Bitcoin (BTC) is projected to potentially reach $220,000 in 2025, according to an analysis leveraging its interplay with gold. This forecast considers Bitcoin’s price cycles and its potential to mirror gold’s market cap growth.

Key Takeaways:

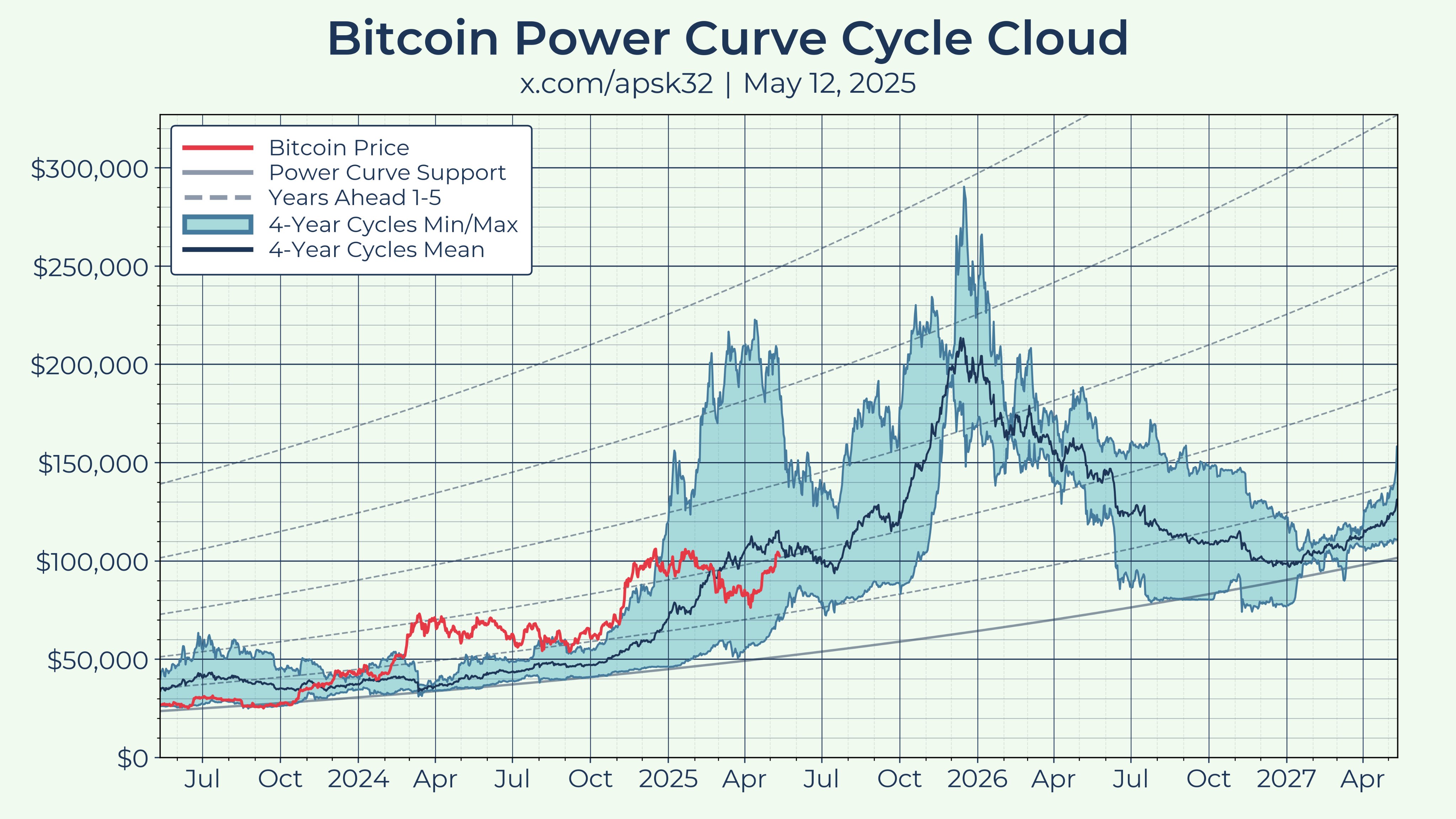

- 2025 Target: A “reasonable” target of $220,000 for Bitcoin in 2025, based on the Bitcoin power curve model.

- Gold Correlation: Bitcoin’s price movements often follow gold’s, with potential for significant gains as gold reaches new highs.

- Long-Term Potential: If Bitcoin captures 50% of gold’s market cap, it could reach nearly $1 million by the end of the decade.

Bitcoin’s Correlation with Gold

The correlation between Bitcoin and gold prices is a key factor in this analysis. Historically, Bitcoin has followed gold’s upward trends, albeit with a delay. As gold reaches record highs, the outlook for Bitcoin becomes increasingly optimistic.

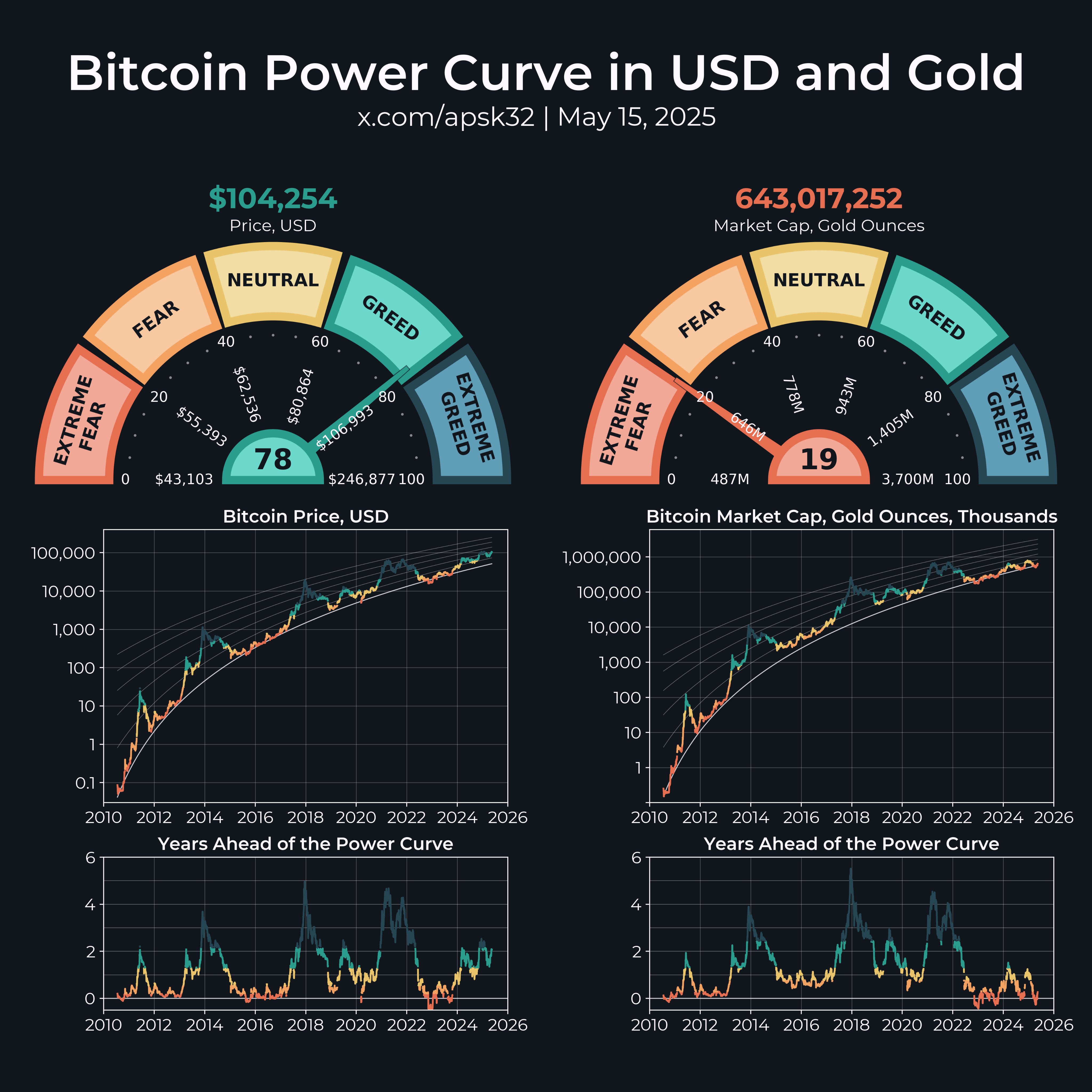

Apsk32, an X analytics account, uses a “power curve” model to measure Bitcoin’s value against gold ounces. This approach aims to avoid the inflationary impact of the US dollar when assessing Bitcoin’s potential. The power curve concept involves measuring Bitcoin’s market capitalization in gold ounces, fitting the data to a curve to project future price targets.

“Bitcoin’s position relative to gold has improved considerably since April,” Apsk32 stated, expressing optimism about higher returns later in the year.

Bitcoin Power Curve and Price Targets

Using the power curve model, analysts have identified potential bull market targets, contextualizing the previous 2017 high of $20,000. According to Apsk32’s calculations, if Bitcoin’s network value, measured in gold, continues to follow the power curve, and gold maintains its current value, Bitcoin’s price could potentially reach $444,000. However, a more conservative target for 2025 is around $220,000.

“If we start getting above $250k, that’s what I would consider ‘higher than expected’,” Apsk32 noted.

Bitcoin as “Digital Gold” and Long-Term Projections

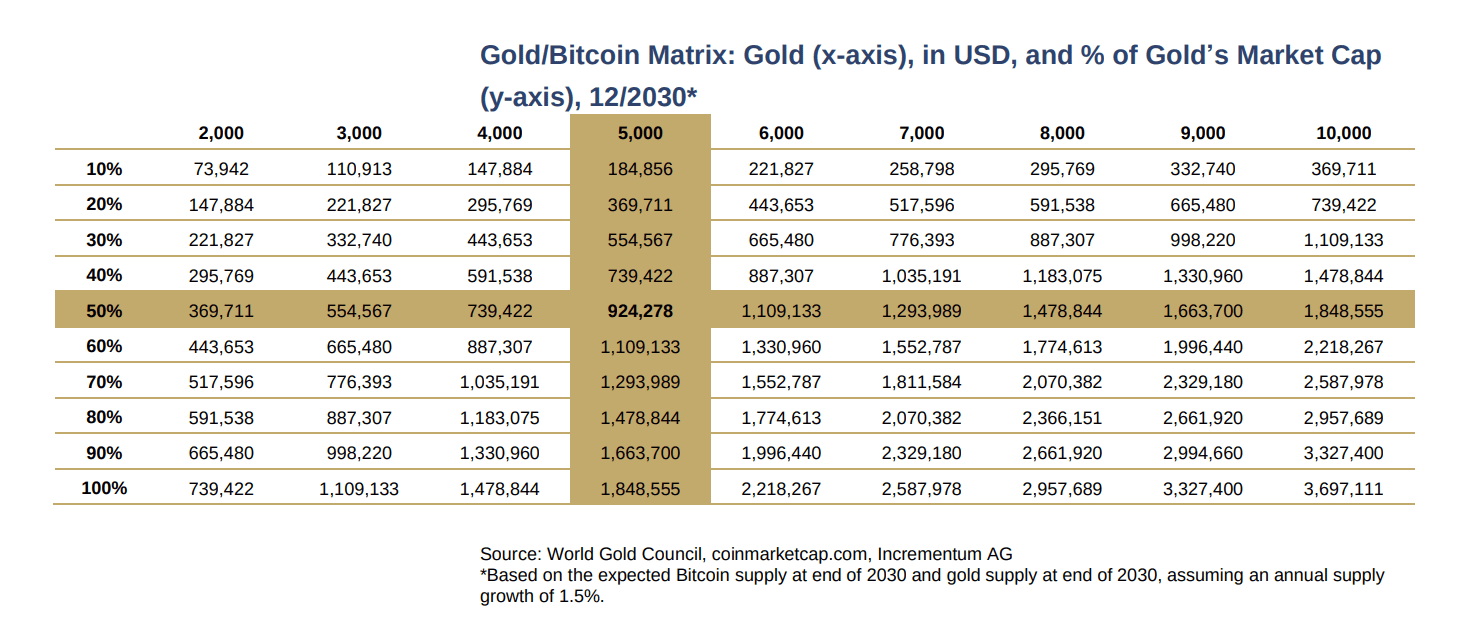

The concept of Bitcoin as “digital gold” is gaining traction, with many anticipating its increased adoption in the coming years. Bitcoin analyst Sam Callahan explored scenarios where Bitcoin captures varying portions of gold’s market capitalization.

Callahan considered data from the In Gold We Trust report, projecting that if gold reaches $5,000 per ounce by 2030 and Bitcoin captures 50% of its market cap, Bitcoin could reach $924,000.

The In Gold We Trust report emphasizes that these figures are not strict price predictions but rather a framework for understanding potential revaluations of non-sovereign hard assets by the end of the decade.

Achieving half of gold’s market cap could lead to a $1 million BTC price. This projection hinges on Bitcoin’s continued adoption and its perceived value as a store of wealth, similar to gold.

Disclaimer: This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.