Key Takeaways:

- Bitcoin’s Quantile Model indicates a potential ‘acceleration phase,’ reminiscent of the Q4 2024 rally.

- Analysts predict Bitcoin could target $130,000 and $163,000 in the coming months if the acceleration phase is triggered.

- Breaking the $110,000 resistance level and increased trading volume are crucial for confirming the bullish outlook.

- Some analysts suggest a price target above $200,000 is reasonable for 2025, based on Bitcoin’s power curve relative to gold.

Bitcoin (BTC) is exhibiting strong momentum, consistently reaching new intraday highs, fueling speculation about a potential surge to new all-time highs. According to 21st Capital co-founder Sina, Bitcoin is nearing a crucial juncture around the $108,000 mark, suggesting a breakout could be imminent.

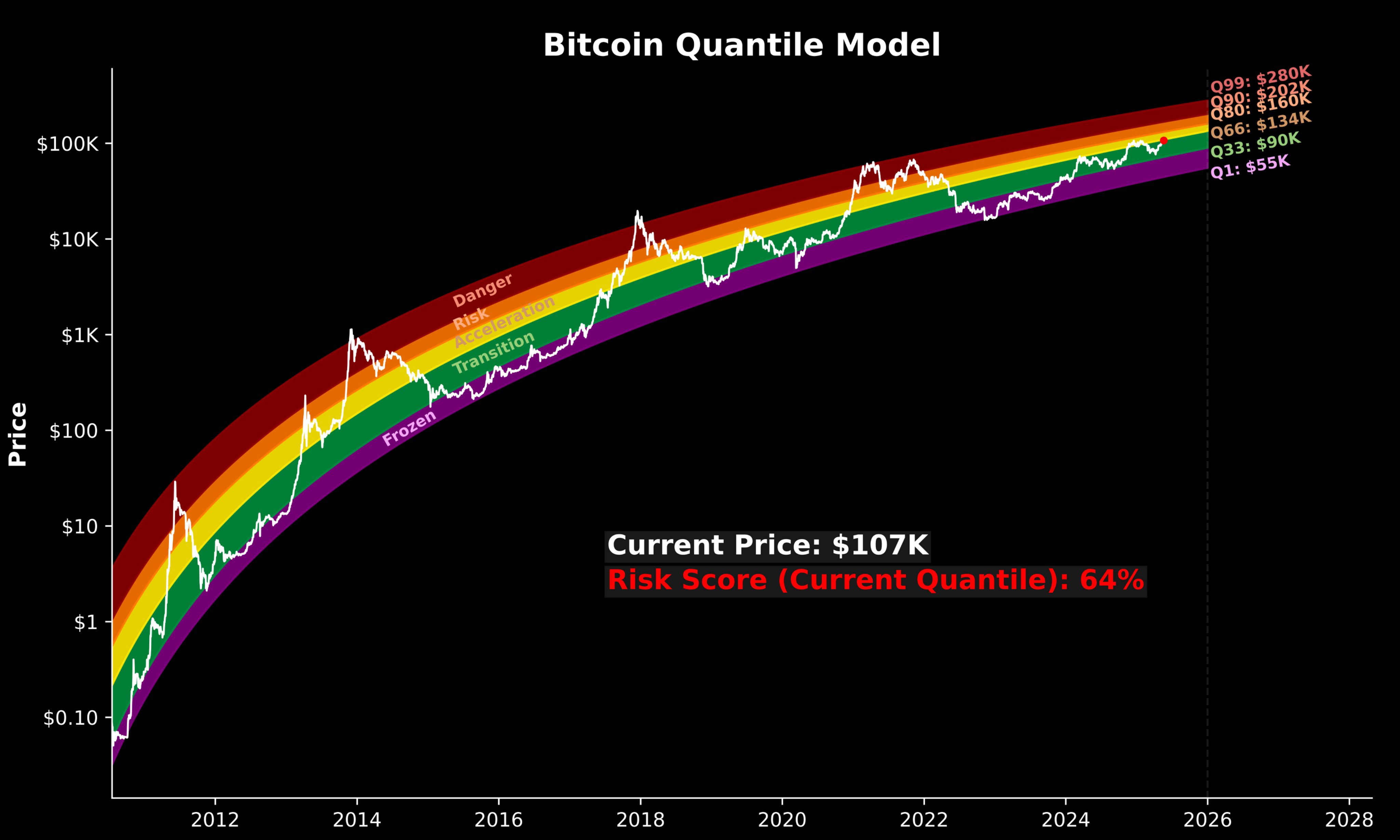

A key indicator supporting this outlook is the Bitcoin Quantile Model. This model, employing quantile regression to map Bitcoin’s price phases on a logarithmic scale, suggests that the current market state mirrors the ‘heat’ observed after the Trump election rally and during the spot ETF-driven highs of Q4 2024. The model identifies Bitcoin as currently residing in the Transition Zone, a critical phase preceding a potential Acceleration Phase. During Q4 2024, Bitcoin experienced a remarkable 45% surge after entering a price discovery period above $74,500.

The chart illustrates that a break into the ‘Acceleration’ Phase could trigger the next significant leg, potentially reaching between 33% and 66%. Based on this model, projections suggest that Bitcoin could progressively target price levels of $130,000 and $163,000 in the months ahead.

Further bolstering the bullish sentiment, anonymous Bitcoin analyst apsk32 anticipates a price target exceeding $200,000 as a ‘reasonable’ expectation for 2025. This projection is grounded in Bitcoin’s ‘power curve,’ with the analyst highlighting a notable improvement in Bitcoin’s position relative to gold since April. This suggests that Bitcoin is increasingly seen as a viable alternative to traditional safe-haven assets.

This viewpoint is reinforced by the recent convergence of Sharpe ratios for Bitcoin and gold, indicating that both assets now offer comparable risk-to-reward profiles for investors. Fidelity’s Director of Global Macro, Jurrien Timmer, has recommended a 4:1 gold-to-Bitcoin ratio from an allocation standpoint, underscoring the growing acceptance of Bitcoin as a legitimate investment asset.

The Importance of Trading Volume

While technical indicators and models paint a bullish picture, strong trading volume is essential to confirm the anticipated breakout and sustain the upward momentum. Crypto researcher Aylo analyzed Bitcoin’s historical price action during consolidation phases near all-time highs, noting that strong, accelerating trends with high momentum typically result in breakouts to new all-time highs within days or weeks.

However, weaker trends have previously led to stalls or retraces. Currently, Bitcoin exhibits a strong trend but lacks the required trading volume. Increased volume is considered the final catalyst needed to confirm a breakout.

Aylo suggests that for Bitcoin to surpass its all-time highs, daily trading volume should exceed the previous 10 days, be at least 1.5 times the 20-day average, and ideally maintain a 3-day increase while the price remains stable or rises.

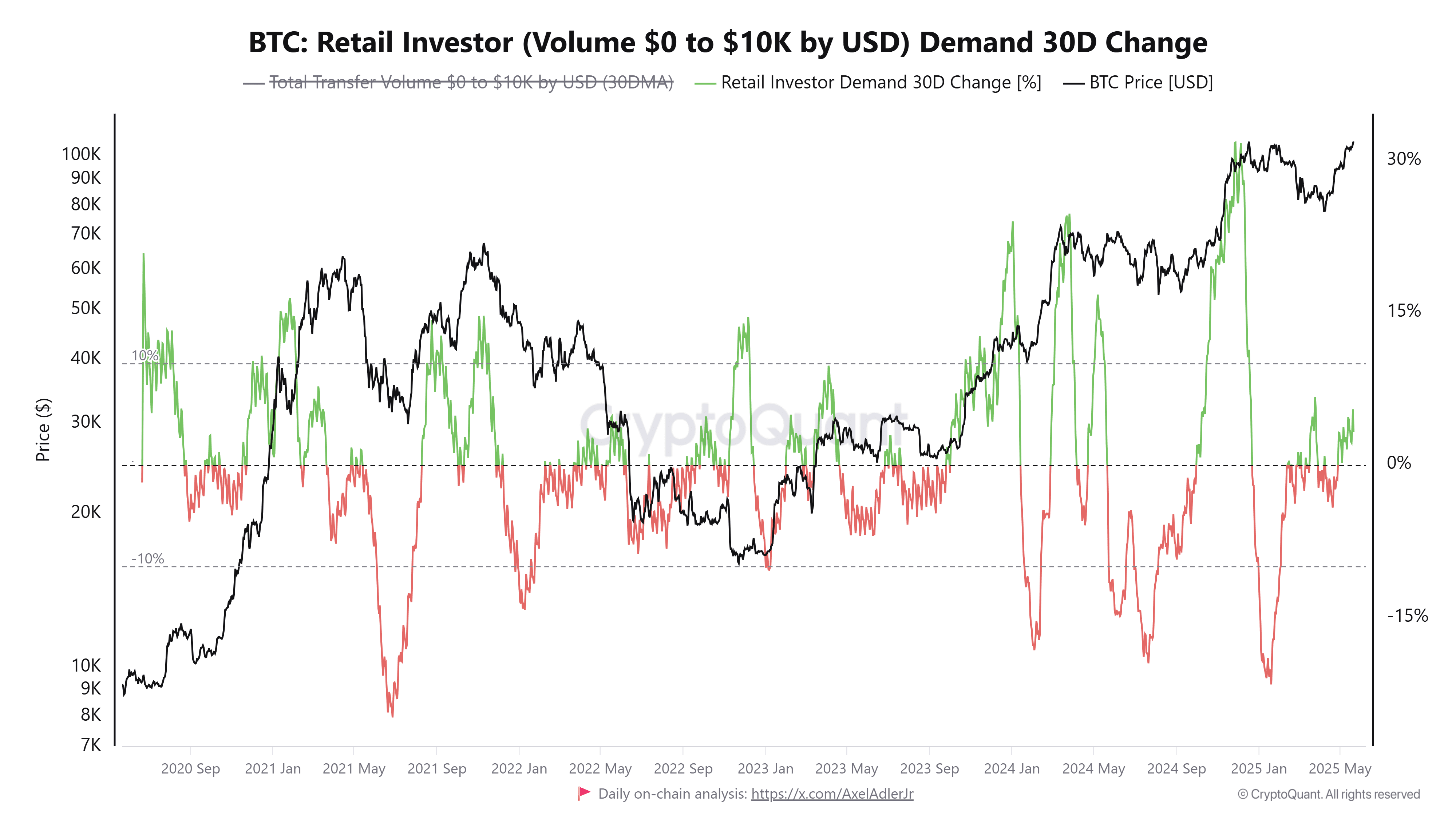

Data from CryptoQuant reinforces these concerns. As of May 21, retail investor demand for Bitcoin, measured by wallets buying/selling between $0 and $10,000, remained low at just 3.2% over 30 days, despite Bitcoin trading within $2,000 of its all-time high. This indicates a lack of widespread participation from smaller investors, which could hinder the breakout.

For context, bullish retail demand accounted for approximately 30% in December 2024, nearly ten times higher than current levels, even when Bitcoin’s price was significantly lower, ranging from $96,000 to $97,000. This stark contrast highlights the need for increased retail participation to fuel a sustainable breakout.

Bitcoin Price Predictions: Key Levels to Watch

In summary, Bitcoin’s current trajectory suggests it’s on the cusp of an ‘acceleration phase’ that could drive prices significantly higher. The Bitcoin Quantile Model points to potential targets of $130,000 and $163,000 in the coming months. However, achieving these targets hinges on two critical factors: breaking the $110,000 resistance level and a substantial increase in trading volume, particularly from retail investors. Should these conditions be met, Bitcoin could be poised for a new era of price discovery, potentially surpassing previous all-time highs and reaching even more ambitious targets.