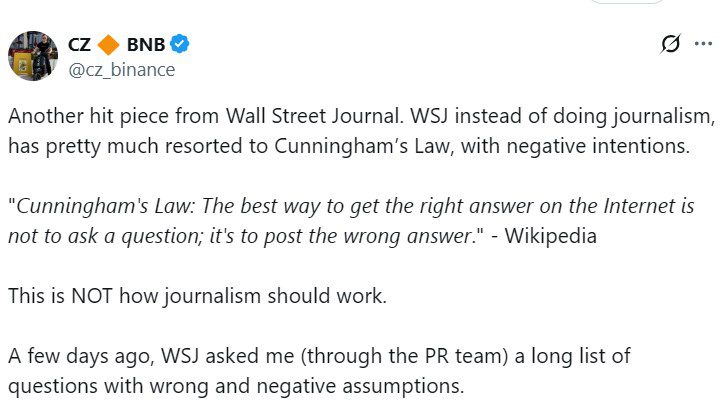

Binance co-founder and former CEO Changpeng “CZ” Zhao has strongly refuted claims made in a recent Wall Street Journal (WSJ) article regarding his alleged involvement with World Liberty Financial (WLF), a decentralized finance project connected to a business entity affiliated with former U.S. President Donald Trump. CZ characterized the report as a “hit piece” riddled with inaccuracies and biased assumptions.

In an X post, Zhao addressed specific points raised in the WSJ article, which suggested he acted as a “fixer” for the WLF team, including co-founder Zach Witkoff, during international trips. The article implied that Zhao facilitated introductions and meetings for WLF leaders, notably during a visit to Pakistan, which reportedly resulted in a memorandum of understanding with a local official.

Key Takeaways from CZ’s Response:

- Denial of “Fixer” Role: CZ explicitly denied acting as a facilitator or “fixer” for WLF, asserting that he did not connect Pakistani official “Mr. Saqib” with WLF and that their relationship predated his involvement.

- WSJ’s “Attack” on Crypto: Zhao accused the WSJ of being a “mouthpiece” for anti-crypto forces in the U.S., aiming to hinder the country’s progress as a leading crypto hub. He views the article as part of a broader campaign to stifle the crypto industry’s growth.

- Seeking Pardon: Zhao confirmed he is seeking a pardon from the Trump administration regarding his money laundering conviction.

The WSJ Report: Key Claims and Concerns

The Wall Street Journal article highlighted the intricate web of diplomatic and business connections involving WLF, raising concerns about potential conflicts of interest. Specifically, the report focused on:

- Steve Witkoff’s Dual Role: Steve Witkoff serves as the U.S. Special Envoy to the Middle East while his son, Zach Witkoff, is involved in securing crypto deals.

- Potential Overlap: The report questioned whether diplomatic efforts were intertwined with private crypto ventures.

- Lack of Transparency: WLFI, which reportedly raised over $600 million in token sales, has been criticized for not fully disclosing its investors.

Expanding on World Liberty Financial (WLF)

To understand the controversy, it’s essential to know more about World Liberty Financial (WLF). WLF operates in the decentralized finance (DeFi) space, a sector known for its innovation but also its regulatory ambiguity. The project’s ambition to raise significant capital through token sales, coupled with its connections to high-profile figures like Donald Trump’s associates, naturally invites scrutiny.

DeFi projects, in general, aim to offer financial services like lending, borrowing, and trading without traditional intermediaries. This is achieved through smart contracts on blockchain networks. However, the lack of centralized control also makes them vulnerable to scams and regulatory challenges.

The Context of Regulatory Scrutiny

This situation unfolds against a backdrop of increasing regulatory scrutiny of the crypto industry. Governments worldwide are grappling with how to regulate cryptocurrencies and related activities, balancing the need to protect investors with the desire to foster innovation. Binance, under CZ’s leadership, has faced considerable regulatory pressure in various jurisdictions.

CZ’s own legal troubles, including his money laundering conviction and subsequent search for a pardon, add another layer of complexity to the narrative. His strong defense against the WSJ’s allegations can be seen as an attempt to protect his reputation and the broader crypto industry from what he perceives as unfair attacks.

Implications for the Crypto Industry

This controversy highlights several key issues for the crypto industry:

- Reputation Management: The need for crypto leaders to proactively manage their public image and address negative press.

- Transparency: The importance of transparency in DeFi projects, particularly regarding investor disclosure.

- Regulatory Compliance: The ongoing challenge of navigating the complex and evolving regulatory landscape.

- Perception: The potential for negative perceptions to hinder the growth and adoption of cryptocurrencies.

In conclusion, CZ’s rebuttal of the WSJ article underscores the ongoing tensions between the crypto industry and traditional media, as well as the challenges of navigating the intersection of business, politics, and regulation in the digital age. The long-term impact of this situation remains to be seen, but it serves as a reminder of the scrutiny faced by prominent figures and projects in the crypto space.