Amsterdam-based Theta Capital Management has secured over $175 million for its latest fund-of-funds, Theta Blockchain Ventures IV, specifically designed to support early-stage blockchain startups through investments in specialized venture capital (VC) firms. This move comes at a time when the crypto venture capital landscape is showing signs of significant recovery.

Theta Capital’s Strategy: Investing in Specialized Crypto VCs

Theta Capital’s strategy revolves around channeling capital into crypto-native VC firms that have a proven track record of backing successful blockchain innovations. Ruud Smets, managing partner and chief investment officer at Theta Capital, emphasized the importance of specialization, noting that these dedicated crypto VCs possess an edge over generalist investors, particularly in the earliest funding rounds.

Smets stated, “We’ve always been looking for areas where specialization and active management provide a sustainable edge.” He highlighted that the experience and established positions of these specialized crypto VCs have created barriers to entry for less focused investors.

Founded in 2001, Theta Capital shifted its focus to digital assets in 2018 and currently manages approximately $1.2 billion. Their portfolio includes investments in leading crypto investment firms such as Polychain Capital, CoinFund, and Castle Island Ventures.

Crypto VC Deals Rebound in 2025

The launch of Theta Blockchain Ventures IV coincides with a notable rebound in crypto venture capital activity. According to data from Galaxy Digital, VC investment in digital assets increased by 54% in the first quarter of 2025, reaching $4.8 billion. This resurgence signals renewed confidence in the crypto sector after a period of downturn.

PitchBook’s analysis further supports this trend, revealing that crypto venture capital funding more than doubled in early 2025, despite a decrease in the overall number of deals. Specifically, while the number of VC deals completed in Q1 2025 dropped by 39.5% year-over-year to 405, total funding surged to $6 billion, compared to $2.6 billion in Q1 2024.

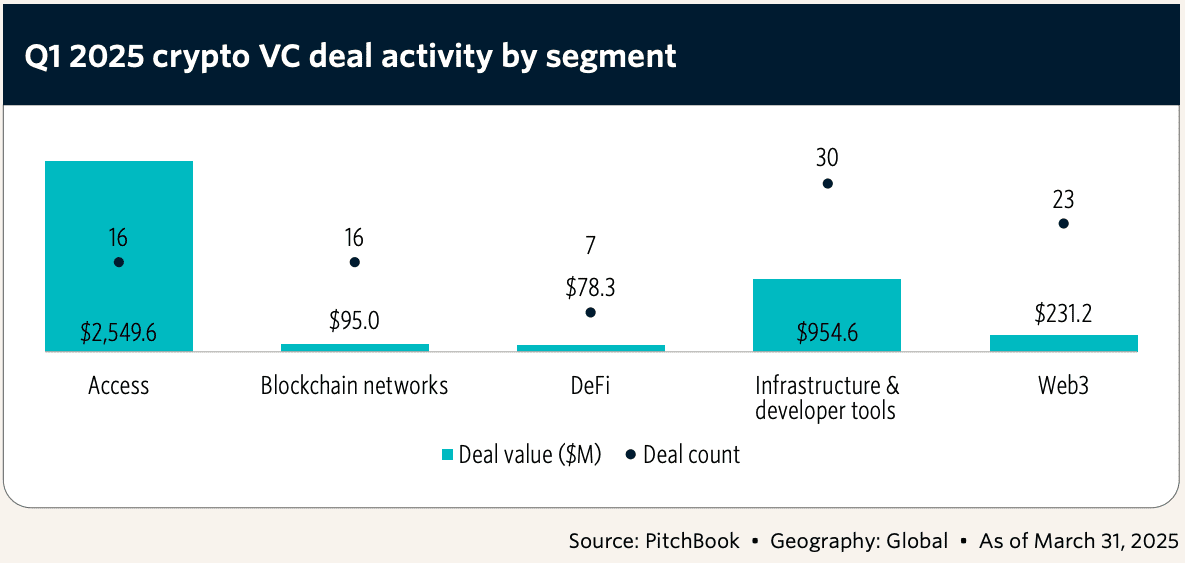

Robert Le, senior crypto analyst at PitchBook, noted that despite macroeconomic uncertainties, investors continue to recognize the core utility of crypto, driving investments into key areas such as asset management, trading platforms, and crypto financial services. These sectors accounted for the bulk of investment, with approximately $2.55 billion allocated across just 16 deals. Infrastructure and development firms followed, securing nearly $955 million across 30 deals.

The Broader Crypto Investment Landscape

Several factors are contributing to the renewed interest in crypto ventures:

- Maturing Infrastructure: The underlying technology and infrastructure supporting blockchain and crypto assets have matured significantly, reducing technical risks and increasing scalability.

- Regulatory Clarity (in some regions): While still evolving, regulatory frameworks in certain jurisdictions are providing greater clarity, fostering a more conducive environment for institutional investors.

- Growing Institutional Adoption: More and more institutional investors are exploring and allocating capital to crypto assets, driving market growth and validation.

- Innovation in DeFi and Web3: Continued innovation in decentralized finance (DeFi) and Web3 technologies is creating new use cases and investment opportunities.

- Inflation Hedge: Cryptocurrencies, particularly Bitcoin, are increasingly seen as a potential hedge against inflation, attracting investors seeking to preserve capital.

Circle’s Potential IPO as a Benchmark

PitchBook has highlighted Circle’s anticipated IPO as a potentially pivotal event for crypto equity pricing, comparable to Coinbase’s debut in 2021. If Circle achieves a valuation exceeding the rumored $4 billion to $5 billion range, it could attract new late-stage capital and positively impact valuation expectations across the payments and infrastructure sectors.

With $1.18 billion in VC funding raised to date, PitchBook estimates a 64% probability that Circle will proceed with its IPO.

Future Outlook for Crypto VC

The resurgence of crypto VC funding indicates a renewed optimism within the digital asset space. While macroeconomic conditions and regulatory developments will undoubtedly play a role, the underlying trends of innovation, institutional adoption, and maturing infrastructure suggest a positive outlook for crypto ventures in the coming years.

Theta Capital’s $175 million fund is strategically positioned to capitalize on this growth, focusing on supporting the next generation of blockchain startups through specialized VC firms with deep expertise in the crypto ecosystem.