Ethereum (ETH) has experienced a notable price surge, capturing the attention of investors and analysts alike. This article delves into the key factors contributing to this rally, examining market trends, technical indicators, and expert opinions to provide a comprehensive understanding of Ethereum’s current trajectory.

Key Factors Fueling Ethereum’s Price Increase

Several factors have converged to drive Ethereum’s recent price increase:

- Market-wide Recovery: The broader cryptocurrency market has shown signs of recovery, with Bitcoin and other major altcoins also experiencing gains. This positive sentiment has created a favorable environment for Ethereum.

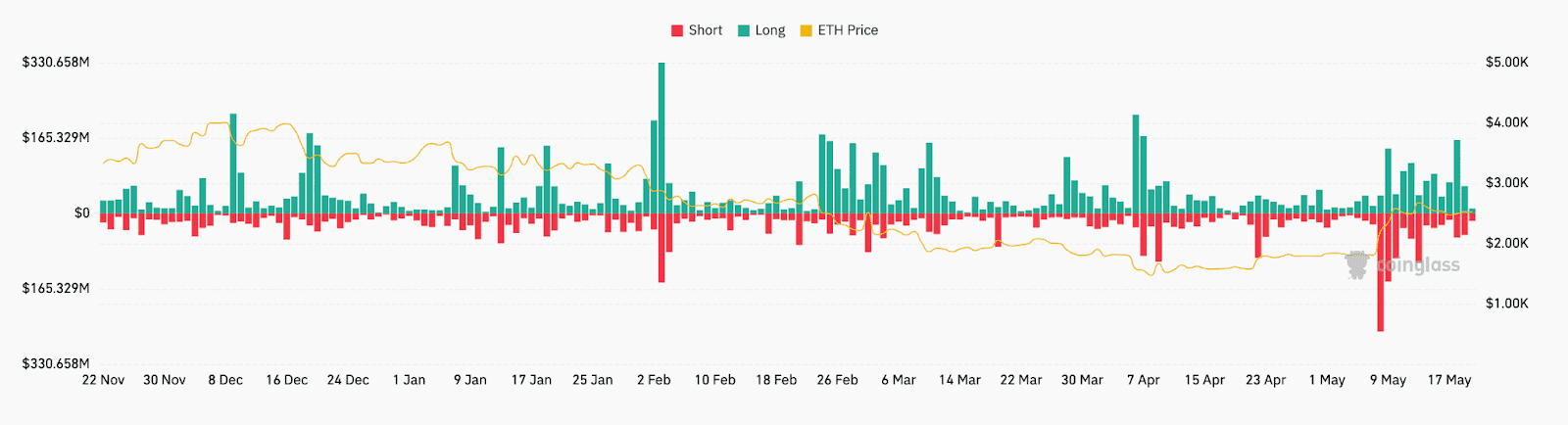

- Short Squeeze: A significant short squeeze in the derivatives market has amplified Ethereum’s upward momentum. As the price rose, traders who had bet against Ethereum were forced to close their positions, further driving up the price.

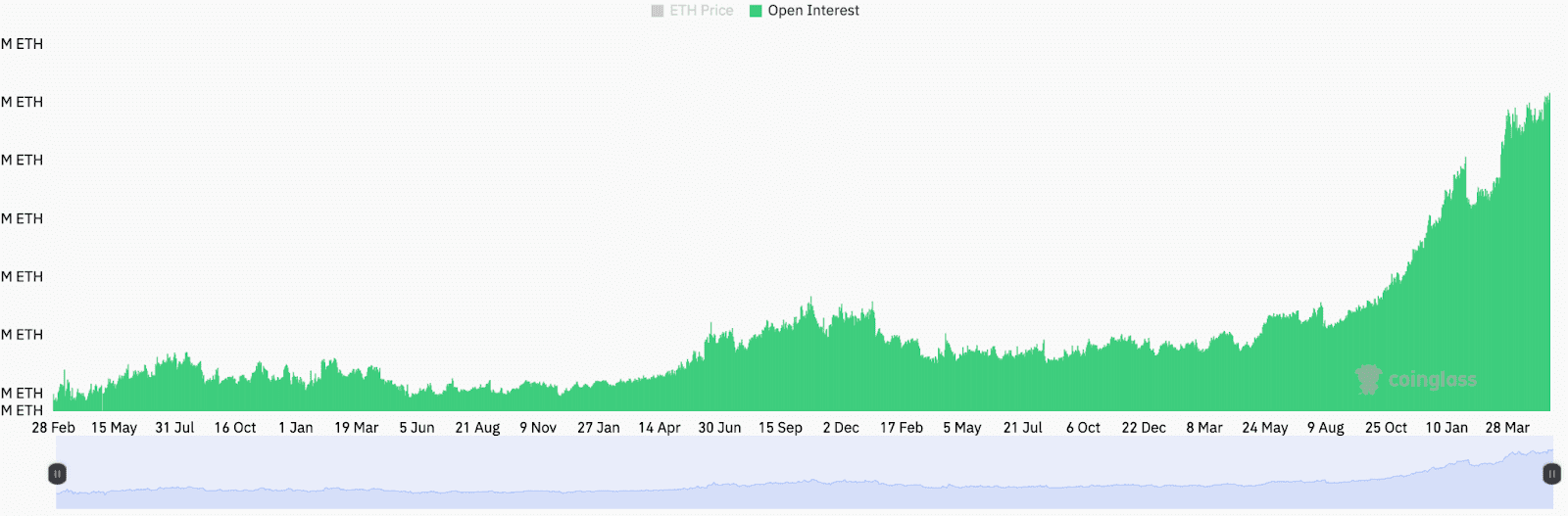

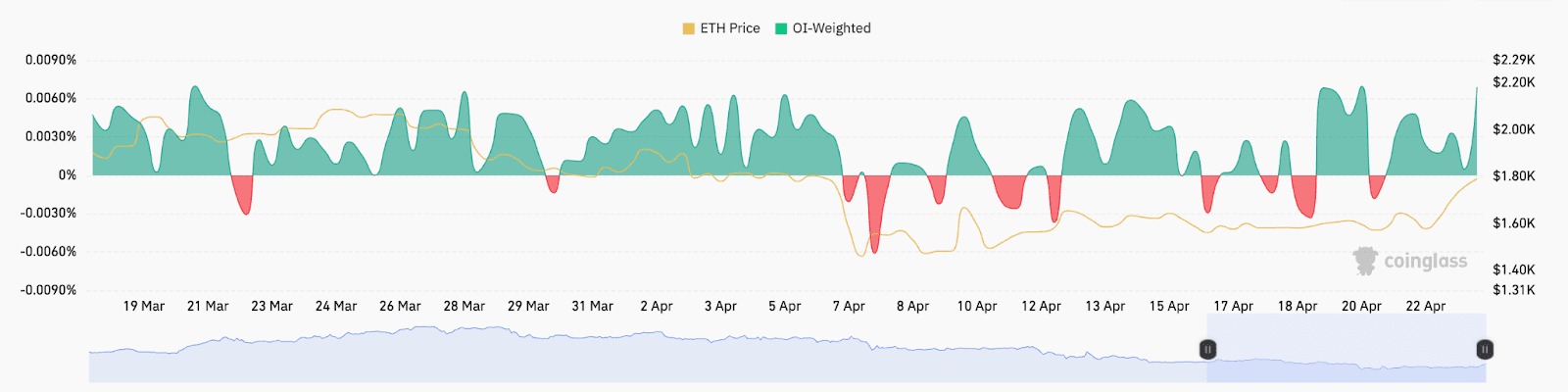

- Rising Open Interest and Funding Rates: Ethereum’s open interest (OI), the total value of outstanding futures contracts, has reached an all-time high, indicating increased trading activity. Positive funding rates in ETH perpetual futures markets also suggest a bullish bias among traders.

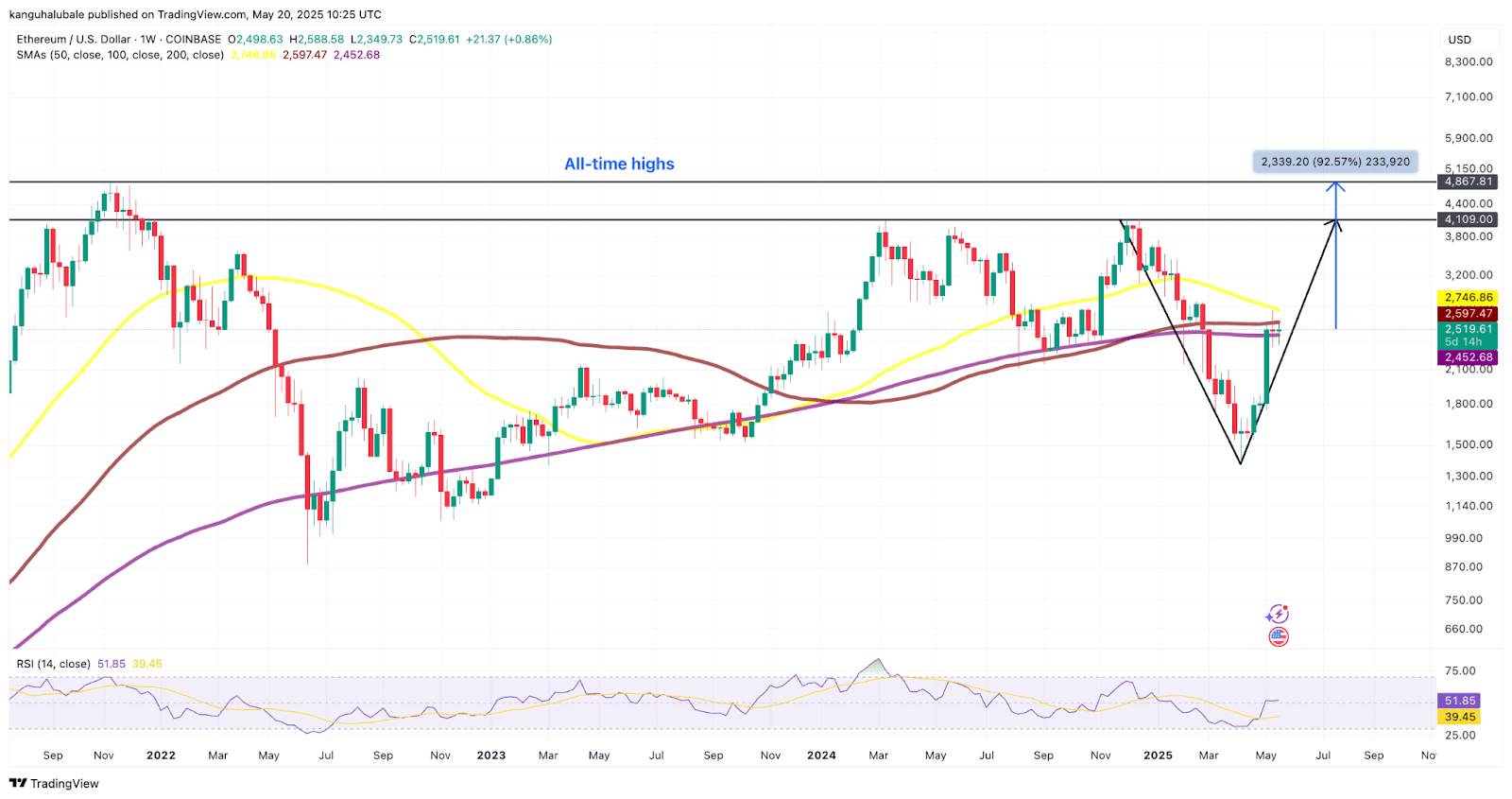

- V-shaped Recovery Pattern: Technical analysis reveals a V-shaped recovery pattern on Ethereum’s weekly chart, suggesting a potential rally towards previous highs.

Let’s explore these factors in more detail.

Market-Wide Recovery and Positive Sentiment

Ethereum’s price increase mirrors a broader recovery in the cryptocurrency market. Bitcoin (BTC) and other major altcoins like XRP and Solana (SOL) have also experienced gains. This positive sentiment can be attributed to several factors, including increased institutional adoption, growing awareness of blockchain technology, and a renewed interest in decentralized finance (DeFi).

The Impact of the Short Squeeze

A short squeeze occurs when the price of an asset rises sharply, forcing traders who have shorted the asset (bet against its price) to buy back their positions to limit their losses. This buying pressure further drives up the price, creating a feedback loop. Ethereum has recently experienced a significant short squeeze, contributing to its rapid price increase.

Rising Open Interest and Funding Rates

Open interest (OI) represents the total value of outstanding futures contracts for an asset. A rising OI indicates increased trading activity and interest in the asset. Ethereum’s OI has recently reached an all-time high, suggesting strong demand for ETH futures contracts.

Funding rates are periodic payments exchanged between long and short-position holders in perpetual futures markets. Positive funding rates indicate that more traders are going long (betting on higher prices) and are willing to pay extra fees to keep those positions open. Ethereum’s funding rates have also increased, further supporting the bullish sentiment.

Technical Analysis: The V-Shaped Recovery Pattern

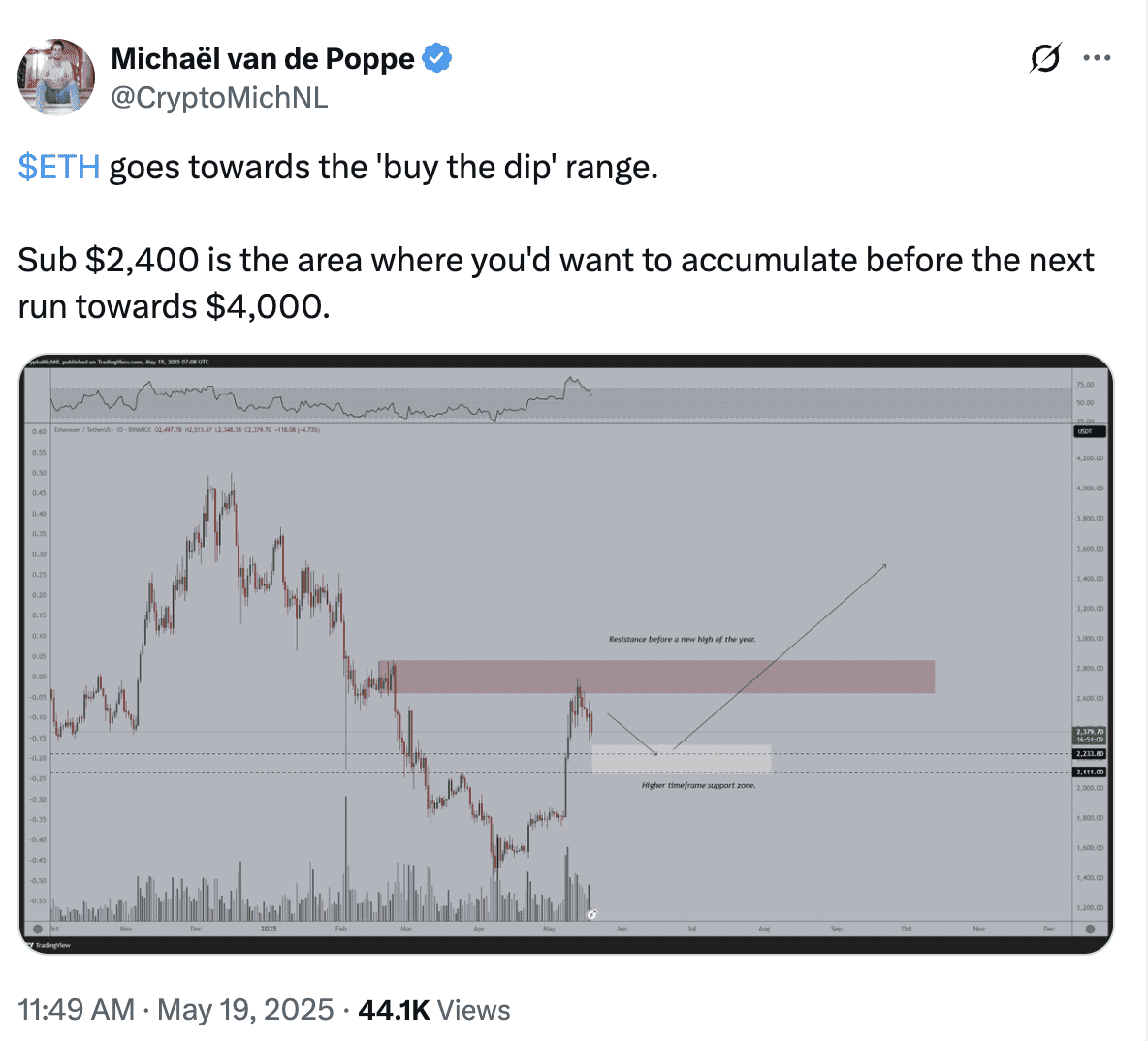

Technical analysis involves analyzing price charts and other market data to identify patterns and predict future price movements. Ethereum’s weekly chart reveals a V-shaped recovery pattern, which is a bullish signal. This pattern suggests that Ethereum has the potential to rally towards previous highs.

Expert Opinions and Future Predictions

Several crypto analysts have weighed in on Ethereum’s recent price increase and its future potential. Some analysts believe that Ethereum could rally to $4,000 or even retest its all-time high of $4,800. However, it’s important to note that these are just predictions, and the cryptocurrency market is inherently volatile.

Potential Resistance and Support Levels

As Ethereum continues its upward trajectory, it will likely encounter resistance at certain price levels. Resistance levels are price points where selling pressure is expected to increase, potentially slowing down or reversing the price increase. Key resistance levels for Ethereum include $2,600-$2,800, $3,000, and $4,000.

Conversely, Ethereum will also find support at certain price levels. Support levels are price points where buying pressure is expected to increase, potentially preventing further price declines. Key support levels for Ethereum include $2,350, $2,000, and $1,800.

The Role of Ethereum’s Fundamentals

Beyond technical factors, Ethereum’s strong fundamentals also play a crucial role in its long-term price potential. Ethereum is the leading platform for decentralized applications (dApps) and decentralized finance (DeFi). Its robust ecosystem, active developer community, and ongoing upgrades contribute to its overall value proposition.

The upcoming Ethereum 2.0 upgrade, which will transition the network to a proof-of-stake consensus mechanism, is expected to improve scalability, security, and energy efficiency. This upgrade could further enhance Ethereum’s appeal to investors and users.

Conclusion

Ethereum’s recent price surge is driven by a combination of factors, including market-wide recovery, a short squeeze, rising open interest and funding rates, and a bullish technical pattern. While the cryptocurrency market is inherently volatile, Ethereum’s strong fundamentals and ongoing development efforts suggest that it has the potential for further growth in the future. Investors should conduct their own research and consider their risk tolerance before making any investment decisions.