Bitcoin (BTC) is poised to experience substantial capital inflows, potentially reaching $420 billion by 2026, according to a report by crypto index fund management firm Bitwise. This growth is fueled by increasing adoption from diverse investors, including publicly listed companies, sovereign wealth funds, exchange-traded funds (ETFs), and even nation-states.

Key Projections and Drivers:

- Projected Inflows: Bitwise estimates $120 billion in Bitcoin inflows by the end of 2025 and a further $300 billion in 2026, totaling $420 billion.

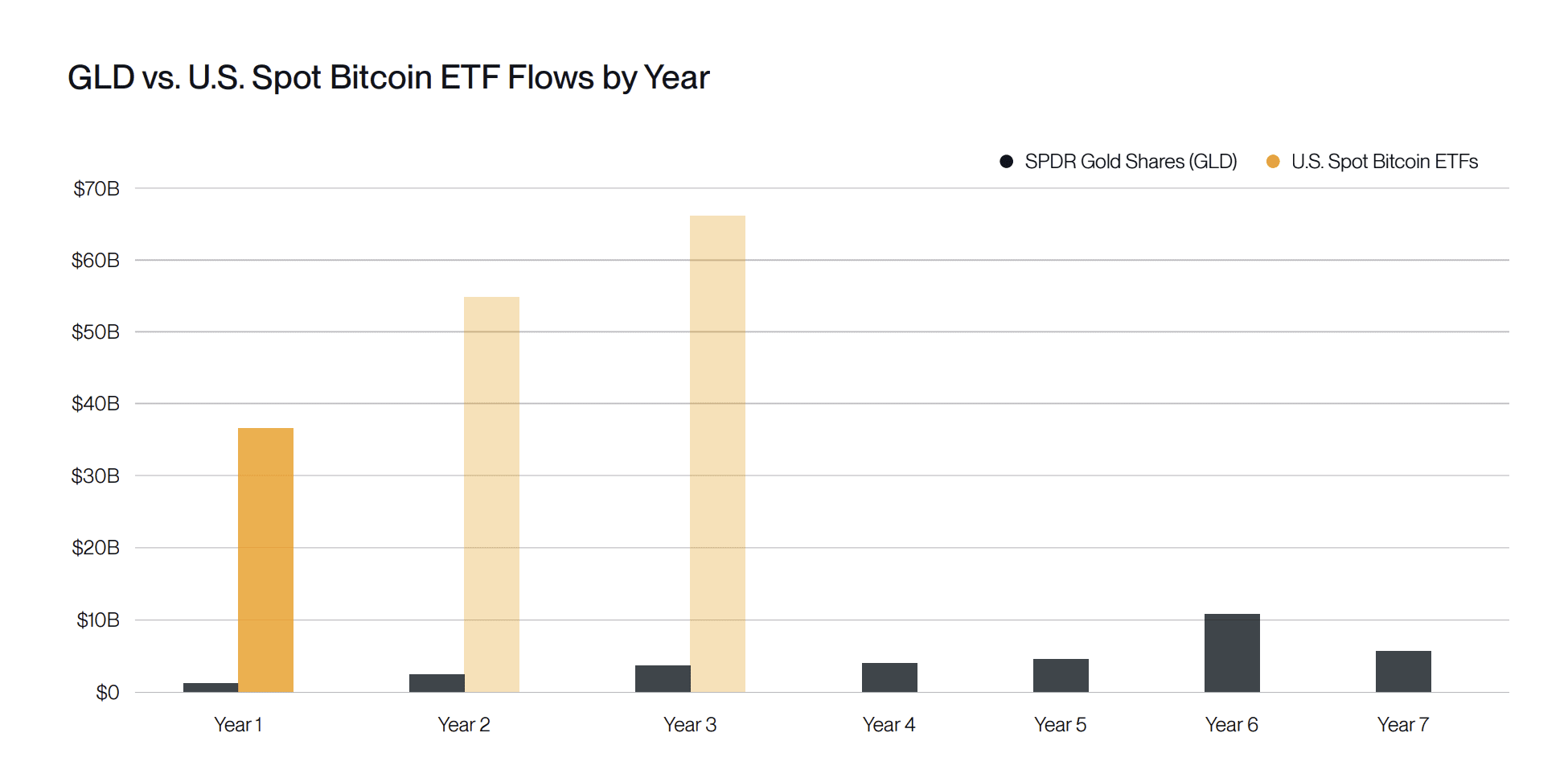

- ETF Growth: US spot Bitcoin ETFs have already demonstrated impressive growth, surpassing gold ETFs in their early stages. They recorded $36.2 billion in net inflows in 2024.

- Institutional Adoption: Publicly listed companies and nation-states collectively hold nearly 1.7 million BTC, signaling long-term confidence in the asset.

The report, titled “Forecasting Institutional Flows to Bitcoin in 2025/2026,” highlights the rapid success of Bitcoin ETFs. Bitcoin ETFs reached $125 billion in assets under management (AUM) within 12 months, a pace 20 times faster than SPDR Gold Shares (GLD). This suggests Bitcoin is on track to significantly outperform gold in terms of attracting investment.

However, potential risks remain. Around $35 billion in Bitcoin demand was sidelined in 2024 due to risk-averse compliance policies at major corporations like Morgan Stanley and Goldman Sachs. The increasing legitimacy of BTC ETFs is expected to unlock this capital, with these firms waiting for multi-year track records.

Fidelity’s Director of Global Macro, Jurrien Timmer, believes Bitcoin’s ability to trade above $100,000 indicates its potential to replace gold as a primary store of value. The Sharpe ratios of Bitcoin and gold have also converged, indicating a similar risk-adjusted return profile.

Bitcoin as a Reserve Asset: The Bull, Base, and Bear Cases

Beyond ETFs, Bitcoin’s attractiveness as a reserve asset is growing among public and private companies, as well as sovereign nations. Currently, companies hold around 1,146,128 BTC, worth $125 billion, representing 5.8% of Bitcoin’s total supply. Nation-states collectively hold 529,705 BTC ($57.8 billion), with the United States, China, and the United Kingdom leading the way.

Bitwise analysts outlined bear, base, and bull case scenarios for future wealth allocation to Bitcoin:

- Bear Case: Nation-states reallocate 1% of their gold reserves to Bitcoin, driving $32.3 billion in inflows. US states create BTC reserves at 10%, adding $6.5 billion, while wealth management platforms allocate 0.1% of assets ($60 billion). Public companies contribute another $58.9 billion, bringing the total inflows to over $150 billion.

- Base Case: Nation-states reallocate 5% of their gold reserves, generating $161.7 billion. US states raise their adoption to 30% ($19.6 billion), wealth platforms allocate 0.5% ($300 billion), and public companies double their holdings to $117.8 billion. This aligns with Bitwise’s forecast of $120 billion by 2025 and $300 billion by 2026, capturing 20.32% of Bitcoin’s supply.

- Bull Case: Nation-states allocate 10% of their gold to Bitcoin, leading to $323.4 billion in inflows. US state adoption rises to 70% ($45.8 billion), wealth platforms allocate 1% ($600 billion), and public companies quadruple their holdings to $235.6 billion. In total, inflows could exceed $426.9 billion, absorbing 4,269,000 BTC.

The Future of Bitcoin:

The growing interest from institutional investors and governments underscores a rising confidence in Bitcoin’s long-term value. With a limited supply, it is increasingly seen as a potential hedge against inflation and fiat currency debasement.

Currently, 94.6% of Bitcoin’s supply has already been mined (19,868,987 BTC as of May 2025), further strengthening its position as a scarce and potentially valuable asset.