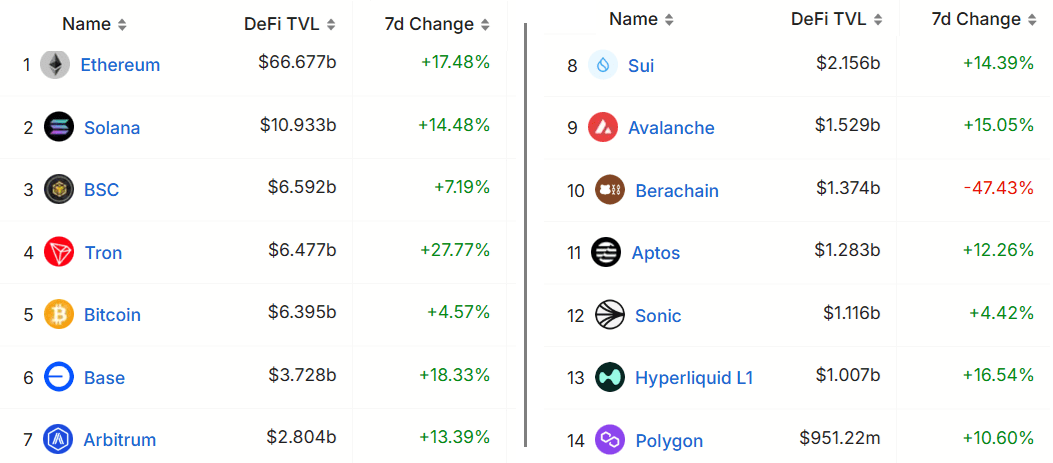

Solana’s Dominance in DeFi: Solana’s DeFi ecosystem is thriving, with its total value locked (TVL) exceeding $10.9 billion. This surpasses the combined TVL of all Ethereum layer-2 solutions like Base, Arbitrum, and Optimism, showcasing Solana’s growing influence in the DeFi space.

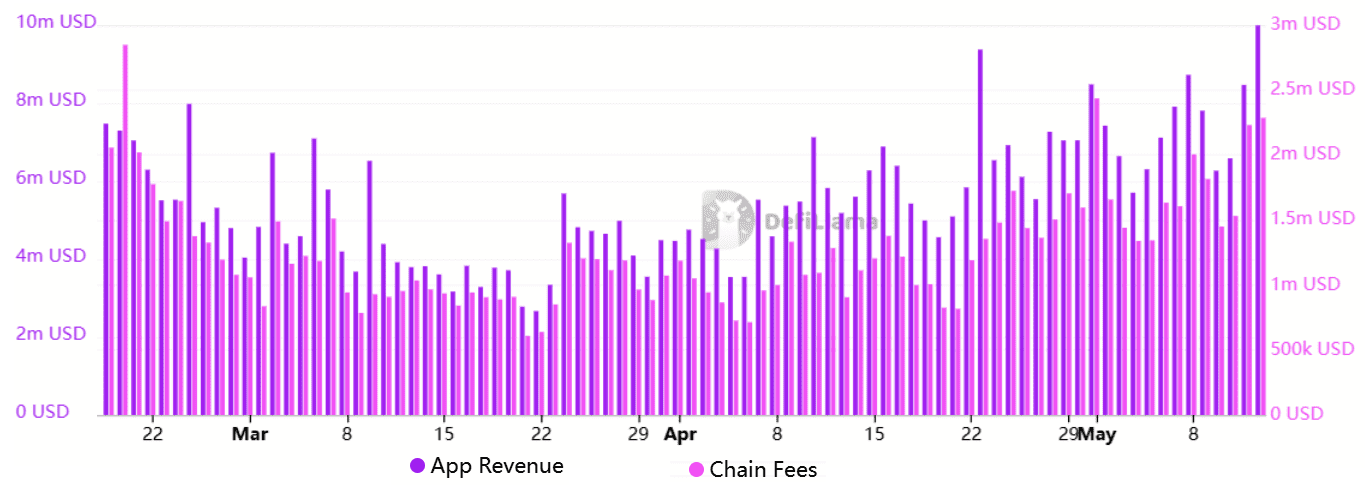

On-Chain Metrics and Network Growth: Solana’s on-chain metrics indicate increasing network usage and demand. Its 30-day fee revenue has seen a substantial increase, highlighting the growing popularity of Solana-based decentralized applications (dApps). The top Solana DEXs include Raydium, Serum and Orca.

Rising Fee Revenue: Solana’s rising fee revenue is a positive sign for SOL’s price. As network usage increases, so does the demand for SOL to pay for transaction fees. This demand helps to drive up the price of SOL.

Staking and Supply Dynamics: A significant portion of the SOL supply is currently staked, reducing the available supply and potentially driving up prices as demand increases. The percentage of SOL staked is 65%.

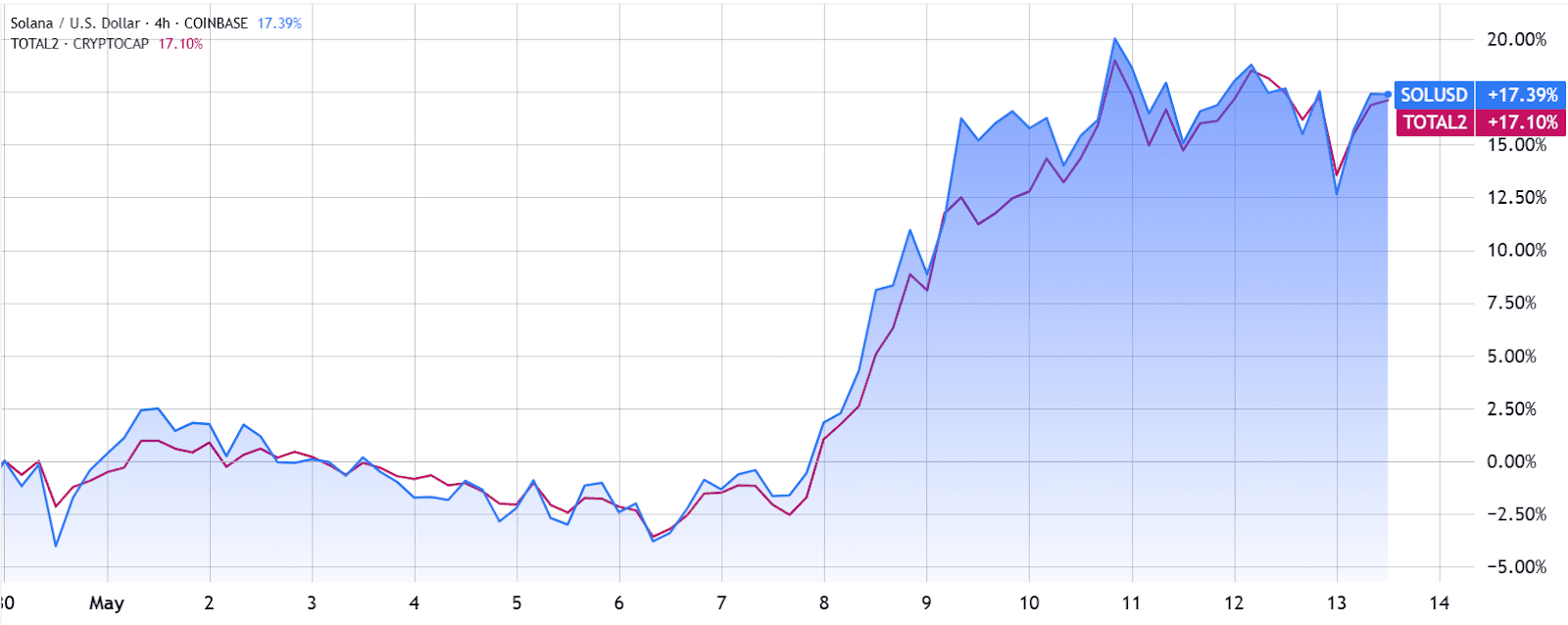

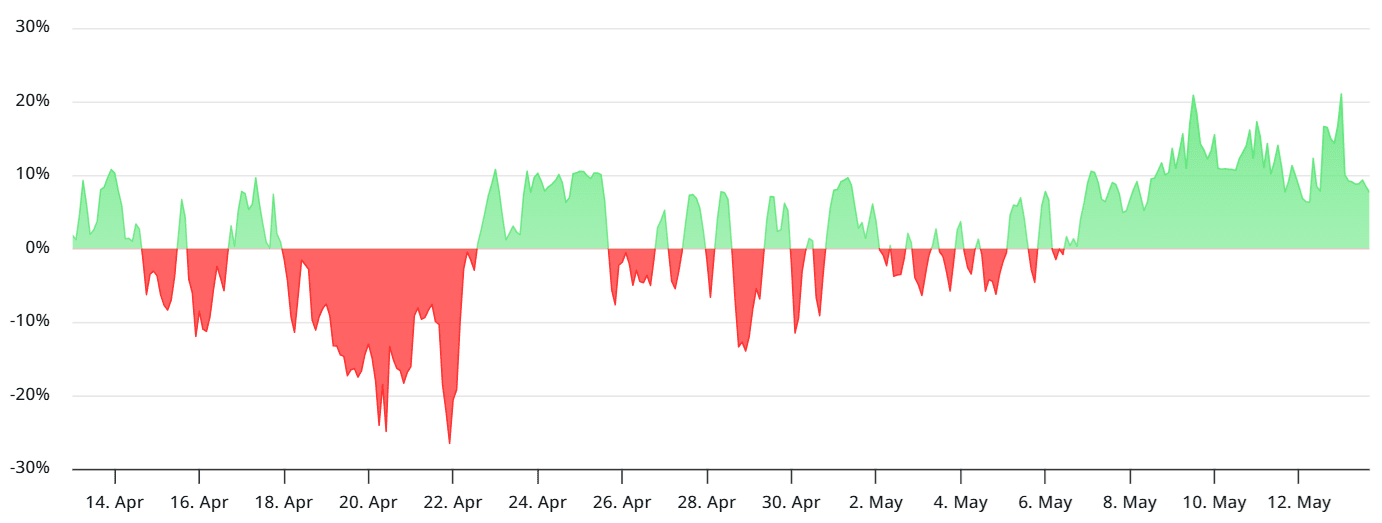

Leverage Demand and Market Sentiment: Examining leverage demand provides insights into traders’ optimism regarding SOL’s price. A positive funding rate in perpetual futures contracts suggests that long positions (buyers) are willing to pay to keep their trades open, indicating bullish sentiment. The Solana perpetual futures funding rate is currently at 8%.

Potential Catalysts for a SOL Price Rally

- Spot Solana ETF: The potential approval of a spot Solana exchange-traded fund (ETF) in the US could attract significant institutional investment and drive up demand for SOL.

- Strategic Reserves: Inclusion of SOL in state-level digital asset strategic reserves could further legitimize the asset and increase its adoption.

- Asset Tokenization: Traditional asset tokenization on the Solana network could unlock further value for SOL, as it becomes the underlying blockchain for these tokenized assets.

Solana Competitors

While Solana has shown significant growth, it also faces competition from other blockchains and ecosystems. Here’s a look at some of Solana’s main competitors:

- Ethereum: The leading smart contract platform, with a large ecosystem of dApps and developers.

- BNB Chain: A fast and low-cost blockchain with strong integration with Binance.

- Avalanche: A highly scalable blockchain with a focus on DeFi.

- Cardano: A blockchain with a strong emphasis on security and scalability.

- Polkadot: A blockchain that allows different blockchains to communicate with each other.

Conclusion: Based on the analysis of on-chain metrics, DeFi activity, and market sentiment, Solana has the potential to rally towards $200. However, several factors could influence SOL’s price, including market conditions, regulatory developments, and competition from other blockchain platforms. Investors should conduct thorough research and consider their risk tolerance before making any investment decisions.