Solana’s Loopscale Pauses Lending After $5.8M Exploit: What Happened?

On April 26, Solana decentralized finance (DeFi) protocol Loopscale experienced a security breach, leading to the temporary suspension of its lending markets. A hacker exploited the protocol, draining approximately $5.8 million worth of assets.

Specifically, the exploit involved the siphoning of 5.7 million USDC and 1200 SOL through what Loopscale co-founder Mary Gooneratne described as “a series of undercollateralized loans.” This attack raises concerns about the security and risk management practices within the burgeoning DeFi space.

Loopscale has since re-enabled loan repayments, top-ups, and loop closing, but all other app functions (including Vault withdrawals) are still temporarily restricted while they investigate and ensure mitigation of this exploit.

Impact and Response

The exploit primarily affected Loopscale’s USDC and SOL vaults. While significant, the losses represent roughly 12% of Loopscale’s total value locked (TVL), according to Gooneratne. This suggests the protocol has other assets which were not impacted.

“Our team is fully mobilized to investigate, recover funds, and ensure users are protected,” Gooneratne stated. Loopscale’s immediate actions included halting lending markets and initiating an investigation to understand the root cause of the exploit and prevent future occurrences.

DeFi Security in the Spotlight

This incident underscores the ongoing challenges related to security in the DeFi ecosystem. The Loopscale exploit adds to a growing list of security breaches that have plagued the crypto industry, raising questions about the maturity and resilience of DeFi protocols.

Blockchain security firm PeckShield reported that in the first quarter of 2025, hackers stole over $1.6 billion worth of crypto from exchanges and on-chain smart contracts. Notably, over 90% of these losses were attributable to a $1.5 billion attack on ByBit, attributed to North Korean hacking group Lazarus Group.

While the Loopscale hack is smaller in scale compared to the ByBit attack, it still represents a significant loss for users and a setback for the DeFi protocol.

Understanding Loopscale’s Unique DeFi Lending Model

Loopscale, launched on April 10, aims to enhance capital efficiency in DeFi lending by directly matching lenders and borrowers. This differentiates it from protocols like Aave, which rely on aggregated liquidity pools.

According to an April announcement from Loopscale, the protocol also supports specialized lending markets like structured credit, receivables financing, and undercollateralized lending. The hack demonstrates that even innovative models are susceptible to exploits, requiring robust security audits and monitoring.

Key Features and Performance

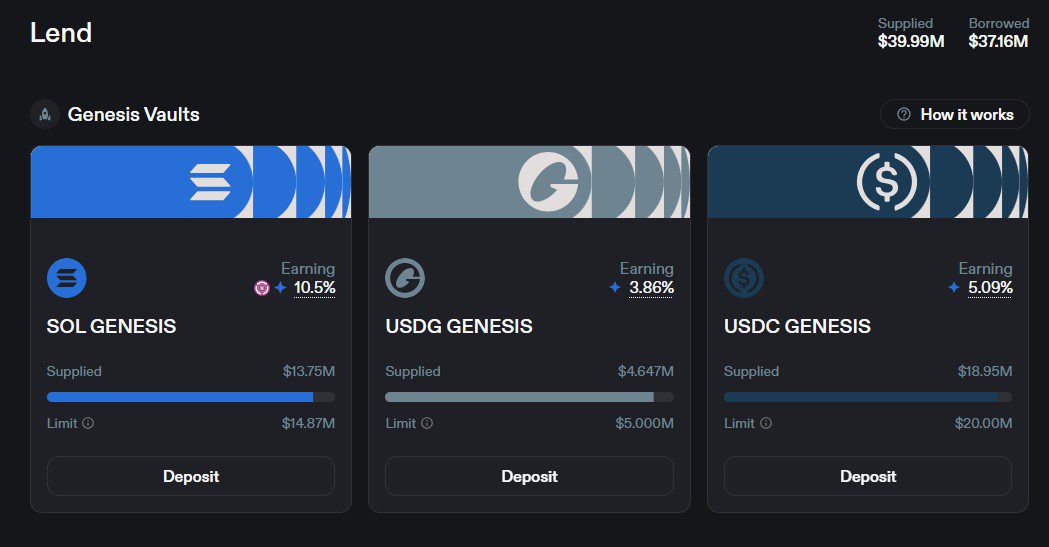

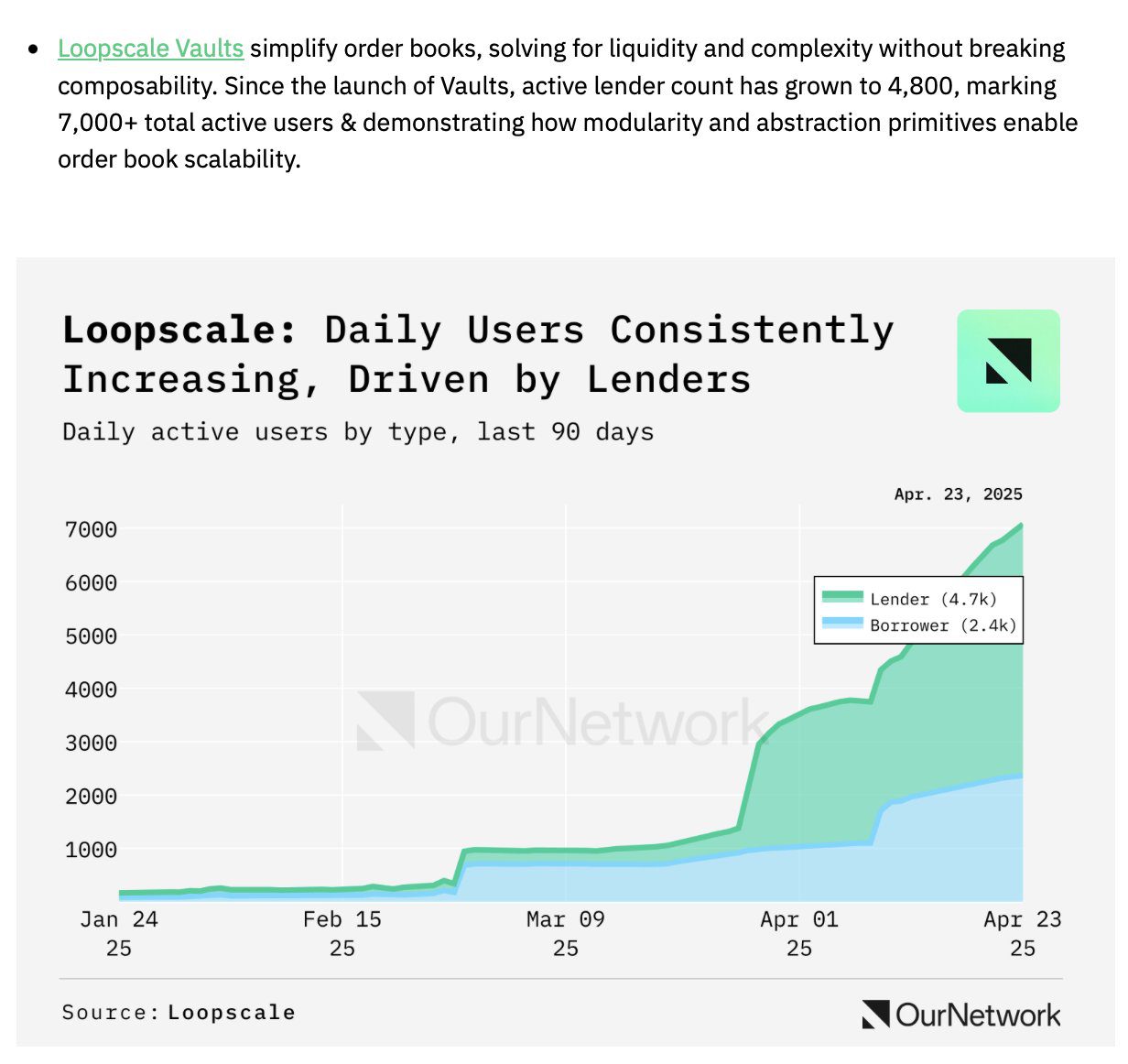

Loopscale’s main USDC and SOL vaults offer competitive APRs, exceeding 5% and 10% respectively. The protocol also supports lending markets for other tokens like JitoSOL and BONK, as well as looping strategies for numerous token pairs. Before the exploit, Loopscale boasted approximately $40 million in TVL and had attracted upwards of 7,000 lenders.

Looking Ahead: Lessons Learned and Future of DeFi Security

The Loopscale exploit serves as a reminder of the importance of rigorous security audits, comprehensive risk management, and continuous monitoring in the DeFi space. It also highlights the need for proactive measures to protect users and recover funds in the event of a security breach.

Key Takeaways for DeFi Users and Developers:

- Diversification: Don’t put all your assets in one protocol. Spread your risk across multiple platforms.

- Due Diligence: Thoroughly research any DeFi protocol before investing. Understand the risks involved.

- Security Audits: Check if the protocol has undergone rigorous security audits by reputable firms.

- Community Engagement: Participate in the community and stay informed about any potential vulnerabilities.

- Insurance: Consider using DeFi insurance protocols to protect against losses from hacks and exploits.

As the DeFi ecosystem continues to evolve, security will remain a top priority. Protocols must invest in robust security measures and proactively address potential vulnerabilities to maintain user trust and ensure the long-term sustainability of the DeFi space.

The incident also shines a light on the undercollateralized lending model, which is deemed riskier than other forms of lending. While it has numerous benefits, the need for a security audit is paramount.