Key Takeaways:

- Bitcoin futures open interest hits a record $72 billion, indicating increased leverage usage by institutional investors.

- $1.2 billion in short positions between $107,000 and $108,000 face liquidation risk, potentially driving Bitcoin’s price higher.

- Growing concerns about U.S. fiscal debt and potential Federal Reserve intervention could further fuel Bitcoin’s rally.

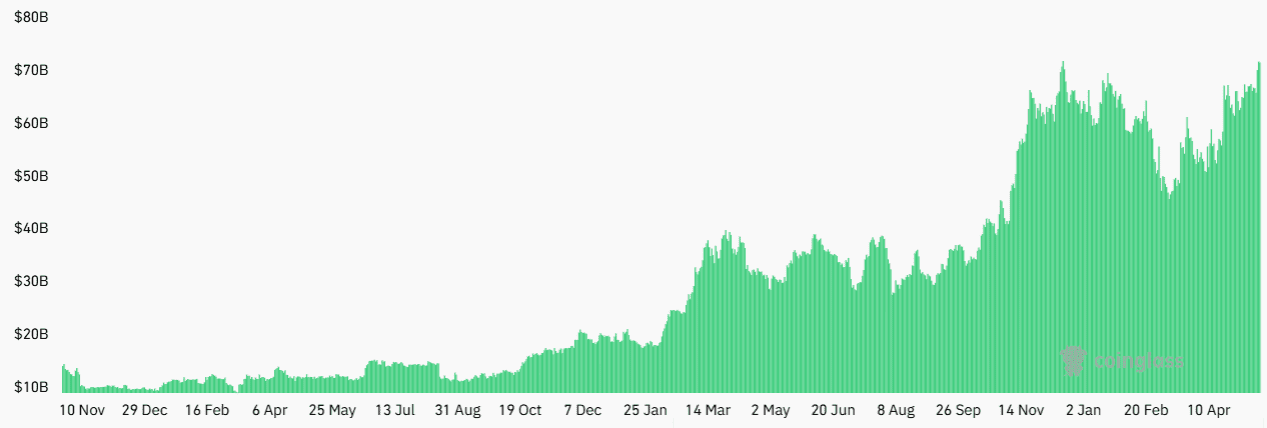

Bitcoin (BTC) futures have seen a surge in open interest, reaching a record high of $72 billion on May 20th. This spike raises questions about the sustainability of bearish positions and the potential for a significant price breakout. Despite repeated attempts to breach the $107,000 resistance level since May 18th, the sheer volume of leveraged positions could act as a catalyst, propelling Bitcoin to new all-time highs.

The total open interest in BTC futures increased by 8% in just one week, climbing from $66.6 billion to $72 billion. This growth is largely attributed to strong institutional demand. The Chicago Mercantile Exchange (CME) leads the way with $16.9 billion in BTC futures, followed by Binance, which holds $12 billion in open interest. This concentration of institutional participation underscores the growing acceptance of Bitcoin as a legitimate asset class.

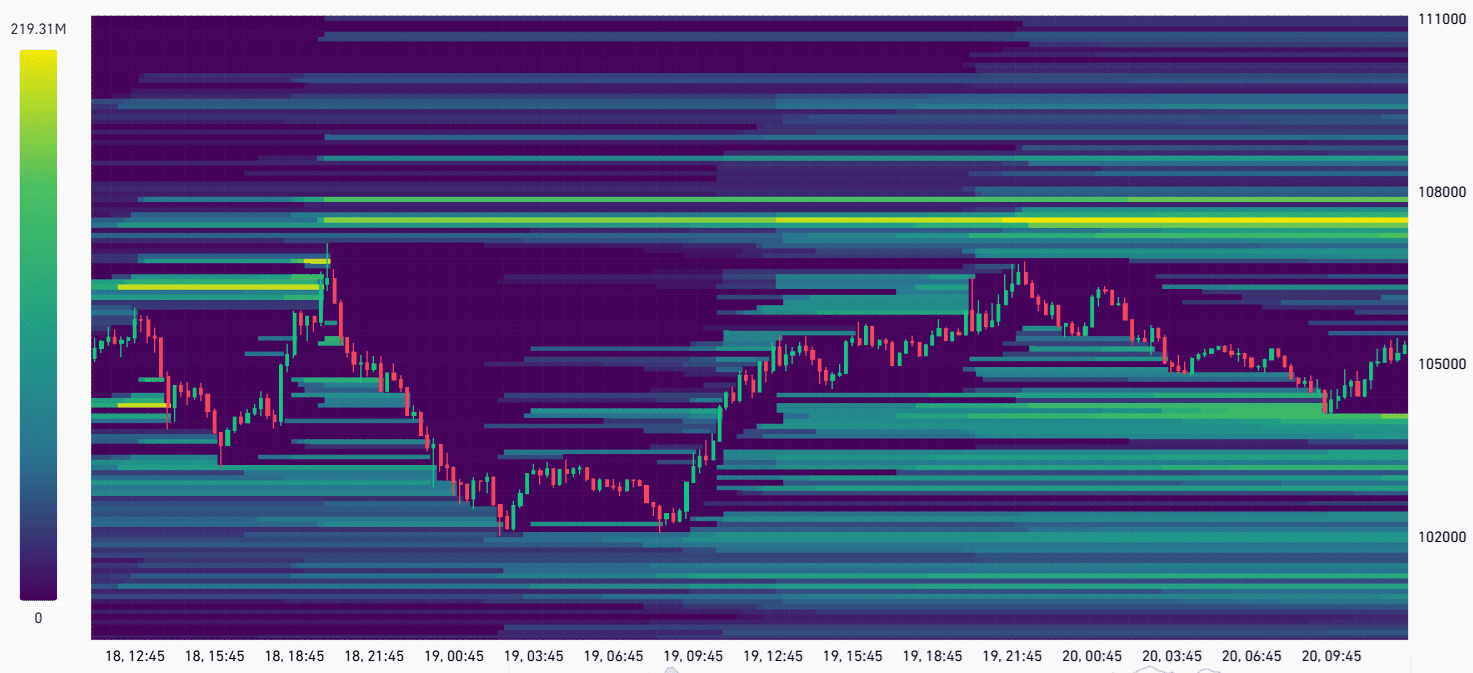

Potential Short Squeeze: $1.2 Billion at Risk

CoinGlass estimates suggest a significant cluster of bearish BTC futures liquidations between $107,000 and $108,000, totaling approximately $1.2 billion. A sustained move above this range could trigger a cascade of liquidations, forcing short sellers to cover their positions and further driving up the price of Bitcoin. This potential short squeeze adds another layer of bullish sentiment to the market.

While the exact trigger for a breakout above $108,000 remains uncertain, several factors could contribute to such a move. Growing concerns about United States fiscal debt and potential shifts in monetary policy are creating a favorable environment for Bitcoin. The ongoing debate between Democratic and Republican lawmakers regarding economic growth and spending cuts adds to the uncertainty.

Furthermore, yields on the 20-year US Treasury remain elevated, hovering near 5%. This persistent demand for higher yields may compel the Federal Reserve to intervene and purchase long-term government debt to maintain market stability. Such a move could weaken the US dollar and incentivize investors to seek alternative hedging strategies, including Bitcoin.

Bitcoin’s Growing Appeal as a Store of Value

Gold remains a dominant alternative asset, boasting a $22 trillion market capitalization and a 24% year-to-date gain in 2025. However, its sheer size makes it less attractive to some investors seeking higher growth potential. In comparison, Bitcoin’s $2.1 trillion market capitalization positions it as a more agile and potentially rewarding asset class. To provide context, the S&P 500 index has a market value of $53 trillion while US bank deposits and Treasury bills (M1) total $18.6 trillion.

Moreover, there are increasing discussions about nations reallocating a portion of their gold reserves into Bitcoin. A modest 5% shift from gold to Bitcoin by these nations would inject $105 billion into the market, equivalent to 1 million BTC at a price of $105,000. This potential influx of capital could significantly boost Bitcoin’s price.

MicroStrategy, led by Michael Saylor, currently holds 576,230 BTC, demonstrating the company’s strong conviction in Bitcoin’s long-term value. The continued institutional buying pressure is a key factor in Bitcoin’s potential to break above the $108,000 level. Such a move would trigger the liquidation of heavily leveraged short positions, accelerating the push toward new all-time highs. However, it is crucial to acknowledge that persistent macroeconomic uncertainties continue to weigh on overall investor sentiment and require careful consideration.

Factors Potentially Influencing Bitcoin’s Price:

- Institutional Adoption: Continued buying pressure from institutions like MicroStrategy.

- Short Squeeze: Liquidation of heavily leveraged short positions above $108,000.

- Macroeconomic Factors: Concerns about US fiscal debt and potential shifts in monetary policy.

- Reserve Reallocation: Potential reallocation of gold reserves into Bitcoin.

- Dollar Weakness: Federal Reserve intervention to stabilize US Treasury yields, potentially weakening the US dollar.

As Bitcoin continues to test the $107,000 resistance level, those holding short positions face significant risks of forced liquidation. This potential outcome could further fuel upward momentum in price, potentially leading to a substantial breakout and new all-time highs. Investors should exercise caution and carefully consider the various factors influencing the market before making any investment decisions.