The United States Federal Reserve’s recent withdrawal of its cautionary guidance on cryptocurrency activities has paved the way for US banks to begin supporting Bitcoin, according to Michael Saylor, co-founder of MicroStrategy. This move signifies a major potential boost for Bitcoin adoption among traditional financial institutions.

Key Takeaways:

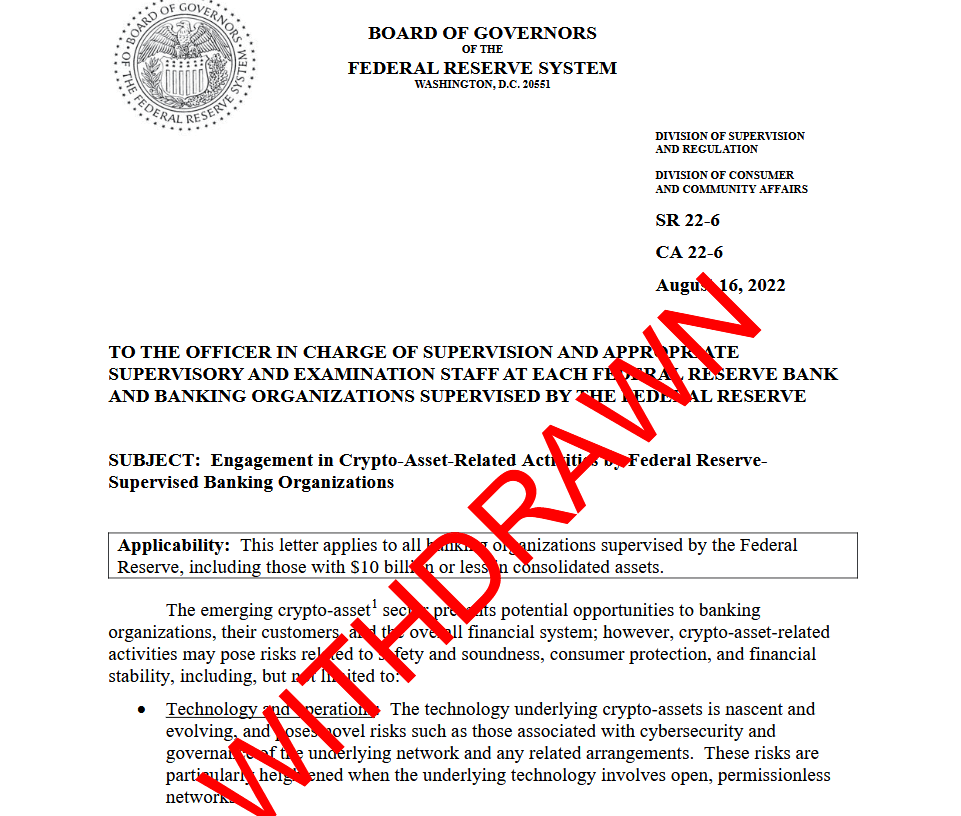

- Fed’s Withdrawal: The Federal Reserve withdrew its 2022 supervisory letter discouraging banks from engaging with crypto and stablecoin activities on April 24th.

- Saylor’s Perspective: Michael Saylor believes that “banks are now free to begin supporting Bitcoin” as a result of this withdrawal.

- Institutional Adoption: Experts suggest that this regulatory shift simplifies the path to institutional adoption of Bitcoin and other cryptocurrencies.

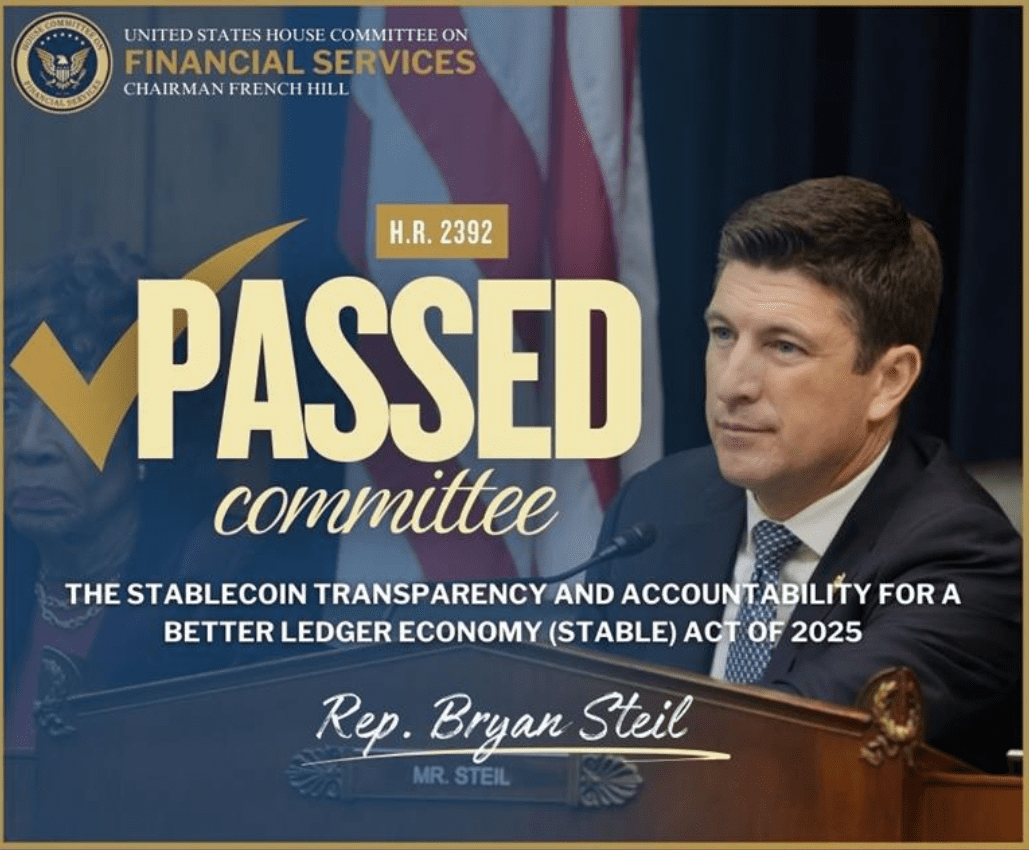

- Legislative Efforts Needed: Harmonizing crypto activities requires the passage of bills like the STABLE Act and the GENIUS Act.

Background: The 2022 Guidance

The now-rescinded 2022 guidance initially warned that crypto assets might pose risks to investors and the overall stability of the US financial system. This cautionary approach effectively deterred many banks from venturing into the crypto space.

Expert Opinions on the Fed’s Decision

Anastasija Plotnikova, co-founder and CEO of Fideum, stated that the withdrawal ensures crypto assets will be overseen through standard supervisory processes. However, she emphasized the need for further legislative action:

“We still need to have GENIUS and STABLE bills to be passed to further harmonize the crypto activities amongst Fed-supervised firms and other market participants. The combination of legislative effort will be the main driver behind the institutional adoption.”

Legislative Landscape: STABLE Act and GENIUS Act

TheSTABLE Act aims to create clear regulatory guidelines for dollar-denominated stablecoins. The GENIUS Act seeks to establish national innovation for US stablecoins.

A Meaningful Turning Point?

Eneko Knörr, co-founder and CEO of Stabolut, believes the Federal Reserve’s decision represents a “meaningful turning point” for Bitcoin’s institutional adoption in the US. He argues that prior regulatory hostility made it nearly impossible for traditional financial institutions to participate.

Knörr suggests that banks are likely to move quickly to meet client demand and compete with crypto-native firms such as Coinbase.

Global Context: European Banks Lagging

While the US shows potential for increased Bitcoin adoption, Europe lags behind, with less than 20% of European banks offering crypto services despite rising investor demand and regulatory clarity.

Potential Implications for Bitcoin

The Fed’s shift in guidance could lead to:

- Increased investment: With regulatory barriers lowered, institutional investors may be more willing to allocate capital to Bitcoin.

- Greater stability: Broader adoption by established financial institutions could reduce Bitcoin’s price volatility.

- Innovation: Banks could develop new Bitcoin-related products and services, benefiting consumers and the broader crypto ecosystem.

Conclusion:

The Federal Reserve’s decision to withdraw its cautionary guidance marks a significant step towards mainstream Bitcoin adoption in the United States. While legislative hurdles remain, the move signals a growing acceptance of cryptocurrency within the traditional financial system, potentially unlocking new opportunities for both banks and Bitcoin investors.