Attorneys representing Roman Storm, a developer of the Tornado Cash protocol, have filed a motion urging the court to reconsider the case’s dismissal, citing the prosecution’s alleged withholding of exculpatory evidence. This evidence reportedly consists of communications with the Financial Crimes Enforcement Network (FinCEN) dating back to 2023.

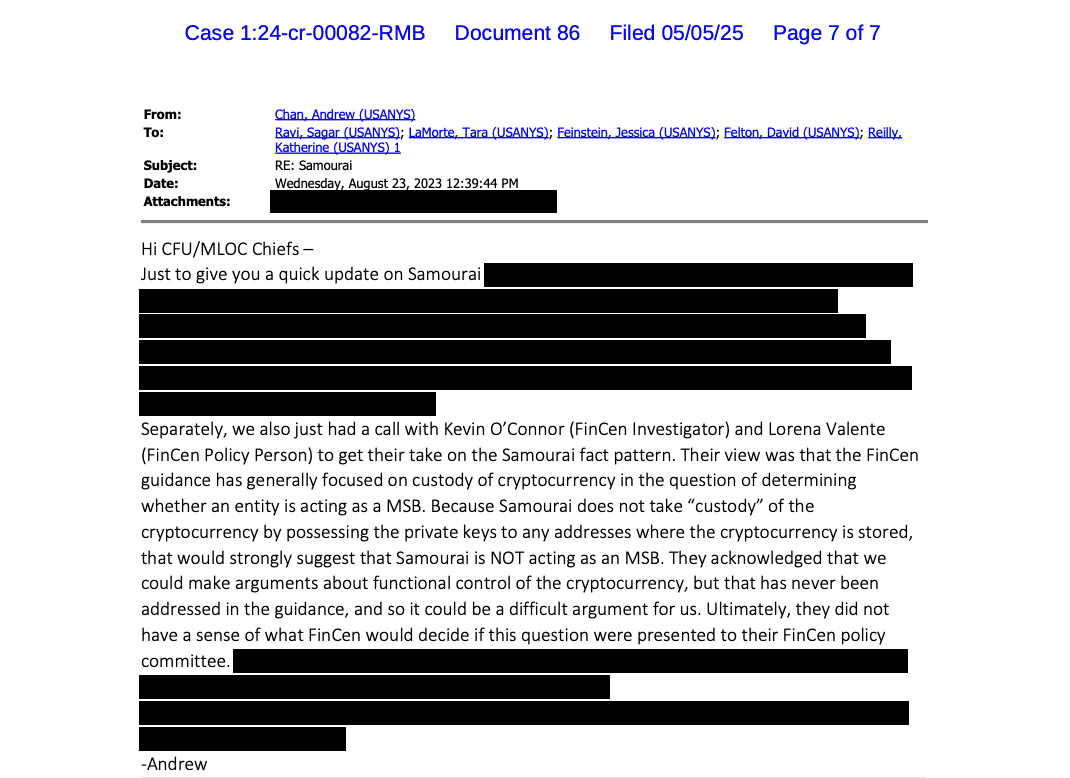

The core of the defense’s argument, outlined in a May 16 letter to Judge Katherine Polk Failla, revolves around the assertion that FinCEN documents indicate non-custodial crypto mixers do not legally qualify as “money transmitting businesses.” The defense further claims that prosecutors were aware of this FinCEN guidance since at least 2023.

Despite this knowledge, the defense alleges, state prosecutors proceeded with cases against developers associated with Samourai Wallet and Tornado Cash.

US prosecutors have refuted these claims, asserting that the FinCEN communications were submitted within the stipulated timeframe for document production during legal discovery.

Storm’s defense draws parallels to the arguments presented by the Samourai Wallet developer’s attorneys, referencing the same legal documents in a May 5 letter. The defense argues that the government has either misled the court or played “fast and loose” with arguments regarding FinCEN guidance.

The letter emphasizes that despite the government’s assertion of only “superficial similarities” between the cases, they share the fundamental characteristics of cryptocurrency mixers, rendering the FinCEN documents highly relevant to the potential dismissal of the case against Storm.

The Legal Battle Continues: Key Developments

Despite a ruling on April 28, where Federal Judge Robert Pitman restricted the Office of Foreign Assets Control (OFAC) from reinstating sanctions on Tornado Cash, the case against Storm continues.

Although charges have been modified, US federal prosecutors are proceeding with the trial.

Understanding the Core Issues

The case against Roman Storm and the broader legal scrutiny of Tornado Cash raise several critical questions about the intersection of cryptocurrency, privacy, and regulation:

- What is Tornado Cash? Tornado Cash is a decentralized, non-custodial cryptocurrency mixer. It allows users to obscure the origin of their cryptocurrency transactions, enhancing privacy.

- Why is it controversial? While designed for privacy, Tornado Cash has been accused of facilitating money laundering and other illicit activities.

- What is FinCEN’s role? FinCEN is a bureau of the US Department of the Treasury that combats financial crimes. Its guidance on crypto mixers is central to the current legal debate.

- What are the potential implications? The outcome of the Storm case could significantly impact the regulation and development of crypto mixers and privacy-enhancing technologies.

Expanding on the Arguments: A Deeper Look

The defense’s argument hinges on the interpretation of FinCEN regulations and whether non-custodial crypto mixers fall under the definition of “money transmitting businesses.” A key point of contention is whether the developers of Tornado Cash can be held liable for the actions of users who utilized the platform for illicit purposes.

Prosecutors, on the other hand, likely argue that the developers had a responsibility to implement measures to prevent the platform from being used for illegal activities. They may also emphasize the significant volume of illicit funds that were allegedly laundered through Tornado Cash.

The Broader Context: Crypto Regulation and Privacy

The Tornado Cash case is just one example of the growing tension between cryptocurrency innovation and government regulation. As cryptocurrencies become more mainstream, regulators around the world are grappling with how to balance the benefits of this technology with the need to prevent financial crime.

The legal battles surrounding Tornado Cash and similar platforms are likely to continue for the foreseeable future, shaping the future of cryptocurrency regulation and privacy.

Key Takeaways:

- Roman Storm’s attorneys are seeking reconsideration of the motion to dismiss the case.

- The defense alleges that prosecutors withheld exculpatory evidence related to FinCEN guidance.

- The case raises fundamental questions about the regulation of crypto mixers and developer liability.

- The outcome could have significant implications for the future of cryptocurrency and privacy.