Pendle Finance: Riding the Liquid Restaking Wave

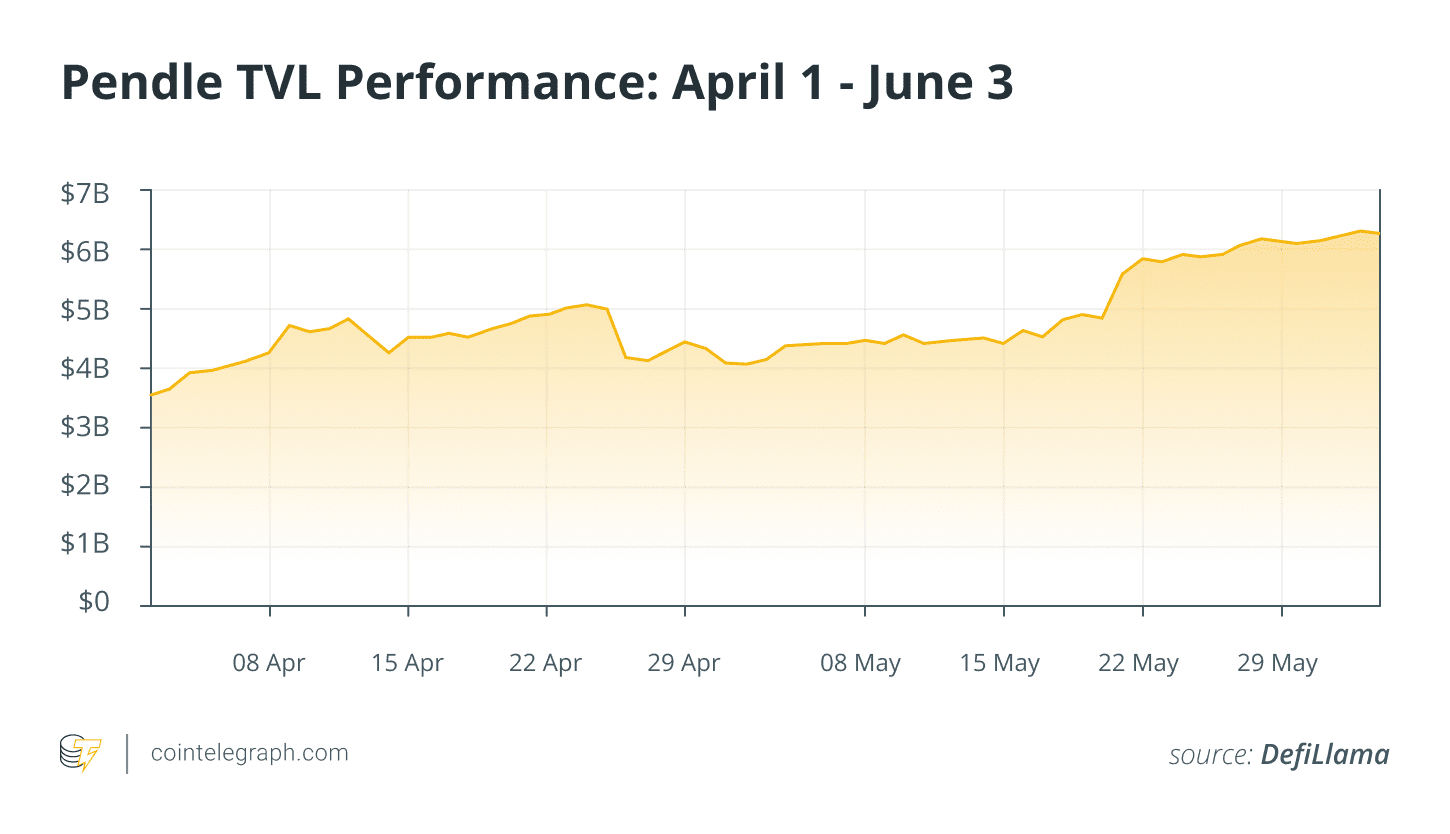

Pendle Finance, an interest derivatives protocol, has experienced significant growth, fueled by the increasing popularity of liquid restaking. In May, PENDLE’s price soared by 58.6%, and its Total Value Locked (TVL) increased by 50.5%, surpassing even Uniswap’s TVL, making it the sixth-largest DeFi protocol. As of June 3, Pendle boasts a TVL of $6.28 billion.

Key Points:

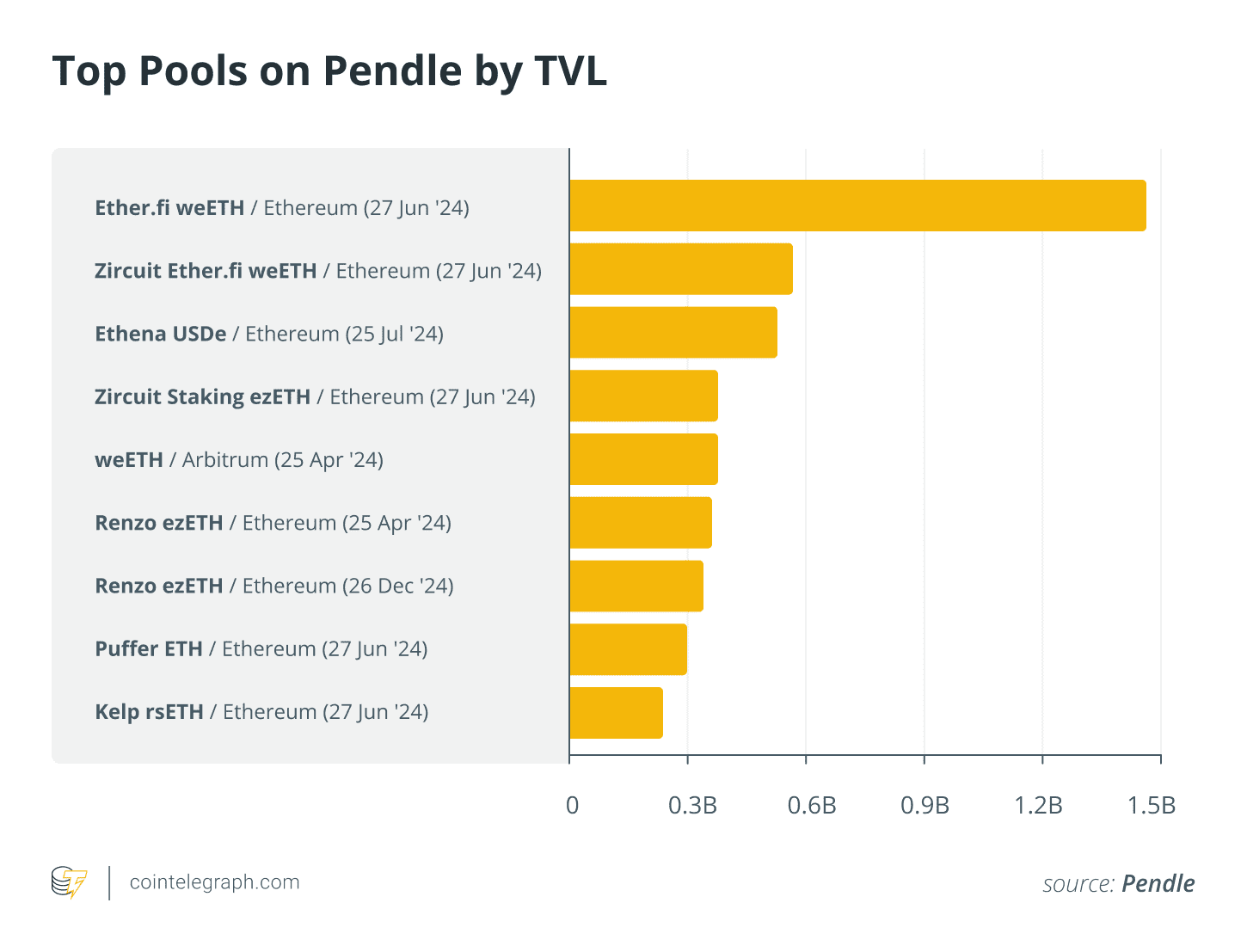

- Liquid Restaking Dominance: Liquid staking tokens are the most deposited assets on Pendle, dominating the top pools.

- Yield Tokenization: Pendle allows users to split yield-bearing assets (like Renzo’s ezETH) into principal tokens (PT) and yield tokens (YT).

- Airdrop Incentives: Leveraged point farming, maximizing airdrop allocations by depositing LRTs into Pendle.

- Multiplier Effects: Protocols offering point multipliers on Pendle pools, incentivizing users to utilize YT tokens.

How Pendle Works:

- Splitting Assets: Users split yield-bearing tokens into PT and YT components.

- PT Redemption: PT tokens can be redeemed for the underlying asset after the maturity date.

- YT Earnings: YT tokens generate proceeds until maturity, and holders may be eligible for airdrops.

- Leveraged Point Farming: Maximize future airdrop allocations through point multipliers offered by liquid restaking protocols. For example, Renzo has been giving out a 4x multiplier on its Pendle pool. By buying YT tokens, one can achieve 117x the number of Renzo airdrop points than from buying the underlying asset.

Risks to Consider:

- LRT Dependence: Pendle’s TVL is highly dependent on liquid restaking tokens, creating a single-risk exposure.

- Airdrop Drawdowns: TVL can decrease after airdrop distribution as users withdraw funds.

Notcoin (NOT): A Telegram Mini-App Phenomenon

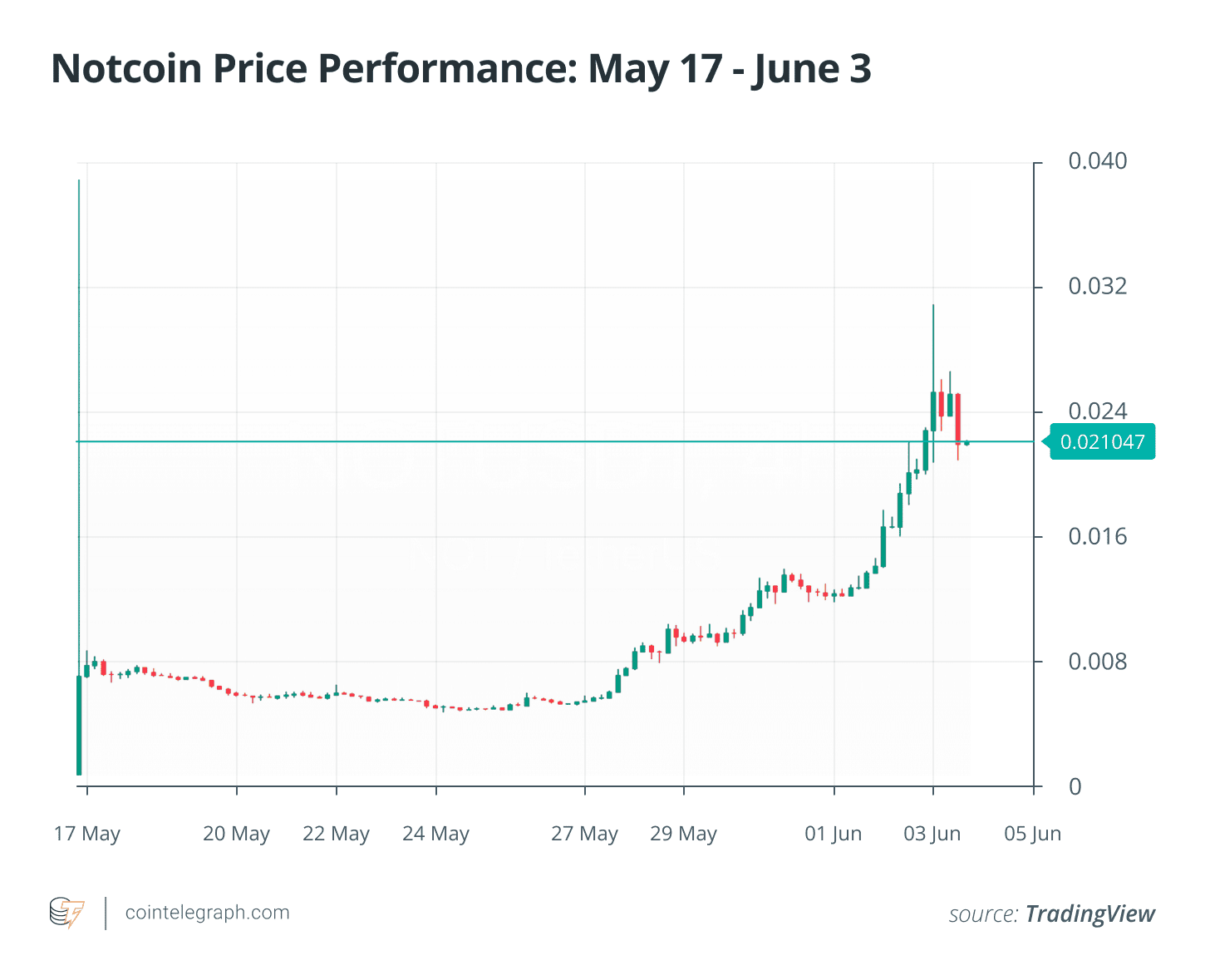

Notcoin (NOT), the token of a Telegram Mini DApp, has witnessed a remarkable price surge, exceeding 400% from May 27 to June 3. This surge is attributed to its easy accessibility, user-friendly earning model, and strong community engagement.

What is a Mini DApp? A mini DApp is a lightweight application embedded within social media platforms. Notcoin, playable within Telegram, eliminates the need for additional software downloads.

Key Features of Notcoin:

- Easy Earning Model: Users earn NOT tokens simply by tapping the screen within the Telegram app.

- Massive User Base: Before token listing, Notcoin attracted over 35 million users, with 6 million daily active users.

- Community-Driven: 78% of the NOT supply was distributed to users, fostering a strong community ownership.

- The Open Network Ecosystem: 1.6 million onchain NOT holders, exceeding many other large-cap memecoins.

Potential Drivers of Notcoin’s Surge:

- TON Ecosystem Growth: Increased community awareness and adoption due to the expansion of applications within the TON ecosystem.

- Collaborations: Integration with other applications like Catizen, a cat-raising game, allows for in-game purchases using NOT.

- Token Burns: The burns are designed to reduce supply and (theoretically) increase demand/price.

Looking Ahead: Airdrops and Altcoin Market Sentiment

The altcoin market is being driven by a combination of factors. The approval of spot ETH ETFs in the US and anticipation of major airdrops continue to contribute to the momentum. While these positive catalysts can drive growth, it’s important to acknowledge the associated risks and perform your own research.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Cryptocurrency investments are inherently risky, and you should conduct thorough research before making any decisions.