Key Takeaways:

- Bitcoin bulls are strategically positioned to potentially drive BTC above $110,000 by the May 30th options expiry, capitalizing on a significant concentration of call options.

- Strong spot BTC ETF inflows and a relatively weak put option positioning provide a considerable advantage to bulls leading up to the monthly expiry.

- Analysis of option strategies, including short calls and bull call spreads, reveals nuanced approaches to risk management and profit-taking among investors.

Bitcoin (BTC) is gearing up for its largest monthly options expiry of 2025, a massive $13.8 billion event. This presents a significant opportunity for bullish investors to solidify Bitcoin’s price above the $110,000 mark. The recent 25% surge in price over the past month has seemingly caught bearish traders off guard, potentially setting the stage for further upward momentum.

Understanding the Options Landscape

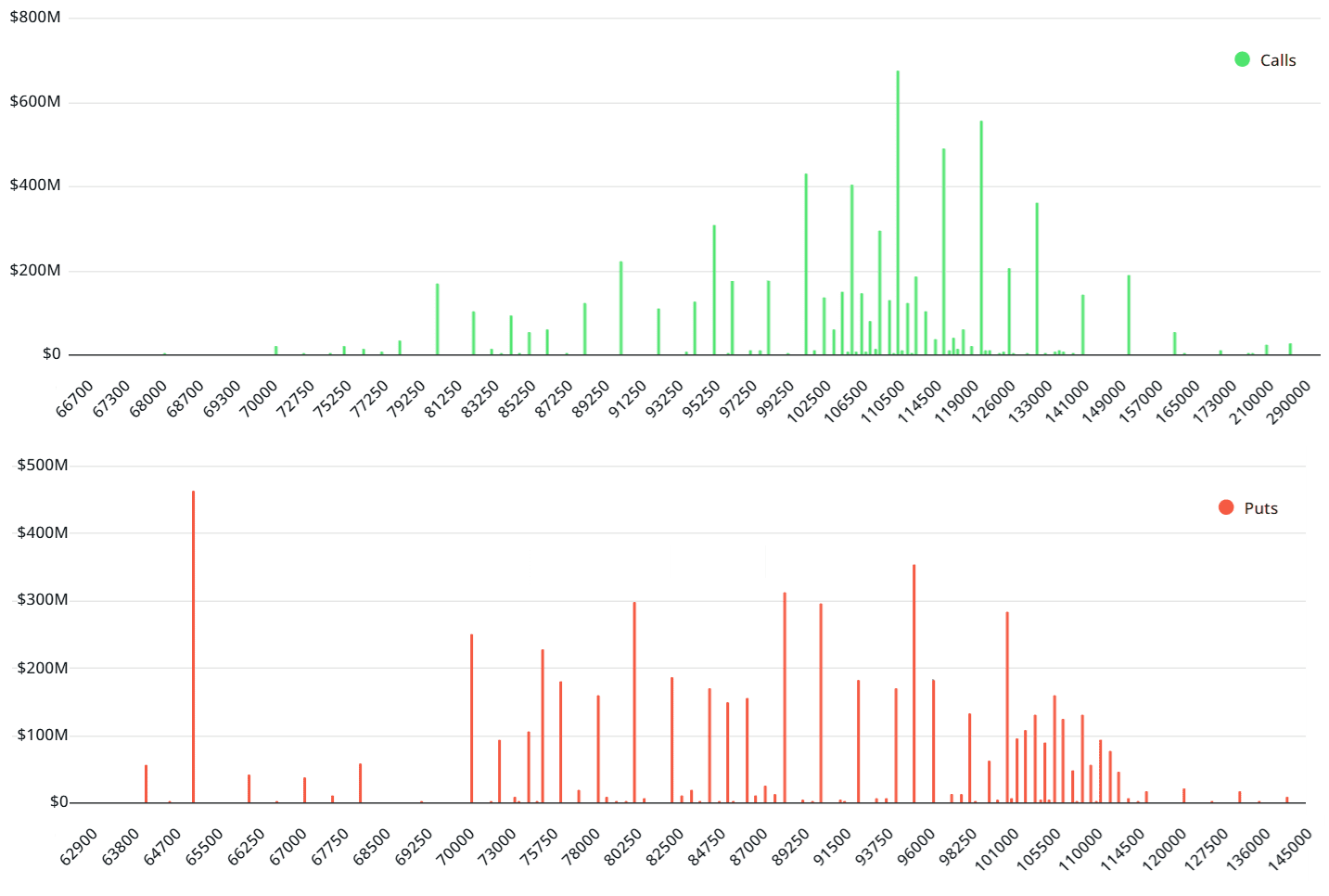

A closer look at the options landscape reveals that put (sell) options account for $6.5 billion of the open interest. However, a substantial 95% of these put options are positioned below the $109,000 price level. This means that if Bitcoin manages to maintain its current levels, less than $350 million worth of put options will have any real impact upon expiry. The relative irrelevance of these puts will benefit the bulls.

Conversely, call (buy) options up to the $109,000 strike price total $3.8 billion. It’s crucial to understand that not all call option holders are necessarily betting on a price increase. Many traders utilize these options as a hedging mechanism to manage their exposure above specific price thresholds.

Decoding Options Trading Strategies

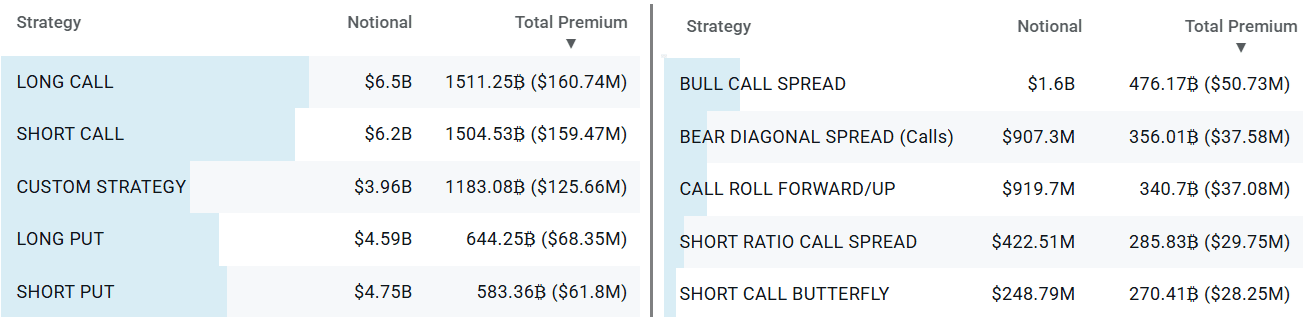

Data from Deribit, a leading cryptocurrency derivatives exchange, highlights some popular option strategies. The “short call” strategy is commonly employed by investors seeking a fixed income return, provided Bitcoin’s price remains above a predetermined level. Another strategy, the “bull call spread,” offers a means of hedging against downside risk, albeit at the cost of capping potential gains beyond a specific price point.

The Role of Bitcoin ETF Inflows

Sustaining Bitcoin above the $109,000 level is paramount for the success of most bullish option strategies as the expiry date nears. While bears may attempt to exert influence through BTC futures markets, their potential losses could escalate significantly if Bitcoin surpasses $110,000, potentially triggering a forced closure of short positions.

Significant net inflows into US spot Bitcoin exchange-traded funds (ETFs) reinforce the bullish sentiment. Between May 20th and May 22nd, these ETFs saw inflows of $1.9 billion, indicating robust demand for Bitcoin even above $105,000. The primary hope for bearish investors hinges on a weakening macroeconomic environment, which could lead to increased risk aversion and a subsequent decline in Bitcoin demand.

Potential Scenarios and Price Predictions

Let’s examine potential scenarios based on current price trends. These are theoretical estimates based on open interest imbalances and don’t account for intricate trading strategies:

- $102,000 – $105,000: $2.75 billion in call options vs. $900 million in put options, favoring calls by $1.85 billion.

- $105,000 – $107,000: $3.3 billion in call options vs. $650 million in put options, favoring calls by $2.65 billion.

- $107,000 – $110,000: $3.7 billion in call options vs. $350 million in put options, favoring calls by $3.35 billion.

- $110,000 – $114,000: $4.8 billion in call options vs. $120 million in put options, favoring calls by $4.7 billion.

In conclusion, Bitcoin bulls stand to maximize their gains by propelling BTC above $110,000, which could potentially pave the way for a new all-time high. However, sustaining this bullish momentum will depend on broader economic developments, including ongoing trade tensions and overall market sentiment. The convergence of strong ETF inflows and favorable options positioning certainly bodes well for the near term.