Key Takeaways:

- Bitcoin’s current bull market performance signals a maturing market with wider adoption and a new investor base.

- A 50% increase in hashrate and a 63% surge in Realized Cap demonstrate strong investor confidence in Bitcoin’s long-term potential.

- Institutional interest, spurred by spot Bitcoin ETFs, plays a crucial role in the current market cycle.

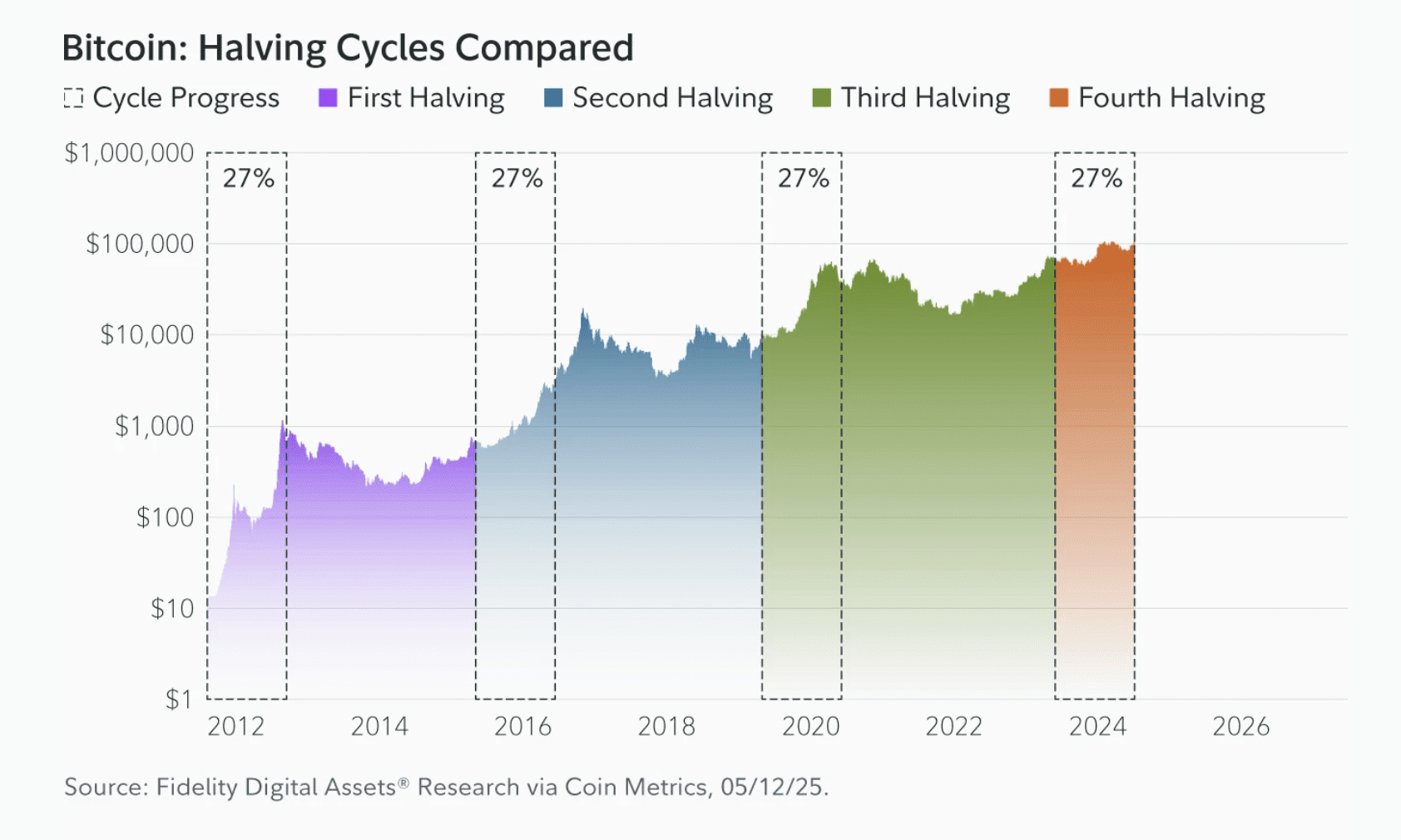

Fidelity Digital Assets’ recent report analyzes the current Bitcoin market cycle, highlighting its maturation and increasing adoption. Examining data from block height 892,500 (25% into the current halving epoch), the report notes Bitcoin’s trading range between $82,500 and $85,000, a 31% rise since the fourth halving on April 19, 2024, which reduced block rewards to 3.125 BTC. This growth indicates a shifting landscape for Bitcoin.

Daniel Gray, Senior Research Analyst at Fidelity, emphasizes the network’s robustness, citing a 50% increase in hashrate since the halving. This highlights miners’ continued commitment despite reduced rewards. Unlike previous cycles with post-halving rallies, the current phase showcases steadier growth. The Puell Multiple, which measures miner revenue relative to Bitcoin’s price, has stabilized, indicating market adjustment to lower issuance without significant volatility.

The report suggests Bitcoin’s muted returns reflect the market’s digestion of various extrinsic factors. Historically, this mid-epoch phase has aligned with new all-time highs, a trend that occurred this week. Fidelity anticipates potential growth extending into Q2 2025, possibly redefining Bitcoin’s standing as a credible asset in modern investment portfolios.

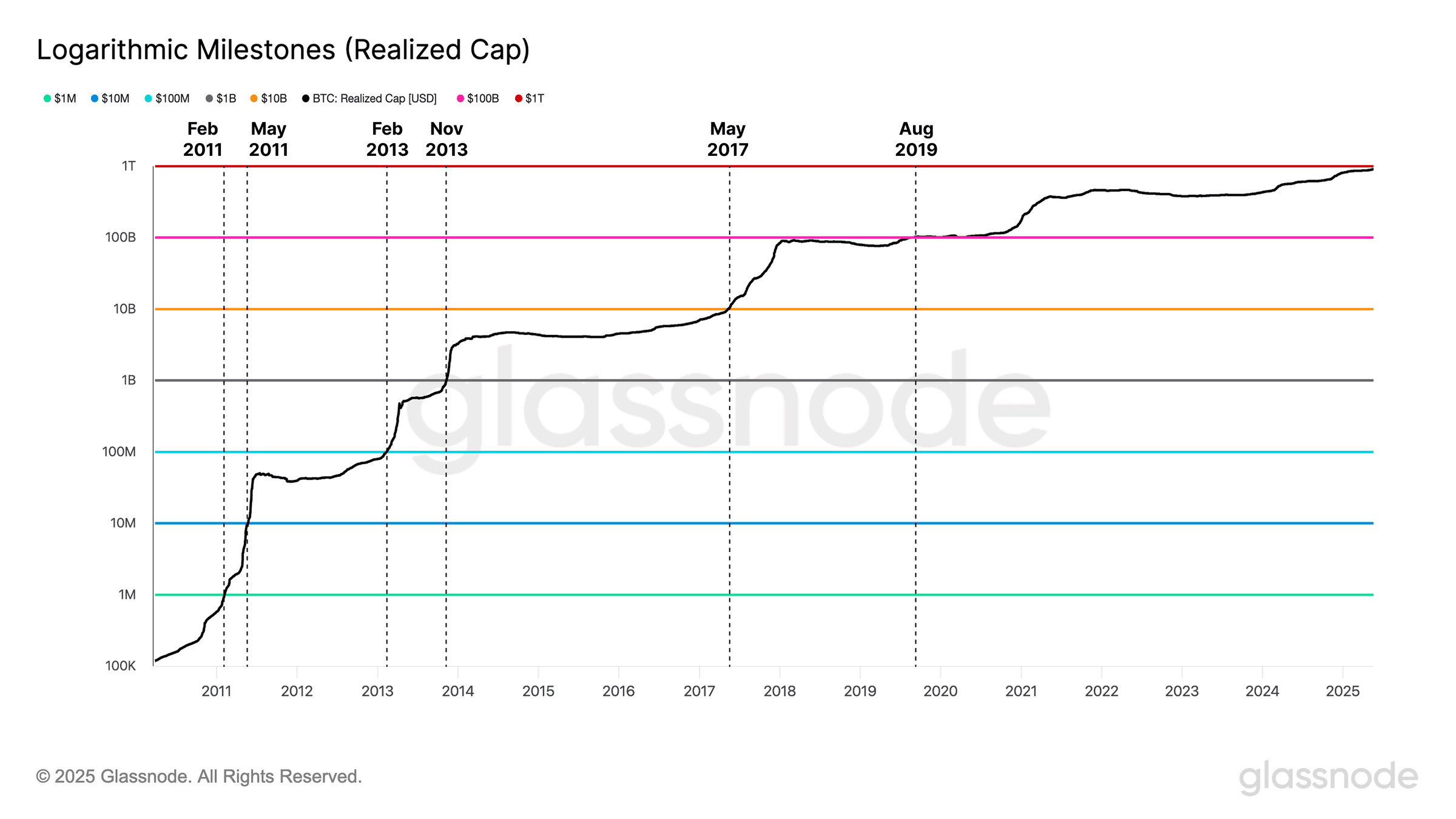

Bitcoin’s Realized Cap: A Measure of Maturation

Bitcoin’s Realized Cap, measuring cumulative net capital inflows, is a crucial indicator of its evolution. Since the 2024 halving, the Realized Cap has surged 63%, from $561 billion to $915 billion, reflecting substantial capital entering the Bitcoin market.

This trajectory aligns with Bitcoin’s long-term growth, where Realized Cap increases with each halving, indicating a maturing asset with significant growth potential.

Key Drivers of the Bitcoin Bull Market

The current bull market distinguishes itself through unprecedented institutional and corporate participation. The approval of spot Bitcoin ETFs in the US in January 2024 has attracted significant inflows, marking a turning point. Monthly trading volumes on major platforms have also surged, highlighting increased market activity.

Institutional and Corporate Adoption

Public companies like Strategy, now holding a significant amount of BTC, are leading the way in corporate Bitcoin adoption. Other firms are following suit, validating Bitcoin’s role as a corporate treasury asset. This growing institutional acceptance reinforces Bitcoin’s legitimacy and long-term viability.

Gray concludes that Bitcoin’s fundamentals and global recognition are stronger than ever, indicating a cycle of growth, institutional anchoring, and market resilience. This positions Bitcoin as a potentially transformative asset within modern portfolios.

Factors Influencing Bitcoin’s Price: A Detailed Overview

Understanding the factors that influence Bitcoin’s price is crucial for investors. Several key elements contribute to its volatility and growth potential:

- Supply and Demand: Bitcoin’s limited supply of 21 million coins creates scarcity, driving price increases as demand rises. Halving events further restrict supply, historically leading to price appreciation.

- Market Sentiment: News, social media trends, and investor confidence significantly impact Bitcoin’s price. Positive news and increased adoption drive prices up, while negative news can trigger sell-offs.

- Regulatory Environment: Government regulations regarding cryptocurrencies play a vital role. Supportive regulations can foster adoption, while restrictive policies can hinder growth.

- Technological Advancements: Improvements in blockchain technology and the development of new applications for Bitcoin can increase its value and utility.

- Macroeconomic Factors: Inflation, interest rates, and global economic conditions can influence Bitcoin’s price as investors seek alternative assets to hedge against economic uncertainty.

By understanding these factors, investors can better assess the potential risks and rewards associated with investing in Bitcoin.