Three Keys Lab is a crypto investment fund that focuses on backing consumer-facing projects that leverage cultural trends. They provide early-stage capital and community-scaling strategies to help founders navigate the volatile crypto market.

Key Focus: The Tokenized Attention Economy

Three Keys Lab has strategically positioned itself to capitalize on what it calls the “tokenized attention economy.” This refers to the increasing value and engagement surrounding onchain cultural assets such as memecoins, social tokens, and digital collectibles. These assets gain value as network momentum and community engagement grow.

The fund invests in community-led products designed for consumers that increase in value as social engagement increases. Three Keys Lab’s investment strategy has proven successful, with the fund delivering top-quartile results and achieving a DPI ratio of 1.0, indicating full capital recovery for investors.

Identifying a Market Imbalance

The fund recognized that there’s a capital imbalance in the crypto space. While applications targeting end-users have a high deal volume, they often lag behind infrastructure ventures in terms of capital raised. This funding gap contributes to the high failure rate of consumer-crypto startups.

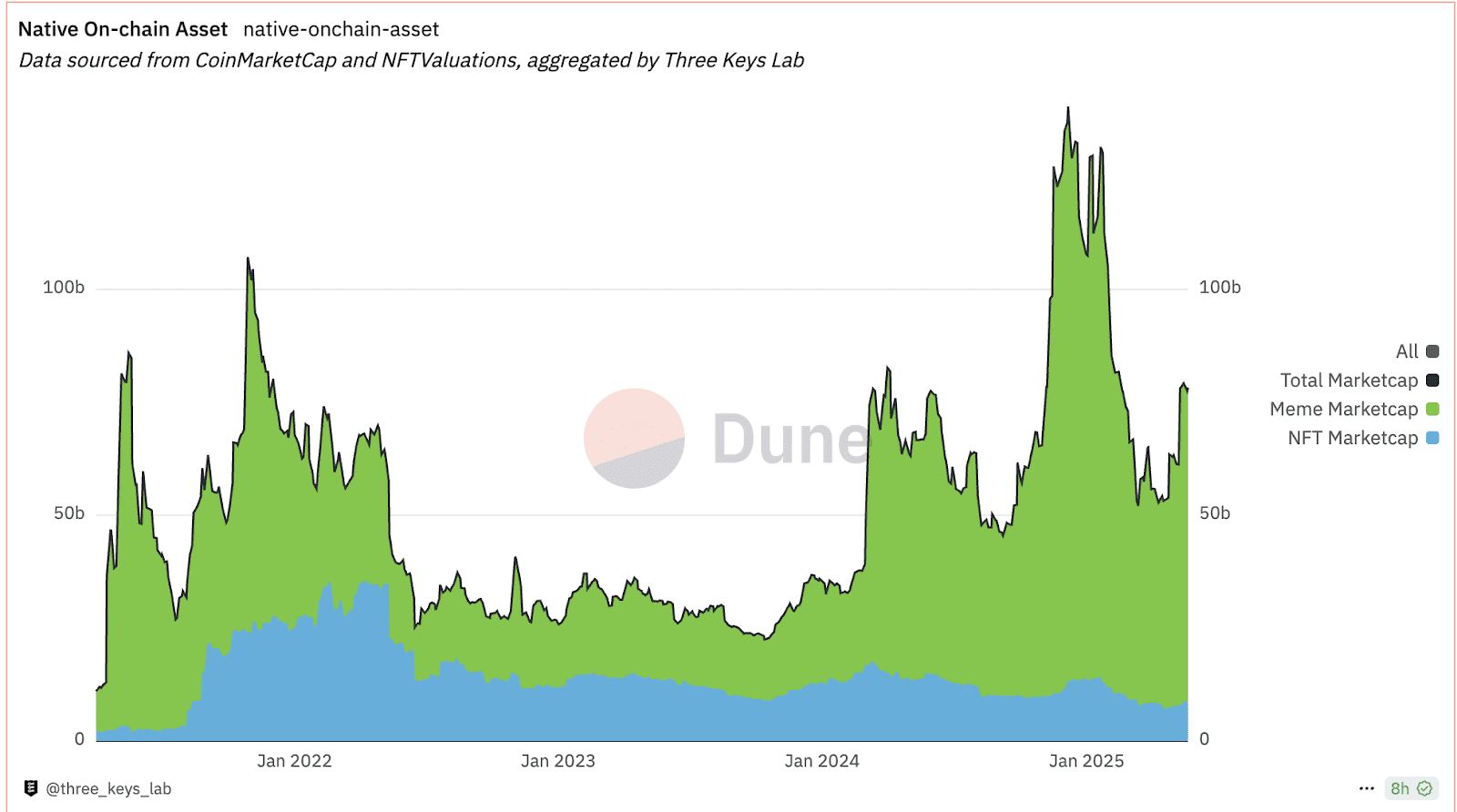

Research indicates that many promising crypto ventures fail due to a lack of capital to withstand market fluctuations, even with significant demand and innovative ideas. The market capitalization of onchain assets, particularly NFTs and memecoins, experienced substantial growth, increasing sixfold in less than a year.

Three Keys Lab’s Performance and Strategy

Despite forming during the NFT boom of 2022, Three Keys Lab successfully navigated the collapse of FTX, the metaverse pull-back, and the NFT retrenchment. Many similar funds were unable to survive these events. Their success stems from embracing the onchain frontier and deploying capital with discipline, resulting in consistent gains and significant returns.

Investment Focus Areas

Three Keys Lab’s portfolio reflects its focus on consumer-facing Web3 segments. These segments include:

- NFT Lending: Gondi, a platform that facilitates NFT-based lending.

- AI-Native Information Markets: Kaito, which develops AI-driven information marketplaces.

- Crypto-Native Art Finance: Fountain, operating as an art finance desk specializing in crypto assets.

- Memecoin Data Infrastructure: Holderscan, providing data infrastructure for the memecoin market.

These projects share the common trait of being able to withstand and adapt to prolonged market downturns.

Institutional Support and Future Plans

Three Keys Lab’s approach has attracted support from institutional investors, including Dragonfly, SIG, and Mirana Ventures. Following their strong Q1 performance, they plan to expand operations in research, engineering, and portfolio support. They aim to capitalize on the convergence of culture, finance, and technology within the onchain market.

The Rise of DEXs and Onchain Assets

The growth of decentralized exchanges (DEXs) is closely linked to the increased adoption of onchain assets. DEXs provide a platform for trading these assets, driving liquidity and increasing market participation. The emergence of new memecoins, including those themed around current events like the Trump-themed tokens, also contributes to DEX volume and adoption.

Hyperliquid: A Key Player in the DEX Landscape

Hyperliquid is a notable decentralized exchange that has experienced rapid growth. Its innovative features and focus on efficient trading have attracted a significant user base, further fueling the surge in DEX volume.

Conclusion

Three Keys Lab’s investment strategy, focused on the tokenized attention economy and consumer-facing crypto projects, has positioned them as a key player in the evolving crypto landscape. Their ability to identify market imbalances, adapt to changing conditions, and attract institutional support underscores their potential for continued success. The growth of DEXs and the increasing adoption of onchain assets further highlight the opportunities within this dynamic market.