The emergence of yield-bearing stablecoins is causing significant unease within the traditional banking industry. Experts like Austin Campbell, a New York University professor and founder of Zero Knowledge Consulting, suggest that banks are worried about the potential disruption these digital assets pose to their established business models.

Why Banks Are Concerned

Banks primarily fear the ability of stablecoins to offer interest or rewards to holders. This concern stems from the fact that traditional banks operate on a fractional reserve banking system, which allows them to maximize profits while offering minimal interest rates to depositors. The advent of stablecoins that provide competitive yields could draw customers away from traditional banking services.

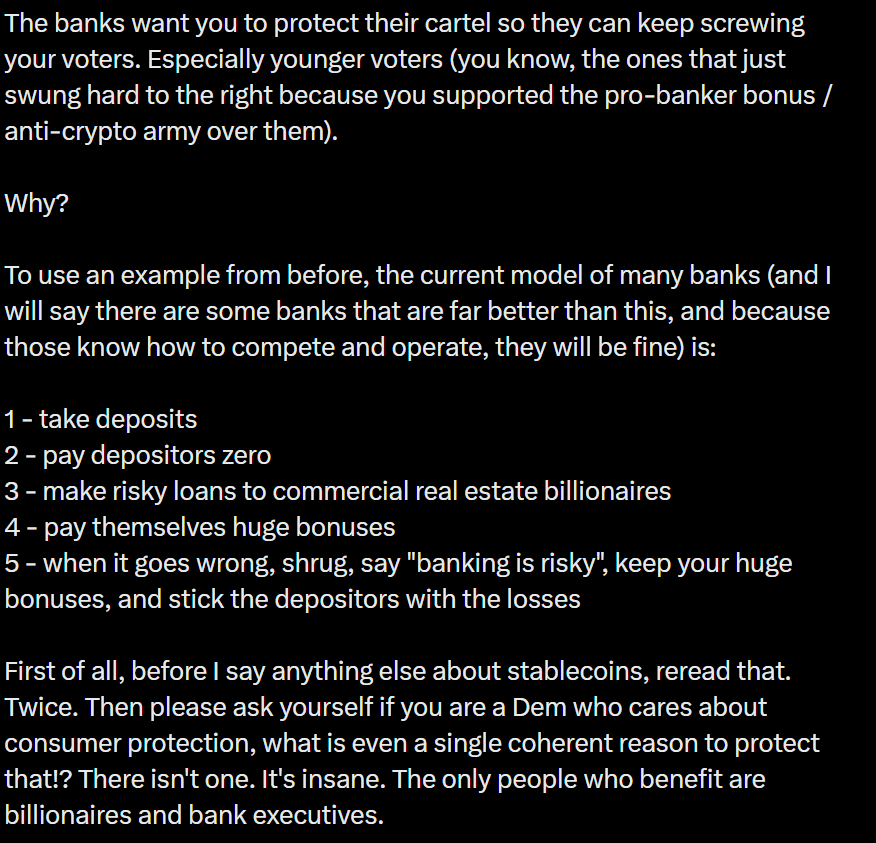

Campbell’s critique highlights the banking lobby’s attempt to protect their ‘cartel’ and maintain their profit margins at the expense of consumers. He urges lawmakers to avoid blanket bans on stablecoin interest payments, emphasizing the need for sensible regulation that fosters innovation while protecting consumers.

The Rise of Yield-Bearing Stablecoins

Several factors contribute to the increasing popularity of yield-bearing stablecoins:

- SEC Approval: The US Securities and Exchange Commission (SEC) approved the first yield-bearing stablecoin security by Figure Markets, signaling a growing acceptance of these assets within the regulatory framework.

- Competitive Yields: Stablecoins like Figure Markets’ YLDS token offer attractive yields, providing investors with an alternative to traditional savings accounts.

- Innovation: Companies like Pi Protocol and Spark Protocol are developing innovative stablecoin solutions that offer interest payments through decentralized lending and tokenized Treasurys.

These developments indicate a significant shift in the stablecoin landscape, with a growing focus on providing users with opportunities to earn passive income on their holdings.

Key Players in the Yield-Bearing Stablecoin Market

Several companies are actively involved in the development and launch of yield-bearing stablecoins:

- Figure Markets: The company received SEC approval for its YLDS token, marking a significant milestone in the stablecoin industry.

- Pi Protocol: Founded by Tether co-founder Reeve Collins, Pi Protocol allows investors to mint the USP stablecoin in exchange for USI, an interest-paying equivalent.

- Spark Protocol: This protocol offers USDS holders interest payments generated through decentralized lending and tokenized Treasurys.

The Future of Stablecoins

The rise of yield-bearing stablecoins has the potential to reshape the financial industry. As stablecoins become more prevalent, they could offer consumers greater access to financial services and investment opportunities. However, it is essential to address regulatory concerns and ensure that these assets are used responsibly.

Sam MacPherson, CEO of Spark Protocol developer Phoenix Labs, emphasizes the importance of providing competitive yields for stablecoin holders. He argues that it’s unacceptable not to receive at least the risk-free rate for holding these digital assets.

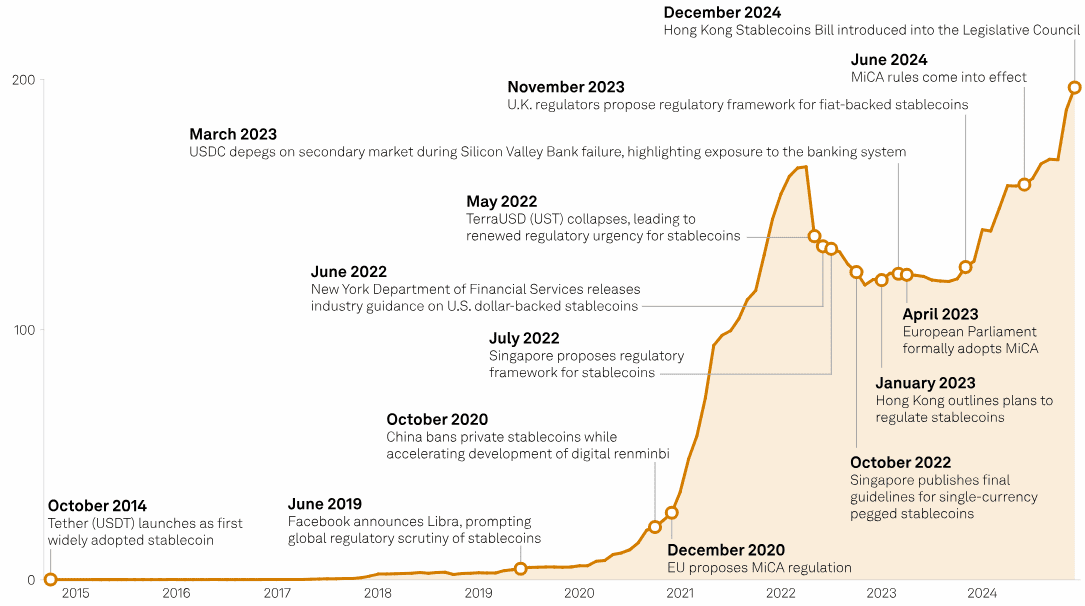

Stablecoins are becoming an increasingly impactful use case for blockchain technology, with global stablecoin volumes rivaling those of major credit card companies like Visa. As the industry continues to evolve, stablecoins are poised to play a significant role in the future of finance.

Potential Benefits of Yield-Bearing Stablecoins

- Increased Accessibility: Stablecoins can provide access to financial services for individuals who are underserved by traditional banking institutions.

- Higher Yields: Yield-bearing stablecoins offer the potential for higher returns compared to traditional savings accounts.

- Greater Efficiency: Stablecoin transactions can be faster and more cost-effective than traditional financial transactions.

- Innovation: The stablecoin market is driving innovation in the financial industry, leading to new products and services.

Conclusion

The banking industry’s concerns about yield-bearing stablecoins are understandable, given the potential for these assets to disrupt traditional business models. However, with sensible regulation and a focus on consumer protection, stablecoins can play a valuable role in the future of finance. By offering competitive yields and increased accessibility, stablecoins have the potential to benefit both consumers and the broader economy.