Prince Filip Karađorđević, the hereditary prince of Serbia and Yugoslavia, believes Bitcoin’s price may be strategically suppressed before a substantial rally. In an interview with Simply Bitcoin, he suggested market participants might be influencing Bitcoin (BTC) price action, potentially mirroring the dynamics observed in the 2021 market.

“People are able to control the market to some extent,” Prince Filip stated. “Maybe that’s what acted on the 2021 market that suppressed its price from jumping high up. We could get that again in 2025, but there will be one point where [Bitcoin price] will run away.”

Despite potential short-term manipulation, Prince Filip remains optimistic about Bitcoin’s long-term prospects, emphasizing its inherent deflationary properties. He anticipates Bitcoin’s value will consistently appreciate over time.

Prince Filip also referenced the “omega candle” theory, popularized by Bitcoin advocate Samson Mow, CEO of Jan3. This theory posits that Bitcoin’s price will experience exponential growth after surpassing the $100,000 mark.

According to Mow, this phase will involve rapid price increases, with daily gains potentially reaching $10,000 initially, followed by “omega candles” representing $100,000 increments.

Factors Driving Bitcoin’s Growth

Mow attributes Bitcoin’s growth to increasing distrust in the traditional financial system. Other factors contributing to Bitcoin’s upward trajectory include:

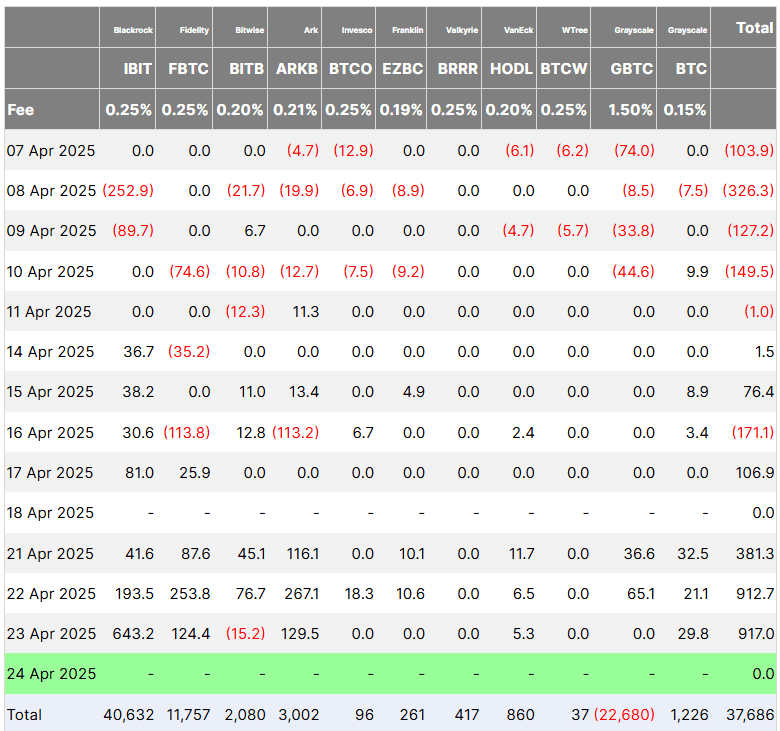

- ETF Inflows: US spot Bitcoin ETFs experienced significant inflows, accumulating over $2.2 billion in Bitcoin within three days.

- Macro Relief: Improving macroeconomic conditions and expectations of a flexible monetary policy from the Federal Reserve are contributing to a positive outlook for Bitcoin.

- Safe Haven Status: Bitcoin is increasingly perceived as a safe haven asset, decoupling from traditional markets like stocks.

Analysts from Bitfinex exchange noted that Bitcoin’s rally aligns with relative strength expectations compared to equities and the dollar. They highlighted macro relief, strong ETF inflows, and anticipation of Fed policy flexibility as key drivers.

However, concerns about a potential recession in the US persist, adding uncertainty to the market. JPMorgan estimates a 60% probability of a recession in 2025, citing potential impacts from tariffs on China.

Bitcoin’s Recent Performance

Over the past week, Bitcoin’s price has recovered by over 9%. This rebound coincided with substantial inflows into US spot Bitcoin ETFs.

Key Takeaways:

- Prince Filip anticipates a major Bitcoin rally despite potential price suppression.

- He highlights Bitcoin’s deflationary nature and the ‘omega candle’ theory.

- ETF inflows, macro relief, and safe-haven demand are fueling Bitcoin’s growth.

- Concerns about a potential recession remain a factor in the market.