Bybit’s MiCA License in Austria: A Strategic Move for European Expansion

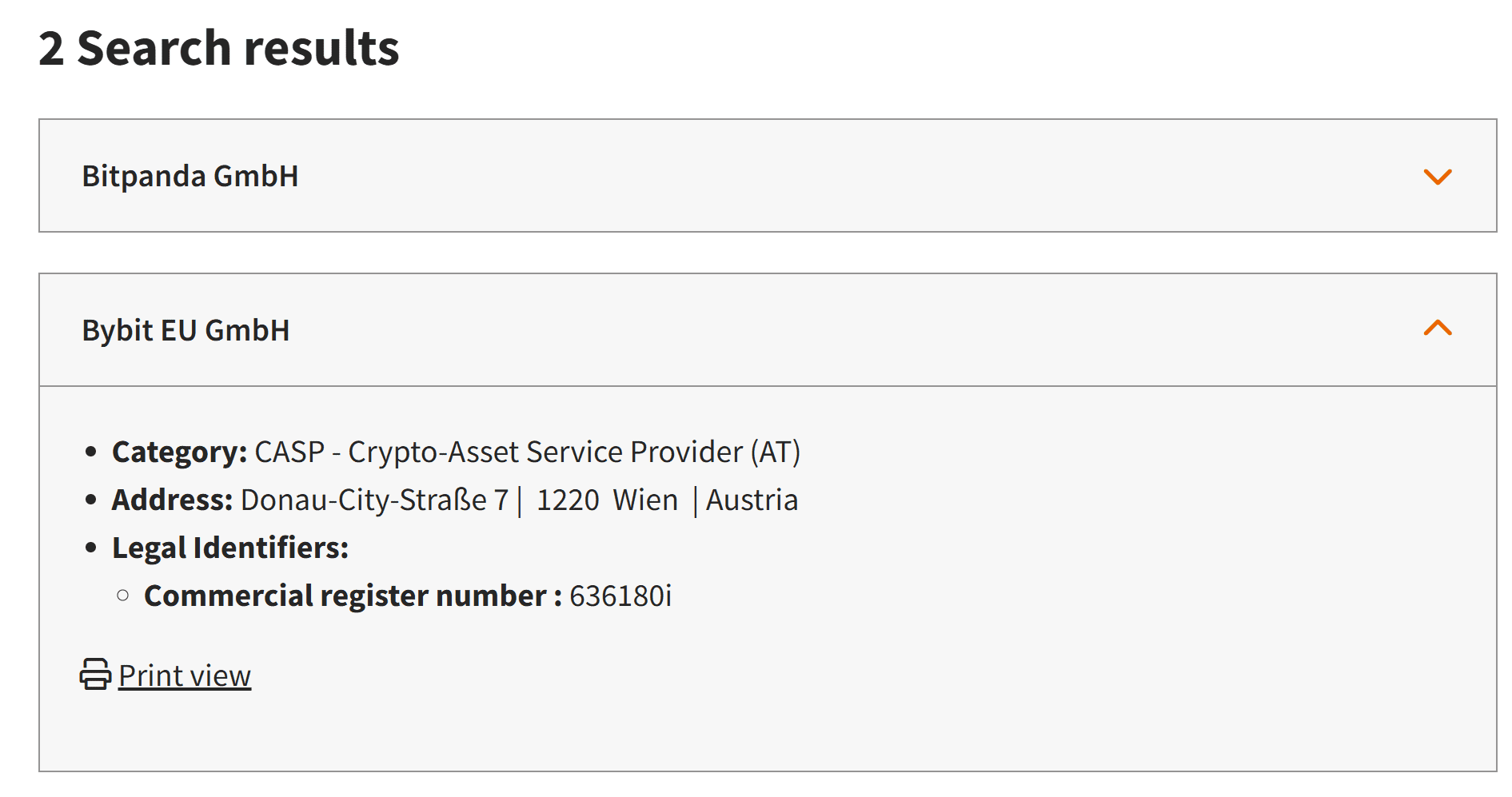

Bybit has obtained a Markets in Crypto-Assets Regulation (MiCA) license from Austria’s Financial Market Authority (FMA), allowing the exchange to expand into the European market.

The approval allows Bybit EU, registered under commercial number 636180i, to operate as a regulated crypto asset service provider (CASP) and extend its services across all 29 European Economic Area member states.

As part of its expansion, Bybit has officially established its European headquarters in Vienna, Austria, according to a May 29 news release shared with Cointelegraph.

The move enables the platform to serve nearly 500 million Europeans under MiCA’s harmonized framework, which is designed to promote regulatory consistency, prevent illicit activity and protect consumers.

“Securing the MiCAR license in Austria is a testament to our compliance-first approach at Bybit,” said Ben Zhou, co-founder and CEO of Bybit. “We are actively collaborating with regulators and pursuing licenses globally to ensure our users can access our innovative platform with the highest levels of regulatory and compliance assurance.”

Quick Summary of the News

- Bybit secures a MiCA license from Austria’s FMA.

- The license enables Bybit to operate as a regulated CASP across 29 EEA countries.

- Bybit establishes its European headquarters in Vienna, Austria.

- The move allows Bybit to serve nearly 500 million Europeans under MiCA’s framework.

- Bybit plans to hire over 100 staff in Vienna.

Why It Matters

This MiCA license is a significant step for Bybit and the broader crypto market. Here’s why:

- Regulatory Clarity: MiCA aims to create a unified regulatory framework for crypto assets in the EU, providing legal certainty for businesses and consumers.

- Market Access: Bybit gains access to a vast European market, potentially increasing its user base and trading volume.

- Competitive Advantage: By being an early adopter of MiCA, Bybit positions itself as a compliant and trustworthy exchange, attracting users who prioritize regulatory adherence.

- Industry Validation: The license underscores the growing acceptance of crypto within traditional financial systems.

Market Impact

The market impact of Bybit’s MiCA license can be viewed in a few ways:

- Increased Confidence: The news could boost investor confidence in Bybit and the crypto market.

- Altcoin Listings: It opens doors for more EU based altcoin projects to partner and list on Bybit.

- Competitive Pressure: Other exchanges may feel compelled to expedite their MiCA compliance efforts.

Expert Take or Personal Insight

Bybit’s proactive approach to securing a MiCA license demonstrates a long-term vision. While the costs of compliance are substantial, the benefits of operating within a regulated framework, including enhanced user trust and broader market access, outweigh the initial investment. I predict we’ll see other major exchanges follow suit, making MiCA compliance the new industry standard.

Actionable Insight

For traders and investors, keep an eye on these points:

- Bybit’s Market Share: Watch for an increase in Bybit’s European user base and trading volume.

- Competitor Responses: Monitor how other exchanges react to Bybit’s move and whether they accelerate their own MiCA compliance efforts.

- MiCA Implementation: Stay informed about the ongoing implementation of MiCA regulations and their impact on the crypto market.

Conclusion

Bybit’s MiCA license in Austria is a pivotal moment, signaling a maturing crypto landscape where regulatory compliance is not just an option but a necessity. As MiCA implementation progresses, expect further consolidation and professionalization of the crypto industry in Europe. The race for regulatory approval is on, and Bybit has taken an early lead.