The cryptocurrency market is buzzing with anticipation as analysts suggest altcoins are on the cusp of a substantial rally, potentially echoing the explosive growth seen in 2017. This optimism stems from various factors, including a significant increase in the total altcoin market capitalization, positive technical indicators, and historical patterns. However, not all analysts are convinced, urging caution based on Bitcoin’s dominance and other market signals. This article delves into the arguments for and against an impending ‘altseason’.

What is an Altseason?

Before diving in, let’s define what constitutes an ‘altseason’. Generally, an altseason occurs when altcoins (cryptocurrencies other than Bitcoin) significantly outperform Bitcoin over a sustained period. This is typically characterized by:

- A substantial increase in the total market capitalization of altcoins.

- Higher trading volumes for altcoins.

- Increased investor interest and capital inflow into altcoins.

- Altcoins generating higher returns compared to Bitcoin.

The Bullish Case for Altcoins

Several factors contribute to the optimistic outlook for altcoins:

Market Cap Growth: The total altcoin market cap (excluding Ethereum) experienced a substantial increase of $126 billion in Q2. This surge suggests growing investor confidence and renewed interest in altcoins.

Analyst Predictions: Crypto analyst Javon Marks highlighted a breakout pattern that could rival the 2017 bull run. Marks pointed to a chart comparing the TOTAL3 index (total market cap of altcoins excluding Bitcoin and Ethereum) against the US money supply, indicating that altcoins are gaining value relative to the overall liquidity in the US economy.

Technical Indicators: Another analyst, Moustache, identified a weekly inverse head-and-shoulders pattern in the TOTAL3 chart. This bullish reversal indicator suggests a potential rally, drawing parallels to the 2021 altcoin season when top altcoins surged significantly against Bitcoin.

The Bearish Counter-Arguments

Despite the enthusiasm, some analysts advise caution:

Unconfirmed Bullish Trend: Technical analyst Crypto Scient argues that the recent rise in altcoin market cap hasn’t yet translated into a higher time frame (HTF) bullish trend shift. The analyst notes that the TOTAL2 trend remains bearish, facing resistance at the $1.25 trillion level.

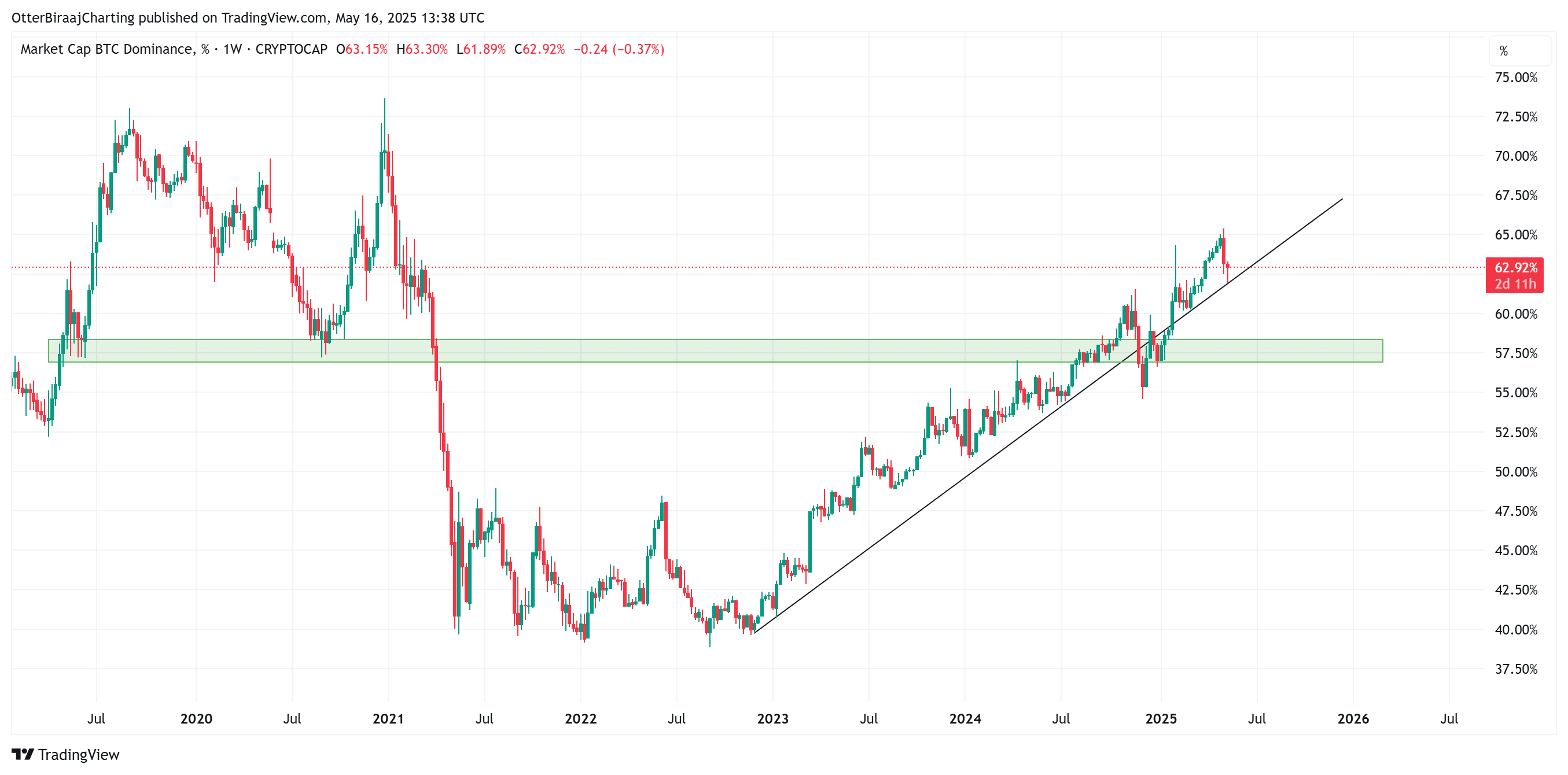

Bitcoin Dominance: Crypto commentator DonaXBT emphasizes the importance of Bitcoin’s dominance in influencing altcoin performance. A significant breakdown in Bitcoin’s dominance trendline is considered essential for altcoins to experience a substantial move. Currently, Bitcoin dominance remains high, suggesting that capital is still primarily flowing into Bitcoin.

Spot Trading Volume and Altcoin Season Index

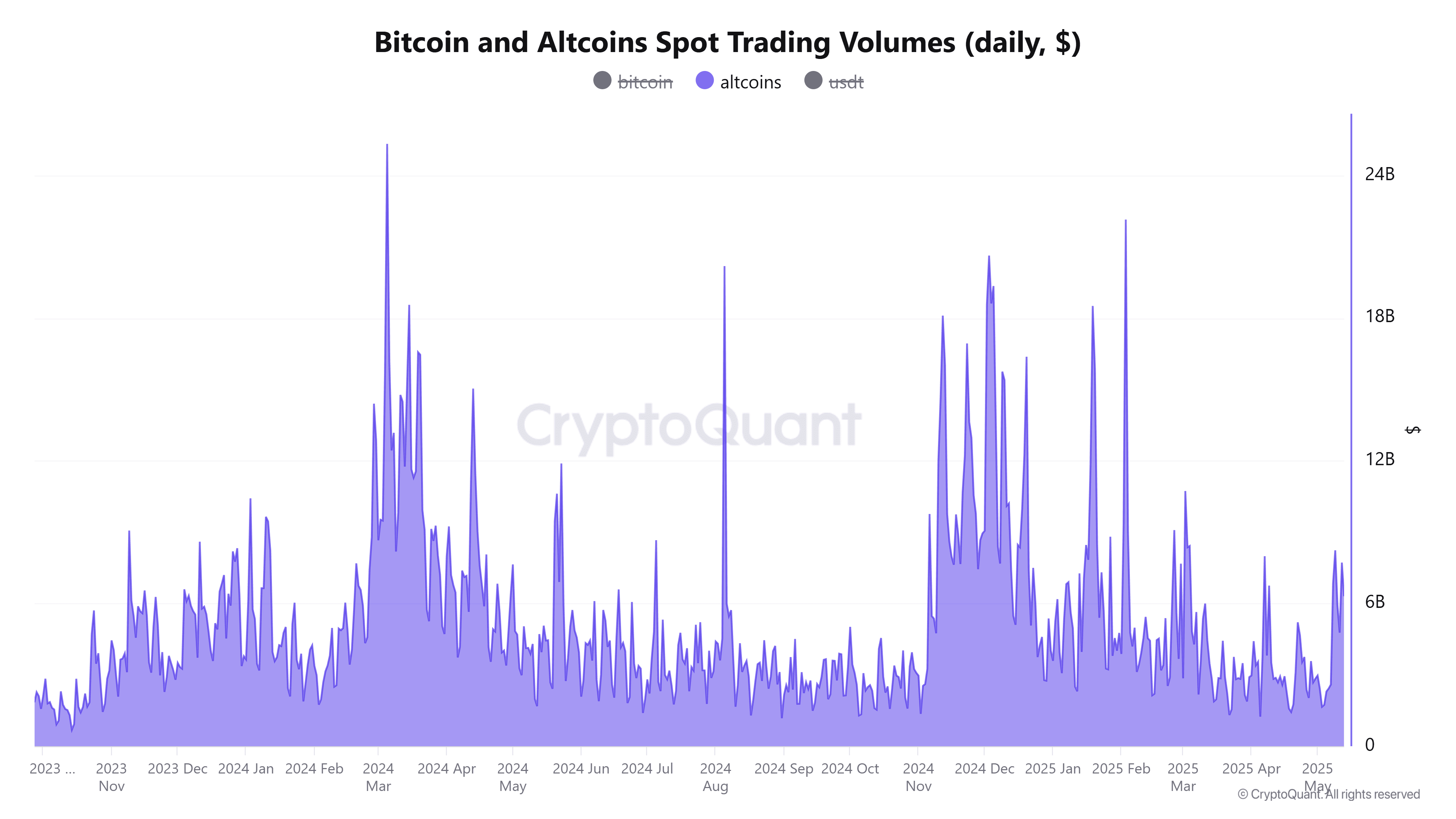

Further adding to the cautious sentiment, altcoin spot trading volumes remain relatively low compared to previous periods. Data indicates that current volumes are significantly lower than those observed in Q4 2024. Additionally, the Altcoin Season Index, currently at 24, indicates that the market is still in Bitcoin season. Historically, an index below 25 signifies Bitcoin dominance, which typically precedes significant altcoin pumps.

Key Altcoins to Watch

While predicting the exact timing and magnitude of an altseason is challenging, keeping an eye on certain altcoins can provide insights into market trends. Here are a few categories of altcoins to consider:

- Layer-1 Blockchains: These are the foundational blockchains that support other applications and tokens (e.g., Solana, Avalanche, Cardano).

- Decentralized Finance (DeFi) Tokens: These tokens are associated with decentralized lending, borrowing, and trading platforms (e.g., Aave, Uniswap, Compound).

- Gaming and Metaverse Tokens: These tokens are used within blockchain-based games and virtual worlds (e.g., Axie Infinity, Decentraland, The Sandbox).

- AI-Related Tokens: With the rise of Artificial Intelligence, tokens that fuel decentralized AI applications are gaining attention.

Conclusion

The potential for an altcoin rally is generating considerable excitement within the crypto community. While technical indicators and market cap growth suggest a promising outlook, caution is warranted due to Bitcoin’s dominance and relatively low trading volumes. As always, conducting thorough research and understanding the risks involved is crucial before making any investment decisions in the volatile cryptocurrency market. Whether the market is on the verge of a new altseason or not, staying informed and adaptable is essential for navigating the dynamic world of cryptocurrency.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.