Decentralized finance (DeFi) platform Synthetix has called off its $27 million acquisition of crypto options platform Derive following significant pushback from both communities. This decision comes after concerns were voiced regarding the token exchange rate, the lock-up period, and the overall benefits of the acquisition.

A Synthetix spokesperson confirmed that the acquisition proposal “did not resonate” with the community. Both projects have mutually agreed to step away from the acquisition.

The initial proposal, announced on May 14, involved a token exchange valuing Derive at approximately $27 million. The proposed rate was 1 SNX (Synthetix Network Token) for 27 DRV (Derive tokens), contingent on approval from both communities.

Synthetix strategy lead Ben Celermajer acknowledged the community’s concerns, specifically citing the three-month token lock-up period and the valuation of the deal as key points of contention. Synthetix attempted to address the lock-up issue by offering an exception for holders with less than 1 million DRV tokens.

Despite some community members finding the deal acceptable, the overall response fell short of expectations. Synthetix stated that it would not move forward with the acquisition without strong community support.

Celermajer clarified that Synthetix will continue to explore opportunities for building a decentralized derivatives platform on Ethereum’s mainnet.

Community Concerns Drive Decision

Derive community members expressed concerns about the proposed acquisition on the project’s forum, focusing on the token exchange rate and the deal’s potential benefits for the Derive platform.

One Derive user, “Ramjo,” argued that the token exchange rate undervalued Derive and was akin to “selling the bottom and locking in lows.”

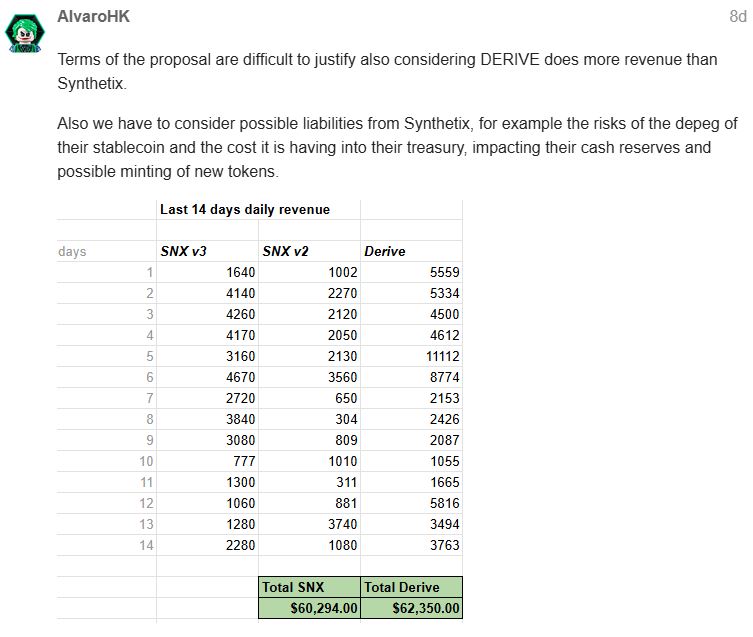

Another user, “AlvaroHK,” questioned the justification for the acquisition, claiming that Derive generates more revenue than Synthetix. They also expressed concerns about potential token dilution from Synthetix issuing additional SNX tokens.

AlvaroHK noted that Synthetix planned to increase its SNX supply from 330 million to 500 million, a move that could further dilute the value of the offer to Derive holders. This lack of transparency was a major point of contention.

Derive, initially incubated by Synthetix as Lyra in 2021, began as a decentralized options protocol within the Synthetix ecosystem. It later rebranded to Derive and sought greater independence, including moving away from Synthetix’s sUSD stablecoin and liquidity pools.

Key Takeaways from the Failed Acquisition:

- Community Approval is Crucial: This event highlights the importance of community buy-in for DeFi projects, especially when acquisitions or significant changes are proposed.

- Tokenomics Transparency: Open communication about token supply and potential dilution is essential to building trust within the community.

- Valuation Disagreements: Differing opinions on valuation can derail even seemingly beneficial deals.

- Independent Growth: Derive’s journey towards independence underscores the evolving dynamics between projects within the DeFi space.

The failed acquisition of Derive by Synthetix serves as a case study in the complexities of DeFi governance and the critical role of community sentiment in shaping the future of decentralized projects. It also sheds light on the challenges and considerations involved in valuing and integrating independent DeFi platforms.