Akshay BD, a key figure at the Solana Foundation, envisions a future where blockchain technology, particularly through the Solana network, can revolutionize investment and create what he calls ‘universal basic ownership.’ He believes the current capital market structure fails to serve a broad investor base and that Solana can empower individuals to become investors and ‘dreamers.’

The Problem with Traditional Finance

Akshay highlights growing investor uncertainty, driven by low bond yields, asset price bubbles, and a perceived disconnect between traditional asset allocation models and consistent returns. The traditional 60-40 portfolio (60% stocks, 40% bonds) is no longer reliably delivering the expected outcomes.

He attributes this tension to a widening gap between income from wages and wealth accumulated through asset ownership. Retail investors are often excluded from lucrative private markets, which are typically reserved for accredited investors, potentially contributing to inflated public market valuations.

AI and the Future of Work: UBI vs. UBO

Akshay warns that the increasing capabilities of artificial intelligence (AI) could further exacerbate existing economic inequalities. He poses a critical question: Will society adopt universal basic income (UBI), creating a welfare system to support those displaced by AI, or will it embrace universal basic ownership (UBO), empowering everyone with a mobile phone to own assets?

Solana’s Solution: Tokenization and Micro-Ownership

His vision centers on crypto infrastructure enabling broader asset ownership. This involves tokenizing assets, allowing individuals to invest in a wide range of entities, from energy companies to local coffee shops. Acquiring an ownership stake could become as simple as scanning a QR code.

Key takeaways of this vision:

- Democratization of Investment: Breaking down barriers to entry and allowing more people to participate in asset ownership.

- Financial Inclusion: Providing access to investment opportunities for those traditionally excluded from private markets.

- Economic Empowerment: Giving individuals a stake in the economy and the businesses they support.

- Fighting Inequality: Addressing the potential economic divides created by AI advancements.

The Role of Solana

The “Non-Chief Marketing Officer” (nCMO) at the Solana Foundation plays a crucial role in supporting the Solana community’s marketing efforts and promoting this vision of decentralized finance.

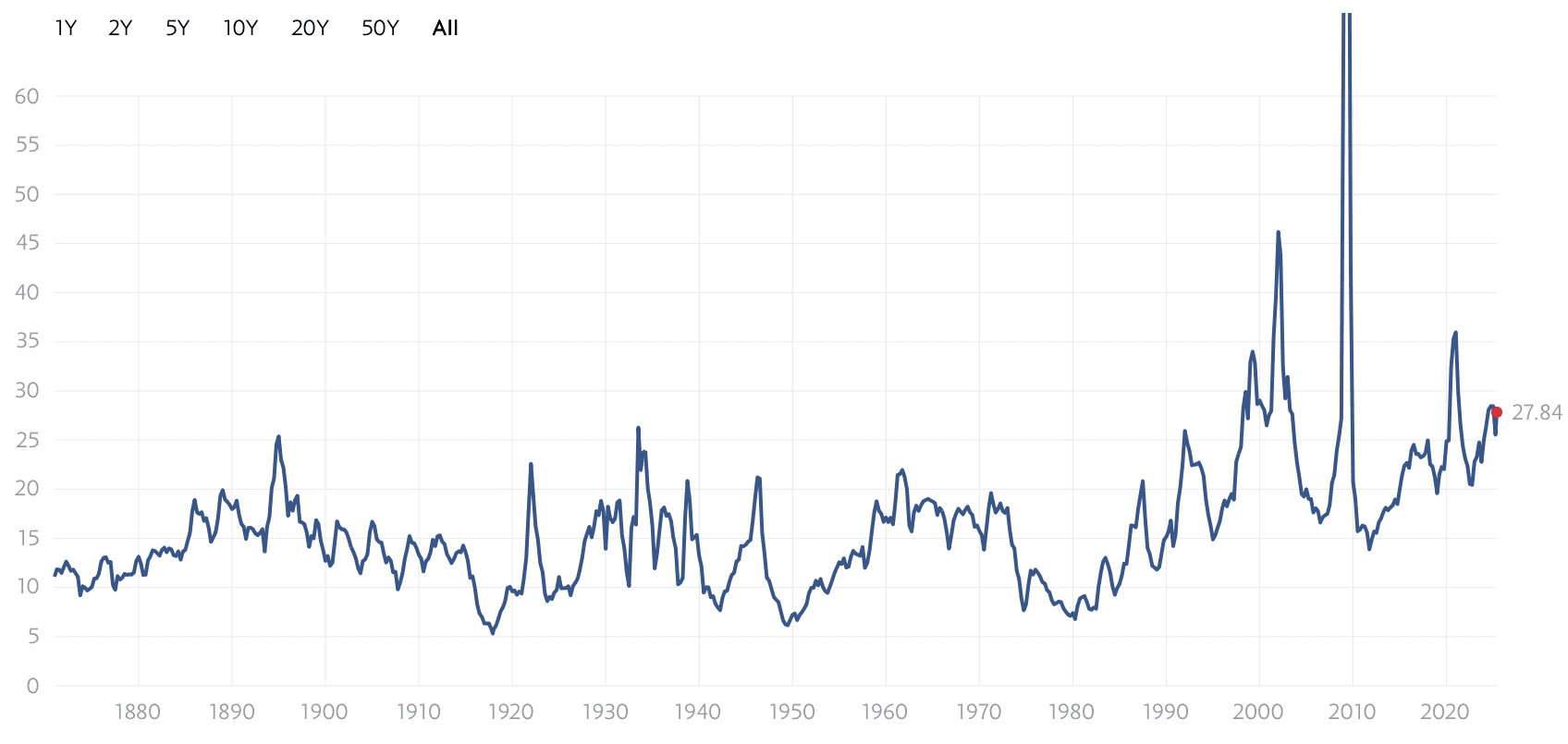

Market Overvaluation and the Need for Change

Public equity markets in the US have been trading above their historical valuation norms for an extended period. The S&P 500’s price-to-earnings (P/E) ratio, a key indicator of market valuation, has consistently remained above its historical average since December 2018.

While factors like low interest rates and technological optimism have contributed to this trend, high valuations can also precede market corrections. Opening up markets to retail investors through tokenization, as facilitated by crypto initiatives like Real World Asset (RWA) tokenization, offers a potential solution to combat market overheating.

Akshay argues that crypto is not just a game; it has profound implications for the future of finance. It allows for the financialization of all productive assets in an economy, enabling anyone who participates in that economy to become an owner.

The Promise of Tokenization

Tokenization is the process of representing real-world assets, such as real estate, commodities, or company equity, as digital tokens on a blockchain. This offers several advantages:

- Fractional Ownership: Allows assets to be divided into smaller, more affordable units, making them accessible to a wider range of investors.

- Increased Liquidity: Tokens can be traded more easily than traditional assets, increasing market liquidity.

- Transparency and Efficiency: Blockchain technology provides a transparent and efficient record of ownership and transactions.

- Global Accessibility: Tokenized assets can be traded globally, opening up new investment opportunities.

Conclusion

Solana’s vision of universal basic ownership, powered by blockchain and tokenization, presents a compelling alternative to a future dominated by AI-driven job displacement and economic inequality. By democratizing investment and empowering individuals to own a stake in the economy, Solana aims to create a more equitable and prosperous future for all.