The emergence of yield-bearing stablecoins is sending shockwaves through the traditional banking industry. These digital assets, which offer holders interest or rewards, are perceived as a direct threat to the established banking model. This article delves into the core of this financial friction, exploring the perspectives of experts and the regulatory landscape shaping the future of stablecoins.

The Banking Lobby’s Concerns

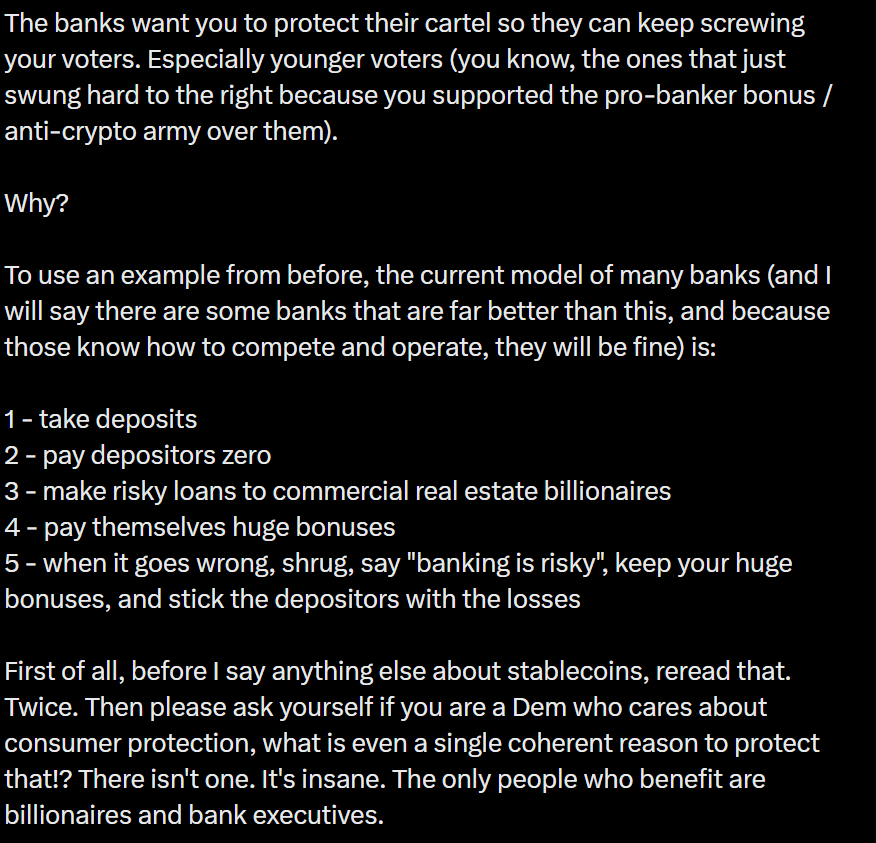

Austin Campbell, a New York University professor and founder of Zero Knowledge Consulting, has highlighted the banking lobby’s growing anxiety over yield-bearing stablecoins. He argues that banks are worried about the potential for stablecoins to attract depositors by offering more attractive interest rates compared to traditional savings accounts. Campbell’s social media posts, including one titled “The Empire Lobbies Back,” accuse banks of seeking protection from lawmakers to maintain their profit margins through fractional reserve banking, where they offer minimal interest to depositors.

Campbell urges lawmakers to avoid supporting blanket bans on stablecoin interest payments, characterizing such measures as “naked pandering for cartel protection.” He has been a vocal advocate for sensible stablecoin legislation in the United States, warning that a lack of clear regulations could drive issuers overseas.

What are Yield-Bearing Stablecoins?

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the US dollar. Yield-bearing stablecoins take this a step further by offering holders the opportunity to earn interest or rewards on their holdings. This can be achieved through various mechanisms, such as lending, staking, or investing in other assets.

The appeal of yield-bearing stablecoins lies in their potential to provide a higher return compared to traditional savings accounts, while still offering the stability of a fiat-backed asset. This has led to a surge in interest and adoption, attracting both retail and institutional investors.

The Rise of Yield-Bearing Stablecoins: Key Players and Examples

Several companies are actively developing and launching yield-bearing stablecoins, signaling a growing trend in the cryptocurrency space. Here are a few notable examples:

- Figure Markets: In February, the US Securities and Exchange Commission (SEC) approved Figure Markets’ yield-bearing stablecoin security, YLDS, which initially offered a 3.85% yield. This marked a significant milestone as the first SEC-approved product of its kind.

- Pi Protocol: Tether co-founder Reeve Collins’ Pi Protocol allows investors to mint the USP stablecoin in exchange for USI, an interest-paying equivalent. This provides an alternative for those seeking to earn yield on their stablecoin holdings.

- Spark Protocol: Spark Protocol’s USDS offers interest payments generated through decentralized lending and tokenized Treasurys. This approach leverages the DeFi ecosystem to provide yield to stablecoin holders.

The Argument for Yield-Bearing Stablecoins

Proponents of yield-bearing stablecoins argue that they provide a much-needed alternative to traditional banking, which often offers low interest rates and charges high fees. Sam MacPherson, CEO of Spark Protocol developer Phoenix Labs, argues that it is “unacceptable to not be receiving at least the risk-free rate for holding stablecoins.”

Yield-bearing stablecoins can also provide access to financial services for individuals who are unbanked or underbanked. By offering a more accessible and potentially more rewarding way to store and manage their money, stablecoins can help to bridge the gap between traditional finance and the digital economy.

Potential Risks and Challenges

Despite their potential benefits, yield-bearing stablecoins also come with risks and challenges. These include:

- Regulatory uncertainty: The regulatory landscape for stablecoins is still evolving, and there is a risk that future regulations could negatively impact the industry.

- Smart contract risks: Yield-bearing stablecoins rely on smart contracts, which are susceptible to bugs and vulnerabilities that could lead to losses.

- Market volatility: While stablecoins are designed to maintain a stable value, they are not immune to market volatility, particularly during periods of extreme market stress.

- Centralization risks: Some stablecoins are more centralized than others, which could make them more vulnerable to censorship or control by a single entity.

The Future of Stablecoins

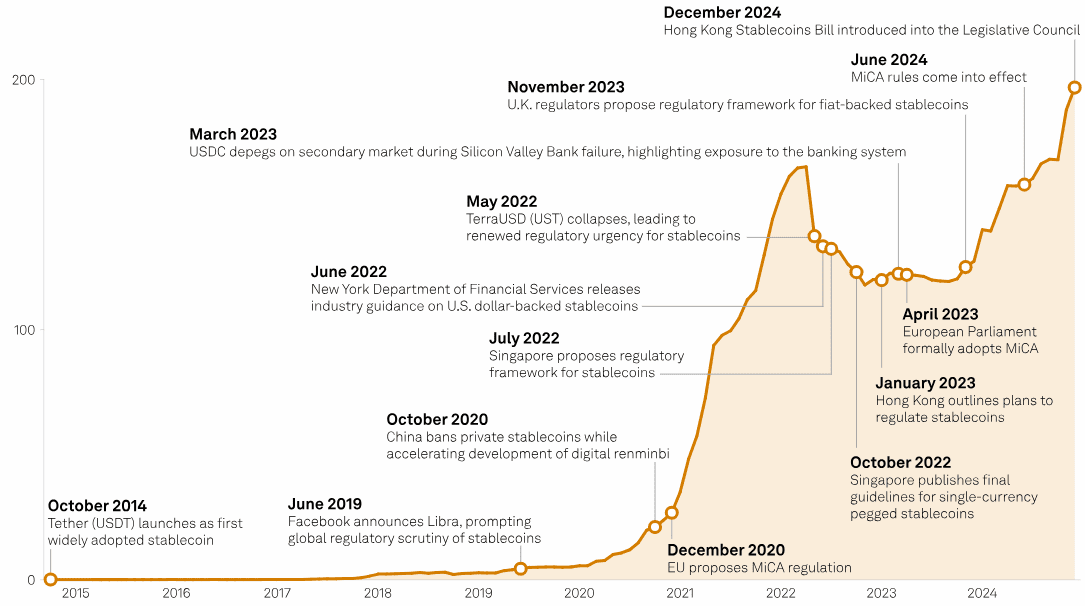

Stablecoins have emerged as a significant use case for blockchain technology, with global volumes approaching those of major credit card networks. As the industry continues to evolve, it is likely that we will see even more innovative applications of stablecoins, including new ways to earn yield and access financial services. The competition between traditional banks and the burgeoning stablecoin market will likely continue to intensify, shaping the future of finance. The ongoing debate highlights the need for clear and sensible regulations that protect consumers while fostering innovation.