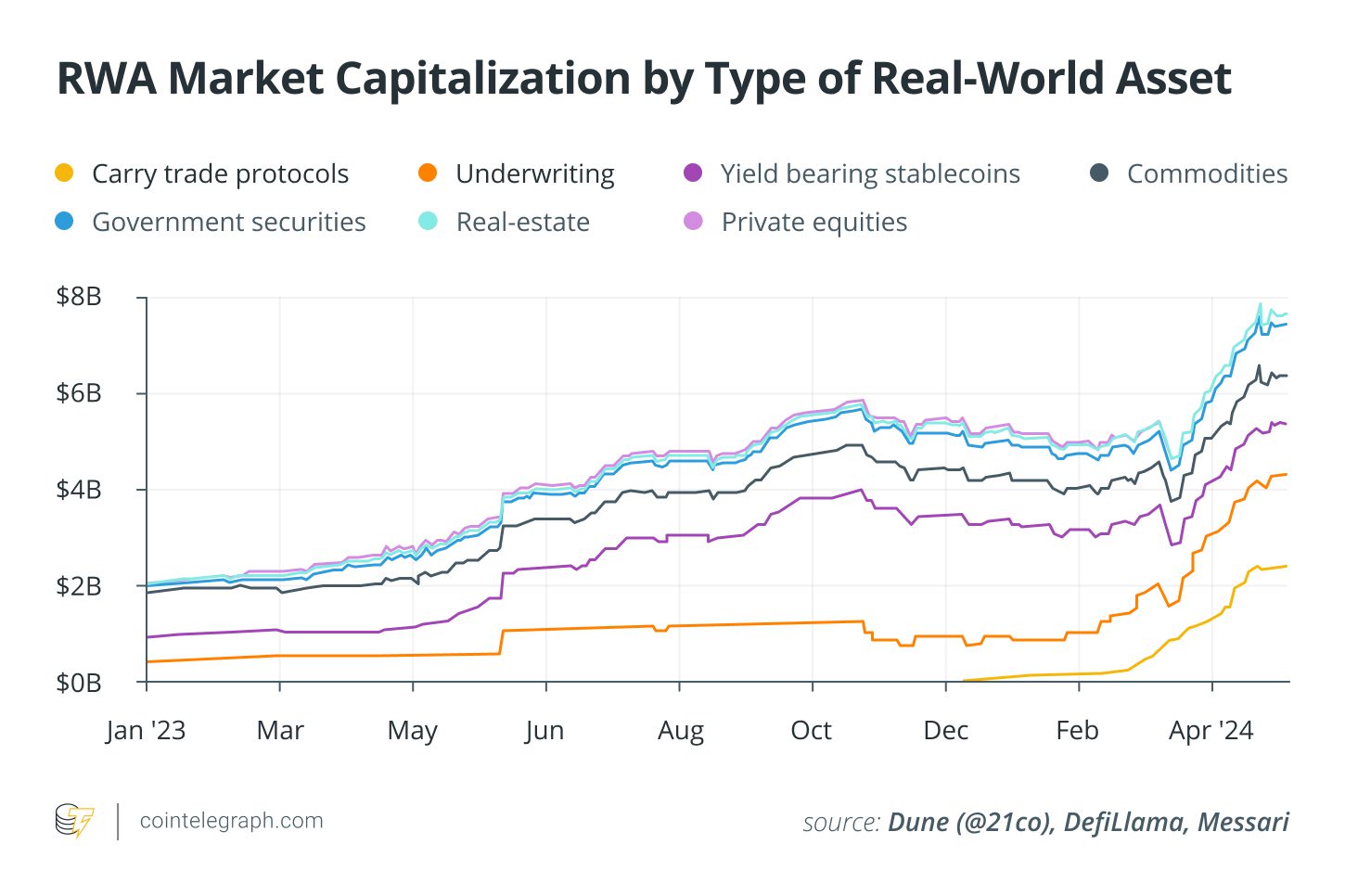

Tokenized real-world assets (RWAs) are experiencing significant growth, reaching a total value locked (TVL) of $8 billion this year, excluding non-yield-earning stablecoins. These RWAs encompass a variety of assets tokenized on blockchains, including private equity, real estate, government securities, commodities, and other financial obligations.

The increasing popularity of tokenized RWAs within decentralized finance (DeFi) gained momentum as bond yields in traditional finance began to outpace the lower-risk DeFi yields during the bear market of 2022-2023. The United States Federal Reserve’s interest rate hikes have made U.S. Treasury yields competitive with DeFi stablecoin yields, despite the lower risk associated with Treasuries.

Real-World Asset Projects Reach $8 Billion Market Cap

Several protocols have capitalized on higher borrowing costs and subdued DeFi activity by offering tokenized U.S. Treasurys and private loans within blockchain ecosystems. As the crypto market rebounded in 2024, driven by renewed institutional interest, the TVL of RWA projects hit its current $8 billion capitalization.

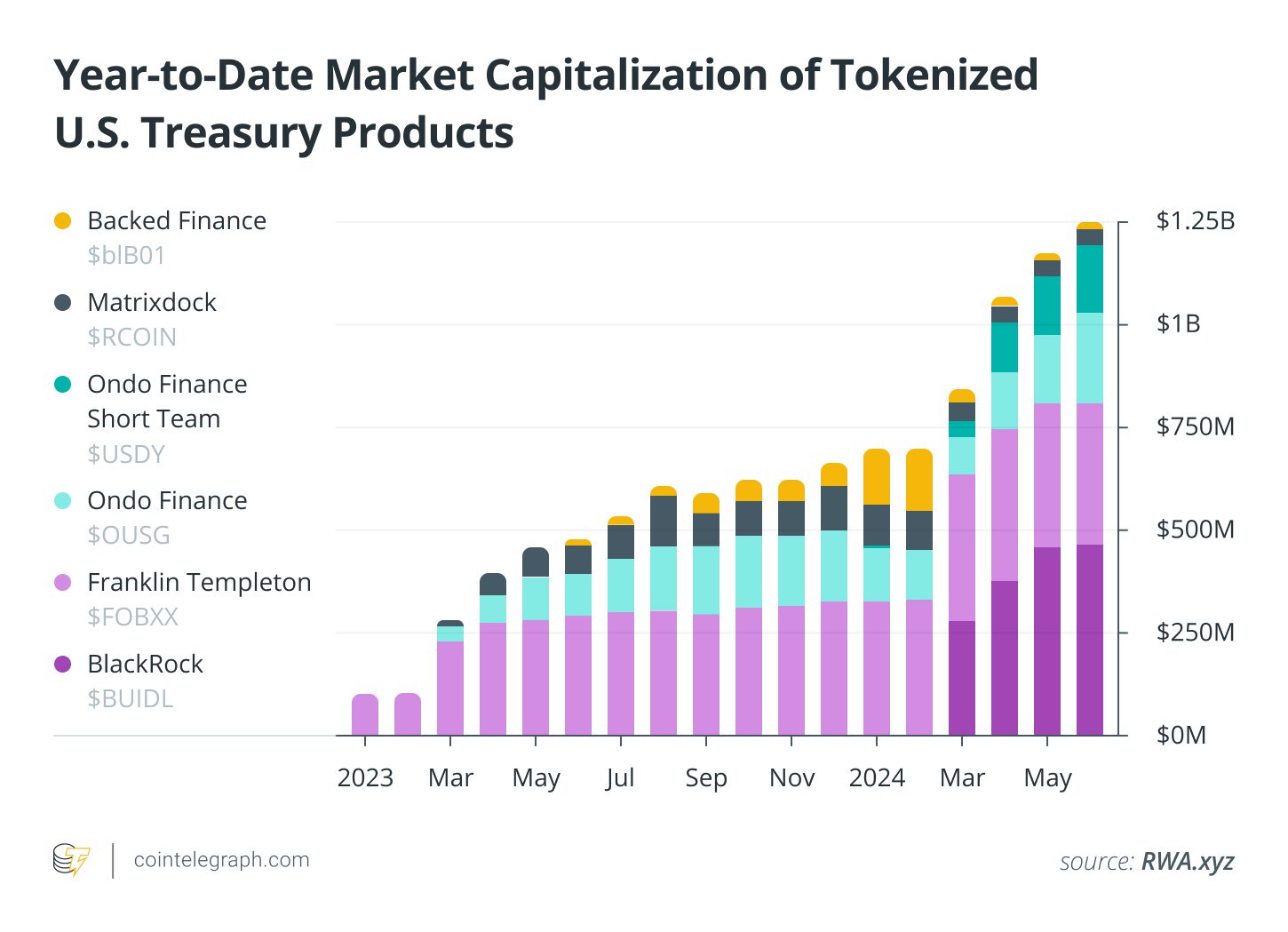

Asset management giant BlackRock has entered the RWA space and quickly established itself as the largest provider of tokenized U.S. Treasurys through its BUIDL fund. Upon launch, the fund rapidly grew to a market cap of $462.27 million, securing a 30% market share and surpassing Franklin Templeton’s Benji Investments fund as the leading issuer of tokenized Treasurys.

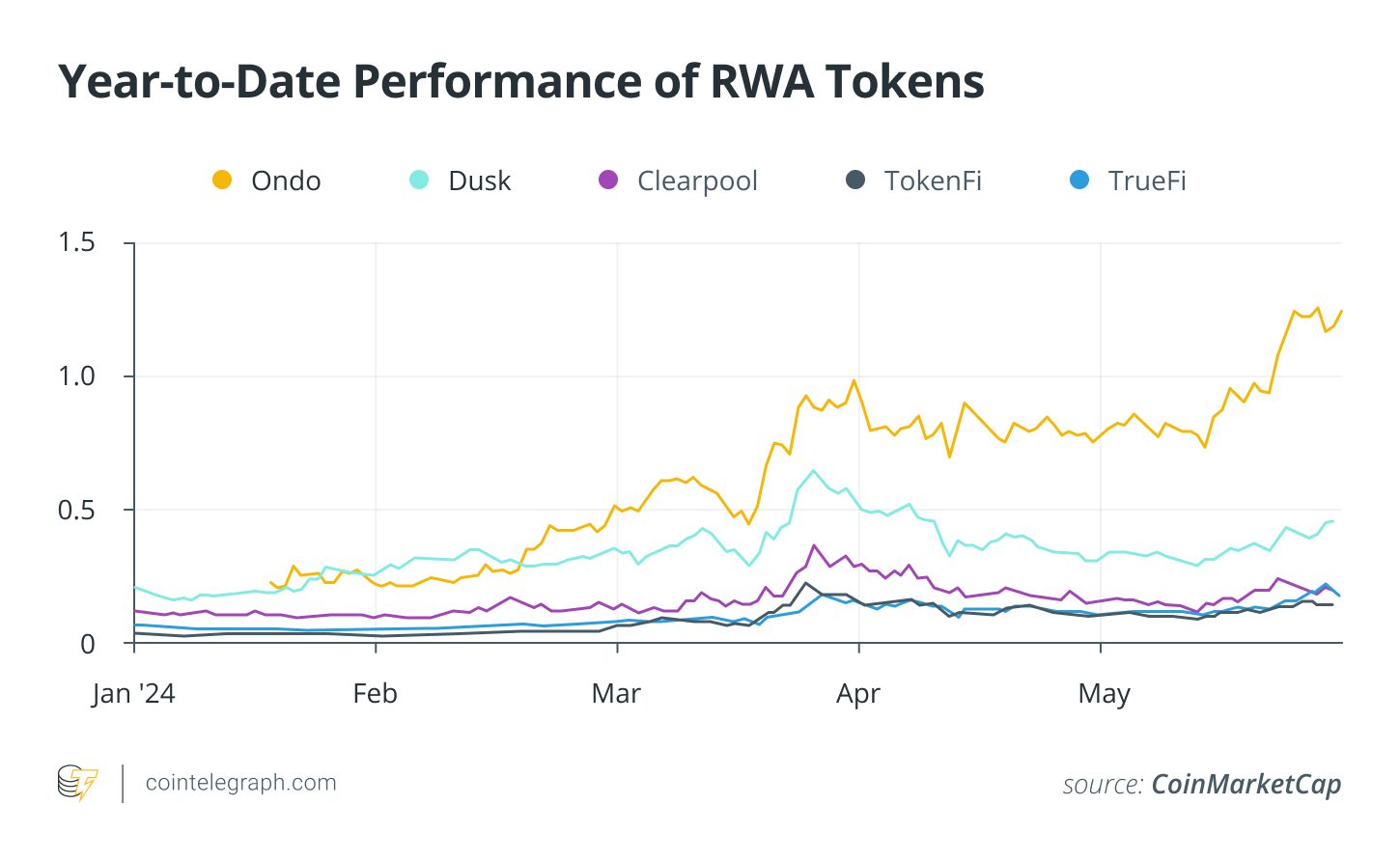

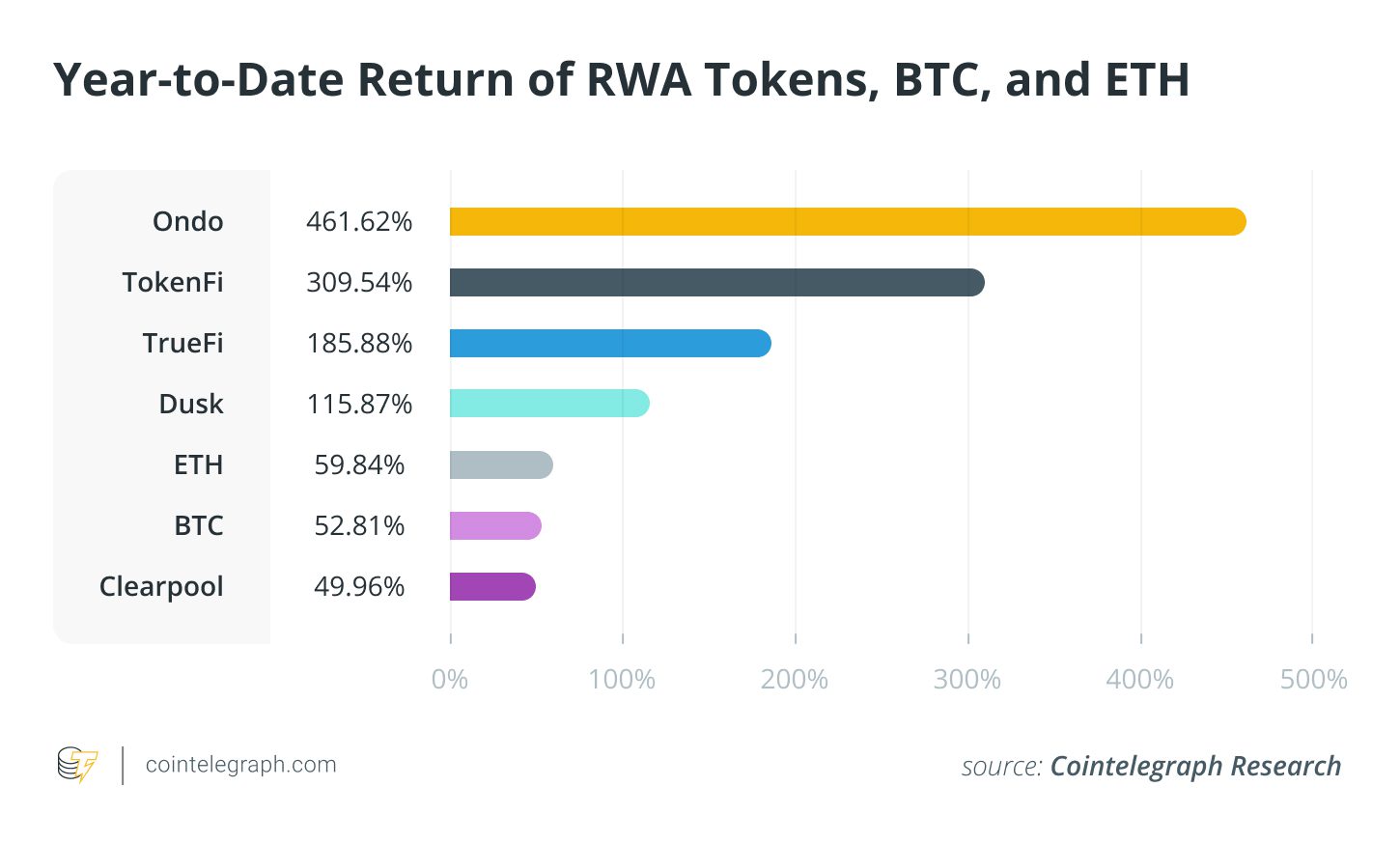

The RWA market’s growth is evident not only in TVL but also in the performance of related tokens. In May, RWA tokens experienced a gain of 55.20%, bringing the year-to-date increase to 224.57%. Key contributors to this growth include tokens like TrueFi, Ondo, Dusk, Clearpool, and TokenFi.

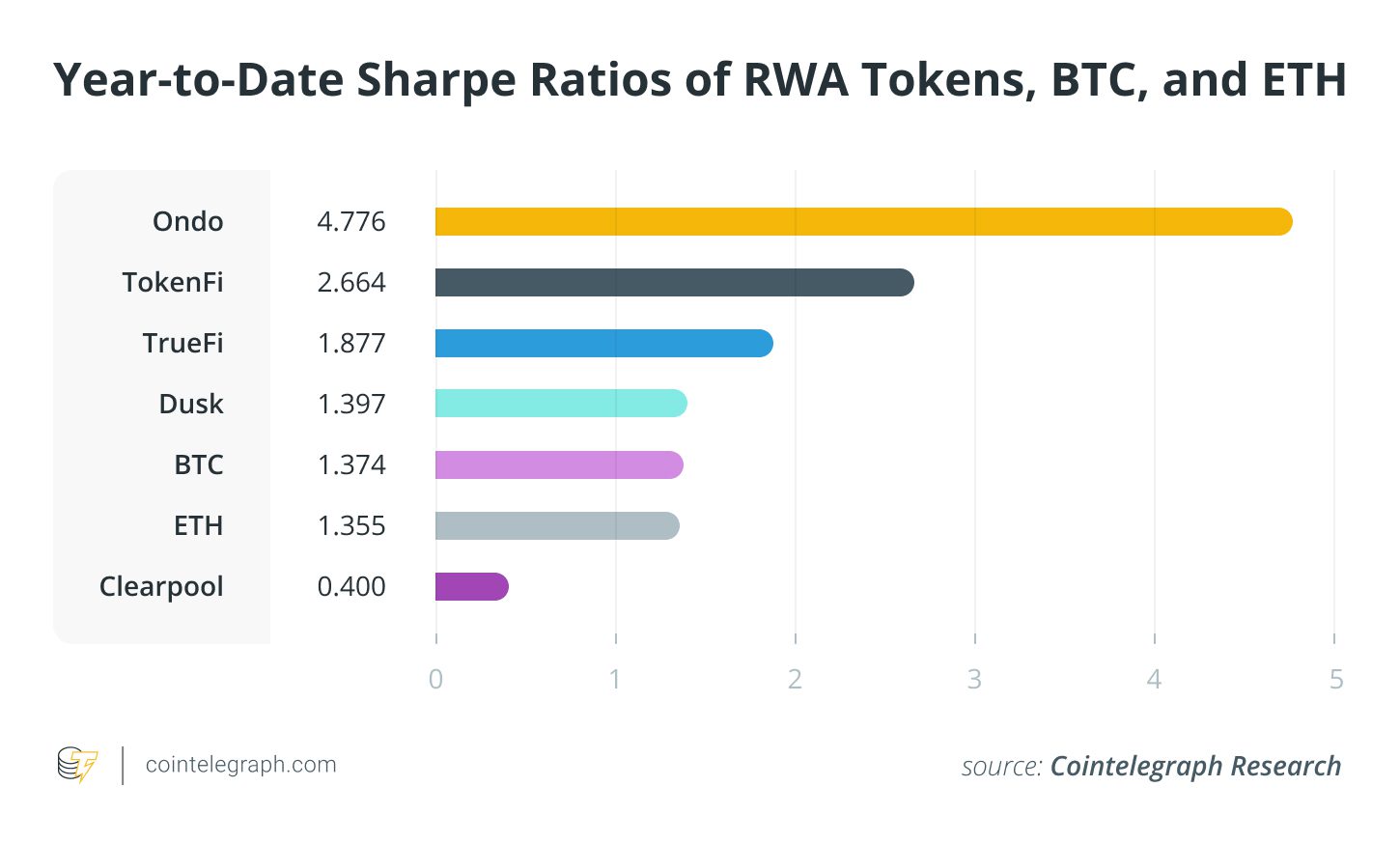

To assess the risk-adjusted performance of RWA tokens year-to-date, a Sharpe ratio analysis was conducted. The Sharpe ratio measures excess return per unit of risk. Using daily returns from January 1 to May 31, the Sharpe ratios for RWA tokens were as follows:

- Ondo: 4.78

- TokenFi: 2.66

- TrueFi: 1.88

- Dusk: 1.4

- Clearpool: 0.4

For context, the Sharpe ratios for Bitcoin (BTC) and Ether (ETH) were 1.37 and 1.36, respectively.

Calculating Returns of RWA Tokens

These ratios were calculated using a risk-free rate derived from the daily annual yield of a one-year Treasury bill. With the exception of Clearpool, all RWA tokens demonstrated a higher risk-adjusted return compared to a BTC/ETH portfolio, which averaged a Sharpe ratio of 1.37 over the same period. This indicates that RWA tokens offered a better balance of return and risk for short-term long trades. They also generally outperformed a BTC/ETH portfolio in terms of raw price performance, with the exception of Clearpool.

Ondo Finance Delivers Highest Returns

Ondo Finance has shown the highest returns, with a year-to-date gain of 461.62% and the strongest Sharpe ratio at 4.776. This exceptional performance can be attributed to the launch of new products on its platform, including the U.S. Government Bond Fund (OUSG), a tokenized derivative of BlackRock’s U.S. Treasurys ETF. Ondo has also expanded to the Solana blockchain and introduced instant investments and redemptions. As of June 13, Ondo has become the third-largest issuer of tokenized U.S. Treasurys.

Factors Driving the RWA Surge

Several factors contribute to the rising popularity of tokenized RWAs:

- Higher Yields: Tokenized Treasurys and private loans offer competitive yields compared to traditional DeFi yields, attracting investors seeking better returns.

- Institutional Interest: The entry of major players like BlackRock validates the RWA market and attracts further institutional investment.

- Improved Liquidity: Tokenization enhances the liquidity of traditionally illiquid assets, making them more accessible to a wider range of investors.

- Efficiency and Transparency: Blockchain technology provides increased efficiency and transparency in the management and transfer of RWAs.

Challenges and Future Outlook

Despite the promising outlook, the RWA market faces some challenges:

- Regulatory Uncertainty: The regulatory landscape for tokenized assets remains unclear in many jurisdictions.

- Security Risks: Smart contract vulnerabilities and other security risks can pose a threat to RWA platforms.

- Scalability Issues: Scaling blockchain infrastructure to support the growing demand for RWAs is a key challenge.

Despite these challenges, the future of tokenized real-world assets appears bright. As the technology matures and regulatory clarity emerges, RWAs are poised to play an increasingly important role in the global financial system, bridging the gap between traditional finance and the world of decentralized finance.