Bitcoin and Gold Rise Amid Japan Debt Woes

Bitcoin (BTC) is maintaining upward pressure, targeting $108,000, coinciding with a surge in gold prices. This movement is primarily driven by growing anxieties surrounding Japan’s national debt, which analysts describe as reaching a “boiling point.” Gold reached $3,320 per ounce, marking its highest level since May 12.

Key Takeaways:

- Debt-Driven Rally: Both Bitcoin and gold are benefiting from the uncertainty surrounding Japan’s debt situation.

- Bitcoin Target: $108,000 remains a key level for Bitcoin bulls, supported by ongoing corporate accumulation.

- Gold’s Performance: Gold’s rally to $3,320 mirrors the concerns in traditional markets.

Japan’s Debt Crisis: A Catalyst for Crypto and Gold

Trading firm QCP Capital highlighted the increasing volatility in Japanese fixed income markets, with 30-year Japanese Government Bond (JGB) yields surpassing 3%, a level that has unsettled global investors. The firm noted that Japan’s debt situation, long a simmering concern, is now reaching a critical point, driving investors toward safe-haven assets like gold and potentially speculative assets like Bitcoin.

Corporate Buying and Potential FOMO

According to QCP, recent Bitcoin gains have been significantly influenced by corporate accumulation. Companies like Strategy and Metaplanet have been headline buyers. However, there’s concern that a slowdown in their buying activity could lead to profit-taking and a reversal of the current uptrend. A potential breakout to new all-time highs could ignite a fresh wave of FOMO (fear of missing out), drawing in sidelined retail investors and pushing prices even higher.

Technical Analysis and Warning Signs

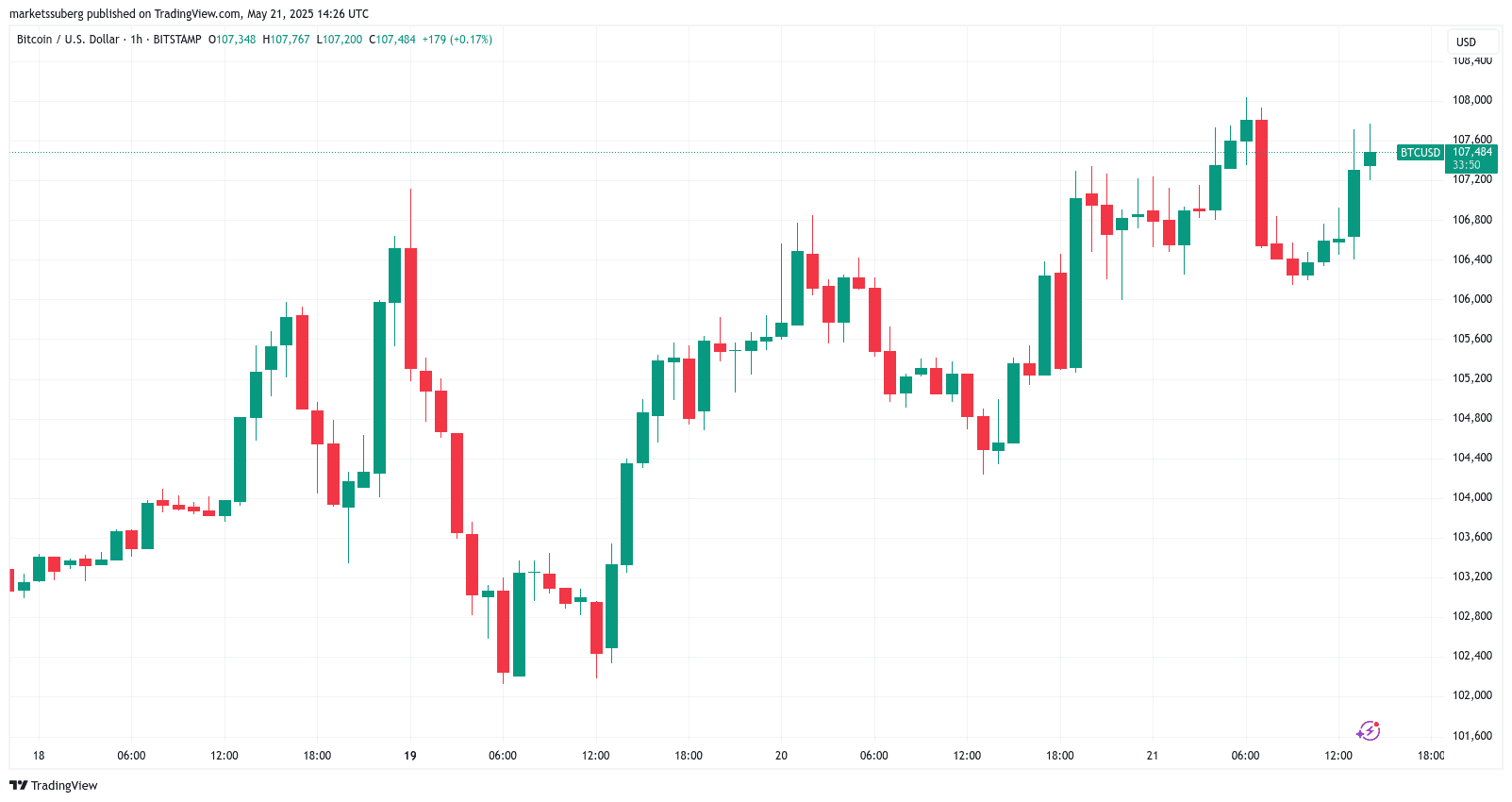

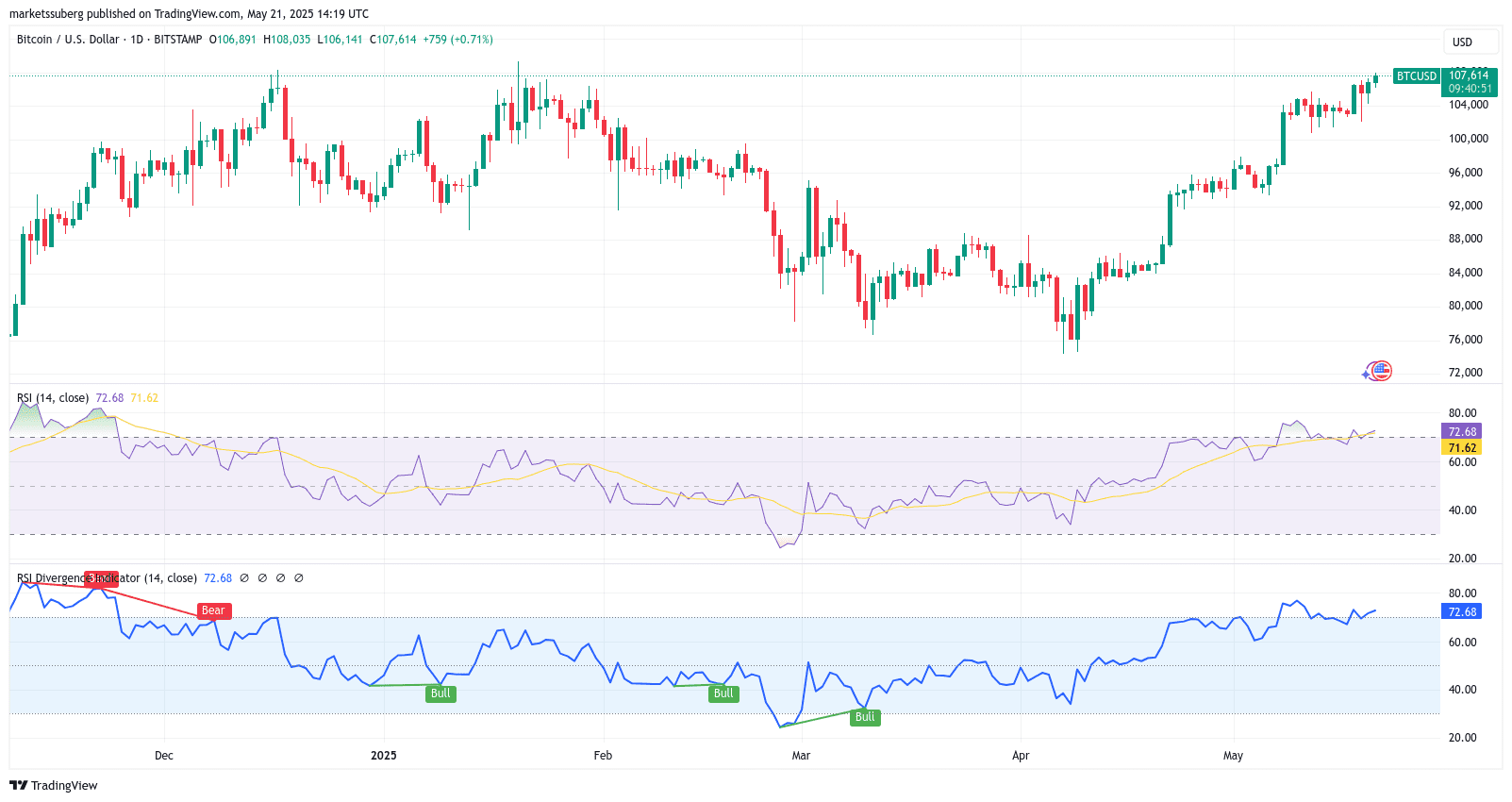

Despite the bullish sentiment, some analysts are pointing to potential warning signs based on Bitcoin’s chart. Trader Roman highlighted three bearish divergences appearing on Bitcoin’s relative strength index (RSI) on daily timeframes. This suggests the possibility of a retest of the $101,000 level before any further upward movement.

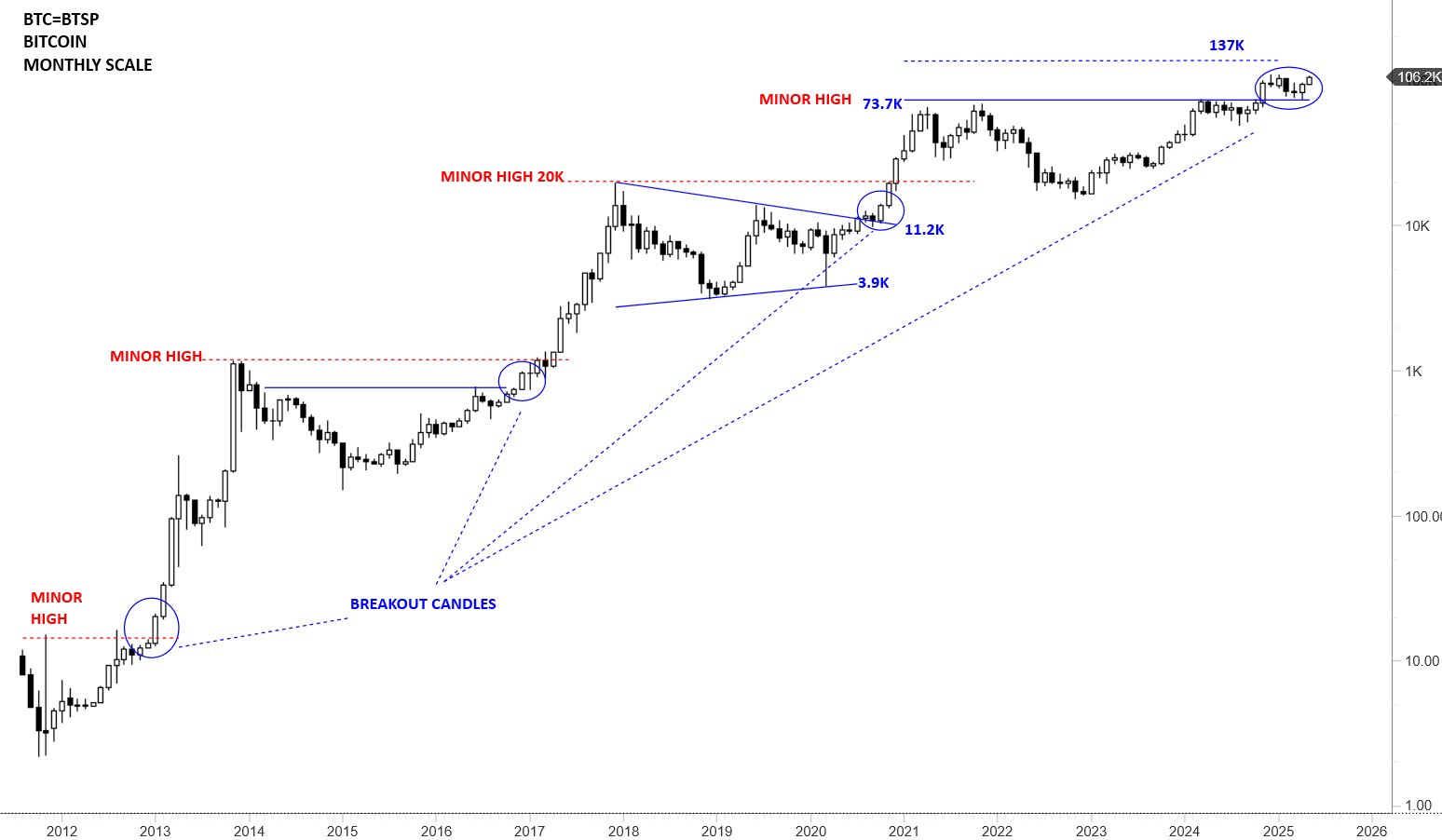

Bitcoin Price Targets: Bullish Outlook Remains

Despite the short-term concerns, many analysts maintain a bullish outlook for Bitcoin. Targets such as $116,000 and even $128,000 are gaining traction. Some analysts predict $220,000 or more in 2025. Analyst Aksel Kibar reiterated a $137,000 target, maintaining that the bull trend remains intact.

Bitcoin’s Resilience Amidst Macro Headwinds

Bitcoin has demonstrated remarkable resilience despite challenging macroeconomic conditions, including rising bond yields, trade tensions, and stagflation risks. This resilience suggests a growing acceptance of Bitcoin as a store of value and a hedge against traditional market uncertainties.

Conclusion

The current Bitcoin rally, fueled by concerns over Japan’s debt and supported by corporate buying, presents both opportunities and risks. While bullish targets abound, technical analysis suggests potential short-term pullbacks. Investors should remain vigilant and conduct thorough research before making any investment decisions. The interplay between macroeconomic factors, corporate activity, and technical indicators will likely determine Bitcoin’s price trajectory in the coming weeks.

Disclaimer: This article does not contain investment advice. Trading and investment involves risk. Conduct your own research before making decisions.