The Rise of Digital Assets: Crypto and NFTs as a Safe Haven

In 2025, cryptocurrencies and Non-Fungible Tokens (NFTs) are increasingly viewed as crucial tools for investors seeking to protect their purchasing power amidst ongoing fiat currency debasement. This shift is driven by a growing understanding of the potential of digital assets to offer stability and growth opportunities in an evolving financial landscape.

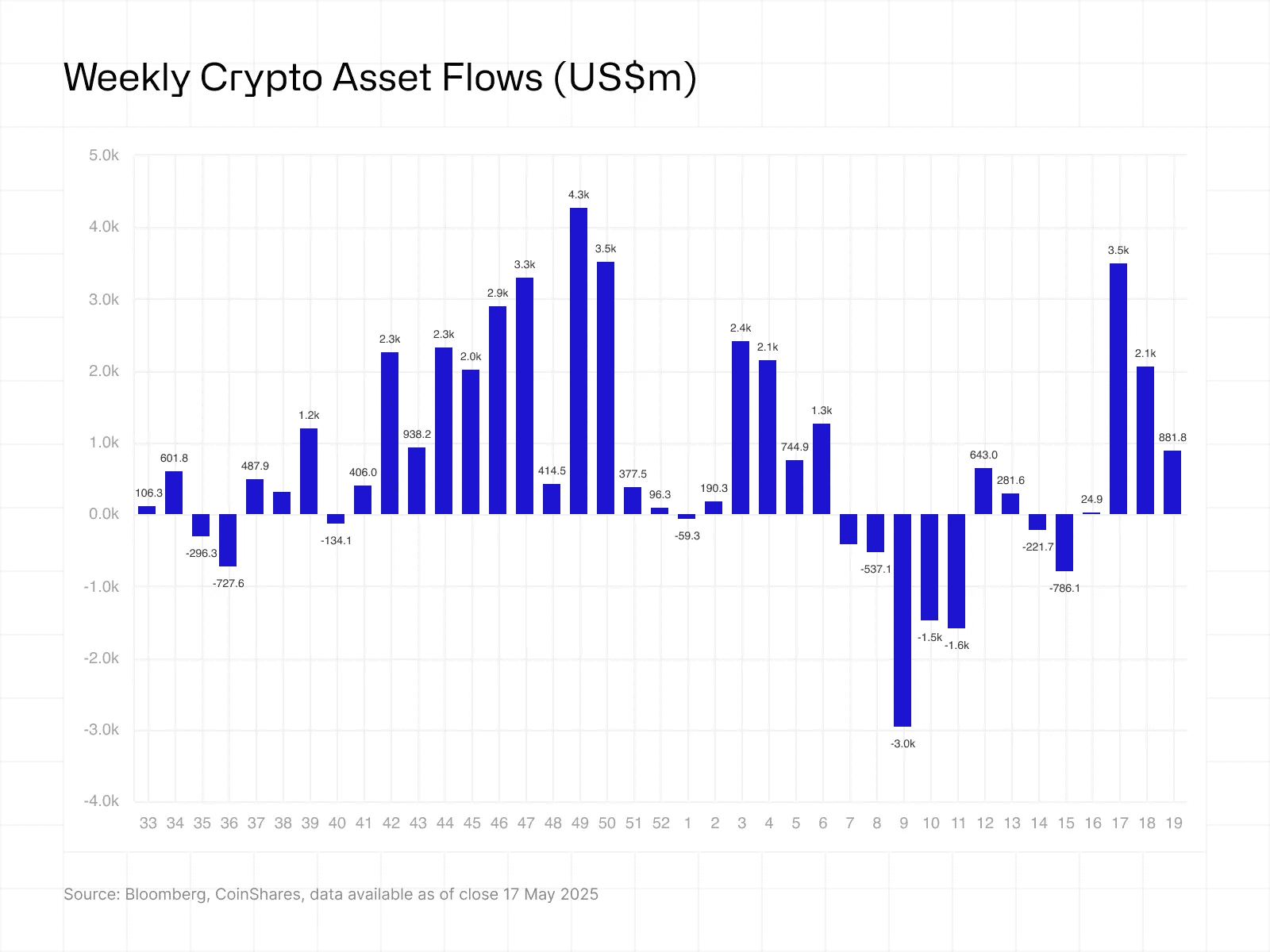

The week saw a resurgence in risk appetite across both traditional and cryptocurrency markets, leading to a significant recovery for United States cryptocurrency funds. These funds amassed over $7.5 billion in weekly inflows, effectively recouping losses incurred during the market corrections of February and March.

Bitcoin (BTC) reached a new all-time high on May 21, surpassing previous records. This milestone occurred shortly after President Donald Trump confirmed ongoing ceasefire negotiations between Russia and Ukraine, signaling a potential easing of geopolitical tensions that positively influenced market sentiment.

Experts Weigh In: The Case for Crypto and NFTs

Raoul Pal, CEO of Global Macro Investor, has been a vocal advocate for increased exposure to cryptocurrencies and NFTs. He warns of further fiat currency debasement, arguing that these digital assets are currently undervalued and represent a unique opportunity for investors.

Pal emphasizes that owning cryptocurrencies and NFTs can help investors safeguard their wealth in an era of exponential currency debasement. He views NFTs, particularly art-related NFTs, as a long-term store of value, offering the potential for significant returns as network effects take hold.

NFTs: Beyond Speculation to Long-Term Value

Nicolai Sondergaard, a research analyst at Nansen, echoes the sentiment that NFTs serve as a vehicle for wealth preservation, especially for high-net-worth individuals. He notes that asset diversification is a natural progression for the wealthy, and NFTs offer a compelling option in this regard.

For traders and investors further down the wealth curve, NFTs present an opportunity to speculate on future returns. However, Sondergaard also highlights the importance of strong communities surrounding NFT projects, adding another layer of value beyond mere wealth creation.

US Crypto Funds See Massive Inflows

In 2025, crypto investment products in the United States have experienced substantial growth, attracting over $7.5 billion in investment. This surge in investment is supported by a fifth consecutive week of net positive inflows, indicating increasing investor confidence in the digital asset space.

The influx of capital into US-based crypto investment products reflects a broader trend of growing institutional and retail interest in cryptocurrencies. The positive inflows signal a strong recovery following outflows earlier in the year.

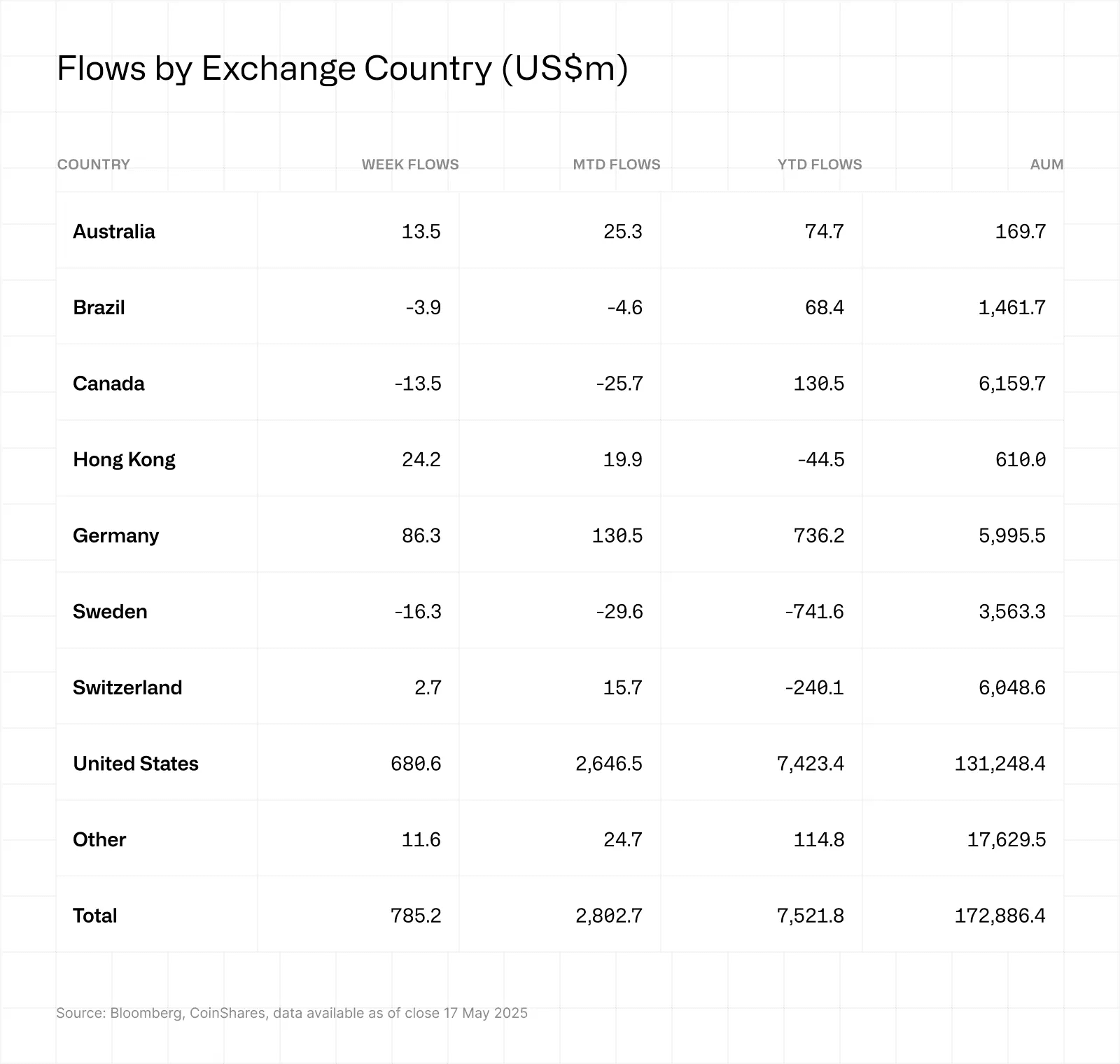

The United States is the primary driver of these inflows, accounting for a significant portion of the total investment. Germany and Hong Kong also contribute to the positive trend, demonstrating the global appeal of crypto investments.

A key factor contributing to the renewed investor confidence is the White House announcement of a 90-day pause on additional tariffs. This move has eased trade tensions and positively impacted risk assets like cryptocurrencies.

VanEck Enters the Avalanche Ecosystem

VanEck is set to launch a private digital assets fund in June, focusing on tokenized Web3 projects built on the Avalanche blockchain network. The VanEck PurposeBuilt Fund aims to invest in liquid tokens and venture-backed projects across various Web3 sectors, including gaming, financial services, payments, and artificial intelligence.

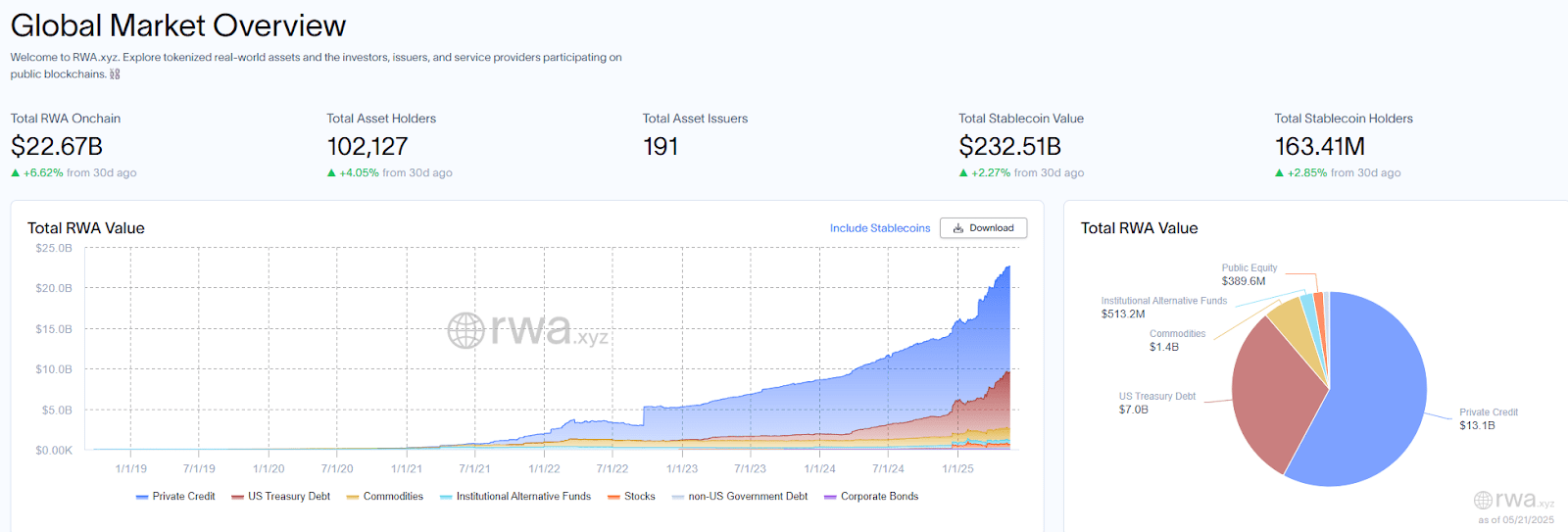

The fund will allocate idle capital into Avalanche (AVAX) real-world asset (RWA) products, including tokenized money market funds. This strategic allocation reflects the growing interest in integrating traditional assets with blockchain technology.

The Surge of Yield-Bearing Stablecoins

Yield-bearing stablecoins have experienced a remarkable surge in popularity, reaching $11 billion in circulation. This represents 4.5% of the total stablecoin market, a significant increase from $1.5 billion and a 1% market share at the start of 2024.

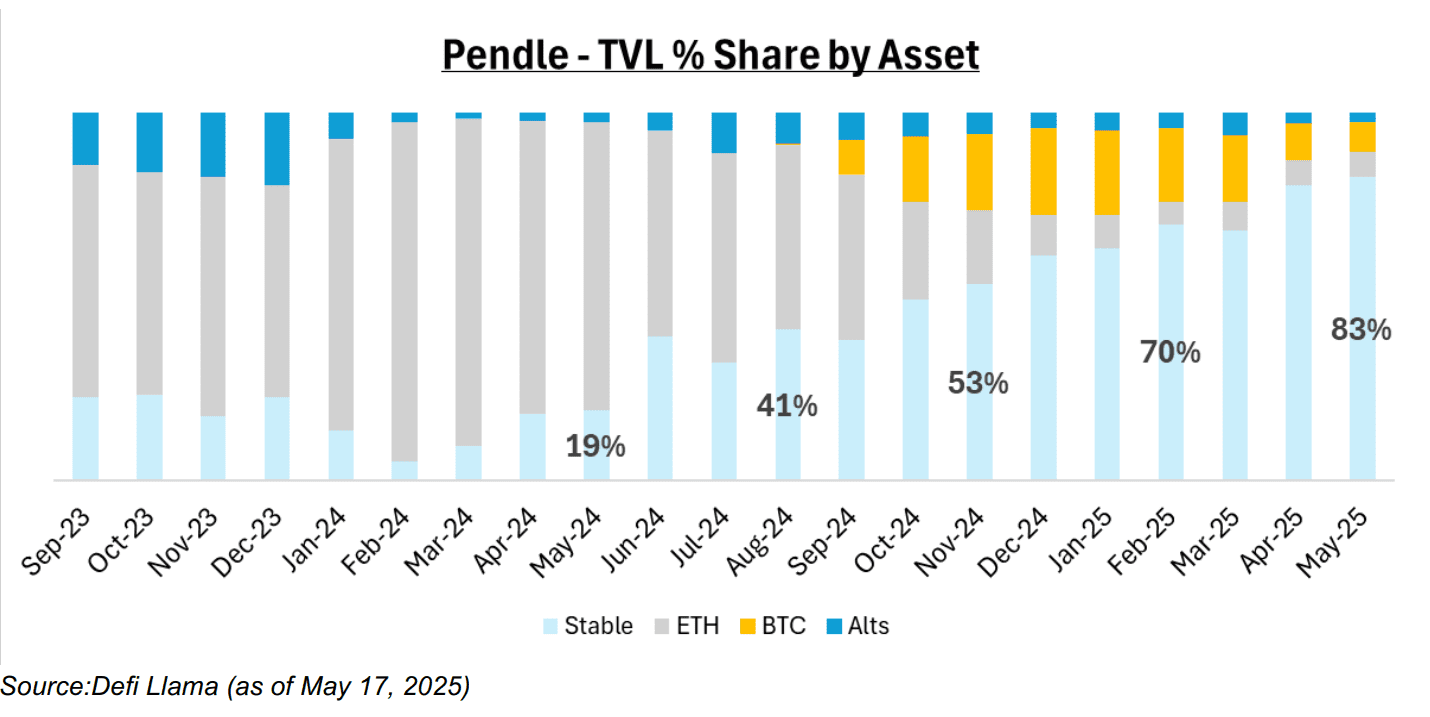

Pendle, a decentralized protocol that allows users to lock in fixed yields or speculate on variable interest rates, is a major player in this space. Pendle accounts for a significant portion of the total value locked (TVL) in yield-bearing stablecoins.

Traditional stablecoins like USDT and USDC do not offer interest to holders. However, with substantial amounts in circulation, holders are potentially missing out on significant annual yields. Yield-bearing stablecoins offer a solution to this problem, providing a way for users to earn interest on their stablecoin holdings.

Tether’s Growing Influence

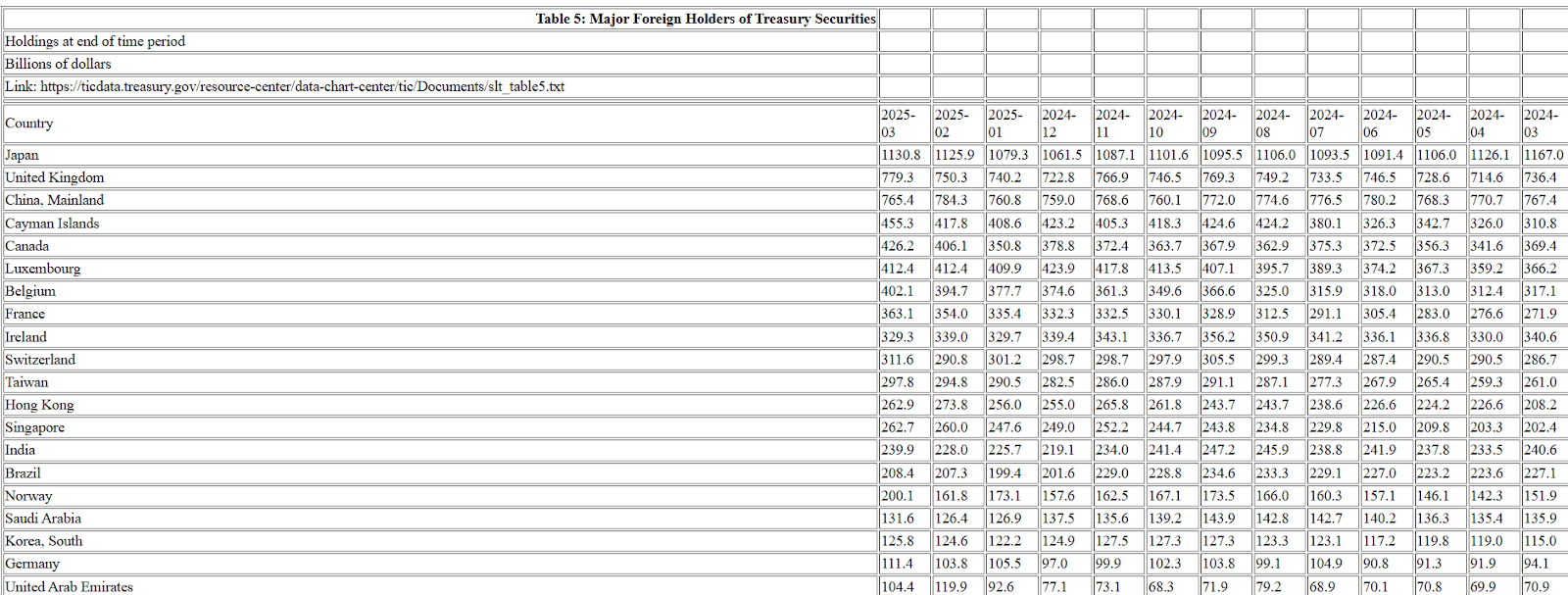

Tether, the dominant stablecoin issuer, holds a significant amount of United States Treasury bills, surpassing Germany in holdings. This showcases the benefits of a diversified reserve strategy, enabling Tether to navigate the volatility of the cryptocurrency market effectively.

Tether’s substantial holdings of US Treasurys position it as a major player in the financial landscape. This milestone reinforces Tether’s conservative reserve management strategy and its growing role in distributing dollar-denominated liquidity at scale.

DeFi Market Overview

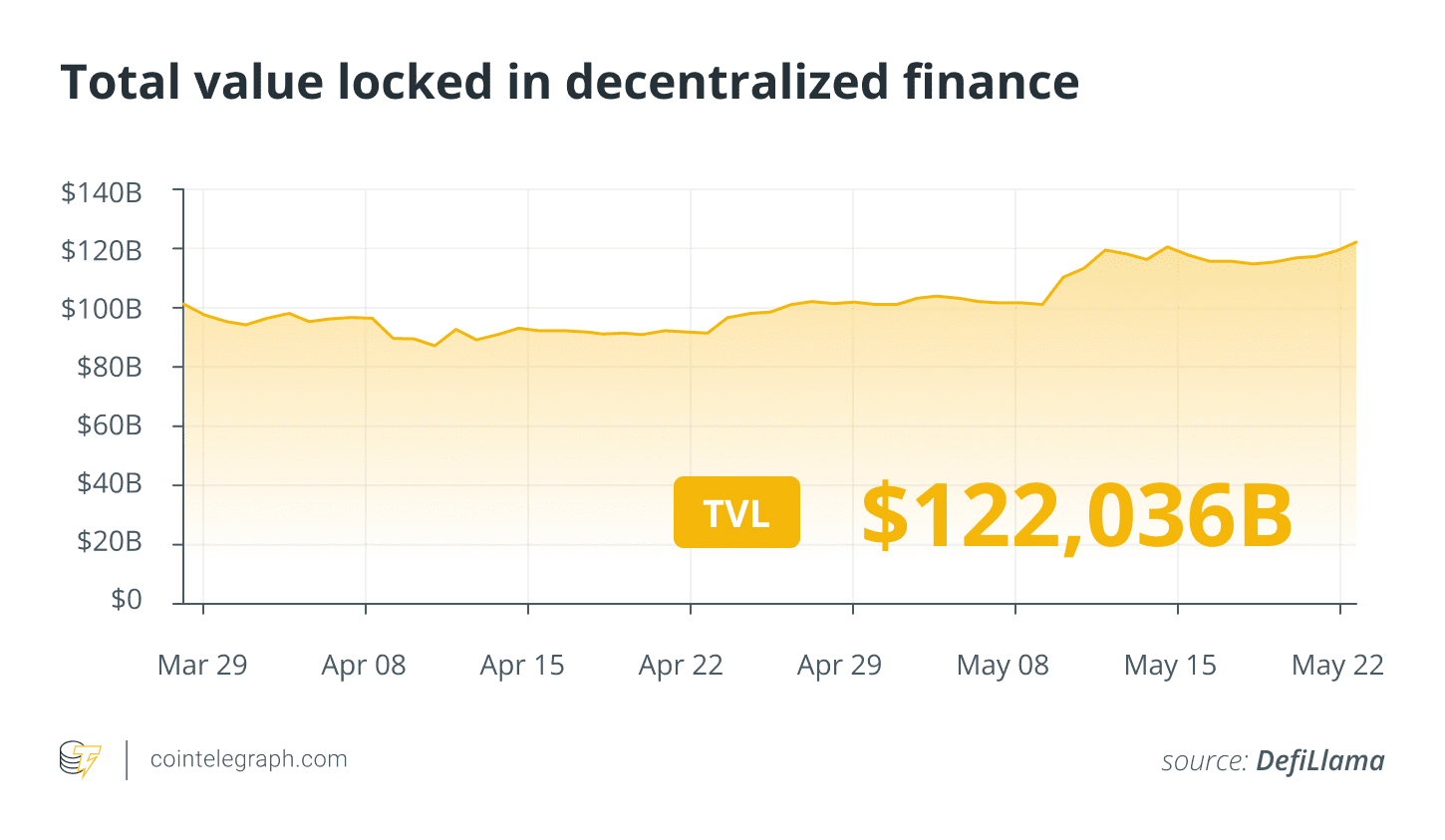

The DeFi market continues to evolve, with many cryptocurrencies experiencing positive price movements. Worldcoin (WLD) and Hyperliquid (HYPE) were among the top performers, demonstrating the dynamic nature of the crypto space.

Conclusion

The cryptocurrency and NFT markets are undergoing significant transformations in 2025, with increased adoption, innovative financial products, and growing institutional interest. As the digital asset space matures, it presents both opportunities and challenges for investors and regulators alike.