Key Takeaways

- AI-powered crypto trading bots leverage machine learning for optimized, emotionless trading decisions.

- Setting up a bot involves platform selection, exchange connection, strategy configuration, and backtesting.

- Bots offer 24/7 operation and instant data reaction, ideal for both passive income seekers and active traders.

- Continuous monitoring and strategy adjustments are crucial for sustained performance.

- Aligning bots and strategies with your financial goals is essential for success.

Understanding AI Crypto Trading Bots

In the fast-paced world of cryptocurrency trading, AI-powered crypto trading bots have emerged as a powerful tool for both beginners and experienced traders. These bots use machine learning algorithms to analyze market data, identify patterns, and execute trades in real-time, 24/7.

Unlike traditional bots that operate based on predefined rules, AI bots can adapt dynamically to changing market conditions. They ingest vast amounts of data, including price action, order book depth, volatility, and even social sentiment, to make informed decisions. This adaptability makes them particularly valuable in volatile environments where speed and objectivity are critical.

Benefits of Using AI Crypto Trading Bots:

- Automation: Bots automate the trading process, eliminating the need for manual intervention.

- Speed: AI bots can react to market changes faster than human traders.

- Objectivity: Bots eliminate emotional decision-making, leading to more rational trades.

- 24/7 Operation: Bots can trade around the clock, maximizing profit potential.

- Backtesting: Bots allow traders to backtest strategies using historical data to optimize performance.

Setting Up Your AI Crypto Trading Bot: A Step-by-Step Guide

Setting up an AI crypto trading bot requires careful planning and execution. Here’s a step-by-step guide to help you get started:

- Choose a Platform: Select a platform that supports AI functionality and aligns with your trading needs. Popular options include Freqtrade, Trality, Jesse AI, 3Commas, Pionex, and Cryptohopper. Consider factors such as ease of use, features, pricing, and supported exchanges.

- Connect to an Exchange: Connect your chosen bot to a cryptocurrency exchange using API keys. Ensure you disable withdrawal permissions and enable two-factor authentication (2FA) for enhanced security. Restrict access via IP whitelisting where available.

- Configure Your Strategy: Define your trading strategy, including trade pairs, order sizes, stop-loss and take-profit rules, cooldowns, and maximum concurrent positions. Some platforms offer prebuilt logic, while others allow you to create custom strategies using Python.

- Backtest Your Strategy: Backtest your strategy using historical data to assess its performance across different market conditions. Platforms like 3Commas, Cryptohopper, and Freqtrade offer robust backtesting tools.

- Deploy and Monitor: Deploy your bot in live conditions with minimal capital. Monitor execution logs, fill prices, slippage, and fees in real-time. Set up alerts for failed orders or significant drawdowns.

Choosing the Right AI Trading Bot

Selecting the right AI-powered crypto trading bot is crucial for building a sustainable automated trading strategy. Here’s what to consider:

- Strategy Complexity: Determine the level of complexity you’re comfortable with. Some bots prioritize simplicity and automation, while others offer deep customization and control.

- Technical Skill Level: Consider your technical expertise. Some platforms cater to no-code users, while others are designed for developers and quantitative analysts.

- Risk Appetite: Choose a bot that aligns with your risk tolerance. Some bots offer more conservative strategies, while others are designed for high-risk, high-reward trading.

- Exchange Support: Ensure the bot supports your preferred cryptocurrency exchanges. Most bots support major exchanges like Binance, Kraken, KuCoin, Coinbase, and Bybit.

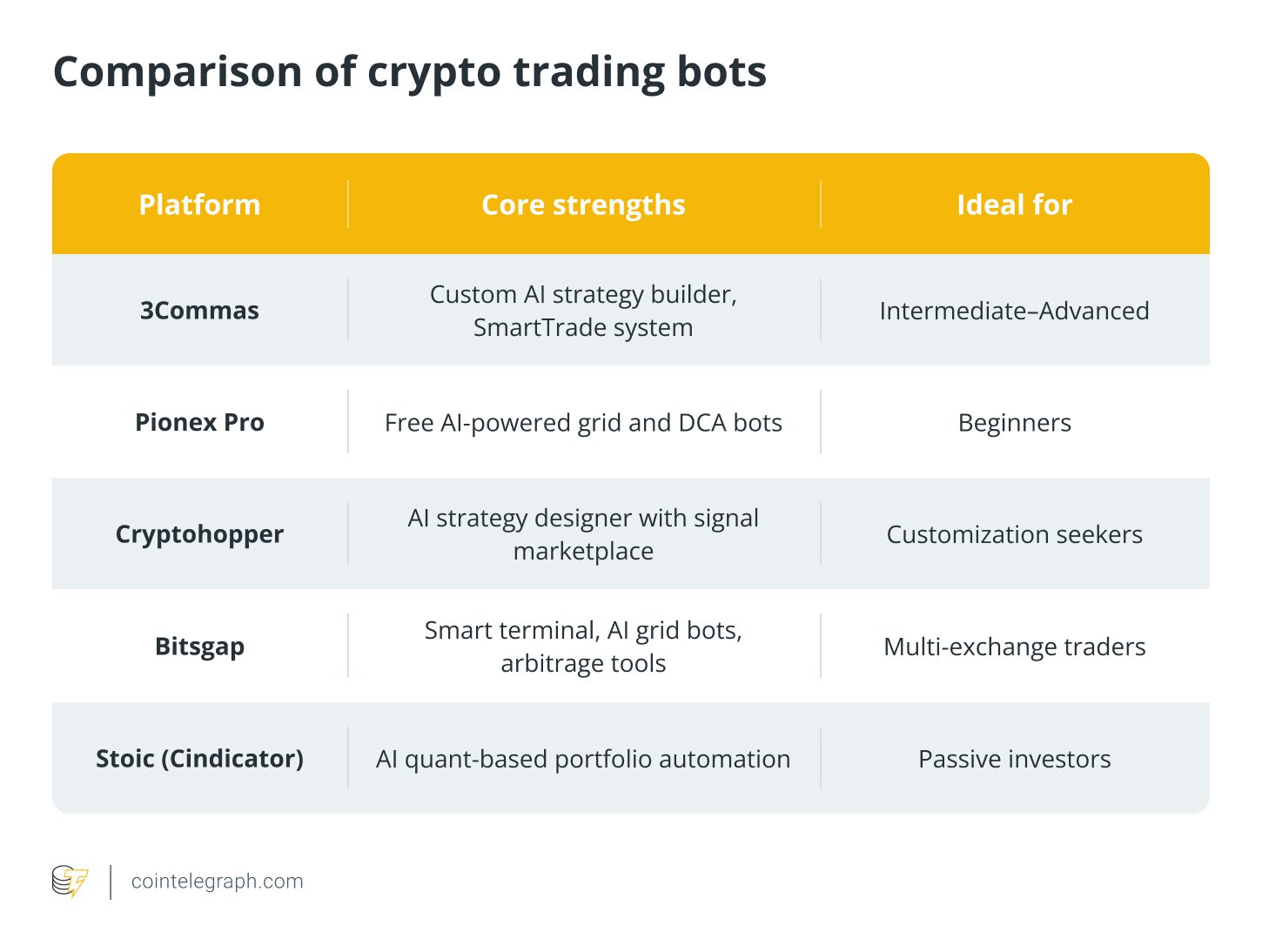

Popular AI Trading Bot Options:

- Pionex: Ideal for grid trading and dollar-cost averaging (DCA) strategies.

- 3Commas: Supports custom logic and popular indicators for trend-based or breakout strategies.

- Freqtrade and Jesse AI: Best for building predictive models with Python.

- Stoic by Cindicator: Uses built-in quant models for automated portfolio balancing.

- Cryptohopper and Kryll: Offer no-code interfaces and visual strategy builders for beginners.

Avoiding Common Mistakes

Even with powerful AI tools, mistakes can lead to poor trading outcomes. Here are some common pitfalls to avoid:

- Overfitting Backtests: Ensure your strategy performs well in live conditions, not just in backtests.

- Relying on Marketplace Bots: Thoroughly test and tweak marketplace strategies before deployment.

- Weak Risk Controls: Always use stop-losses and appropriate position sizes to manage risk.

- Ignoring Trading Costs: Account for slippage and fees in your backtests.

- Lack of Monitoring: Regularly monitor your bot’s performance and set up alerts for critical events.

- Overleveraging: Avoid using excessive leverage, which can lead to liquidation.

- Wrong Market Fit: Choose strategies that are appropriate for the current market conditions.

The Future of AI in Crypto Trading

The future of AI in crypto trading involves real-time learning and continuous adaptation. Emerging systems use reinforcement learning and online model retraining to adapt to shifting market dynamics.

Integration of large language models (LLMs) is also on the horizon. LLMs can interpret unstructured information from various sources, such as news articles, social media, and regulatory filings, and convert it into actionable insights.

AI is also expanding its presence on-chain, with smart contract-based agents executing trades and managing DeFi yield in a decentralized manner.

Conclusion

AI-powered crypto trading bots offer a powerful way to automate trading, optimize strategies, and potentially generate profits in the volatile cryptocurrency market. By carefully selecting a platform, configuring your strategy, and continuously monitoring performance, you can harness the power of AI to achieve your trading goals.