GENIUS Act: Paving the Way for Institutional Stablecoin Adoption

The United States Senate is poised to debate the Guiding and Establishing National Innovation for US Stablecoins (GENIUS) Act, a landmark piece of legislation aimed at regulating the stablecoin sector. This act, already passed by the US Senate in a 66–32 procedural vote on May 20, could significantly impact the adoption of stablecoins by institutions worldwide.

The GENIUS Act seeks to establish clear regulatory guidelines for stablecoin collateralization and mandate compliance with Anti-Money Laundering (AML) laws. This clarity is seen as crucial for fostering confidence among institutional investors and integrating stablecoins into the broader financial system.

Andrei Grachev, managing partner at DWF Labs and Falcon Finance, emphasized the significance of the bill, stating, “This act doesn’t just regulate stablecoins, it legitimizes them. It sets clear rules, and with clarity comes confidence. That’s what institutions have been waiting for.”

Stablecoins aren’t a crypto experiment anymore. They’re a better form of money. Faster, simpler, and more transparent than fiat. It’s only a matter of time before they become the default.

Key Provisions and Potential Impacts of the GENIUS Act

The GENIUS Act aims to provide a comprehensive regulatory framework for stablecoins in the United States. Here’s a closer look at its key provisions and potential impacts:

- Clear Collateralization Rules: The bill mandates that stablecoin issuers maintain adequate reserves to back the value of their stablecoins. This ensures that stablecoins can be redeemed at par value, reducing the risk of instability.

- AML Compliance: The GENIUS Act requires stablecoin issuers to comply with AML regulations, helping to prevent the use of stablecoins for illicit activities.

- Federal Reserve Oversight: The bill grants the Federal Reserve the authority to oversee stablecoin issuers, providing an additional layer of regulatory scrutiny.

- State Regulatory Roles: Maintain the roles of state regulators in the oversight of stablecoin issuers, ensuring a balanced approach to regulation.

The GENIUS Act is viewed by some as a catalyst for the development of a unified digital financial system that is borderless, programmable, and efficient. As Grachev noted, “When the US moves on stablecoin policy, the world watches.”

Regulatory clarity alone will not drive institutional adoption. Products offering stable and predictable yield will also be necessary. Falcon Finance is currently developing a synthetic yield-bearing dollar product designed for this market, he noted.

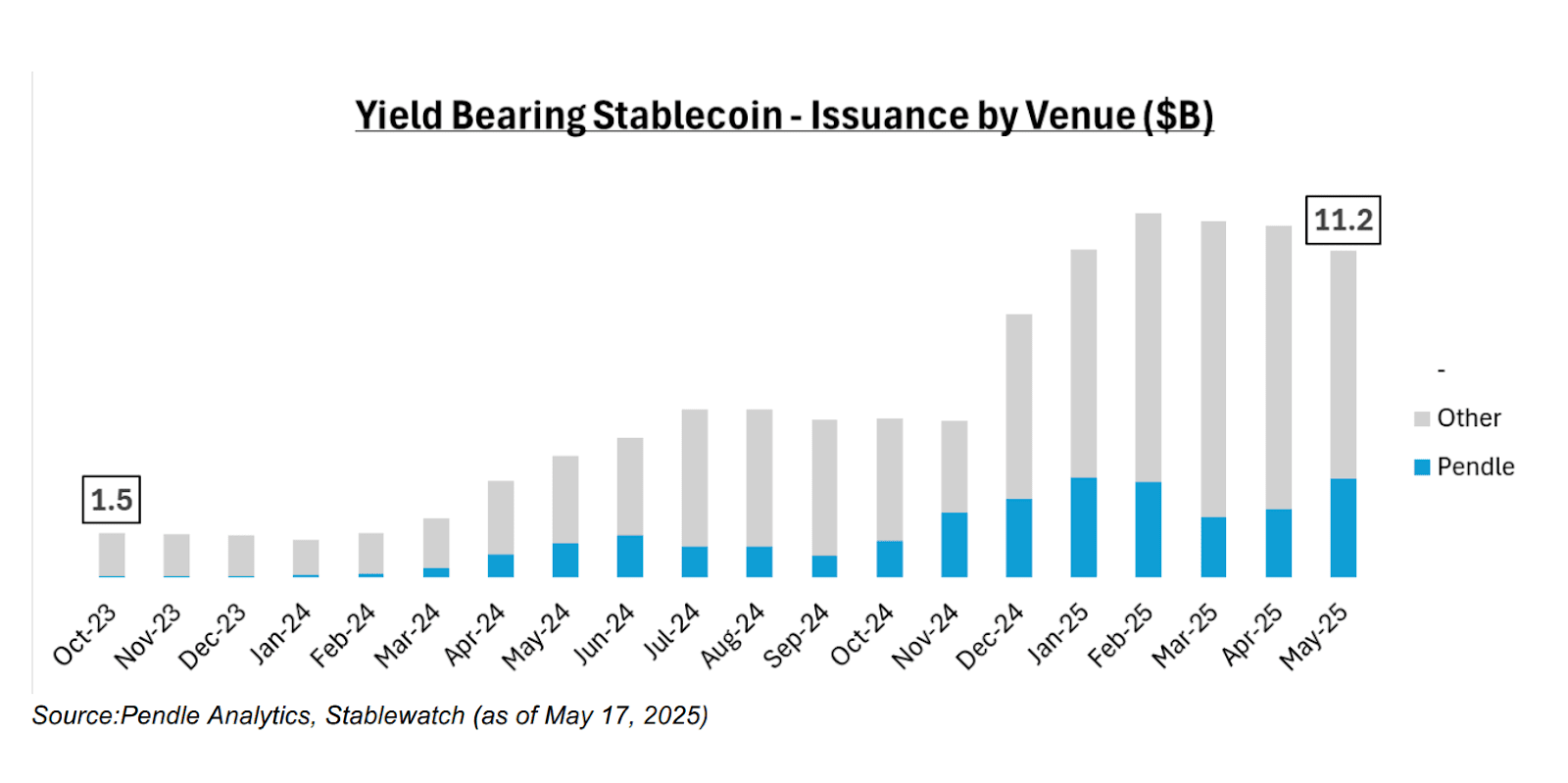

Yield-bearing stablecoins now represent 4.5% of the total stablecoin market after rising to $11 billion in total circulation, Cointelegraph reported on May 21.

Concerns and Criticisms

Despite the broad support for the GENIUS Act, some critics argue that the legislation does not go far enough. Vugar Usi Zade, the chief operating officer at Bitget exchange, pointed out that the bill doesn’t fully address offshore stablecoin issuers like Tether, which continue to play an outsized role in global liquidity.

He added that US-based issuers will now face steeper costs, likely accelerating consolidation across the market and favoring well-resourced players that can meet the new thresholds.

The Path Forward for Stablecoins

The GENIUS Act represents a significant step forward in the regulation of stablecoins in the United States. While challenges remain, the bill’s passage could pave the way for greater institutional adoption of stablecoins and the development of a more robust digital financial ecosystem. Further development include:

- Further refinement of the regulatory framework to address offshore issuers.

- Continued innovation in stablecoin technology and use cases.

- Increased collaboration between regulators and industry stakeholders.

The future of stablecoins remains uncertain, but the GENIUS Act provides a foundation for their continued growth and integration into the global financial system.